by Craig Basinger, David Benedet, & Brett Gustafson, Purpose Investments

At no point in history that we can remember has the U.S. President been squarely responsible for a one-day stock market loss to this degree. The S&P 500 fell nearly 5% after “Liberation Day.” To investors, it was really obliteration day. There were no broader factors impacting the move. No carry trade, no pandemic, no financial crisis. Just presidential actions to reshape America in his vision. The sell-off continued on Friday, with the S&P 500 down 7.7% on the week at the time of writing.

On Wednesday, the U.S. President imposed the steepest American tariffs in a century, sparking swift retaliation by China and threats from others. Although the announcement had been well-telegraphed, the long-awaited tariffs took the market by surprise.

The announcement highlighted a two-tier system: a broad 10% baseline tariff on all imported goods, along with an individualized "naughty list" of countries targeted as bad actors. Each country will have varying reciprocal tariffs applied to all trade with the United States. The big reveal came out as a naughty list of sorts printed on what appears to be foam board. I should know since I just helped make one for my daughter’s Grade 8 school project.

The "reciprocal" tariff rate, which at first glance appeared arbitrary, is not actually based on existing tariff levels but rather derives from a formula apparently developed by the Council of Economic Advisers. This calculation – approximately half of the current trade deficit with a given country – operates on the premise that trade imbalances represent the cumulative effect of all unfair trade practices. Interestingly, this simplistic approach bears a striking resemblance to what one might receive when prompting ChatGPT with: "What would be an easy way to calculate tariffs that should be imposed on other countries to level the playing field regarding trade deficits? Set minimum at 10%."

What markets got on Wednesday was a type of worst-case scenario: aggressive moves coupled with questions about the rationale used to set the new rates and whether they will remain or be negotiated downward. The initial thought by many might be: why did this take more than two months? It ignores competitive advantage, elasticities, and supply chain nuances, and assumes broadly that selling the United States things that they cannot even grow or have in their country is cheating.

We don’t have any good answers for this. Few do, which is why markets have sold off due to panic and uncertainty.

Since the beginning of this year, tariffs have been the number one concern for investors. Our numerous publications and thoughts can be boiled down to really three key points:

Tariff Key Points

- Market uncertainty and volatility – Tariffs have significantly increased market unpredictability, eroding investor confidence and weighing on corporate decision-making and profits. The evolving nature of tariff policies has kept markets on edge, with frequent announcements and retaliatory measures creating a "risk-off" environment. No policy is set in stone.

- Economic impacts – Tariffs are a drag on economic growth, with potential recessionary effects. They also contribute to inflationary pressures by raising costs for businesses and consumers, complicating monetary policy.

- Investor strategy – Investors should remain calm amidst the noise, avoiding overreactions to short-term volatility. Diversification is extremely important during volatile periods. Investors should focus on long-term opportunities that may arise from market overreactions or valuation dislocations.

Let’s keep these points in mind as we assess the current state of the market.

Market Uncertainty

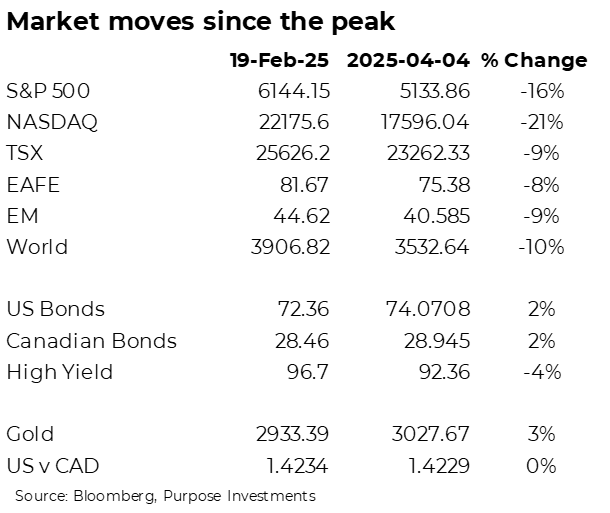

Markets peaked on February 19th, and since then the S&P 500 is down -16%. The NASDAQ has sold off a little more and has now entered bear market territory, down -21% from its high. The TSX has fared better, down -9%.

It’s not all bad news. Yields have fallen and bonds are working again as portfolio diversifiers. Gold, though volatile the past couple of days, is up 5% over that time period and is still above $3,000/oz. Without a doubt, the trade war escalation has increased uncertainty and volatility. The good news, however, is that diversifiers are diversifying.

Economic Impacts

It’s still too soon to see the impacts in the hard data. However, recession fears have drastically increased this week. Oil prices have crumbled, no thanks to the surprise OPEC+ announcement that they will be increasing production. Margins and earnings will be under pressure if tariffs remain as announced.

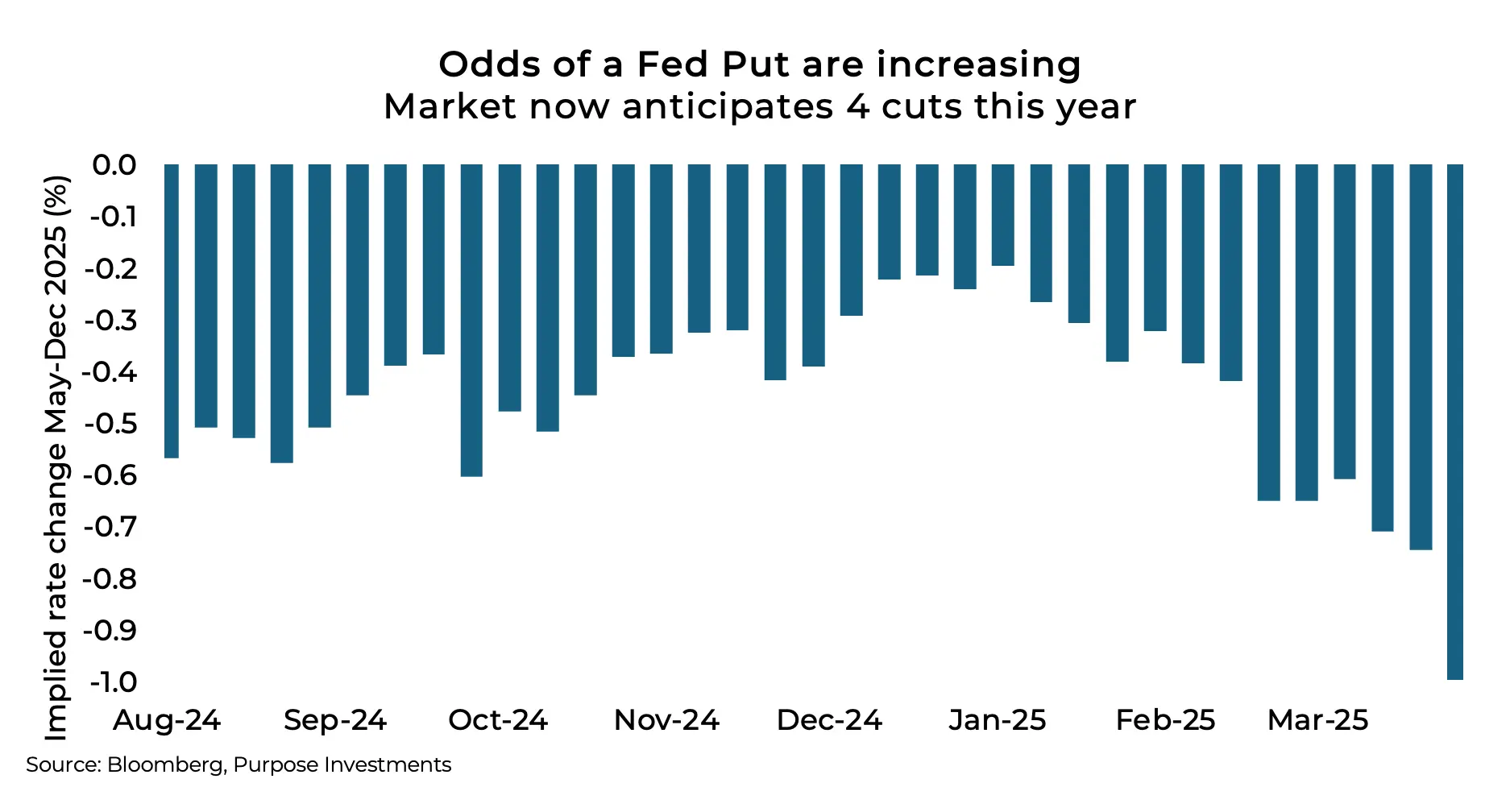

Oddly enough, we’re now in the growth scare phase of the sell-off even before the data has turned. One of the clearest signs is the swift move in Fed rate cut expectations. Before this week, the Federal Open Market Committee was expected to cut rates just two times this year. That’s now more than doubled, with the market now pricing in four cuts by December, as seen in the chart below.

Forget the Trump Put – the Fed Put is back on the table. This is the belief that policymakers will step in with easier money policy if the stock market stumbles. When push comes to shove, the market expects the Fed will cut and provide liquidity, even if inflation numbers begin to climb.

Investor Strategy

At the beginning of this year, we expected volatility to be higher and that markets were at an elevated risk of a correction. Our recommendations were that investors should have a more defensive stance. Given concentration risks in the U.S. market and elevated valuations, we preferred international equities with a healthy allocation to bonds and other diversifiers. With this stance in mind, our thinking was that investors should focus on long-term opportunities that may arise from market overreactions or valuation dislocations.

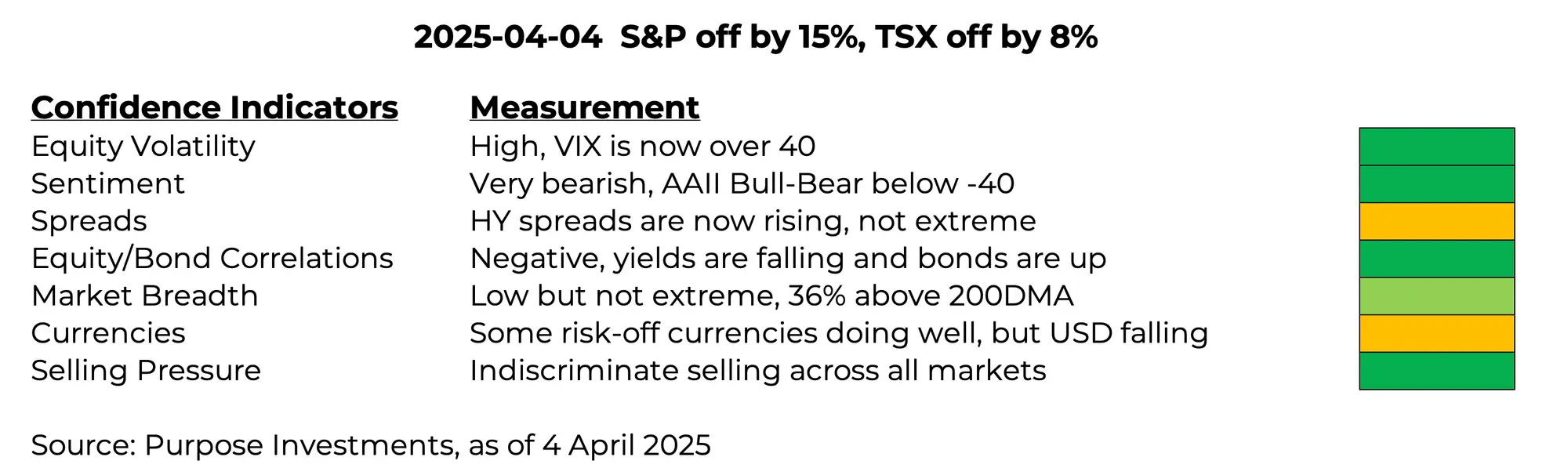

During market corrections, emotions can sometimes lead to poor decision-making. In an effort to mitigate knee-jerk, fear-induced reactions, we developed a framework to aid decision-making in the midst of market corrections. It’s a good exercise to review these confidence indicators to get an idea as to what signals the market is telling us. Using this framework to ride out corrections in the past has proved beneficial.

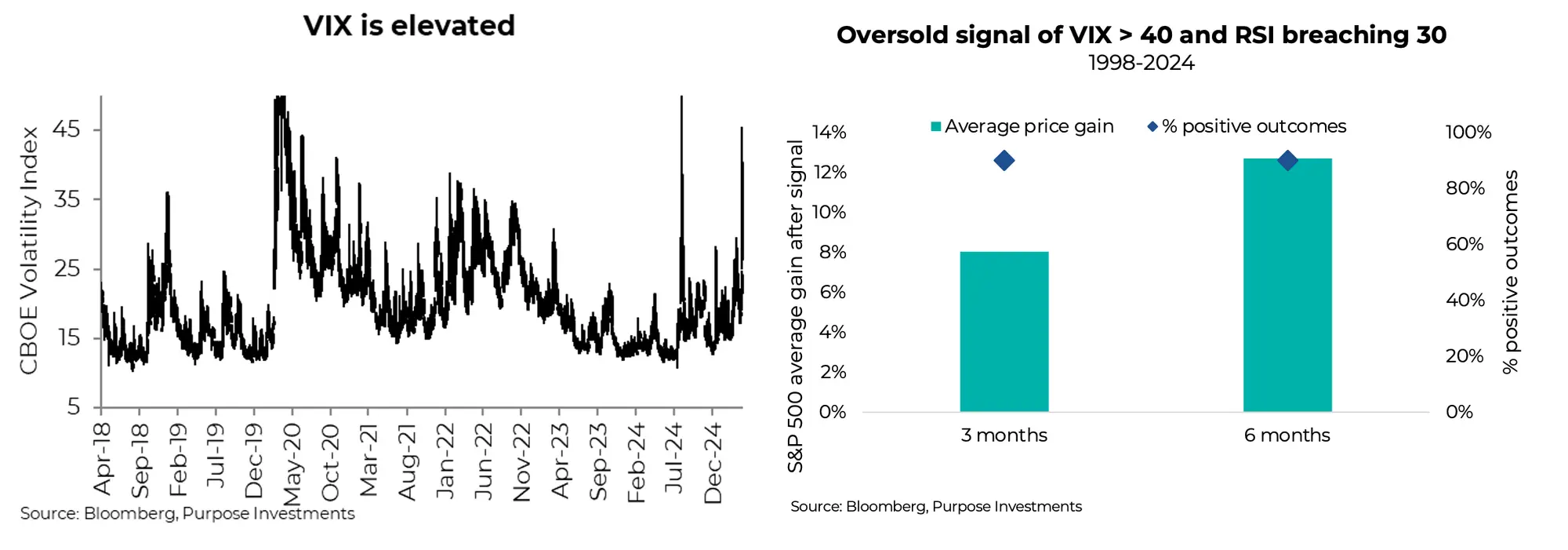

Volatility measures have spiked higher. As of the time of writing, the VIX index sits at 44, only the second time we’ve seen this level since the pandemic. Sentiment is extremely low and has been for a number of weeks. Technically, the markets are quite oversold, with the 14-day Relative Strength Index currently at 25, well below the oversold threshold of 30. Breadth is low, but not quite extreme enough to give it the clear go-ahead that bargains abound, with 36% of S&P 500 members still above their 200-day moving averages. On average, most of the indicators we like to watch to monitor market corrections are flashing contrarian buy signals.

Looking back to 1998, using the VIX>40 and RSI<30 as a signal, markets were higher 90% of the time after both three- and six-month periods, with average forward returns of 8% and 13% respectively. Of course, each situation is unique, and past performance does not always translate into the future, but on average when markets are this oversold it’s a good time to begin to lean into the correction. One of the key tenets of contrarian investing is to be buyers when there is blood in the streets.

Within our multi-asset portfolios, we have done just that. We’ve shifted allocations closer to neutral, adding to U.S. equity believing that fear-induced correction has presented a decent opportunity for long-term investors. From a portfolio perspective, we don’t recommend taking big swings, as nobody can time the market. We prefer to do incremental buying, leaning into corrections or even bear markets.

Remember, this can all go away, or at least have the fear subside substantially with just one Truth Social post. The hopeful view is that, far from being the final word, these latest tariff announcements from the U.S. are just the start of a negotiation process between Washington and the rest of the world. It won’t be fun, but it is likely that the initial salvo can be de-escalated. It’s an unusual market environment, with markets hinging on a single, unpredictable person. It’s one thing to adjust and forecast changes due to economic policy, but another to anticipate changes in personality.

Unfortunately, as investors, we don’t have much choice. All we can do is balance managing risk, but also keep an eye out for opportunities for long-term return.

— Derek Benedet is a Portfolio Manager at Purpose Investments

Get the latest market insights in your inbox every week.

Sources: Charts are sourced to Bloomberg L. P.

The content of this document is for informational purposes only and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained in this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities. No securities commission or similar regulatory authority has reviewed this document, and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable; however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated. Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” intend,” “plan,” “believe,” “estimate” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are, by their nature, based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose Investments and the portfolio manager believe to be reasonable assumptions, Purpose Investments and the portfolio manager cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on the FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

Copyright © Purpose Investments