Why Investors Should Brace for a Break in the Old Rules

“There are decades where nothing happens; and there are weeks where decades happen.” With this opening nod to Vladimir Lenin, Alfonso Peccatiello, founder of The Macro Compass, delivers one of the sharpest macroeconomic diagnoses we’ve seen in recent memory—an urgent warning that a rare, high-stakes market configuration is resurfacing. He calls it the “Macro Unicorn.”

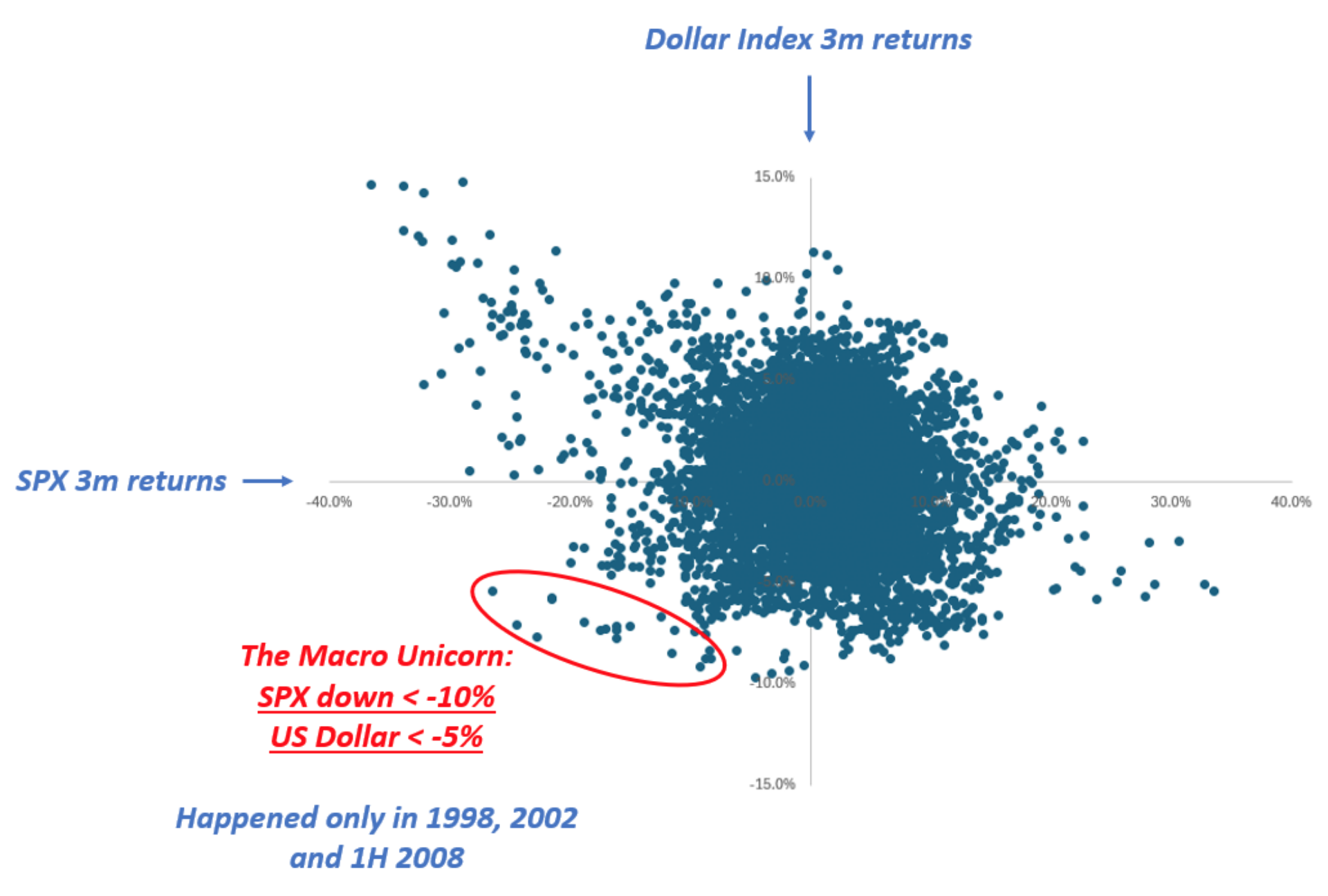

The Macro Unicorn is a situation so uncommon in global macro that it last truly emerged in the first half of 2008: a simultaneous drawdown in both the S&P 500 and the US Dollar. Normally, when equity markets drop, the dollar strengthens—as investors seek safety in USD-denominated assets. But when both go down together? That’s when something deeper is broken.

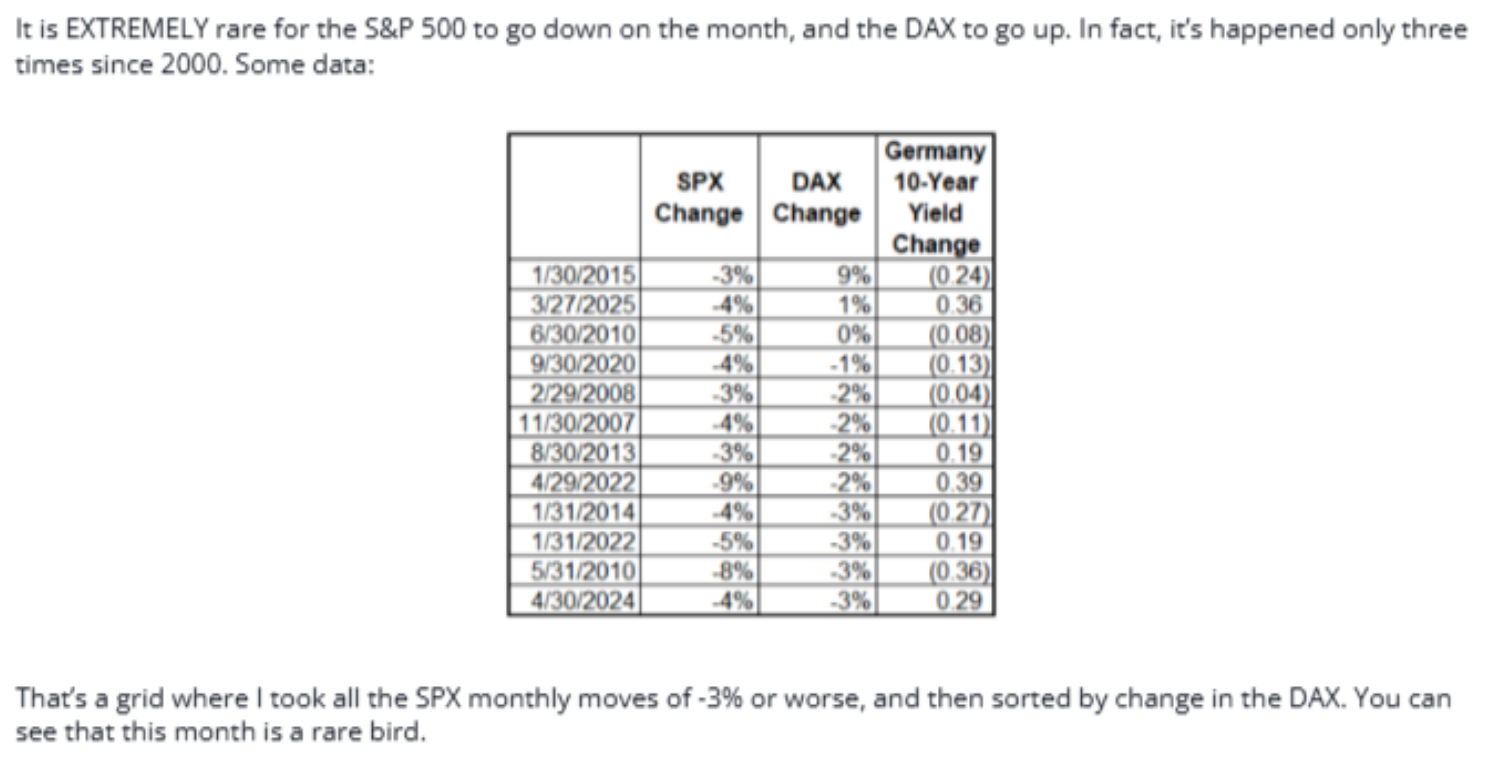

The ‘’Macro Unicorn’’ bottom-left quadrant with SPX drawdowns happening alongside a weak USD is not very populated. It’s crucial to remember the last Macro Unicorn dot goes back to July 2008.

The ‘’Macro Unicorn’’ bottom-left quadrant with SPX drawdowns happening alongside a weak USD is not very populated. It’s crucial to remember the last Macro Unicorn dot goes back to July 2008.

“Markets were sleepwalking into April 2nd,” Peccatiello writes, “before we had a decent sell-off in US stock markets… But the size of the YTD sell-off in the S&P 500 (a mere 5%) masks a very interesting pattern happening below the surface.”

This isn't just about a short-term anomaly. Peccatiello makes the case that this rare divergence signals a fundamental shift—one that could reset the hedging and positioning frameworks institutional investors have relied on for over a decade.

Why This Matters: The Power of the USD-S&P Correlation

Peccatiello brings the receipts. Historically, large equity drawdowns have gone hand-in-hand with US dollar strength. That’s the classic “risk-off” playbook: when markets panic, capital floods into Treasuries and the dollar, reinforcing America’s safe-haven status. This reflex has been remarkably durable, underpinned by three critical forces:

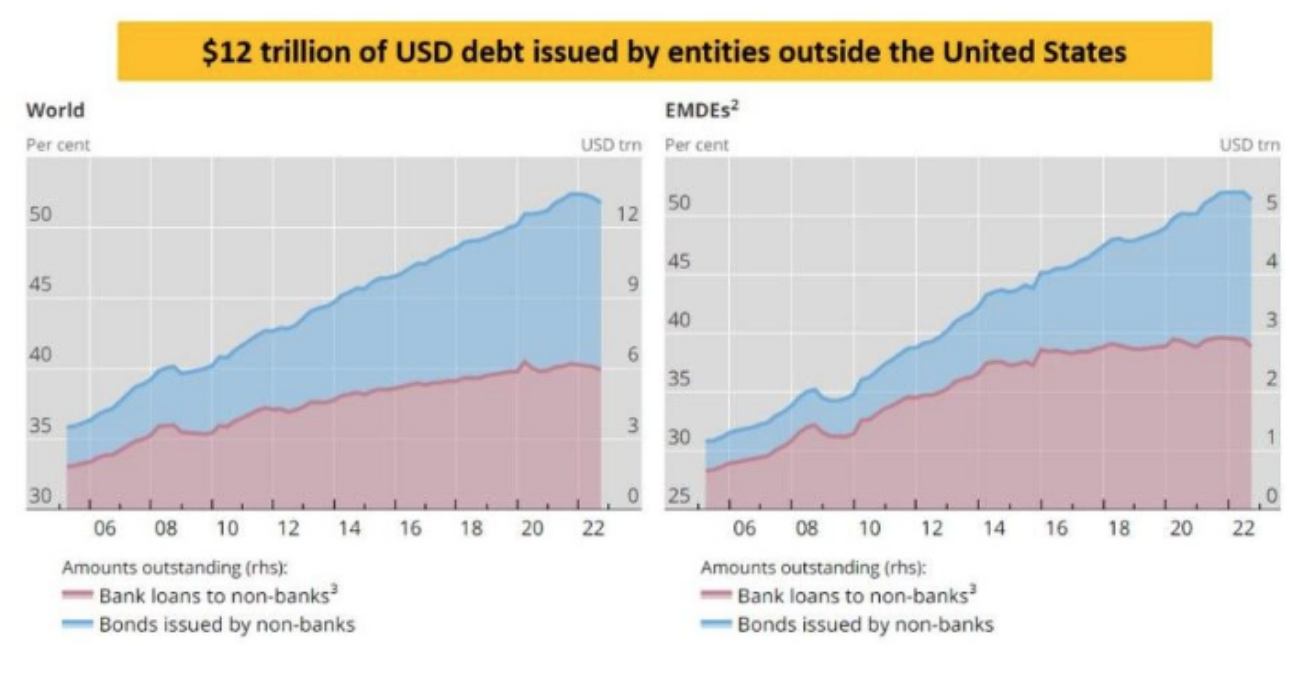

- The post-2008 explosion of the Eurodollar system.

- The US acting as the global sponge for trade surpluses.

- Growth-friendly disinflationary policies and geopolitical dominance via Pax Americana.

These forces ensured that “the USD tends to appreciate during risk-off events,” as foreign entities scrambled for dollars to service trillions in offshore USD debt, and parked capital in Treasuries expecting Fed rate cuts. “The same foreign investors are reluctant to wind down their US equity exposures because Fed cuts will ultimately restore confidence.”

In other words: the dollar used to be the market’s ultimate hedge. But what if that’s breaking down?

Déjà Vu? 1998. 2002. 2008. 2025?

Peccatiello is clear: the only times this kind of dollar-equity decoupling has occurred were during “US idiosyncratic crises”—the dot-com bust, the housing crisis, and the Long-Term Capital Management meltdown. What binds those episodes together? A breakdown within the US system itself, not imported from abroad.

And that’s where 2025 starts to look a lot like history rhyming.

“Today, US policymakers seem to be doing all they can to generate one,” he warns.

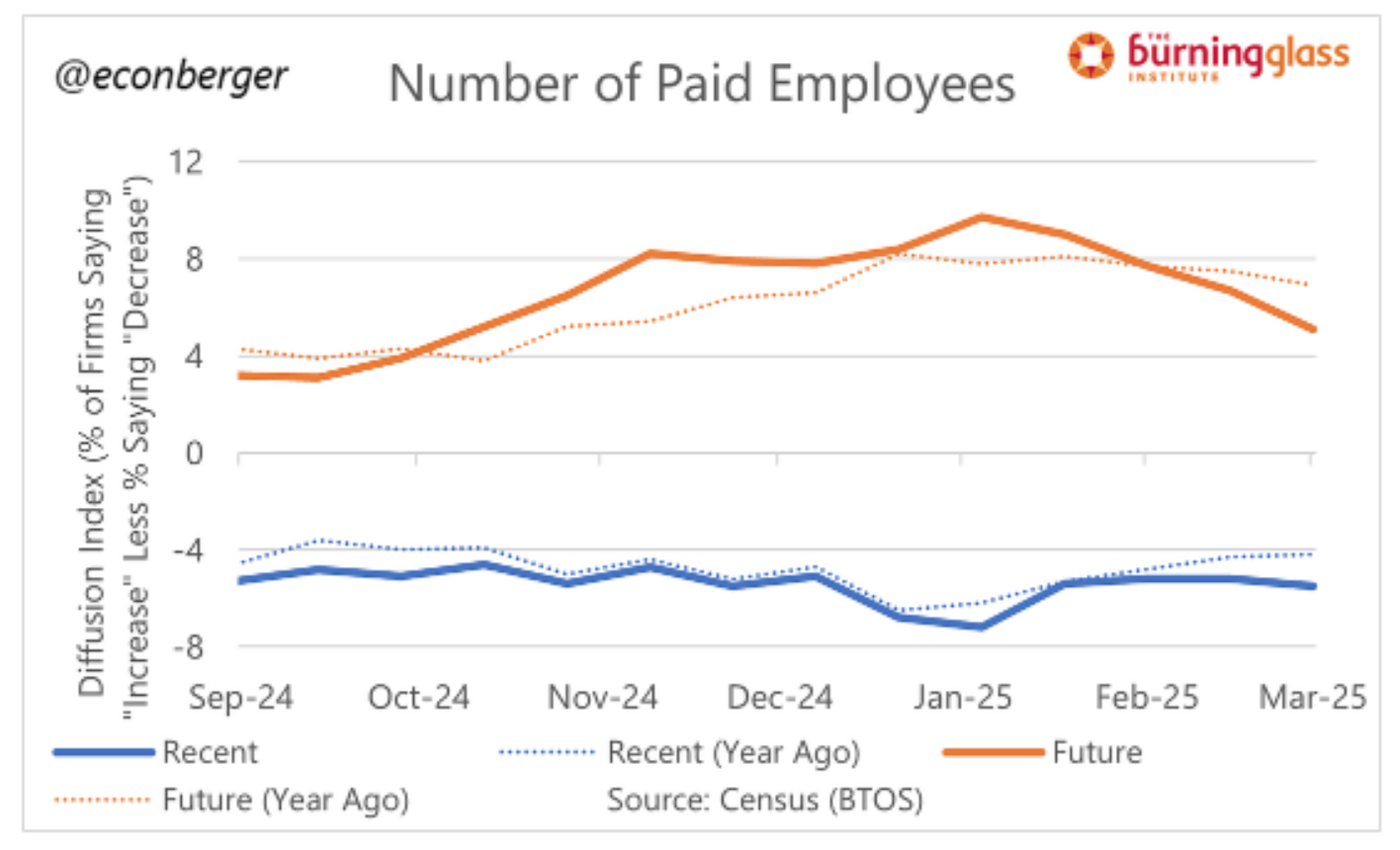

Between unpredictable tariffs, a lack of visibility for corporate capex planning, and leaked White House plans to gut the federal workforce by up to 35%, the macro picture is becoming increasingly unhinged. Quoting former LinkedIn Chief Economist Guy Berger, Peccatiello highlights a labor market already showing signs of trouble:

“The diffusion index of future headcount plans is now worse than it was immediately prior to the election... that pessimism about the future is also affecting the present.”

Add to this the looming elimination of ~800,000 federal jobs, and it’s not hard to see where this road leads.

Foreign Investors: The Sleeping Giants Begin to Stir

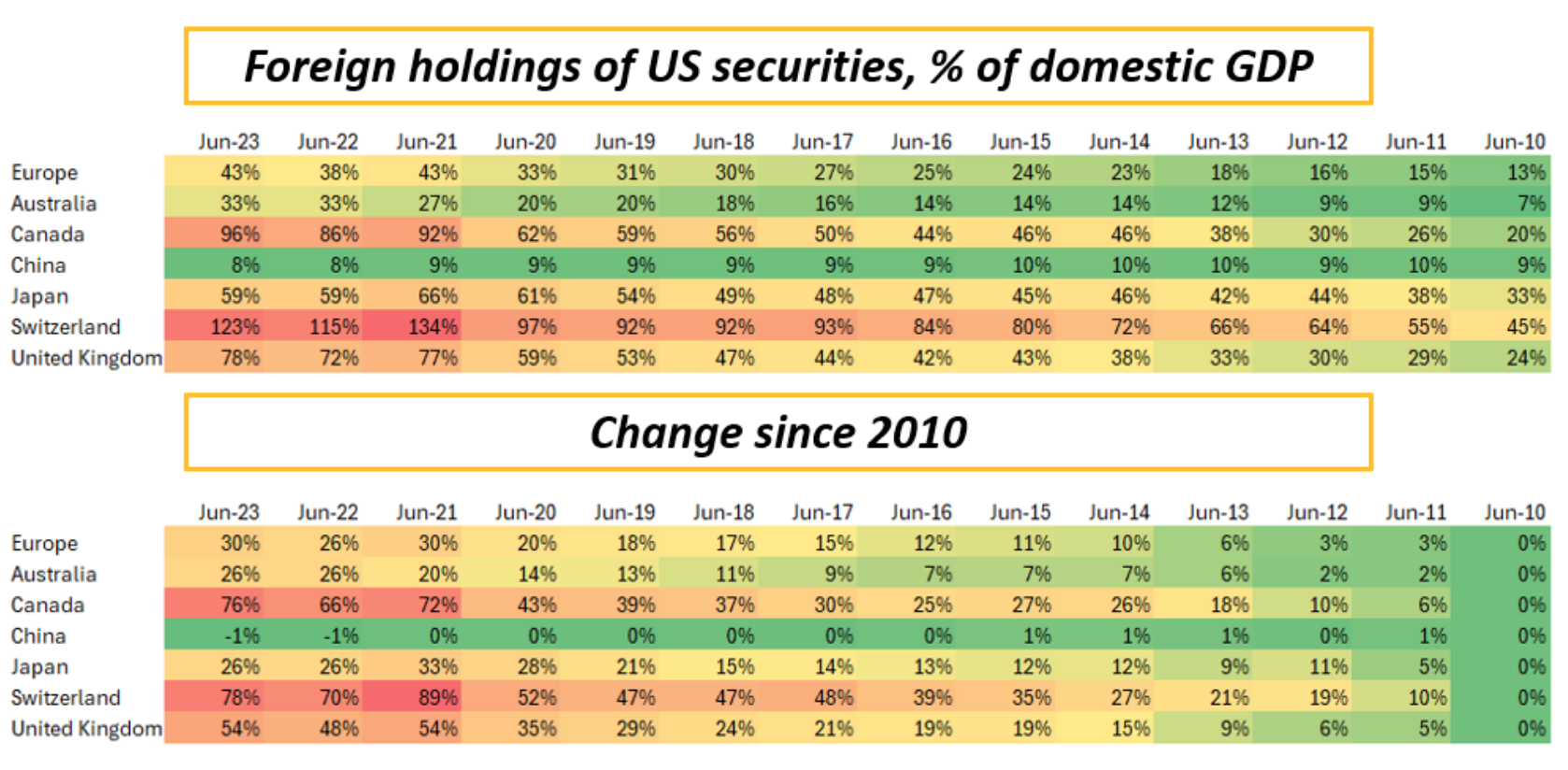

One of Peccatiello’s most prescient observations is around the quiet yet powerful role of foreign asset allocation. Since 2010, global investors—Germany, Norway, Canada, Switzerland—have recycled their trade surplus dollars into US equities and Treasuries. In some cases, these holdings exceed 100% of national GDP.

But what happens when the narrative shifts?

“What if some of these foreign whales decide to reduce their exposure to US assets?” he asks. “It would make sense given the new US geopolitical stance, the non-supportive policy mix (non-proactive Fed and tighter fiscal stance), business uncertainty from tariffs and still elevated valuations.”

We’re already seeing signs of this: a month where Germany’s DAX rises while the S&P 500 falls—an extremely rare divergence. These dislocations, if they continue, could mark the early phases of foreign capital rotation away from the US.

The Trifecta That Can’t Be Won

In a particularly biting assessment, Peccatiello calls out the near-impossible balancing act being pursued by the Trump administration:

“The Trump administration is trying to achieve an arduous trifecta: a weaker USD, lower yields, and a robust stock market.”

Historically, the only way to make this work is via aggressive disinflation and a dovish Fed. But what’s currently on offer? Tariffs, fiscal tightening, and a Federal Reserve that isn’t playing ball.

“The current policy mix of geopolitical shifts, tariffs and macro uncertainty risks achieving a weaker USD and lower yields but at the expense of the economy and the stock market,” Peccatiello explains.

In other words: you can’t have your cake and eat it too. And this time, the markets might just call the bluff.

Implications for Investors: Rethinking the Hedge

The core message to long-term investors? Rethink your implicit and explicit exposure to the US dollar.

“After 17+ years of absence, the Macro Unicorn of simultaneously weak USD and weak US stock markets could stage an unexpected comeback,” Peccatiello warns.

He points out that USD exposure has historically been a hedge against equity risk. But in the new regime, that may not hold:

“If the Macro Unicorn appears again, a long USD long stock position could hurt twice.”

For hedge funds and institutional allocators, this signals the need to re-examine portfolio construction. Peccatiello even offers a hint to savvy derivatives traders: “There are very interesting derivatives trades that can be structured to take advantage of the Macro Unicorn – text me on Bloomberg and I’ll be happy to discuss.”

Conclusion: Time to Get Humble

Peccatiello signs off with a trademark blend of wit and humility:

“As always, stay hungry for macro and humble in markets.”

The Macro Unicorn isn’t just a rare market alignment—it’s a signal that the era of reliable hedges and predictable correlations may be ending. In its place: a world where risk comes not from external shocks, but from internal contradictions, political volatility, and policy-driven uncertainty.

In the GSM editorial spirit, the takeaway is clear: ignore this at your peril. Reassess your assumptions, reallocate your risks, and get ready for a market environment that breaks the old rules. The Macro Unicorn is no myth. It's back. And this time, it may not be riding alone.

For more macro insights from The Macro Compass and Alfonso Peccatiello, visit themacrocompass.com.

Copyright © AdvisorAnalyst