by Brian Levitt, Global Market Strategist, Invesco

Key takeaways

- Price of uncertainty - While the setup was good coming into 2025, markets struggled with ongoing changes to the US policy approach.

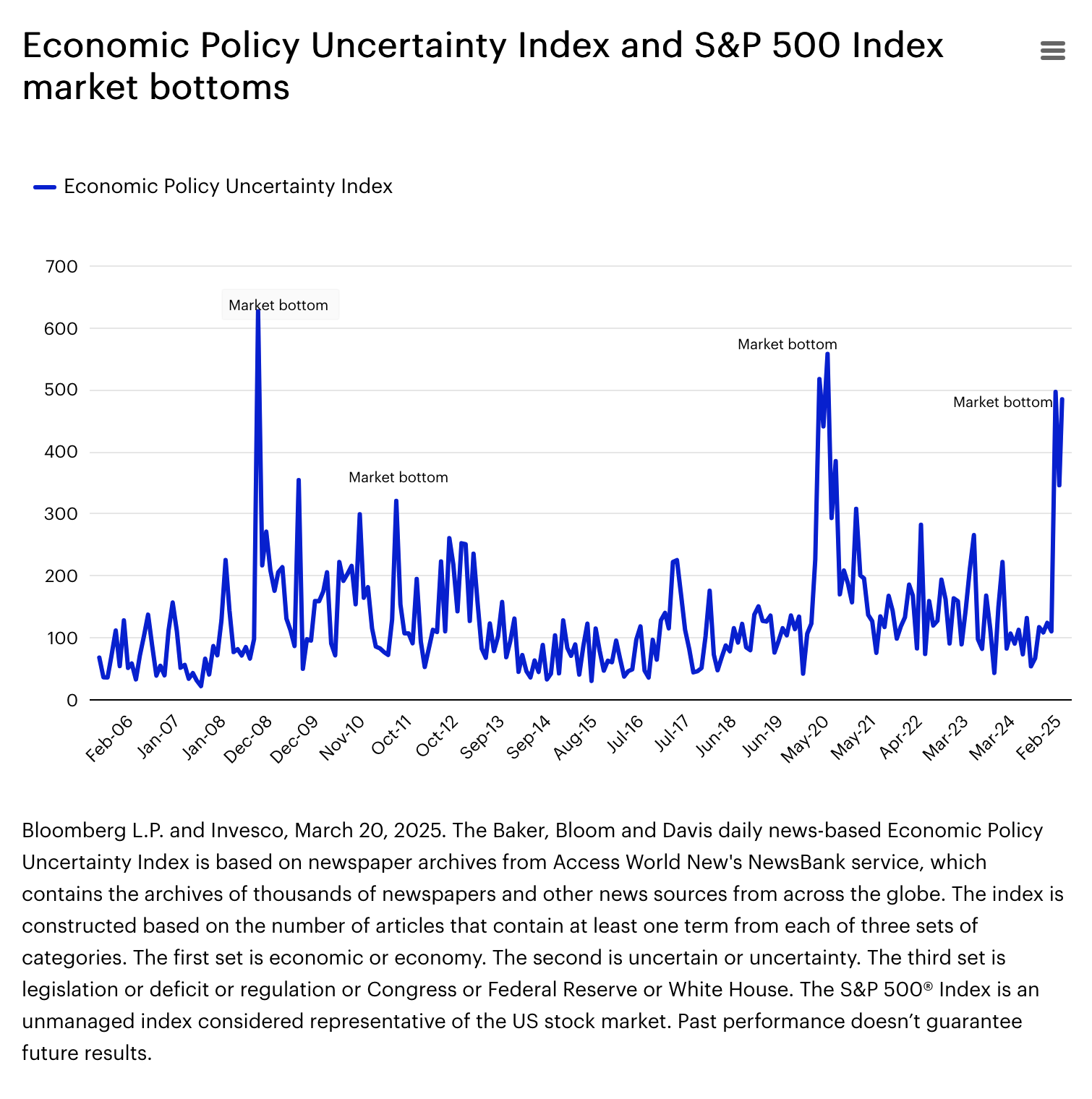

- Buying opportunity? - We may not be at peak policy uncertainty, but past peaks have been attractive buying opportunities for investors.

- European spending - European markets are excited about a generational shift for increased defense spending, leading to fiscal stimulus.

The first rule of policymaking is "Don't talk about policymaking." No, wait, that's the first and second rules of Fight Club. The first rule of policymaking is "do no harm." Why do I cite this rule now? While the setup for markets was good coming into 2025 (the US economy was resilient and inflation had stabilized1), markets have struggled this year as investors assess ongoing changes to the nation’s policy approach.2

I recognize that suggesting our policymakers are doing harm could alienate some readers, but this isn’t a comment on the policies. I leave it to the voters to render their opinions, and I’m confident that the US economy is strong enough to adjust to different fiscal and trade policies. Rather, it’s the uncertainty regarding our future policies that can harm the economy. Already, consumer sentiment is waning.3 Business sentiment may not be far behind. It’s difficult to put plans in place without knowing the rules.

The seventh rule of Fight Club is “Fights will go on as long as they have to.” Therein lies the current rub for the markets. The longer the uncertainty on tariffs persists, the longer the volatility may persist. I expect we’ll get past it, as we always have, with greater policy clarity and dovish signals from the Federal Reserve.

The focus will then shift to the extension of the Tax Cuts and Jobs Act. That’s something the market can likely get behind.

Public service announcement (part 1)

The 93rd worst day for the Nasdaq Composite Index in the past 30 years was on Monday, March 10, 2025.4 Painful, yes, but nothing compared to the 12.3% decline on March 16, 2020, at the start of the COVID-19 shutdown five years ago.

On days like those, investors may be tempted to deviate from their long-term plan and pull money out of the market. Let’s remember why a long-term view is so important. According to my calculations:5

- A $100,000 investment in the Nasdaq in 1995 would have grown to $2.45 million by March 10, 2025.

- Investors who withdrew $1,000 after each of the 92 worst days would have seen their investment worth only $1.70 million.

- Those who added $1,000 on each of those worst days, on the other hand, would have $2.99 million.

And that’s one to grow on.

Public service announcement (part 2)

Market downturns of 5% to 10% occur almost annually, a fact most are familiar with by now. Market corrections (10% to 20%) are less frequent. Since 1945, the Dow Jones Industrial Average has experienced 15 corrections, with an average recovery time of eight months.6

It may be confirmation bias, but …

… market downturns have tended to coincide with peaks in economic policy uncertainty. Alas, we may not be at peak uncertainty yet. Regardless, past peaks have represented attractive buying opportunities for investors.7

It was said

Social Security is “the biggest Ponzi scheme of all time.” – Elon Musk

I don’t think Bernie Madoff is in jeopardy of losing his status as the orchestrator of the biggest Ponzi scheme of all time. While Social Security, like a Ponzi scheme, relies on current contributions to pay benefits, the similarities end there.

Social Security isn’t fraudulent. Unlike a Ponzi scheme, it’s transparent and legally mandated. A Ponzi scheme collapses when it fails to attract new investors or faces high redemption demands. Social Security, however, has mechanisms to adjust benefits and taxes as needed. Although some may question the political will to implement these adjustments, the alternative is unlikely. One could argue that Social Security has done more than almost any other program to alleviate poverty among the elderly.

Since you asked

Q: Would a recession be a good thing? Wouldn’t it drive interest rates lower, making it easier for the US to fund the debt?

A: No. Recessions are never beneficial. They don’t serve as a therapeutic measure or detox for the economy. Instead, recessions often lead to significant job losses and lifetime earnings can be adversely affected. Some of the unemployed may never return to the workforce. We should strive to avoid recessions at all costs.

Regarding debt funding, a recession would exacerbate the debt situation by reducing tax revenue and increasing spending through automatic stabilizers. In fact, the opposite is true: Debt is sustainable when a nation's nominal growth rate exceeds its borrowing costs.

Phone a friend

European stocks have had a great start to the year. What’s driving the rally, and how sustainable is it? I posed the question to Alessio de Longis, Head of Investments for Invesco Solutions. His response:

“A byproduct of the geopolitical tensions between the US, Ukraine, and Russia is Europe finding itself caught in the crossfire. The eurozone and the European Union, more broadly, have realized that the Pax Americana, which provided protection through international cooperation with the US for 80 years post-World War II, is no longer as secure.

In European circles and markets, there’s excitement due to a generational shift in the willingness and ability to increase defense spending, leading to substantial fiscal stimulus. This change was unexpected in economic circles just three to four months ago. It marks a significant inflection point in fiscal policy, which may significantly boost an otherwise relatively anemic private sector growth.”

On the road again

My travels took me to an event in Hershey, Pennsylvania, “The Sweetest Place on Earth,” where I heard a profoundly sad yet inspiring story from the keynote speaker and fellow Michigan Wolverine, Austin Hatch. Austin survived two plane crashes. The first claimed the lives of his mother and two siblings. The second, which occurred nine days after he had been offered a scholarship to play basketball at the University of Michigan, killed his father and stepmother and left Austin in a coma. Severely injured, Austin had to relearn how to walk, talk, and eat. Despite these challenges, he eventually fulfilled his dream of being a four-year varsity player at the University of Michigan.

Austin's message centers around overcoming adversity through the G.R.I.T. framework, which stands for Growth, Resilience, Integrity, and Teamwork. He emphasizes that adversity is an opportunity to grow and that by adopting a growth mindset, being resilient, maintaining integrity, and working as a team, individuals and organizations can help overcome any challenges they face.

Copyright © Invesco