by Craig Basinger, David Benedet, & Brett Gustafson, Purpose Investments

This week, we’re testing out a new idea. OK, it isn’t new, as we borrowed it from a European bank research report, but it is new for the Ethos.

In any given month, our team fields many questions from both advisors and investors. Not surprisingly, there is some overlap. So, once a month for a few months, we will be providing relatively succinct answers to many of these questions.

Is it too late to add to international equities?

Since 2010, the U.S. equity market has really dominated most others thanks to significantly higher earnings growth. And while there were periods when it looked like leadership was pivoting back to international markets, they were false signals. So, is the strong start for internationally developed equity market performance a new trend or another head fake?

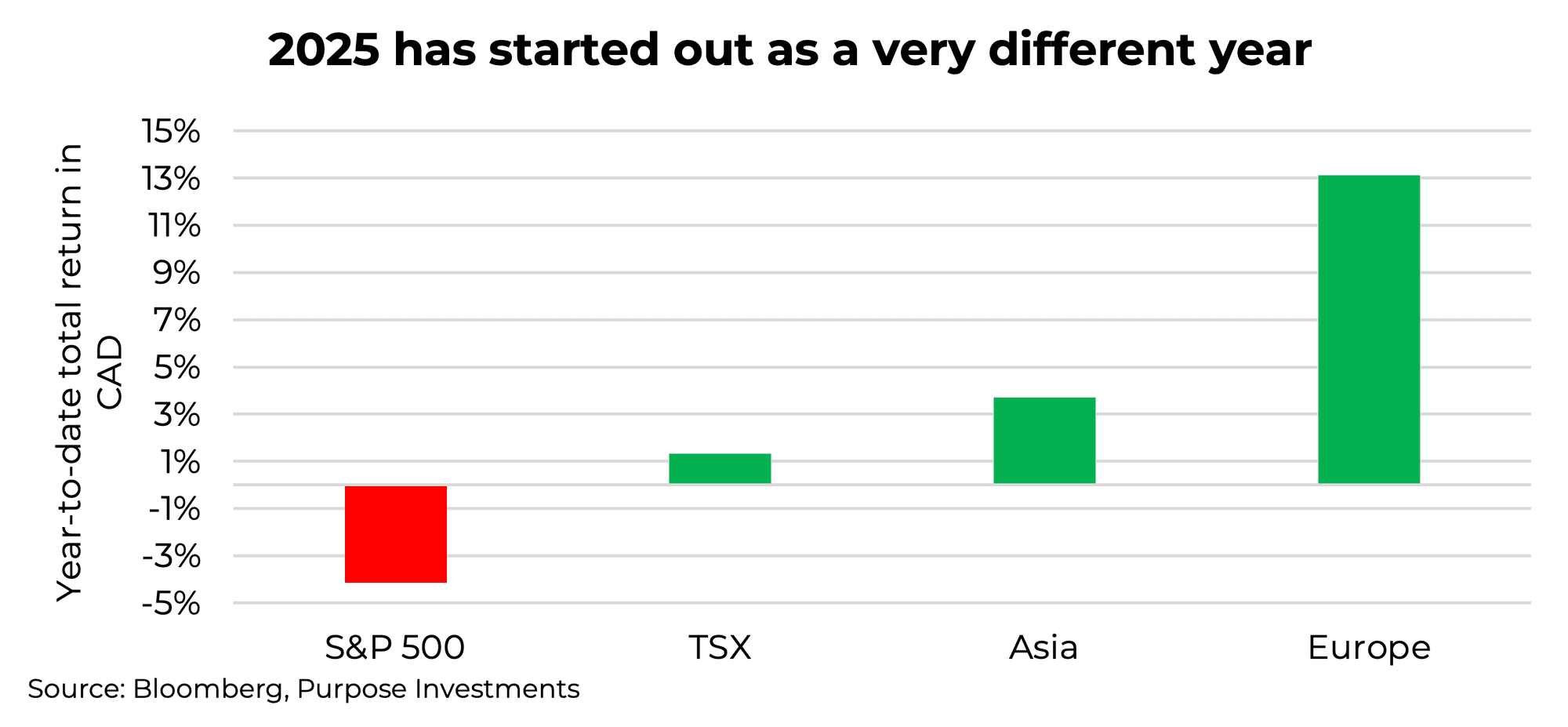

2025 has started off more so with European exceptionalism compared to the U.S. As the end of Q1 nears, the S&P 500 is down -4%, Asia is up +4% and Europe is up a strong +13%. That is a pretty big delta. Adding greater importance to the question is the fact that most portfolios are likely overweight in the U.S. after so many years of relative outperformance compared to international markets.

At some point, the leadership will change. History tells us there are very long periods of relative outperformance which lead to long periods of underperformance. Unfortunately, that will only become known in hindsight. The timelier question is whether this relative rally has legs.

Valuations are a bit less compelling – Given the rally in Europe, and to a lesser extent Asia, combined with the drop in valuation for the S&P 500, the valuation gap has narrowed a bit. Europe and Asia are now about 14–15x while the U.S. is just above 20x. But we would point out that valuations have not been a good predictor of relative performance, noting how the spread remained high for many years.

Sticking with fundamentals, the relative earnings growth gap is narrowing even faster. In December, the market consensus was for 13% U.S. earnings growth comparing 2025 estimates vs 2024. This has now fallen to 10%, still higher than Europe and Asia but moving in the wrong direction. Meanwhile, Europe has improved from a paltry 5% to 7%, with Asia going from 2% to 4%. This has the relative earnings growth rates narrowing.

Fiscal spending – After Covid, government spending went in divergent directions. Europe brought down its deficits steadily over the past few years, closer to pre-pandemic levels. Meanwhile, the U.S. kept spending, with a deficit more aligned with a full-on recession or war. Much of the U.S. exceptionalism has been their willingness to spend, spend, spend. Not just the government, but the consumer as well. When $1 hits an American’s pocket, it’s time to go buy something. European consumers have been much more restrained, similar to their governments.

This is changing. Today, we have the U.S. dialling down fiscal spending (DOGE), and Germany followed by other European countries increasing fiscal spending. This is a total flip and may lead to a continued boost for European earnings and a headwind for the U.S. Hard to say what the consumer is going to do, but consumer debt in Europe is about 52% of GDP compared to 70% in the U.S. Their consumer is in better shape.

Trump – Then there is Trump. Or, more specifically, the policy flip-flopping about, creating more uncertainty for the U.S. compared to other areas. Given that the wording out of the U.S. tends to be antagonistic, this is further leading money to relocate. Europe has just enjoyed some of the strongest inflows in many, many years. Could this be in part a patriotic reallocation? Maybe. It is certainly calling into question the sustainability of U.S. exceptionalism.

Currency has been another contributor. While the CAD/USD has remained relatively stable over the past month, make no mistake: both these currencies are falling vs the euro and yen. The euro and yen are still cheap.

While the valuation gap has narrowed somewhat, it still remains favourable for international developed markets compared to the U.S. And if the earnings revision momentum continues, so should the relative performance. Hard to say if this is the start of a longer-term secular trend of international outperformance. However, in the near term, it could easily have legs. Many portfolios remain relatively underweight in international. We don’t think it is too late, even for latecomers.

If elevated volatility is anticipated for the rest of the year, what should I add to the portfolio to help manage the impact?

Our expectations for 2025 are rather muted. Global equity markets have enjoyed two very strong years and while a third is not impossible, it is less likely. Especially considering the policy risks in today’s markets, including tariffs. However, our muted return expectations do not translate into flat markets. Instead, we believe there will be bigger swings, some up and some down. This puts additional focus on the defensive characteristics of a portfolio.

In years past, this would simply mean more bonds. The challenge is that inflation remains elevated and volatile, which may reduce the defensive characteristics of bonds. Higher inflation typically results in higher correlations between equities and bonds than in years past. The silver lining is bonds now carry higher yields. Less portfolio defence, but more performance contribution.

This creates an environment that makes diversifying your defensives appear prudent. The biggest concern today is the uncertainty around tariffs. We do believe, that even if the news is bad, this uncertainty will become less uncertain in the coming weeks or months. The market can often handle bad news better than uncertainty. And this may create a market bounce at some point. However, a bit further downfield, the current period of uncertainty may start showing up in earnings and the economic data. This may lead to another challenging period for markets, as people will start talking about recession risks.

Bonds, with decent duration, remain the core of defence. Especially if weak economic/earnings data fuels rising recession risk. But with higher inflation, looking for other sources of defence to complement is best. Volatility management alternative strategies, gold, and tactical momentum are some of the defensive diversifiers we currently employ. For illustrative purposes, the chart below shares diversified defensives beyond bonds.

We believe utilizing a more diversified approach to a portfolio’s defence will be increasingly important in 2025.

Final Note

If you would like to have a deeper discussion on any of these topics, please reach out to the team and let’s chat.

Additionally, if there are burning questions you would like our take on in future editions, feel free to email any member of the team. Hope you found this useful, as these are some of the more popular questions we’ve been receiving from advisors of late.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Get the latest market insights in your inbox every week.

Sources: Charts are sourced to Bloomberg L. P.

The content of this document is for informational purposes only and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained in this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities. No securities commission or similar regulatory authority has reviewed this document, and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable; however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated. Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” intend,” “plan,” “believe,” “estimate” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are, by their nature, based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose Investments and the portfolio manager believe to be reasonable assumptions, Purpose Investments and the portfolio manager cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on the FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

Copyright © Purpose Investments