Despite cratering consumer confidence, Canadian shoppers have yet to fully close their wallets. That’s the key takeaway1 from RBC Economics' Rachel Battaglia and Abbey Xu, who argue that “Canadian consumer spending not as soft as confidence yet but risks remain.” In a climate where trade tensions and stormy weather collide with fading stimulus, the story of the Canadian consumer is far more nuanced than headlines suggest.

A Historic Plunge in Confidence

Let’s start with the headline risk. According to Battaglia and Xu, “Trade disruptions sent Canadian consumer confidence to its lowest level in history in March.” That stark assessment reflects a sharp response to escalating tensions in the ongoing trade war with the U.S.

How sharp? “The Conference Board of Canada’s Index of Consumer Confidence fell 32% from January to March as the trade war with the U.S. intensified.” This kind of collapse in sentiment would normally be associated with a commensurate pullback in consumer spending—but not this time. Or at least, not yet.

Spending Holds—For Now

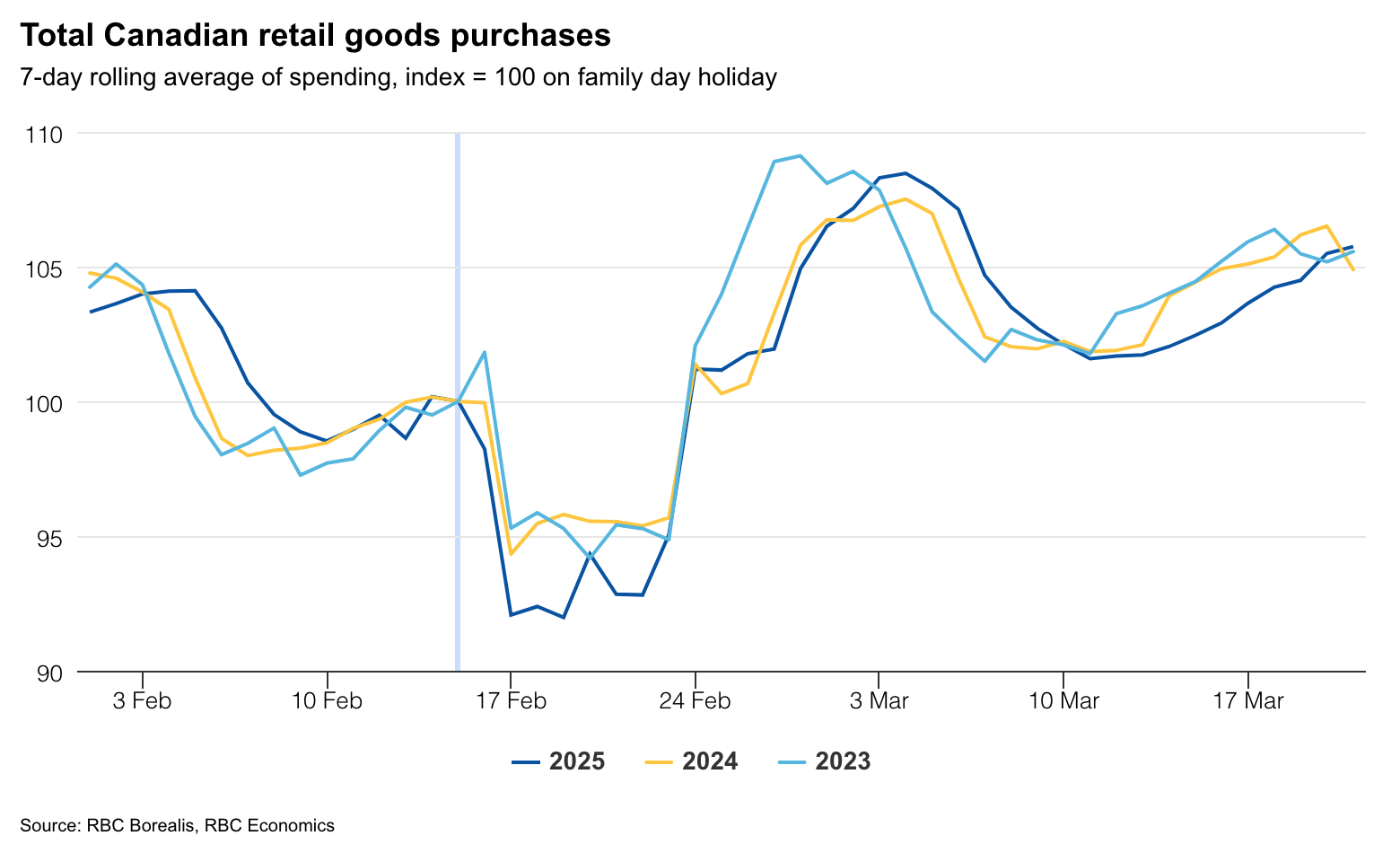

Despite the gloom, RBC’s proprietary data shows consumers aren’t tightening their belts quite as severely. “Retail data shows spending hasn’t softened to the same degree with RBC cardholder data reflecting a smaller pullback.”

Specifically, “Card transactions in February showed a 0.2% (seasonally adjusted) drop in spending on retail goods excluding autos—broadly consistent with Statistics Canada’s advance estimate of retail sales falling 0.4% in February.” Not exactly a spending boom, but hardly the kind of retreat implied by a 32% collapse in confidence.

That divergence between sentiment and behaviour may be the result of temporary supports—including tax breaks and stimulus cheques—that are now rolling off.

The GST/HST Cliff and Weather Disruptions

The data shows that a key turning point came mid-February. “The pullback in purchases was also influenced by the end of the GST/HST tax holiday on Feb. 15, and severe weather in Ontario.”

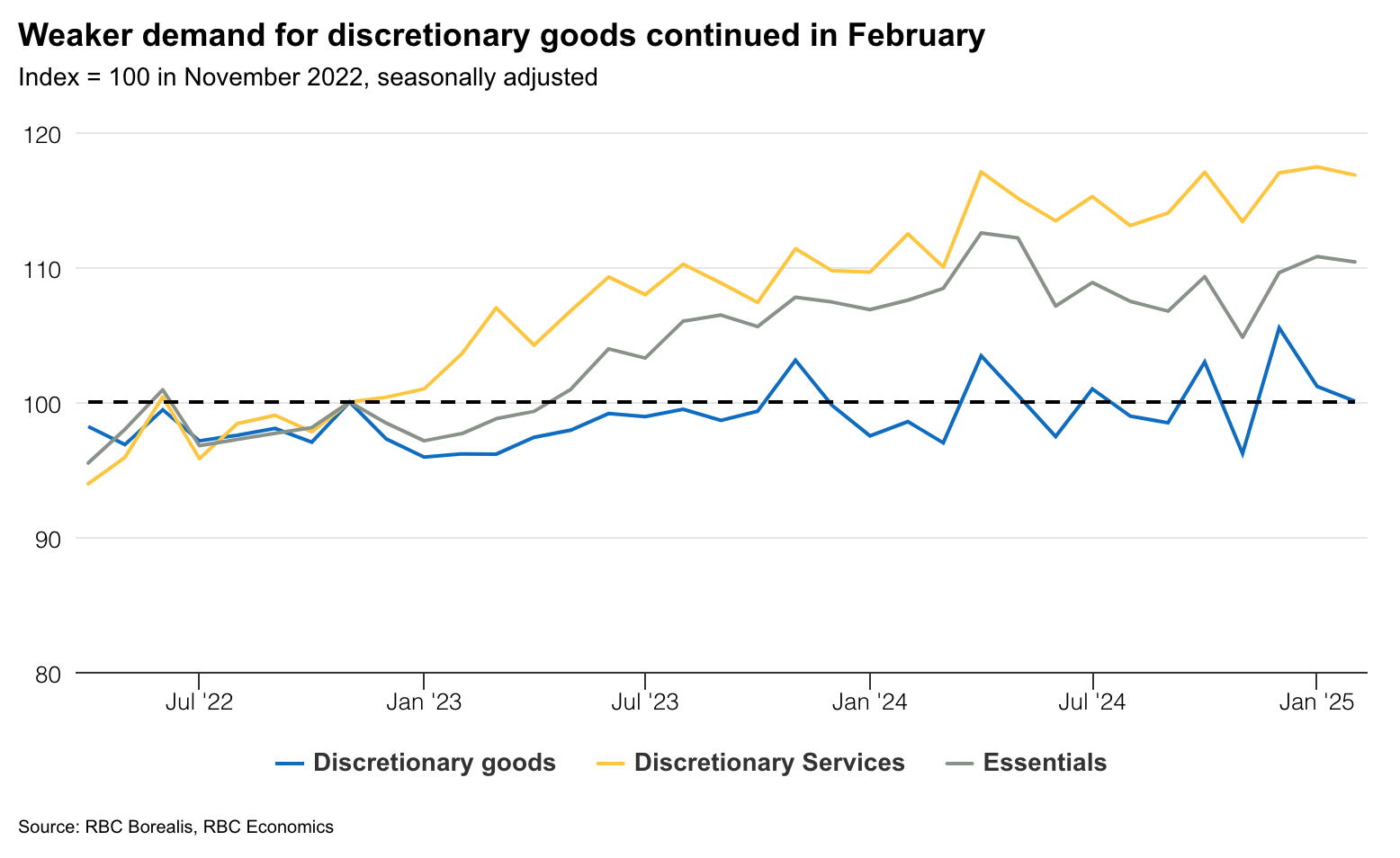

This matters, especially for discretionary goods. “Spending on discretionary goods declined in February, but spending on discretionary services and essentials were little changed from January.” That consumer selectivity helps explain why “sales at restaurants edged higher—broadly consistent with data from OpenTable showing restaurant bookings still running 20% above year-ago levels into late March.”

It also demonstrates that Canadian households aren’t yet retreating across the board, but they are becoming more cautious—and responsive to incentives.

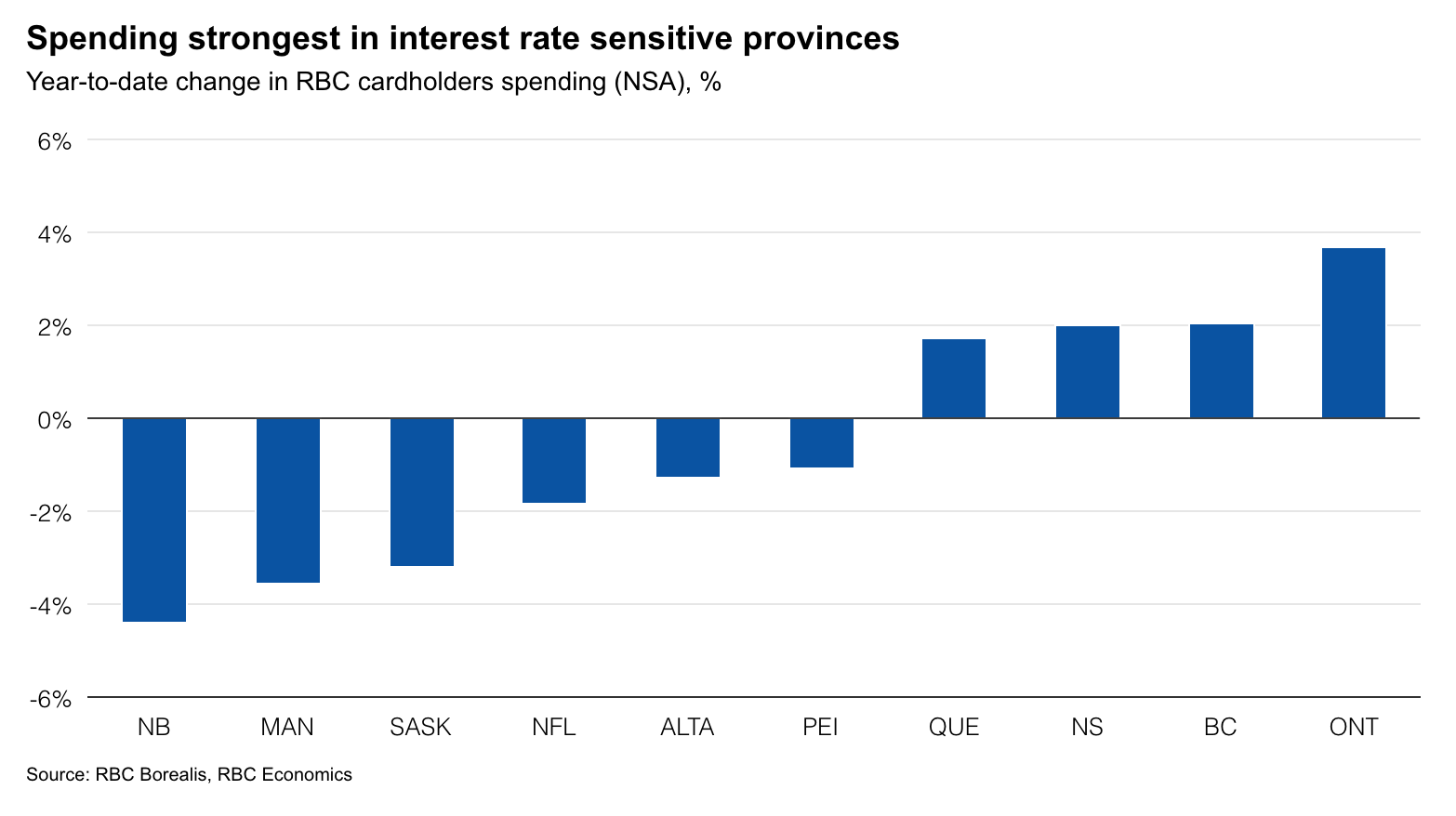

Regional Divergence Tells a Deeper Story

As always in Canada, the regional breakdown reveals more than national aggregates. “Spending fell most in the Prairies and Atlantic provinces so far this year where easing population growth is weighing on overall activity.” The kicker? “Low sensitivity to interest rates in these regions means per capita spending hasn’t seen much of a lift either from lower interest rates.”

By contrast, Ontario appeared more resilient—at least early in the year. “Ontario has shown stronger numbers so far this year, supported by the distribution of $200 stimulus cheques and the tax holiday.” But the impact was short-lived. “Spending quickly eased mid-February after the end of the tax holiday coincided with Family Day and a severe two-day snowstorm. Most of the tax rebate cheques had already been mailed out by this point as well.”

Without the tailwinds of fiscal relief, there’s little incentive left for consumers to keep spending. As Battaglia and Xu bluntly note: “Consumers had less incentive to spend after the tax holiday ended.”

Looking Ahead: Tariffs, Tensions, and Tapering Resilience

So where does this leave the outlook? Cautiously neutral—for now, with the threat of tipping into a downturn if external shocks escalate.

“Consumer spending appears to have remained relatively resilient compared to the plunge in confidence measures over February and March,” the economists conclude, “but escalating international trade uncertainty, including the potential for another round of significant tariff hikes in April, could add downward pressure on spending in the months ahead.”

In other words, the Canadian consumer is skating on thin ice—and the weather forecast is far from clear.

Bottom Line for Advisors

The dissonance between confidence and consumption is a crucial signal. While spending hasn't cratered yet, its resilience may be running on fumes—propped up by one-time fiscal supports and mild weather in some regions. As trade risks return and those supports roll off, the potential for a delayed consumer pullback is growing.

Advisors should be watching for the next phase of this story—particularly if tariff hikes materialize in April and consumer sentiment remains suppressed. Expect more uneven regional dynamics, selective spending behaviours, and increased pressure on discretionary categories. In this environment, understanding why consumers are still spending may be more important than how much they’re spending.

In the meantime, the RBC team’s message is clear: Confidence has collapsed, but consumers haven’t—yet.

1 Rachel Battaglia, Abbey Xu. "RBC Consumer Spending Tracker - RBC Economics." RBC Thought Leadership, 26 Mar. 2025, thoughtleadership.rbc.com/rbc-consumer-spending-tracker.