Long revered as the only free lunch in finance, diversification now finds itself on trial, its once-unquestioned wisdom challenged by a shifting market landscape. From the rise of concentrated equity indices to the reemergence of positive stock-bond correlations, investors are navigating unfamiliar terrain. UBS Asset Management’s The Red Thread: Diversification Edition1 serves as both compass and cautionary tale, tracing the evolving role of diversification across market cycles, asset classes, and economic regimes.

This edition blends history, hard data, and high-level strategic thinking, bringing together voices from academia and industry to answer one critical question: Is diversification still working the way we think it is?

Revisiting First Principles: The Academic Foundation

“The intuition that diversification reduces risk goes back centuries,” explains Professor Paul Marsh of the London Business School. Referencing Don Quixote’s 1605 adage about eggs and baskets, Marsh walks us through the evolution from proverb to Nobel Prize-winning science. “Just over seventy years ago, Harry Markowitz (1952) published Portfolio Selection, which laid the foundations of modern portfolio theory.”

Marsh, whose collaboration on the UBS Global Investment Returns Yearbook spans more than two decades, points out that diversification’s historical track record is nuanced. Global investing, for instance, “led to higher Sharpe ratios than domestic investment in the vast majority of countries,” he notes. “However… one of these [exceptions] was the world’s largest and most important market, the US.”

That exception, driven by both US equity outperformance and low domestic volatility, raises a sobering point: “Although before the event global diversification always seems like a good idea, it does not necessarily have a good outcome.”

Correlation in Crisis: The Non-Linearity Problem

In the core analytical section titled The Non-Linearity of Diversification, Michele Gambera, Fatomata Konteh, and Gianluca Oderda delve into how asset correlations shift in stress scenarios.

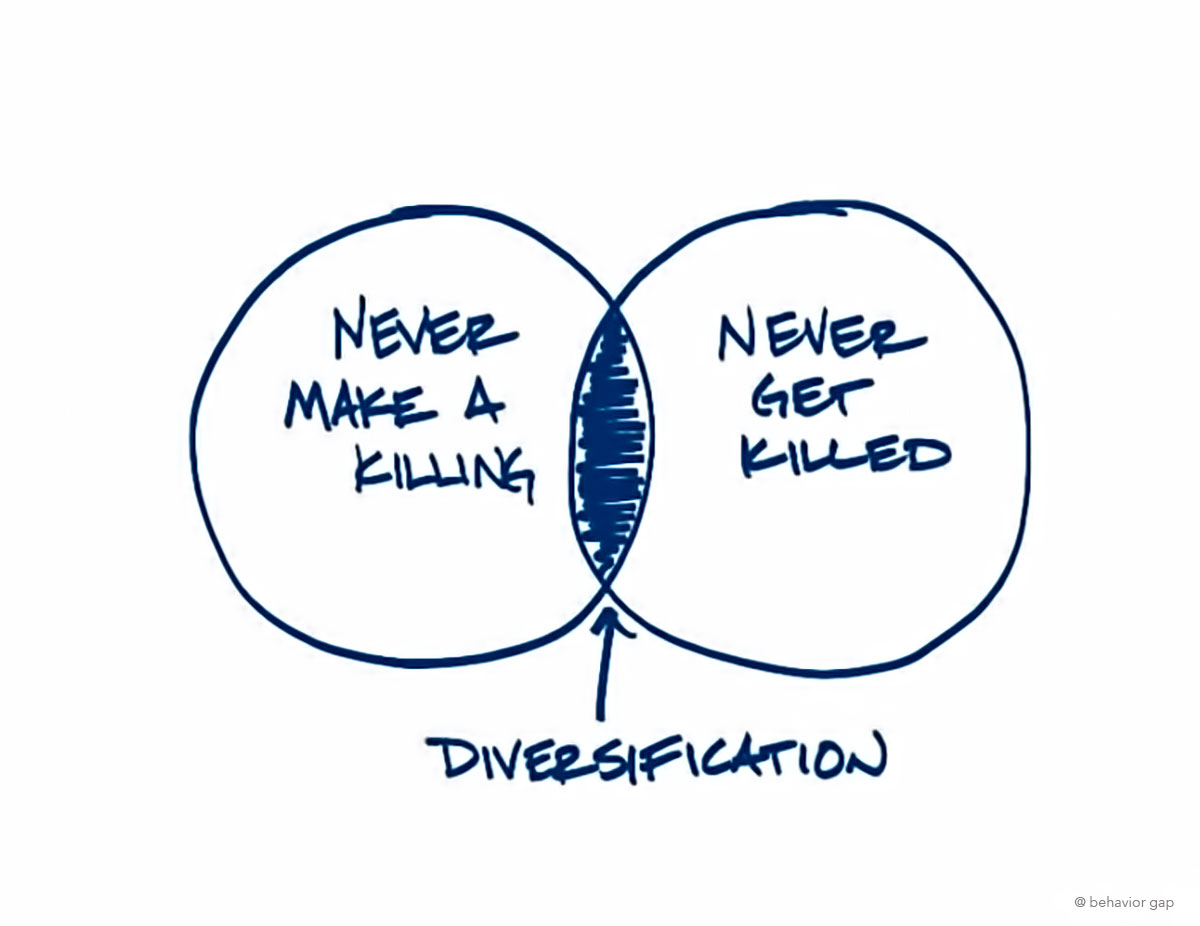

They remind us of an uncomfortable truth: “Diversification is the beating heart of any multi-asset portfolio,” yet “the relationship between ‘risk assets’ and ‘safe assets’ is not linear.”

Using nearly 30 years of data, the team shows how the classic negative stock-bond correlation — a cornerstone of 60/40 portfolios — has reverted to positive territory. “Triggered by a return to inflation and a move to ‘normal’ rates levels, the relationship has turned positive again. Stocks and bonds no longer offset each other as much.”

In high-inflation and high-volatility regimes, they find, traditional diversifiers falter. “Even ‘safe-haven’ assets, such as US government bonds, provide only a limited degree of diversification,” the authors caution. The only consistent hedges in extreme conditions? “Cash and government bonds,” with macro and market-neutral hedge funds showing promise — but with caveats.

The Illusion of Index Safety: When Diversification Disguises Concentration

Today’s passive portfolios may appear diversified, but many are anything but. Ian MacIntosh, Head of Active Equities, issues a direct warning: “In the S&P 500, three stocks (Nvidia, Apple, Microsoft) now account for around 20% of the index weight and more than one quarter of the risk.” As he bluntly puts it: “Errors of omission are now costly.”

MacIntosh backs his critique with data. Running 1,000 simulated 50-stock portfolios against the S&P 500 over the past year, only three outperformed. “The median simulated portfolio underperformed the index by a whopping -12.2%,” he reports. “This search equates to looking for a needle in a haystack.”

For active managers, hugging the benchmark has become a survival strategy. But, MacIntosh reminds us, “the dominance of cap weighted indexes is not pre-ordained… like every regime that came before, this one shall end.”

Smarter Indexing: Fixing the Flaws in Passive Exposure

Boriana Iordanova, Head of Index Research, offers investors a roadmap out of the concentration trap. “Buy a stock in a company that makes umbrellas and a stock in a company that makes ice cream,” she quips, invoking a university lesson on diversification. “Holding a ‘slice of the market’ should, in theory, be the ultimate diversifier.”

But with global indices increasingly “Technology heavy, US-oriented, and concentrated in a handful of stocks,” Iordanova proposes a menu of solutions: equal-weighted indexes, capped exposure, and factor indexing.

Her research shows that blending factors — such as value, low volatility, and quality — “can reduce performance cyclicality and produce diversification benefits.” The UBS HOLT framework further refines these strategies, using CFROI® to strip away accounting distortions and enhance comparability.

Her takeaway is clear: “Trying to time the market and the allocations to different factors is hard. A more pragmatic approach would be to invest in a blend.”

Diversifying the Diversifier: A Blueprint for Smarter Alternative Allocations

In recent years, investors have turned to alternative strategies with the hope of escaping the growing correlation trap of traditional 60/40 portfolios. But as Daniel Edelman and Edo Rulli explain in The Red Thread: Diversification Edition, alternatives are not a silver bullet. “Alternative investments have long been touted as portfolio diversifiers,” they write, “but simply investing in hedge funds or private markets does not guarantee diversification.” The mere presence of non-traditional assets is insufficient. True diversification demands a structured framework—one that acknowledges the nuances of strategy construction, market behavior, and implementation complexity.

Edelman and Rulli propose a clear, actionable framework to cut through this complexity: the Three Rs of diversification — replication, risk reduction, and representation. This triad anchors the role of alternatives not as add-ons or performance chasers, but as core building blocks in robust portfolio design. “Replication strategies offer the potential to provide hedge-fund-like exposures at lower cost and with greater transparency,” they explain, referencing systematic strategies that mirror hedge fund factor exposures. By using liquid alternatives, investors can gain exposure to alpha sources traditionally locked behind high fees, limited access, and quarterly liquidity windows—without inheriting the full spectrum of operational and structural risks.

The second ‘R’, risk reduction, focuses on one of the least glamorous yet most important dimensions of alternatives: managing downside and diversifying away from traditional risk premia. Edelman and Rulli are clear: “Risk reduction is achieved by diversifying across multiple dimensions: manager, strategy, region, and liquidity profile.” Rather than relying on a single manager or strategy to deliver non-correlation, the diversified approach ensures that no single bet dominates the outcome. This principle is especially important in stressed markets when correlations between traditional assets tend to spike and diversification is needed most.

Finally, representation speaks to the strategic intent behind incorporating alternatives. “Representation ensures that the alternative investment allocation captures unique market traits and structural opportunities not readily available through traditional instruments,” Edelman and Rulli write. This may include private credit niches, macroeconomic trend-following, or long/short thematic strategies that reflect persistent inefficiencies. Representation means alternatives are not simply volatility reducers or yield enhancers—they are expressions of differentiated thinking. As the authors put it plainly, “Diversification should not end at the 60/40 frontier.” When guided by the Three Rs, alternatives become not only diversifiers—but essential tools for risk-managed, forward-looking portfolios.

The Evolving Role of Private Equity: Diversification or Valuation Mirage?

Private equity has long been held up as a powerful diversifier — an illiquid alternative to public markets that promises both return enhancement and risk reduction. But as Markus Benzler and James Pilkington argue in The Red Thread: Diversification Edition, this promise deserves closer inspection. “Private equity is often seen as an effective diversifier within a multi-asset portfolio,” they write, “but the reality is more complex.” That complexity stems from how private equity is priced. Because valuations are typically based on appraisals rather than actual market transactions, they caution that “the returns are ‘smoothed’ compared to listed markets,” which “reduces reported volatility and correlations.” In other words, the perception of diversification may be more about optics than actual risk dispersion.

The illusion of diversification becomes even more problematic during market stress. Unlike public assets, where price discovery is instantaneous and brutally honest, private equity valuations are lagged, retrospective, and reliant on manager discretion. Benzler and Pilkington warn: “During periods of market volatility, it may take some time for private equity valuations to fully adjust to the new environment.” While this delay may cushion drawdowns on paper, it doesn’t immunize portfolios from underlying risk. “This time lag in valuation adjustment can give the appearance of diversification — when in fact the risks remain,” they emphasize. That distinction is critical for institutional and high-net-worth investors who rely on alternatives not just for performance, but for portfolio stability.

This doesn’t mean private equity should be dismissed — far from it. Benzler and Pilkington are clear-eyed about its role, particularly as a source of differentiated return streams and long-term capital growth. But they urge investors to be realistic. “Private equity can still play a key role in a diversified portfolio, but investors should be cautious about assuming it always offers diversification benefits,” they write. The implication? PE exposure should be evaluated in terms of what it diversifies — whether by sector, business model, vintage year, or strategy — and not assumed to be a panacea based solely on historical Sharpe ratios. In a world increasingly defined by transparency, mark-to-market discipline, and real-time risk assessment, private equity’s evolving role must be measured not just by what it earns — but by what it truly hedges.

Beyond Markets: Diversification in the Real World

Finally, UBS zooms out to explore how diversification principles apply in global supply chains. In Comparative and Competitive Advantages, Max Castelli and Lucy Thomas examine how geopolitics, sustainability, and efficiency collide. “The delicate trade-offs faced when trying to optimize supply chains,” they write, are not unlike portfolio construction — “only the inputs are political risk and emissions intensity instead of beta and correlation.”

The Bottom Line: Rethinking Resilience

Barry Gill, Head of Investments at UBS Asset Management, opens the edition with a stark observation: “In theory, theory and practice are the same. In practice, they are not.”

Diversification remains vital — but it’s not a static formula. In today’s environment of market concentration, rising correlations, and inflationary tail risks, investors must look past simplistic splits and passive allocations. The message from UBS’s experts is unified: to stay resilient, investors must re-underwrite their assumptions, rethink their exposures, and revisit the very definition of what it means to be diversified.

1 UBS. "The Red Thread: Diversification Edition." Asset Management, 7 Mar. 2025, www.ubs.com/global/en/assetmanagement/insights/investment-outlook/the-red-thread/trt-end-year-2024.html. Download: