by Kathrin Forrest, Equity Investment Specialist, Capital Group

The ongoing trade war launched by the United States against its major trading partners (Canada, Mexico, China and Europe) has created a complex environment that’s in a constant state of flux. On-again, off-again tariffs, retaliatory measures, select industry carve-outs for some and concessions for others have left investors’ heads spinning and rattled U.S. and Canadian stock markets.

In this environment, it’s natural for investors to feel uneasy, to worry about their portfolio or to question whether they should shift some of their holdings.

But according to equity investment specialist Kathrin Forrest, it’s more important than ever for investors to tune out the noise, maintain a well-diversified portfolio and stick with their long-term investment plans.

1. Tune out the noise

“With news headlines constantly changing, I encourage investors to take a step back and look at the bigger picture,” says Forrest. She acknowledges that investors may feel compelled to react to startling news and seek to adjust their holdings.

That could be a mistake. The S&P 500 index of U.S. stocks in U.S. dollars has on average over the past 70 years fallen by 5% or more about twice a year and 10% about once every 18 months.

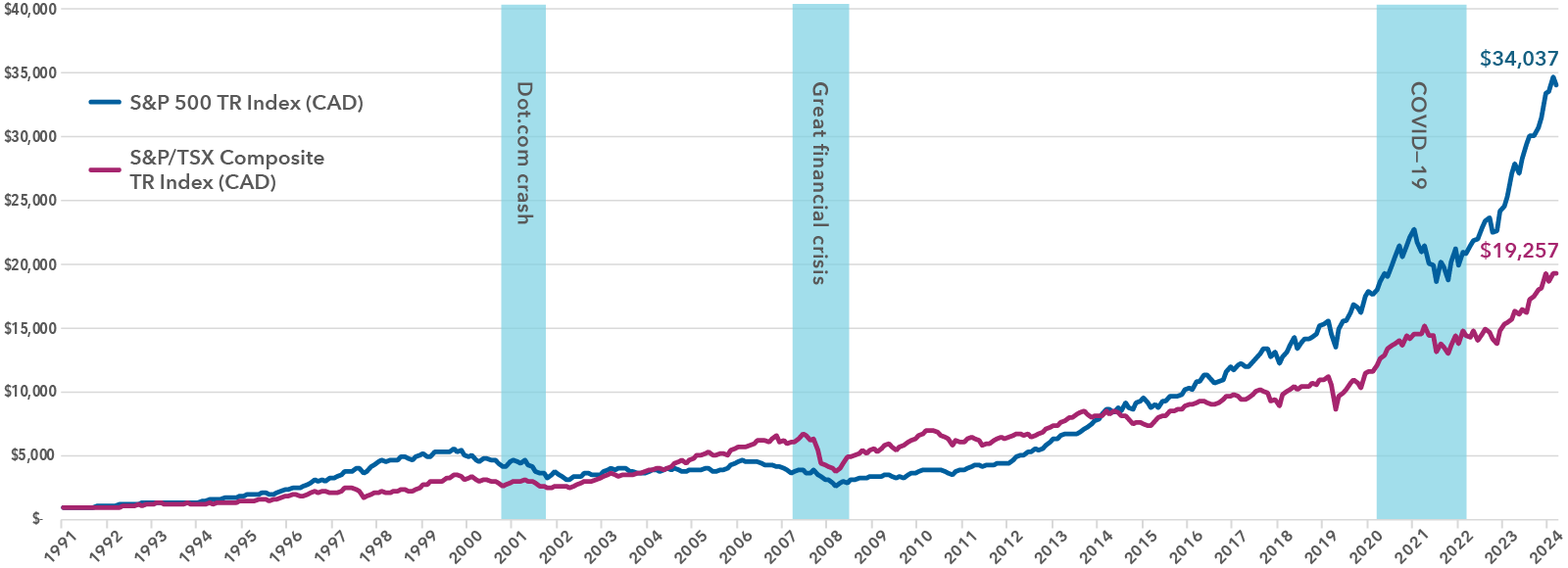

“While past results do not predict future returns, the markets have gone on to new heights each time,” Forrest points out. In other words, investors have weathered upheavals in the past, and by staying invested, you avoid the risk of selling at a low point and missing potential rebounds, as illustrated in the chart below.

The two lines show how the S&P 500 and S&P/TSX have gone on to new heights following other major events such as the bursting of the internet bubble, the Great Financial Crisis and the COVID-19 pandemic.

Historically, markets go on to new heights over time

Growth of $1,000 – December 31, 1991 to February 28, 2025

Sources: Capital Group, Morningstar Direct. S&P/TSX index reflects Canada and the S&P 500 index reflects U.S.

Another important outcome from staying invested is the benefit that accrues from dollar-cost averaging, a simple system of regularly investing a fixed amount of money. By doing so, investors buy more shares/units when prices are low and fewer shares/units when prices are high, which can lower the average cost per share/units over time. This approach helps mitigate the impact of market volatility and reduces the risk of making poor timing decisions. Additionally, staying invested helps you maintain a diversified portfolio, which is the second key component when fighting trade war market volatility.

2. Maintain a well-diversified portfolio

Diversification is the process of spreading your money across different investments in a single portfolio. During volatile markets, some investments may underperform while others outperform, which has certainly been the case thus far in 2025.

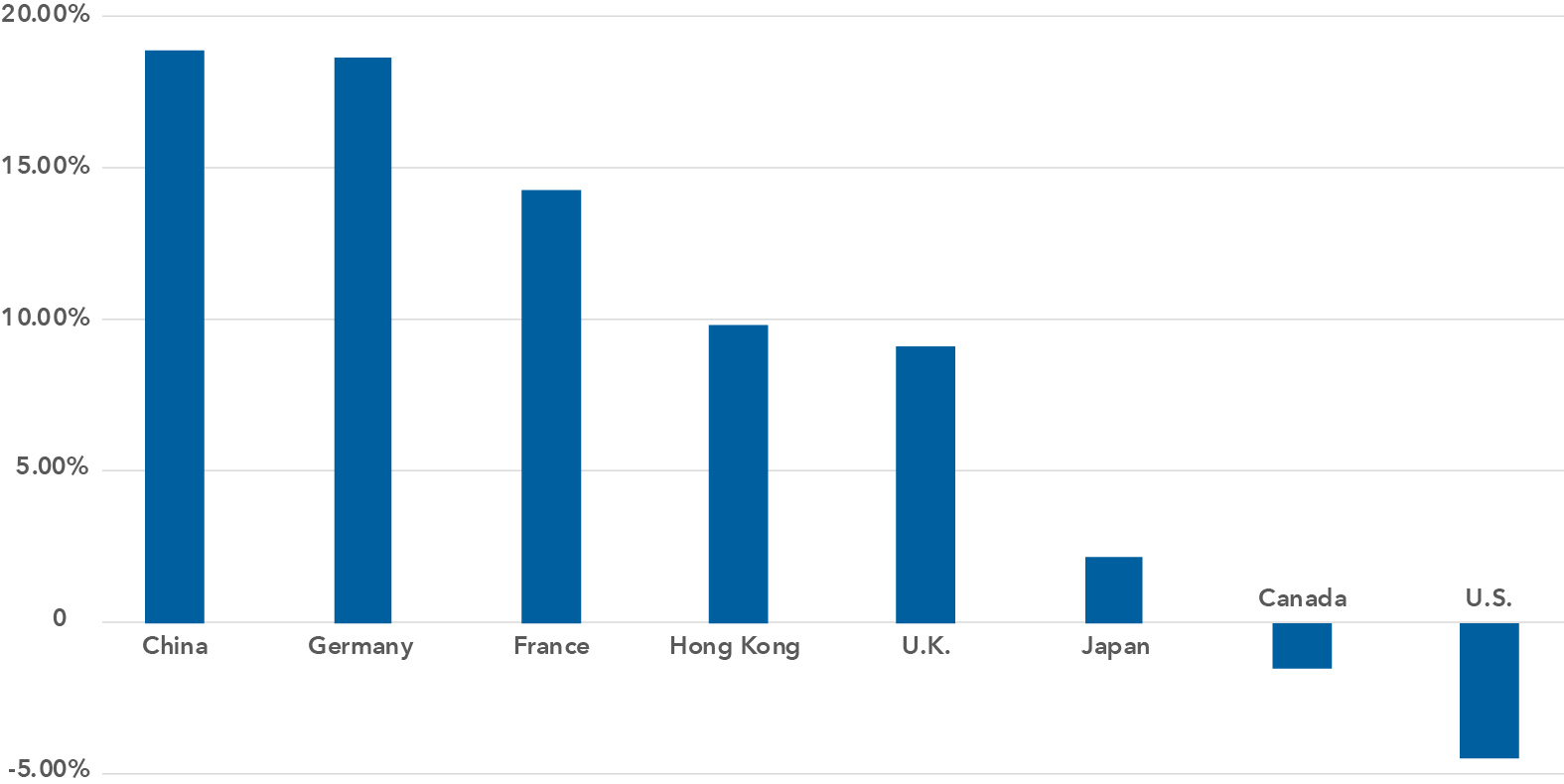

As shown below, many international markets have performed well since the start of the year through March 11 despite what’s happening in Canada and the U.S. The same can be said about Japanese and emerging markets stocks, if to a lesser extent. Country-wise, some of the stand-out performers include China, up 18.87%; Germany, up 18.65%; France, up 14.29%; Hong Kong, up 9.80% and the U.K., up 9.13%. In comparison, Canada is down 1.49% and the U.S. declined 4.48%.

Better results overseas

Year-to-date total returns across select equity market benchmarks — December 31, 2024 to March 11, 2025

Sources: Capital Group, Morningstar Direct. MSCI China index reflects China, MSCI Germany index reflects Germany, MSCI France index reflects France, MSCI Hong Kong index reflects Hong Kong, U.K. MSCI index reflects the U.K., MSCI Japan index reflects Japan, S&P/TSX index reflects Canadian stocks, and the S&P 500 index reflects U.S. stocks.

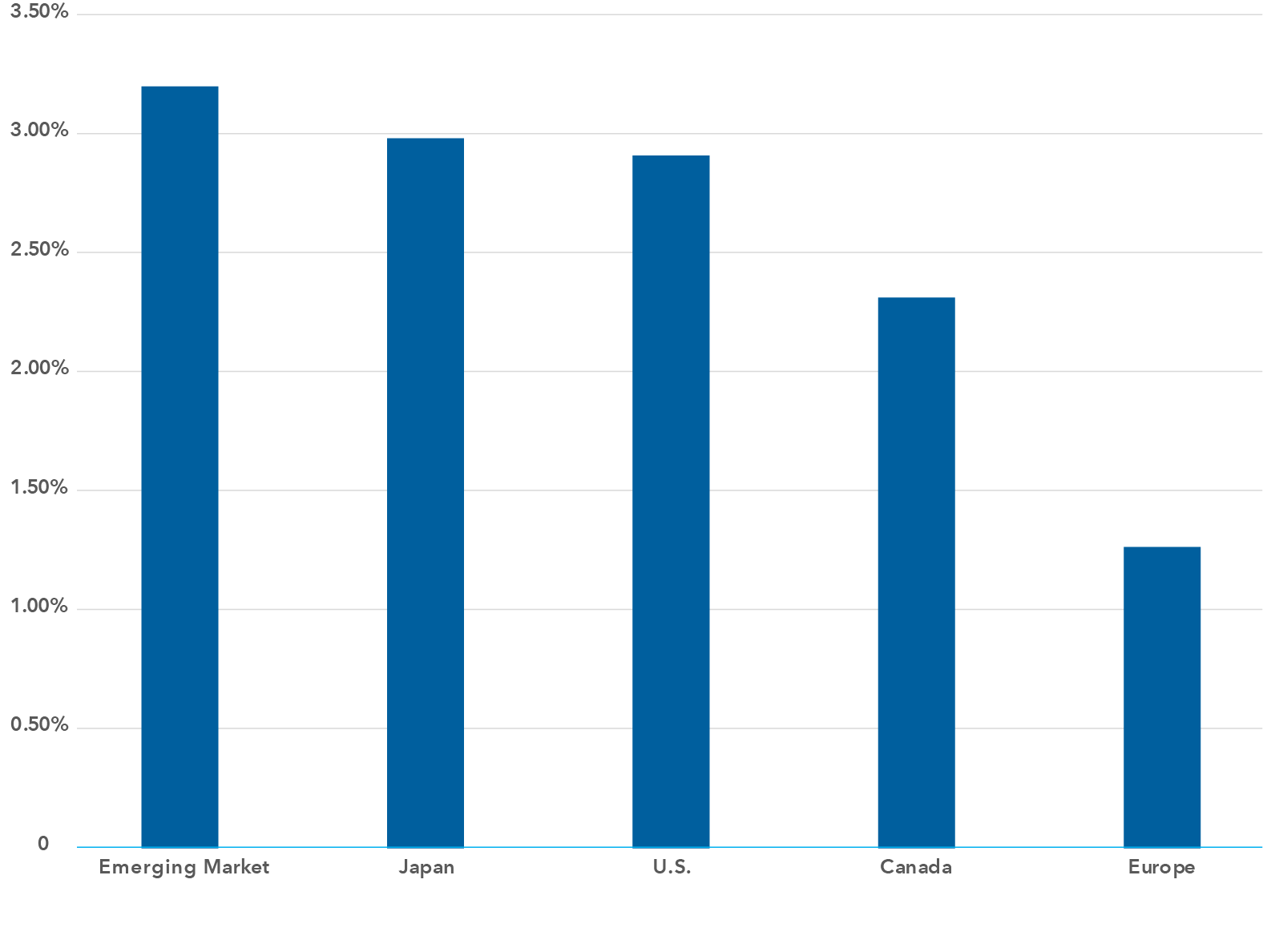

Meanwhile, bonds, a foundational pillar of asset class diversification, are also doing their jobs. In fact, Canadian, U.S., Japanese and European bonds are all up this year, with emerging markets issues leading the others.

Bonds doing their job

Year-to-date total returns across select fixed income benchmarks — December 31, 2024 to February 28, 2025

Sources: Capital Group, Morningstar Direct. The J.P. Morgan Emerging Markets Bond Index Global Diversified reflects emerging markets, Bloomberg Japanese Aggregate Bond index reflects Japan, Bloomberg U.S. Aggregate Bond index reflects the U.S., FTSE Canada Universe Bond index reflects Canada, and the Bloomberg Euro Aggregate Bond index reflects Europe.

3. Stick with your investment plan

As tempting as it may be to sell your investments during periods of market volatility and disconcerting news cycles, your advisor has created an investment plan that’s designed for your financial objectives, risk tolerance and time horizon.

“Deviating from an investment plan can take you off track and hinder the achievement of your long-term goals,” says Forrest.

One of the primary reasons to adhere to an investment plan is to avoid emotional decision-making. Market fluctuations can trigger fear and anxiety, leading investors to make impulsive decisions such as selling assets during a downturn or chasing high-performing investments. These actions can result in buying high and selling low, which is detrimental to long-term returns. By sticking to a well-thought-out plan, investors can maintain discipline and make decisions based on logic rather than emotions.

“We know market turbulence can be painful and even a little frightening,” says Forrest, “but we believe the wisest strategy is to stick to your long-term investment plan.”

Kathrin Forrest is an equity investment specialist at Capital Group. She has 20 years of industry experience and has been with Capital Group for three years (as of 12/31/24). She holds a master's degree in economics from Wayne State University and holds the Chartered Financial Analyst® designation.

Copyright © Capital Group