by Craig Basinger, David Benedet, & Brett Gustafson, Purpose Investments

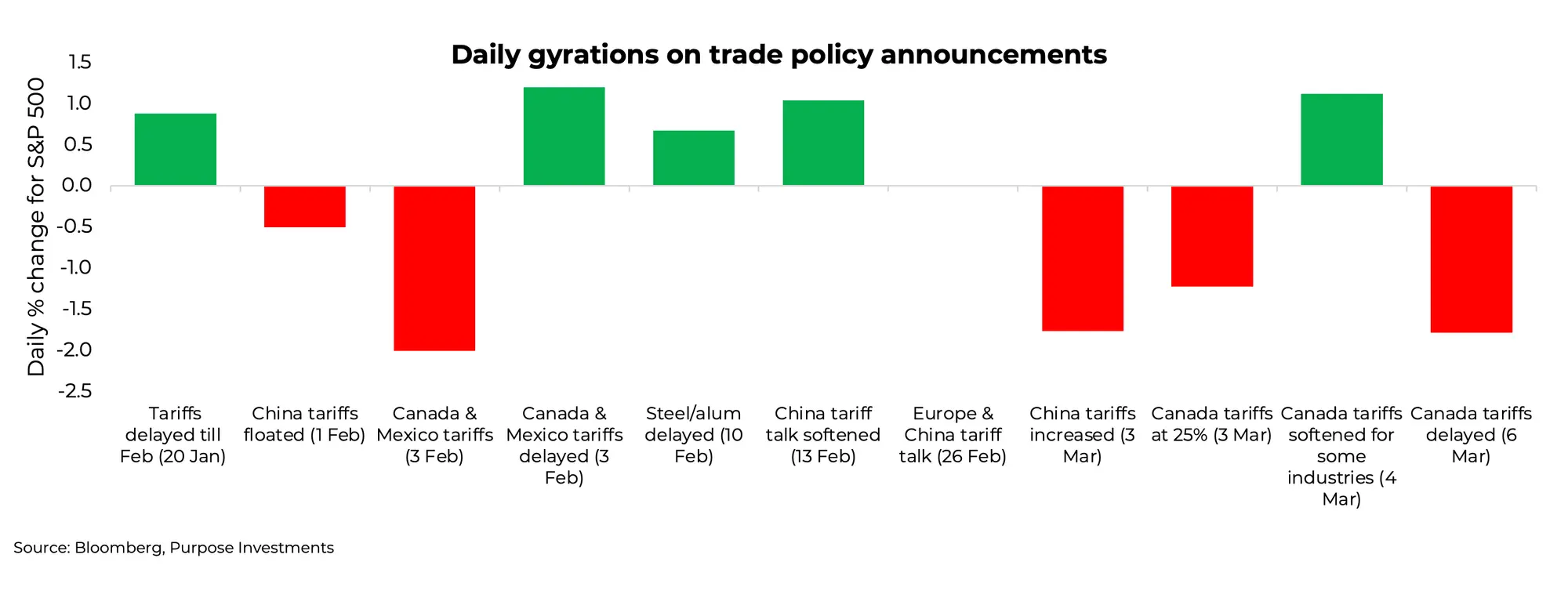

It would appear the market is becoming exhausted as well, or at least fed up. Daily gyrations have clearly risen, just looking at how many +/-1% days we have experienced over the past few weeks. The bigger issue is that the market reaction function appears to be changing. Early on during this tariff policy news barrage, tariff implementation news was bad while delays were good for markets. But the one-month delay for Canada and Mexico tariffs announced on March 6th elicited no bounce for oversold markets. This market appears to want more than delays to tariff uncertainties.

The markets had been rather patient with all this policy flip-floppery during the first month and a half of 2025. But not since then. It is increasingly causing decision paralysis for companies. And we’ve often cited that markets dislike uncertainty more than bad news. Bad news can be priced in relatively quickly; uncertainty cannot. Sadly, uncertainty is the only constant at the moment.

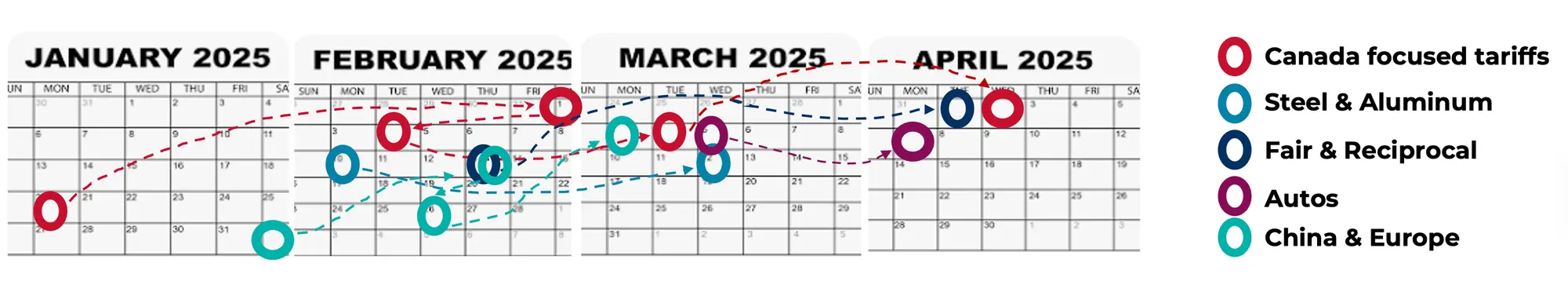

Here is a calendar edition of the key tariff policy announcement dates and deferrals (just follow the dotted lines connected the coloured circles, if you can). Not surprisingly, this has pushed the U.S. Trade Policy Uncertainty Index to higher levels than seen at the peak of the China-U.S. tariff tussle in 2019. This is a text analysis index based on newspaper content. Not sharing the chart as it simply looks like a line going straight up!

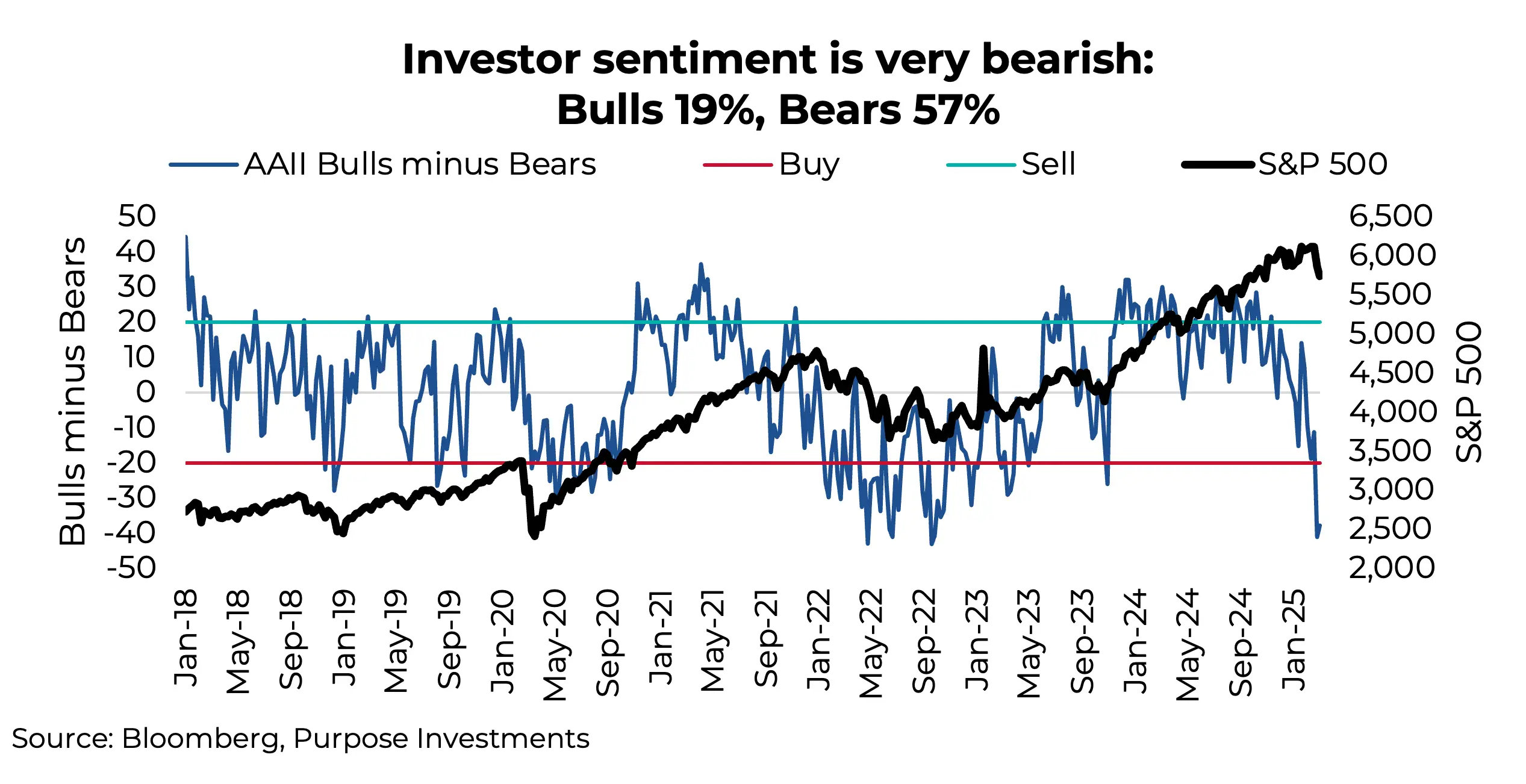

The uncertainty has also started to weigh on investors’ mindsets. The American Association of Individual Investors has a weekly survey that dates back over 30 years. The survey asks a sampling of investors whether they think the market will be higher, the same or lower in six months. Survey results on Feb 27 had an astonishing 19% bullish and 61% bearish. The last time there was a reading over 60% bearish was September of 2022, with the S&P 500 at the time down 23% from its high. This February reading came when the S&P 500 was down -3%. The past week’s survey is about the same: 19% bullish and 57% bearish, and now we have an S&P 500 down about -7% from its high.

The chart below shows the percent bullish minus the percent bearish alongside the S&P 500. The general rule is that when the bulls minus bears (net sentiment) is below -20, it is time to buy. Historically, this is a contrary indicator for market direction. With any indicator, sometimes they work and sometimes they don’t. Early in the 2022 S&P 500 bear market, net sentiment hit the -20 mark, but the S&P had almost -18% more to go. While this is a very intriguing potential buy signal, is a 7% drop in the S&P 500 enough?

The next big tariff period is in early April. Not just because of the one-month delay for Canada/Mexico tariffs lands around that time but also because the trade finding reports are due. There are some 20+ trade reports expected to land on the President’s desk from various sources/industries on trade fairness, which will certainly nudge towards more tariff announcements.

Sentiment readings are more bearish than during Covid, and the S&P is trading just below its 200-day moving average with an RSI of 32. It does make a case for some buying. After all, if you wait for good news, the market will have already moved on without you. We’re waiting, though; 7% just isn’t enough, given the magnitude of uncertainty.

We also believe there is going to be an economic growth scare in the coming months, which may create a better opportunity. A lot of economic activity appears to have been front-loaded to get across before any potential tariffs. And we will start seeing the labour impact from DOGE efforts next month. Add to this the general uncertainty for businesses to make decisions on hiring, expanding, and M&A. More on all this in a future ethos.

Final Note

Our expectations for 2025 are for a more challenging market, given the headline noise, that will have big swings in both directions (hopefully in both directions). The Eagles won the Super Bowl with defense over a high-powered offense. Believe that this will play out in the markets as well: a year for defense and being opportunistic.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Get the latest market insights in your inbox every week.

Sources: Charts are sourced to Bloomberg L. P.

The content of this document is for informational purposes only and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained in this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities. No securities commission or similar regulatory authority has reviewed this document, and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable; however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated. Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” intend,” “plan,” “believe,” “estimate” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are, by their nature, based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose Investments and the portfolio manager believe to be reasonable assumptions, Purpose Investments and the portfolio manager cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on the FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

Copyright © Purpose Investments