by Sonal Desai, Ph.D., Chief Investment Officer, and Team, Franklin Templeton Fixed Income

Franklin Templeton Fixed Income economists explore the impact of proposed changes to US tariffs and the implications for other economies. Meanwhile, the eurozone contemplates increasing defense spending given a United States that promises to be less active in global security, and the Bank of Japan tightens monetary policy in light of increased price pressures.

Executive Summary

US economic review

US economy: Tariffs—the great equalizer?

________________________________________________________________________________________

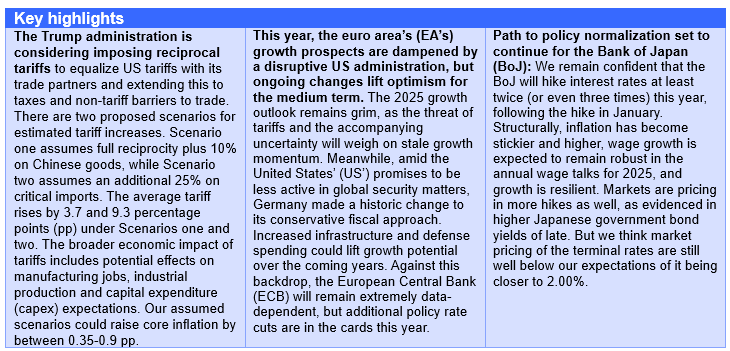

- Tariff strategy: Within six weeks of the beginning of Trump’s second term, the administration imposed a 10% tariff on all Chinese exports to the United States, while other trade partners have faced a “carrot-and-stick” approach, with deferred tariffs in exchange for concessions. The February 13 memo calls for equalizing US tariffs with a trade partner’s average tariff rate on the United States and proposes extending that reciprocity to taxes (including value-added tax and extraterritorial taxes on US businesses) and non-tariff barriers (unfair subsidies, burdensome regulatory environments, lax intellectual property protections, exchange-rate and wage-suppression policies).

- The scope of reciprocity remains unclear: Country-level tariffs would be the easiest to execute, but the administration has not explicitly endorsed this approach. The memo suggests that new import taxes are to be tailored for each US trading partner, meaning tariffs could apply to specific products and/or entire industries of a country. Tariffs on “critical imports” will likely remain independent of reciprocal tariffs. It is also uncertain whether countries with free trade agreements (FTAs) with the United States will remain untouched.

- No clear timeline: The February 13 memo merely instructs the White House Office of Management and Budget (OMB) to submit a report within 180 days (by August 12)—likely to be informed largely by the Department of Commerce, the Office of the US Trade Representative and other trade-focused agencies’ review of foreign trade practices due by April 1. Therefore, it could take several months to formulate a reciprocal trade plan. The expansive scope of this approach may bring more trading partners to the negotiating table, with the long lead time intended to create room for negotiations.

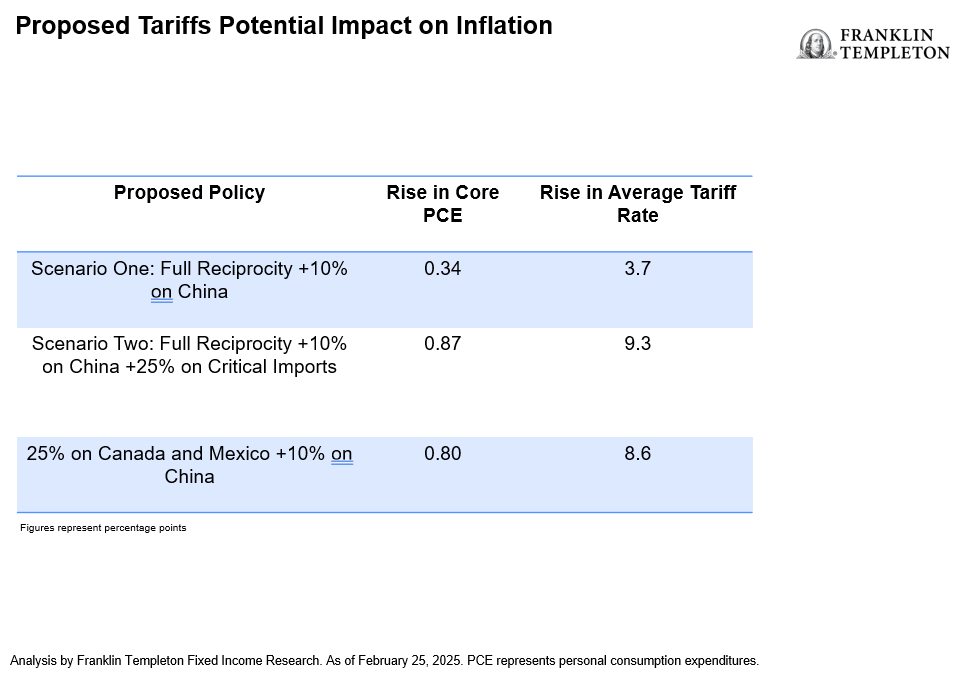

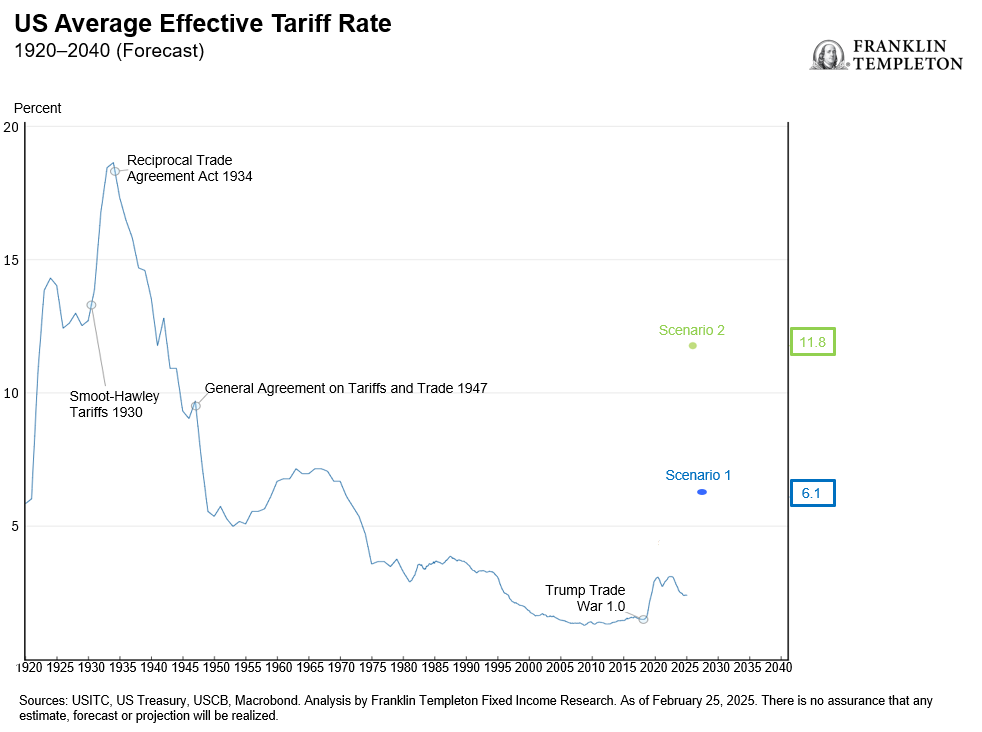

- Two scenarios for estimated tariff increases: Scenario one—full reciprocity + 10% on Chinese goods—could raise the weighted average tariff by 3.7 pp to 6.1%. Scenario two—full reciprocity + 10% on Chinese goods + 25% on “critical imports” could see tariffs rise by 9.3 pp to 11.8%. The inclusion of critical imports adds an extra 5.8 pp over Scenario one, of which the 25% tariffs on autos and pharmaceuticals contribute roughly 2.6 pp and 1.6 pp.

- Customs revenue over a 10-year period: Assuming little-to-no import substitution, shrinkage of imports and/or re-routing of trade flows, Scenarios one and two lead to a roughly US$1.2 trillion and US$3.7 trillion increase in gross revenue over a 10-year (fiscal) budget window. Although net revenue would likely be lower due to reduced tax receipts elsewhere, net revenue under Scenario two would likely be closest to the US$2.7 trillion in net customs revenues that Trump’s 10% universal tariff and the 60% tax on Chinese imports was expected to have generated. Note that a lower-than-previously expected collection in net import duties would further strain the fiscal arithmetic, meaning tax cuts need to be smaller and/or spending cuts larger than previously proposed.

- Economic impact: The 2018 tariffs led to a contraction in manufacturing indices and job losses. Manufacturing surveys show tariff concerns are beginning to weigh on the capex outlook. Tariffs are featuring more prominently in US companies’ management discussions compared to 2018, leading some companies to delay or suspend capex. Analyst capex expectations have declined for firms that have the highest exposure to Canada, Mexico and China. And even though US imports of manufacturing goods have shifted away from China and toward Mexico and the rest of Asia, overall import dependency for manufacturing goods remains high—nearly 40% of US domestic manufacturing output. Therefore, the broader scope of proposed tariffs could have far-reaching consequences for a large swath of US workers and consumers.

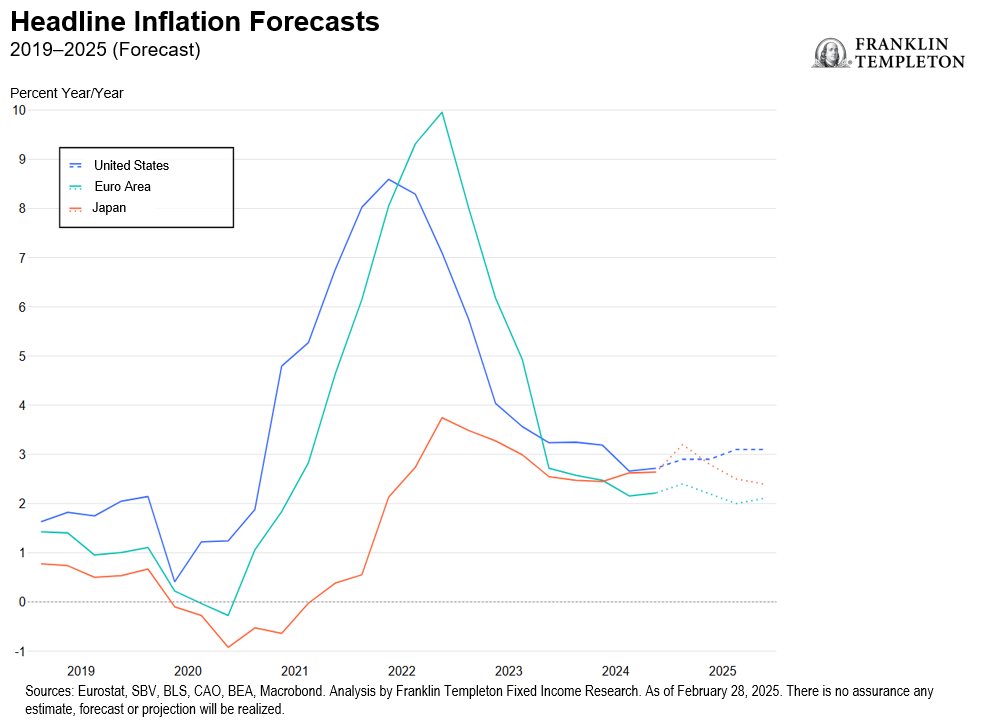

- Inflationary impact: This is tricky to estimate because tariffs essentially lead to a change in relative prices. While US-dollar strength will continue to be a tailwind for inflation, we are currently in a very different price environment relative to 2018 and, therefore, unlikely to see deflationary offsets from other sectors, meaning that the short-term shock to the core goods space may be more noticeable this time. We find that our assumed scenarios could raise core inflation by between 0.35-0.9 pp.

European economic outlook

Euro-area economy: Disruption creates uncertainty

________________________________________________________________________________________

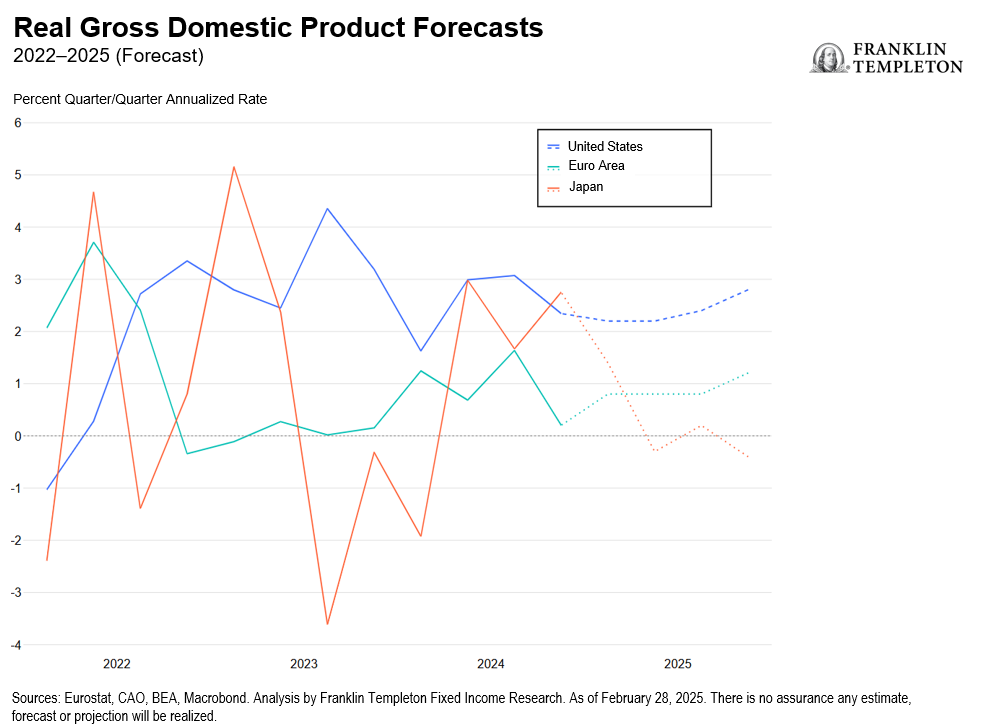

- We expect growth in the EA to remain subdued this year, weighed down by uncertainty stemming from an increasingly protectionist United States which is also reevaluating its role in global security. This will likely exacerbate existing structural weaknesses and add to the already elevated internal economic uncertainty. However, the changing geopolitical landscape is triggering a European response. Germany announced a historical fiscal package to increase infrastructure and defense investment and European Union (EU) member states are discussing a new paradigm for European military spending. Although several challenges remain, radical changes are underway. This means that medium-term growth prospects are getting more interesting.

- The impact of potential US tariffs is hard to estimate. We currently lack details on the scope, magnitude, and timing of the different measures proposed by US President Trump. We estimate that the EU’s export exposure could range between less than 0.1% to 0.5% of gross domestic product (GDP), depending on the implemented measures. However, additional sectors could be targeted, and harsher tariffs could be announced. Though the direct impact of higher US tariffs remains relatively contained, the surge in uncertainty will likely matter more for growth by weighing on investment confidence. EU inflation should not be meaningfully impacted, as the scope for retaliation on US goods imports is limited, though US tech giants’ services imports could come under scrutiny.

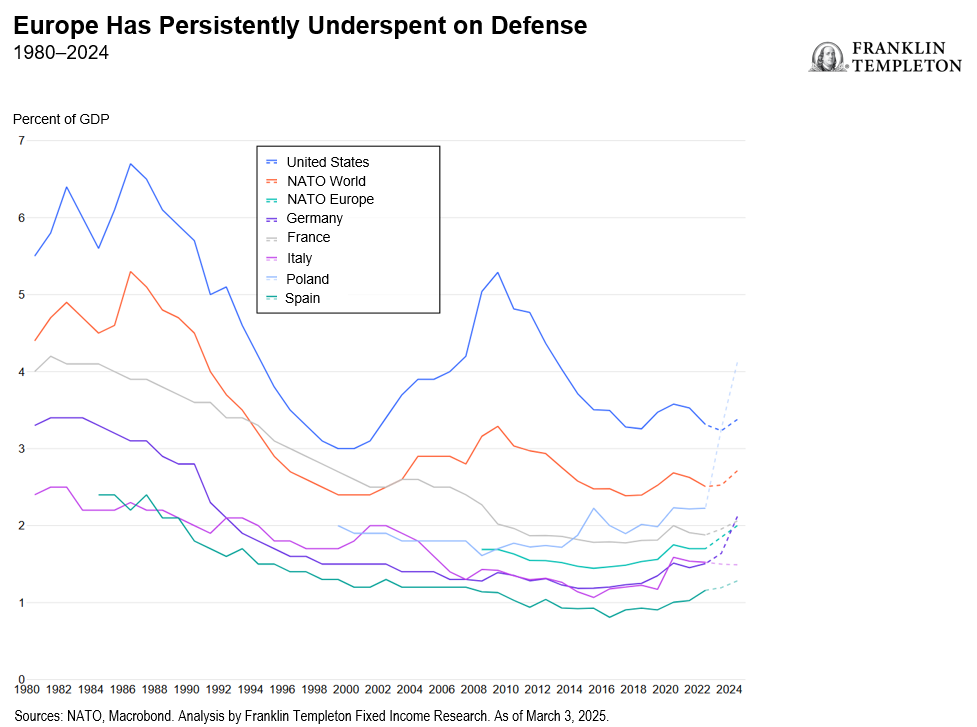

- After years of underspending, the EU is eying a new defense paradigm. With the US reexamining its role in global security, the EU can no longer benefit from the so-called “peace dividend.” Increasing defense spending above the current 2% of GDP is an inevitable necessity but the EU faces several issues with no quick solution. Government deficits and debts are still high in many countries and EU or supranational funding options require a non-trivial political consensus. Moreover, with military equipment supply in Europe likely to be insufficient for the new need, a large share will have to be imported. Meanwhile, Germany’s overhaul of its fiscal rules will further boost spending on defense and infrastructure projects, but both take time. Therefore, the short-term impact of these paradigm shifts is likely limited, but medium-term growth prospects appear improved.

- Against this uncertain backdrop, the ECB remains cautious. The March monetary policy meeting confirmed this, as ECB President Christine Lagarde stressed that uncertainty is “phenomenal,” driven by both internal and external sources. We believe this means that the ECB will be even more data dependent going forward. Some additional rate cuts are still possible this year since short-term growth prospects remain grim, but the ECB’s optionality has widened.

Japan economic outlook

Japan’s economy: A higher terminal rate than what markets expect

_____________________________________________________________________________________

- Japan’s GDP remains sluggish but private consumption is resilient. We continue to see resilient growth prospects in 2025 (GDP forecast at 1.2% year-on-year [y/y] compared to 0.1% in 2024), contingent on strong private consumption as real household incomes solidify. Details around the annual wage negotiations (Shunto) will be coming in March but from reports so far, most companies will likely show willingness to accept demands. The Japanese Trade Confederation (Rengo) has demanded a 5% total hike this year and 6% for small enterprises. This, added to the tourism boost (visitor arrivals touched 10 million in the fourth quarter of 2024 vs 7.7 million in the fourth quarter of 2023) should underpin strong domestic demand, in our view. Tariffs, especially on automobiles, will be a pain point as they make up the bulk of Japan’s exports to the United States, but we believe a middle ground can be reached via some concessions on non-tariff barriers.

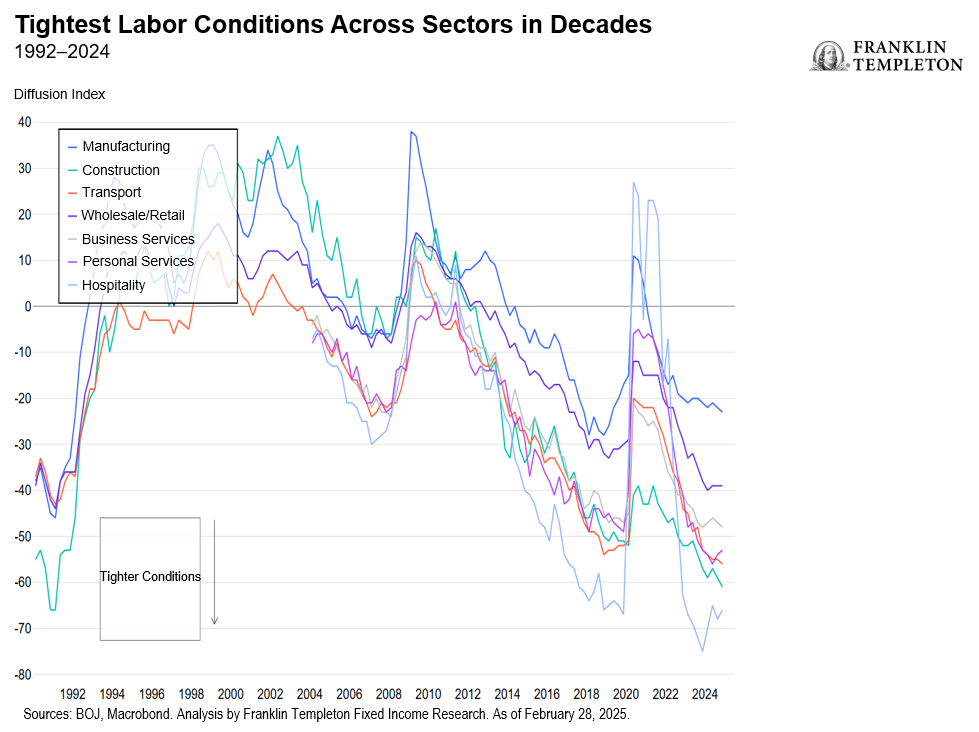

- Inflation is rearing its head again with the January headline print at 4.0% y/y owing to sharply higher food prices (7.8% y/y), which are led by rice prices (70.9% y/y), as distributional and speculative challenges have thrown the latter off the cliff since end of 2024. We expect overall core Consumer Price Index (ex fresh food) to remain elevated at 2.7% y/y in 2025 even though intermittent subsidies on energy will keep numbers volatile. We see a structural change in Japan’s inflationary dynamics is well underway, with firms increasingly favored to pass along high input costs (labor, raw materials) to retail prices. The labor market remains tight across a magnitude of sectors.

- The BoJ is likely to hike at least twice more this year, but we are tilting to three. Recent BoJ commentary, including of member Takata has bolstered markets that the path to normalization is well underway. Not only is the BoJ more confident about wages being strong this year but growth is likely to also remain nimble for further hikes. Such comments are likely a signal to markets that terminal rates could well be above 1%, a belief we have held for well over a year now. While for some this may seem an abberation, incoming data supports the view that rates will face heightened upward pressure as monetary policy tightens.

*****

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high-yield bonds are subject to greater price volatility, illiquidity and possibility of default.

Equity securities are subject to price fluctuation and possible loss of principal.

International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

Investments in companies in a specific country or region may experience greater volatility than those that are more broadly diversified geographically.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information, and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S.: Franklin Resources, Inc. and its subsidiaries offer investment management services through multiple investment advisers registered with the SEC. Franklin Distributors, LLC and Putnam Retail Management LP, members FINRA/SIPC, are Franklin Templeton broker/dealers, which provide registered representative services. Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com.

The views and opinions expressed are not necessarily those of the broker/dealer; or any affiliates. Nothing discussed or suggested should be construed as permission to supersede or circumvent any broker/dealer policies, procedures, rules and guidelines.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

Copyright © 2025 Franklin Templeton. All rights reserved.