by Nick Schommer, CFA, Portfolio Manager & Brian Recht, Portfolio Manager, Research Analyst, Janus Henderson

Portfolio Managers Nick Schommer and Brian Recht outline five transformational themes they believe are shaping the investment landscape and creating accelerated growth investment opportunities.

The investment landscape is constantly evolving, shaped by technological advancements, societal shifts, and economic trends. As growth investors, we seek companies operating in end markets that are poised to outpace the broader economy. But the question then becomes, what are these markets, and what themes are driving their expansion?

We believe five transformational themes – artificial intelligence (AI), cloud computing, digitization, healthcare innovation, and deglobalization – are reshaping society and creating durable growth opportunities. These themes are not fleeting trends; they represent secular tailwinds that can help businesses grow faster than the market.

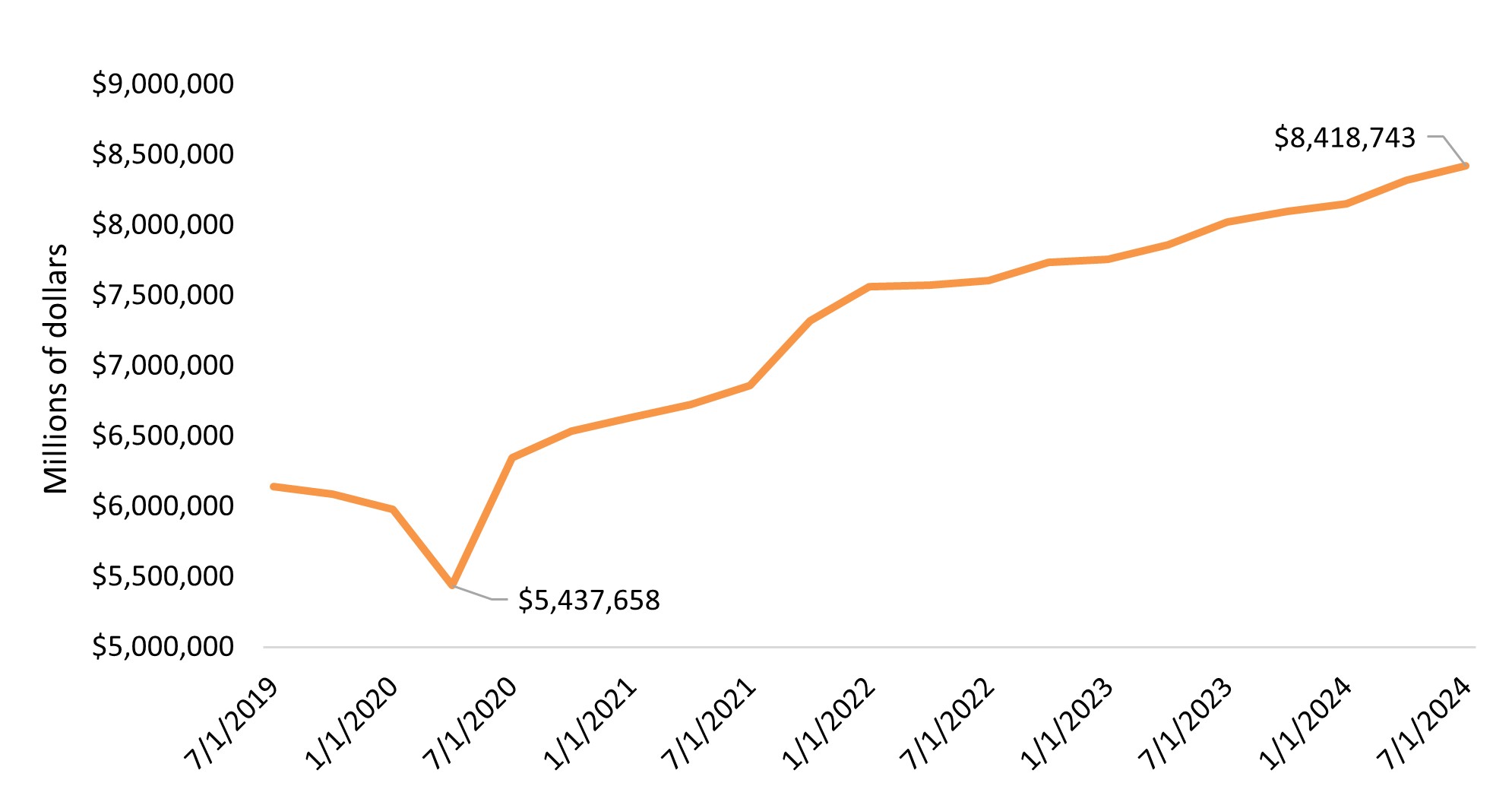

An acceleration in domestic investment activity reflects the impact these trends are having across the economy. Capital expenditures have grown from under $6 trillion five years ago to $8.4 trillion in 2024, with projections approaching $9 trillion in 2025 – a nearly 10% compound annual growth rate (see Exhibit 1).1

Exhibit 1: Total capital expenditures

Source: Board of Governors of the Federal Reserve System (US), All Sectors; Total Capital Expenditures, retrieved from FRED, Federal Reserve Bank of St. Louis; 11 February 2025.

Artificial intelligence’s broad reach

AI is no longer a futuristic concept – it’s here, and the economic ramifications are massive. Since ChatGPT’s 2022 launch, generative AI has become a dominant market force, and we believe we’re still in the early stages. AI represents the next major computing paradigm, comparable to the rise of mobile computing a decade ago.

AI’s durability as an investment theme lies in its ability to transform numerous industries, drive productivity, and create new revenue streams. Its impact extends beyond technology companies, producing ripple effects across the economy, from data center development to consumer-facing businesses developing AI applications. Companies are already leveraging AI to enhance advertising targeting, improve customer service through AI-powered call centers, and optimize fulfillment center operations.

Tech giants are increasing capital expenditure to support this transformation. As a result, the AI infrastructure sector is experiencing unprecedented growth, and an expanding set of companies is providing essential chips and hardware. For instance, as AI models evolve and mature, we see a shift from general purpose graphics processing units (GPUs) to application-specific integrated circuit (ASIC) chips, creating opportunities for companies that specialize in custom AI chips.

Cloud computing’s continued rise

Cloud computing has been a transformative force for over a decade, and its growth trajectory remains strong. The three largest providers have grown from $29 billion in annualized run rate revenue in 2018 to nearly $250 billion today.2 With only 10%-20% of workloads currently cloud-based, significant growth potential remains.

The sector’s expansion has created a rich ecosystem of investment opportunities beyond the major cloud providers. Building cloud infrastructure requires advanced semiconductors, manufacturing capability, and specialized cooling solutions. As data centers scale to support AI, the need for these technologies should grow.

Digital economy expansion

The digitization of commerce and payments continues to transform how people live and transact. In the U.S., e-commerce has grown from $175 billion in 2010 to $1.2 trillion in 2024 and has increased from 6.5% to 22% of retail spending.3 However, the U.S. still lags behind markets like China, where penetration is significantly higher. In Latin America, e-commerce penetration remains in the low- to mid-teens, providing an even longer runway for growth.

The digitization of payments is equally compelling. Outside of China, $44 trillion in global spending has the potential to move to card-based payments, yet only $23 trillion is currently digital.4 This transition creates opportunities for credit card companies, especially in cash-dominant international markets.

Innovation in healthcare

Healthcare breakthroughs are transforming patient care while creating investment opportunities. The FDA approved 60 novel drugs in 2024, following a record 72 approvals in 2023.4 Breakthrough treatments span multiple areas, from fatty liver disease to GLP-1 medicines for obesity management. These advances are driving impressive revenue growth: GLP-1 drugs alone generate over $50 billion in annual revenue,5 with further growth potential as treatments evolve from weekly injections to oral regimens.

The sector’s innovation pipeline remains robust, particularly in rare diseases – 95% of which lack treatment options. As the sector continues to deliver novel therapies to address unmet medical needs, we believe companies with strong pipelines and underappreciated commercial potential are well positioned to benefit.

Deglobalization’s economic impact

Economic nationalism and trade protectionism are reshaping global commerce. The pandemic exposed vulnerabilities in global supply chains, accelerating the trend toward reshoring and nearshoring. This shift – which is gaining momentum under the second Trump administration – is driving demand for domestic production and manufacturing.

The move toward reshoring is creating opportunities across multiple industries. Take for example industrial gas producers: These companies are seeing increased demand as new domestic fabrication plants and food storage facilities come online. Similarly, power management companies are benefiting from the surge in data center construction needed to support AI infrastructure.

Themes that are durable, but evolving

We believe these five themes are reshaping society and represent durable growth opportunities. Companies aligned with these trends have the potential to compound growth and gain market share across economic cycles. As these trends often persist longer than the market anticipates, we believe capturing this secular growth requires a three- to five-year investment horizon.

The evolving nature of these themes, particularly AI, highlights the importance of active management. In our experience, continuous engagement with management teams and deep fundamental research helps us stay ahead of trends and identify competitively advantaged companies capable of adapting to changing conditions.

*****

IMPORTANT INFORMATION

References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.