by Nick Mersch, CFA, Portfolio Manager, Purpose Investments

“There are decades where nothing happens; there are weeks where decades happen.”

January had one of those weeks.

The driving force of animal spirits in the market as of late is the dawn of a new era: The AI Revolution.

This revolution has led to the strongest wealth creation run in the history of the stock market, catapulting Megacap companies to market capitalizations that eclipse the GDP of entire developed countries.

The market was telling itself a story – a trilogy, if you will. The AI revolution is going to change everything; a rising tide lifts all boats, and it will be smooth sailing along the passage. Here’s where I like to play one of my favourite games: Two Truths and a Lie. After the January we had, I’ll let you spot the lie.

January was like a duck on a pond. Calm on the surface but paddling like hell underneath.

But enough with verbosity, let’s get to what the heck happened in January and, more importantly, the long-term setup after all this mumbo jumbo.

The Commoditization of LLMs

I won’t rehash too many of the nuances behind the DeepSeek model release because a) you’re probably sick of hearing it, and b) I already did that here. But I did want to talk about how unit economics has changed. I promise I won’t say Jevons Paradox in this blog (besides that time just there).

DeepSeek confirmed what we already know: the LLM layer is being commoditized. Don’t get me wrong – what they did was incredibly inventive. Whether they used $6M in costs to do it or 25x that… I don’t really care. What they did here was use several methods (MoE, MLA, and RL for CoT) that permanently changed the process in which reasoning models approached both training and inference, drastically reducing the cost. This ‘software update’ led to a 30x cost decrease.

While impressive, I don’t think this is anything new in terms of how the LLM industry was already trending. The cost of LLM inference (running models) has been plummeting at an astonishing rate. Advances in model efficiency, scaling, and hardware are driving down the price per query.

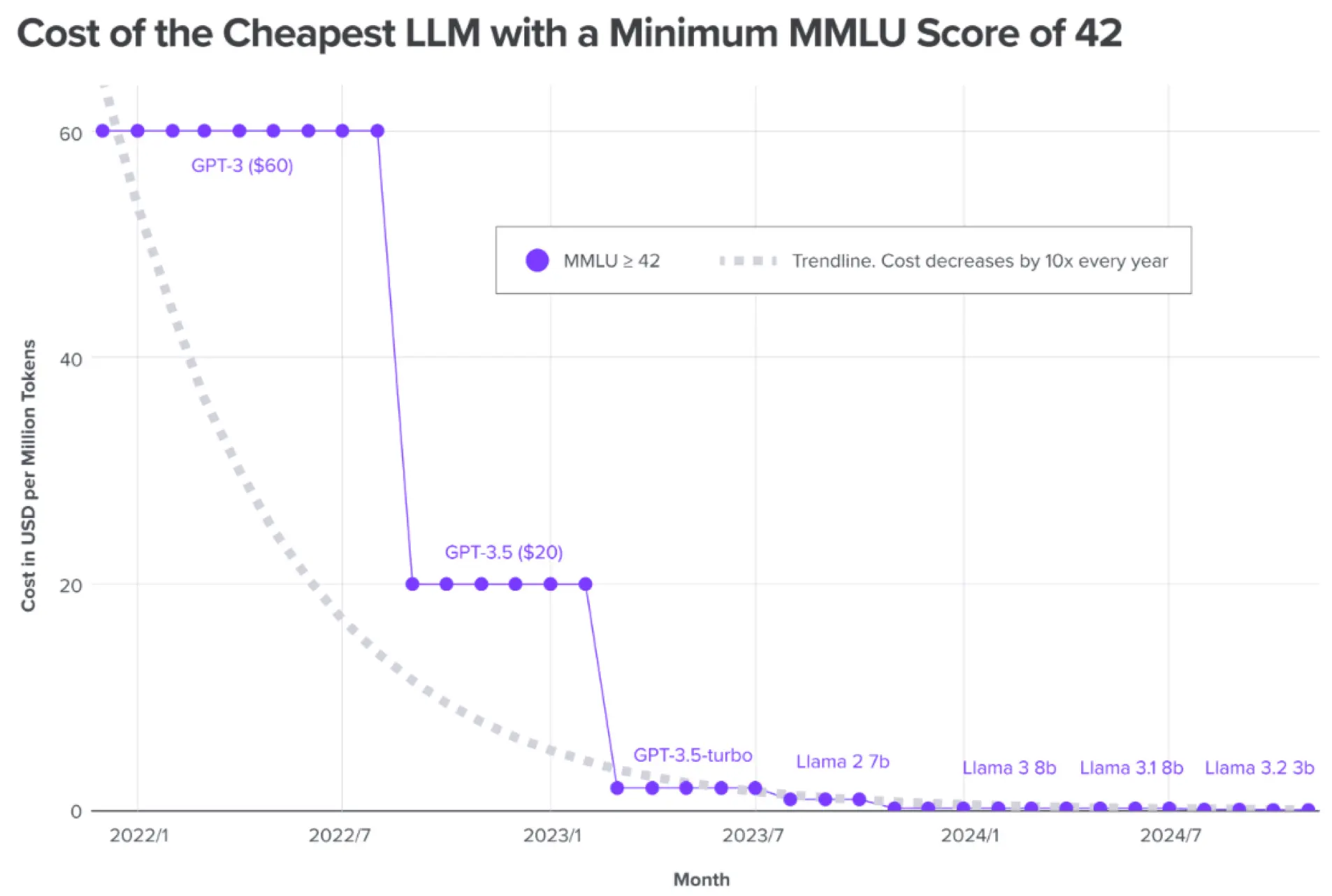

A recent analysis by Andreessen Horowitz dubbed this phenomenon “LLMflation,” noting that the token cost for a given level of model performance has been dropping by roughly 10x every year (so DeepSeek sped this up a little).

For example, when OpenAI’s first GPT-3 API launched in 2020–21, a model with a certain capability level cost about $60 per million tokens. By late 2024, however, an equivalent capability could be obtained for $0.06 per million tokens using open-source Llama-based models on certain services.

That is a 1,000x reduction in price in about three years. While this is an extreme case, it exemplifies the trend: what was cutting-edge (and expensive) yesterday becomes cheap or free tomorrow.

The bottom line is that the marginal cost of intelligence is racing toward zero, and all LLM vendors must adapt to that reality.

In essence, the commoditization of LLMs paints a future where simply having a great model isn’t enough – providers must either operate at an immense scale with thin margins (like a utility company) or differentiate through vertical integration, superior service, or ecosystem.

It’s the productization and implementation that matters, not the token business. Case in point here is OpenAI. They used to have fat cat margins on their token cost spreads, but DeepSeek + other open weight models came to crash that party, and where OpenAI wins now is in the subscription and implementation game. You have to provide a product and ecosystem around the LLM.

DeepSeek vs. Deep Research

What was also critically important was how OpenAI responded. Immediately after the wakeup call, OpenAI came out and had a bit of a different flavour to their reasoning models. They started to show the Chain of Thought reasoning processes, then they released o3-mini-high on Friday, then Deep Research on Sunday.

I have experimented extensively with these two versions of the model, which are direct responses to competition, and let me tell you… these are groundbreaking. When you pair o3-mini-high with search, it can give you sell-side analyst quality reports on earnings the second after they are released with the click of a button. When you turn on the Deep Research button, the entire game changes. The Deep Research button blew my mind, and you can see some of my prompts here, here, and here. I highly suggest you click at least one of these; the second one is a huge game changer. I input an inquiry, and the model then pokes me for further detail. I provide it, the model goes and “thinks” for 20 minutes, and then provides an 11,000-word whitepaper on the topic. Let me repeat that. It thinks for 20 minutes. TWENTY MINUTES. You know how much inferencing is being done in that time?!

You know where this is going! Lower costs = increased usage. This sounds kind of like the economic concept that states that when a technology becomes more efficient in using a resource, it can paradoxically lead to an increase in overall consumption of that resource rather than a decrease, as the lower cost incentivizes people to use more of it – AKA Jevons Paradox (Ha! Got you).

What This Means for Stocks

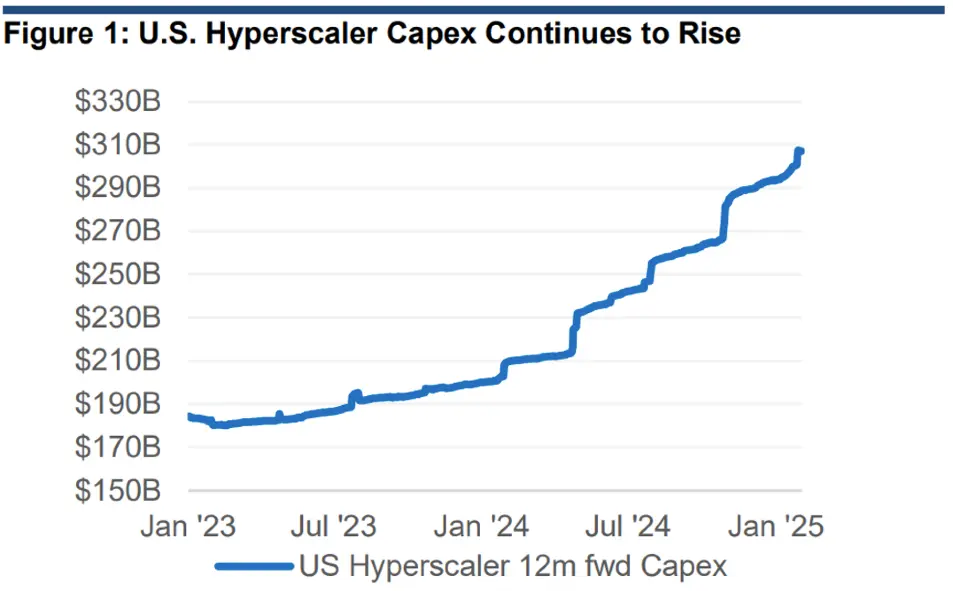

I’ll start with Semis. I quite publicly made a call on Nvidia that it would be the most valuable company for a majority of the year. The Monday after that call, the stock was down 18%. Nailed it. While I sold some of the bounce, I’m now back to slowly building a larger position. Why? Several reasons: 1) The sell-off here looks overdone – greedy when others are fearful; 2) The core fundamental thesis is still intact (for now); 3) Hyperscalers are telling us CapEx is still OK:

- Amazon: $97B

- Microsoft: $85B

- Google: $75B

- Meta: $65B

While I understand that the party will eventually end, as every CapEx cycle does, the Hyperscalers are already telling us what we need to know – the projected CapEx is still intact. I’ll change my mind when this chart changes (hopefully, I can figure it out before it happens):

A massive beneficiary of recent events is software. As the marginal cost for intelligence moves to zero, this starts to alleviate COGS (cost of goods sold) pressure on software companies. The outlook used to be that this was going to be expensive and margin dilutive to implement, but this now looks like this layer will benefit. As LLMs chase a race to the bottom, what we’re seeing now is lower friction and higher adoption to deployment because it’s so darn cheap to do so. This truncates the timeline in which the value accrual shifts from the infrastructure layer to the application layer, although we’re not fully there yet. Software is a way to skate to where the puck is going.

We still need more power. Throughout the selloff, the Utility IPPs got sold off the hardest (Vistra, Constellation, Talen). These were the same names that also ran up the fastest, so a first-in-first-out selling order looked to be the case. However, there are still very noticeable bottlenecks when it comes to power. As inference loads drastically increase on reasoning models, we still need the energy to power these massive data centers. Although AI is the step-function increase thesis, there are several encouraging non-AI tailwinds as well. Stay long power.

Wrapping Up…

The coming wave of artificial intelligence is going to change everything. We don’t know the shape of the wave, but we can get an idea of the height. And it’s looking bigger and bigger each week.

I have previously said that “every company that does not consider itself a technology company either becomes one, buys a product from one, or gets left behind.”

I would like to replace this mantra with a new one:

“Every company that does not consider itself an artificial intelligence company either becomes one, buys a product from one, or gets left behind.”

Strong convictions. Loosely held.

– Nick Mersch, CFA

Receive the latest tech insights in your inbox every month.

The content of this document is for informational purposes only and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained in this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities. No securities commission or similar regulatory authority has reviewed this document, and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable; however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated. Certain statements in this document are forward-looking.

Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” intend,” “plan,” “believe,” “estimate” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are, by their nature, based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose Investments and the portfolio manager believe to be reasonable assumptions, Purpose Investments and the portfolio manager cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on the FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.