by John H. Fogarty, CFA, Co-Chief Investment Officer—US Growth Equities, Adam Yee, Senior Quantitative Analyst—US Growth Equities, AllianceBernstein

Technology stocks have been the poster child for growth in recent years. Other sectors deserve a closer look today.

Equity investors seeking long-term growth have focused on popular technology stocks in recent years. As a result, other industries have been left behind—and today they offer attractive growth prospects and valuations for investors who can find them.

Technology has been a powerful impetus for US growth stocks. From the migration to the cloud to the artificial-intelligence (AI) revolution, the unfolding technological disruption has helped push a small group of US mega-cap stocks to dizzying heights in recent years. But as we’ve seen this January, the biggest technology stocks are vulnerable to dramatic corrections, given their size and the potential for AI disruptors like DeepSeek to shake up the market.

The good news: growth stocks can be found across diverse sectors and industries that haven’t been on investors’ radar for a while. Examples include various industries within the healthcare and consumer sectors, such as specialty retailers and medical-device companies.

Attractive Valuations and Earnings Growth Potential

Some of these industries offer very favorable growth profiles today, with attractive valuations to boot. For example, several healthcare industries trade at relatively low price/earnings valuations to their most-recent 10-year history, including healthcare equipment and supplies at the 13th percentile and healthcare providers and services at the sixth percentile (Display). Food, beverage, and tobacco and consumer services are at the first and 10th percentiles, respectively, over the same period.

Consumer and Healthcare Stocks: Attractive Valuations, Healthy Earnings GrowthS&P 500: Select Industry Groups

Stocks in these industries lagged the broad market in 2024 even though their earnings-growth outlook is quite attractive, in our view. In the consumer services industry, consensus forecasts anticipate 13.6% earnings growth in 2025 versus 2024. In the three healthcare industries shown above, earnings growth is projected at between 8.1% and 9.7%.

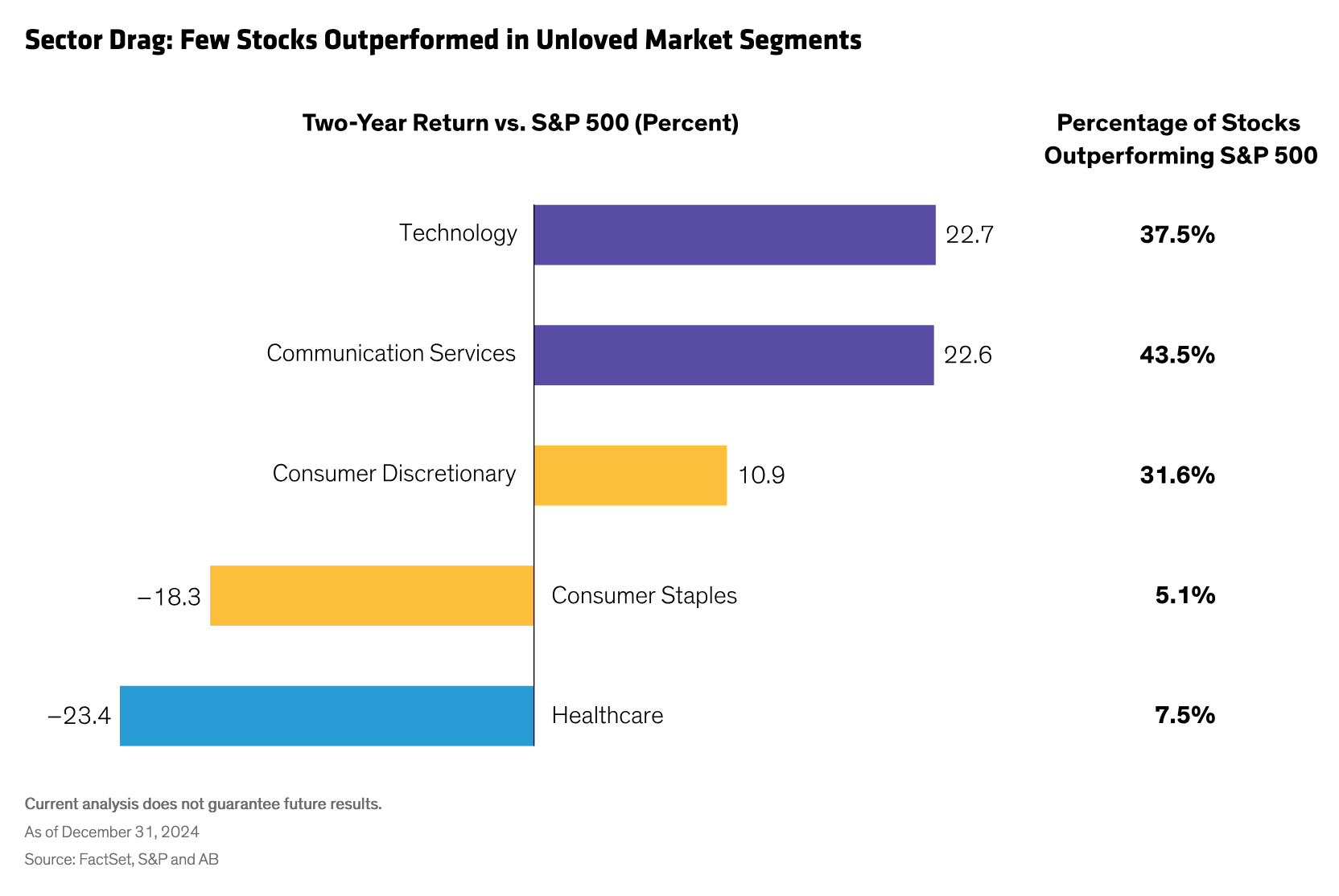

At the sector level, we’ve seen a huge disparity in performance. As technology and communication stocks beat the market by a wide margin over the last two years, a relatively large portion of stocks in these sectors outperformed the S&P 500 (Display). In contrast, only 5.1% of consumer-staples stocks and 7.5% of healthcare stocks beat the benchmark amid especially weak relative performance. In our view, the downward drag of anemic sectors has cast a shadow over many stocks with attractive fundamentals. We think investors can find stocks in unloved industries with strong earnings-growth potential that trade at low valuations, implying powerful long-term recovery prospects.

Keep Focused on Quality Features

Of course, not every stock in an attractively valued industry is a good investment. And there are plenty of risks to contend with, particularly given the incoming US administration’s plans to launch a range of policy changes that could have complex effects on different types of businesses. We believe investors should apply thorough fundamental research to identify companies with high-quality businesses that can surmount new policy-driven challenges and are capable of consistently generating earnings above their cost of capital to support reinvestment.

Companies that meet these criteria offer compelling risk/reward profiles for equity investors. Today, in particular, after equity markets have been driven by a small number of very large stocks, we think a broadening of market returns is likely to materialize over time.

By diversifying portfolios to include stocks in overlooked sectors, investors can capture significant growth potential while mitigating the risks associated with having dominant positions in technology stocks.

About the Authors

John H. Fogarty is a Senior Vice President and Co-Chief Investment Officer for US Growth Equities. He rejoined the firm in 2006 as a fundamental research analyst covering consumer-discretionary stocks in the US, having previously spent nearly three years as a hedge fund manager at Dialectic Capital Management and Vardon Partners. Fogarty began his career at AB in 1988, performing quantitative research, and joined the US Large Cap Growth team as a generalist and quantitative analyst in 1995. He became a portfolio manager in 1997. Fogarty holds a BA in history from Columbia University and is a CFA charterholder. Location: New York

Adam Yee joined the firm in 2004 and is a Senior Vice President and Senior Quantitative Analyst for the US Growth Equities portfolios. He previously served as a senior associate portfolio manager within the Global Portfolio Management Group, where he covered growth equity products. Yee holds a BA in economics from Trinity College and an MBA in finance from Fordham University's Graduate School of Business (now the Gabelli School of Business). Location: New York

Copyright © AllianceBernstein