by Nelson Yu, Head—Equities, Walt Czaicki, CFA, Senior Investment Strategist—Equities, AllianceBernstein

Quality has become a popular buzzword in equity investing. But what does it really mean?

In a world of uncertainty, investors increasingly crave equity portfolios with high-quality holdings and return patterns. But kicking the tires of a portfolio isn’t as easy as verifying the credentials of a car or smartphone.

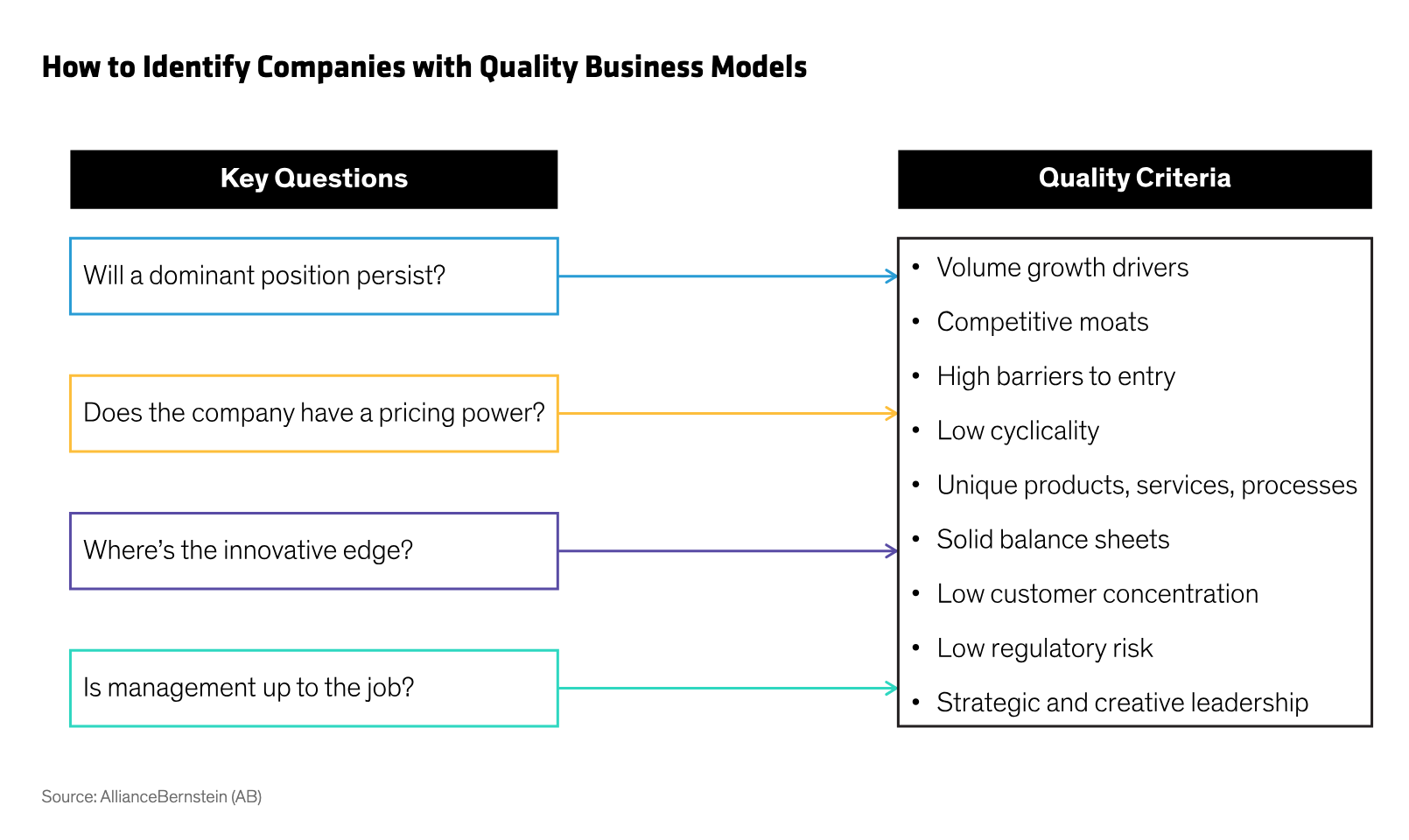

By developing a clear definition of quality, investors will be better equipped to gauge what’s inside an equity portfolio—and whether the stocks it owns have staying power. These questions can help serve as a guide.

- Most equity portfolio managers say they target quality companies. But what does “quality” really mean in equity investing?

According to the dictionary definition, quality denotes a “degree of excellence.” The problem is that this term has become so overused in investing that it’s not always clear how a portfolio captures high quality for its clients. We think there are two key interrelated concepts that can help investors understand whether a portfolio truly offers quality or is just talk. First, quality is a characteristic that refers to a company’s business model within its industry. Second, various financial metrics can be used to help identify and measure quality stocks.

- What is a quality business model?

Several features characterize high-quality business models. Competitive advantages, pricing power, innovation and management skill are among some of the key attributes of companies with high-quality businesses. By asking the right questions, investors can find companies with high-quality fundamentals that are likely to persist over time (Display). We believe an investment approach focused on quality can help position a portfolio to cope well with inflation, slowing growth and geopolitical risk—three major hurdles facing investors today.

It’s a common misconception that high-quality stocks can only be found in specific sectors and investment styles. In fact, quality stocks can be found in diverse sectors and industries, and range from companies that are more sensitive to economic cycles to those that enjoy profitable growth drivers.

- How do different portfolios define quality?

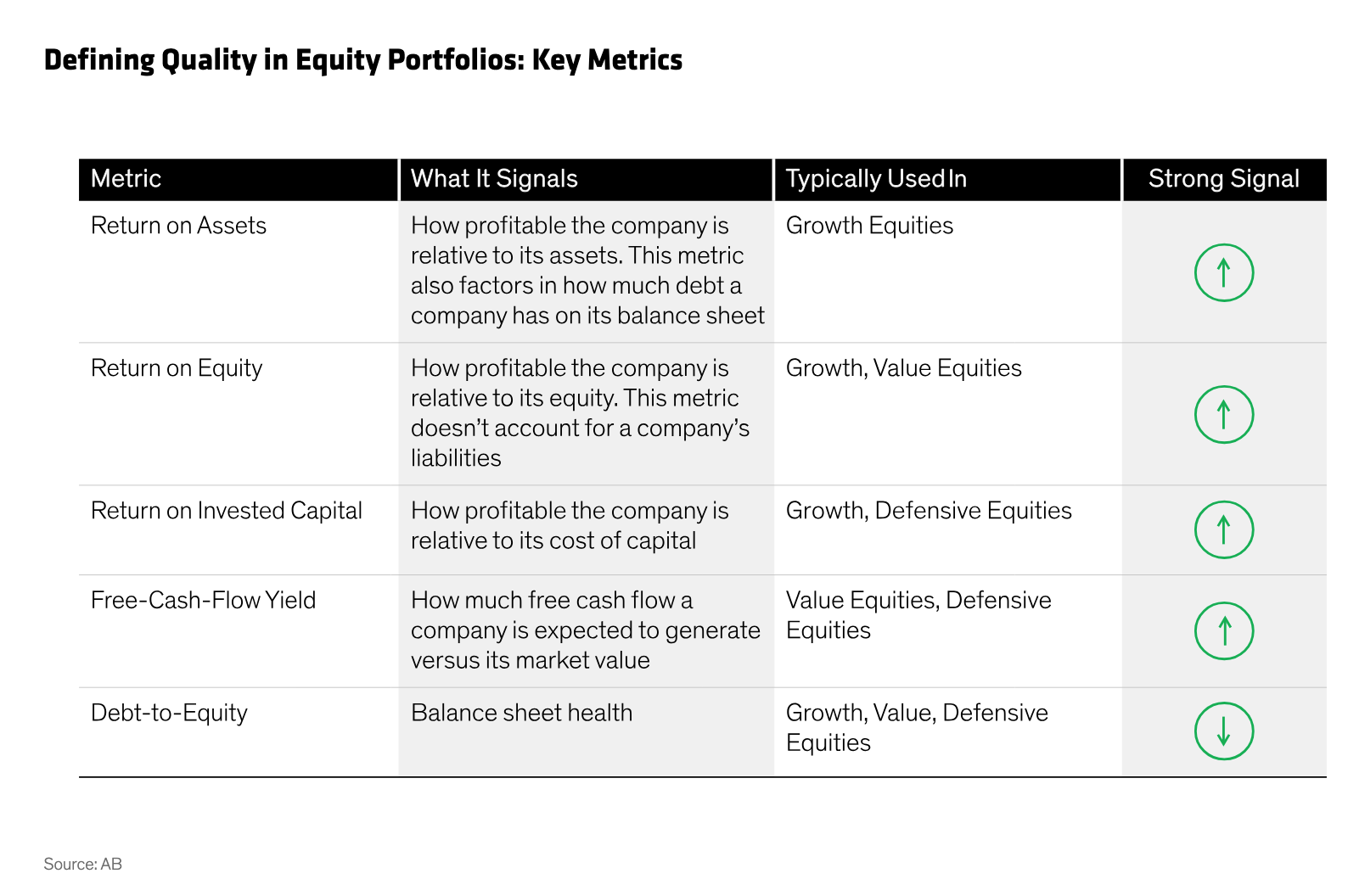

There are many ways to define quality in equities. Different equity strategies will deploy different metrics/factors to align with a portfolio’s investing philosophy (Display).

Profitability metrics such as return on assets (ROA) and return on equity (ROE) often signal strong equity return potential. High returns on invested capital (ROIC) are a hallmark of skilled management teams who allocate capital into attractive reinvestment opportunities that secure future business growth by earning economic profits above a company’s cost of capital. Strong cash-flow metrics such as free cash flow yield indicate that management has optionality to maintain or increase dividends, buy back shares or launch strategic acquisitions; this metric is more commonly used in value portfolios. Debt-to-equity ratio is used across many equity strategies, as a low signal indicates that a company isn’t overly burdened by debt or financial obligations.

Profitability metrics such as return on assets (ROA) and return on equity (ROE) often signal strong equity return potential. High returns on invested capital (ROIC) are a hallmark of skilled management teams who allocate capital into attractive reinvestment opportunities that secure future business growth by earning economic profits above a company’s cost of capital. Strong cash-flow metrics such as free cash flow yield indicate that management has optionality to maintain or increase dividends, buy back shares or launch strategic acquisitions; this metric is more commonly used in value portfolios. Debt-to-equity ratio is used across many equity strategies, as a low signal indicates that a company isn’t overly burdened by debt or financial obligations. - What does the portfolio team do to find companies that meet their quality criteria?

Defining quality is the first step toward building a portfolio. Identifying shares of quality companies with long-term return potential requires a disciplined research process. In our view, using a combination of quantitative and fundamental research can be particularly effective in the hunt for quality.

Quantitative research is used to sift through a vast universe of stocks to distill those that score high on the defined quality metric. Fundamental analysts with deep industry expertise can study a company’s business model to determine whether it is well positioned in its sector and industry to deliver consistent earnings growth over time. Taken together, these two approaches can underpin a diversified portfolio of high-quality stocks with staying power.

- What type of performance can you expect from quality companies during different stages of the economic cycle?

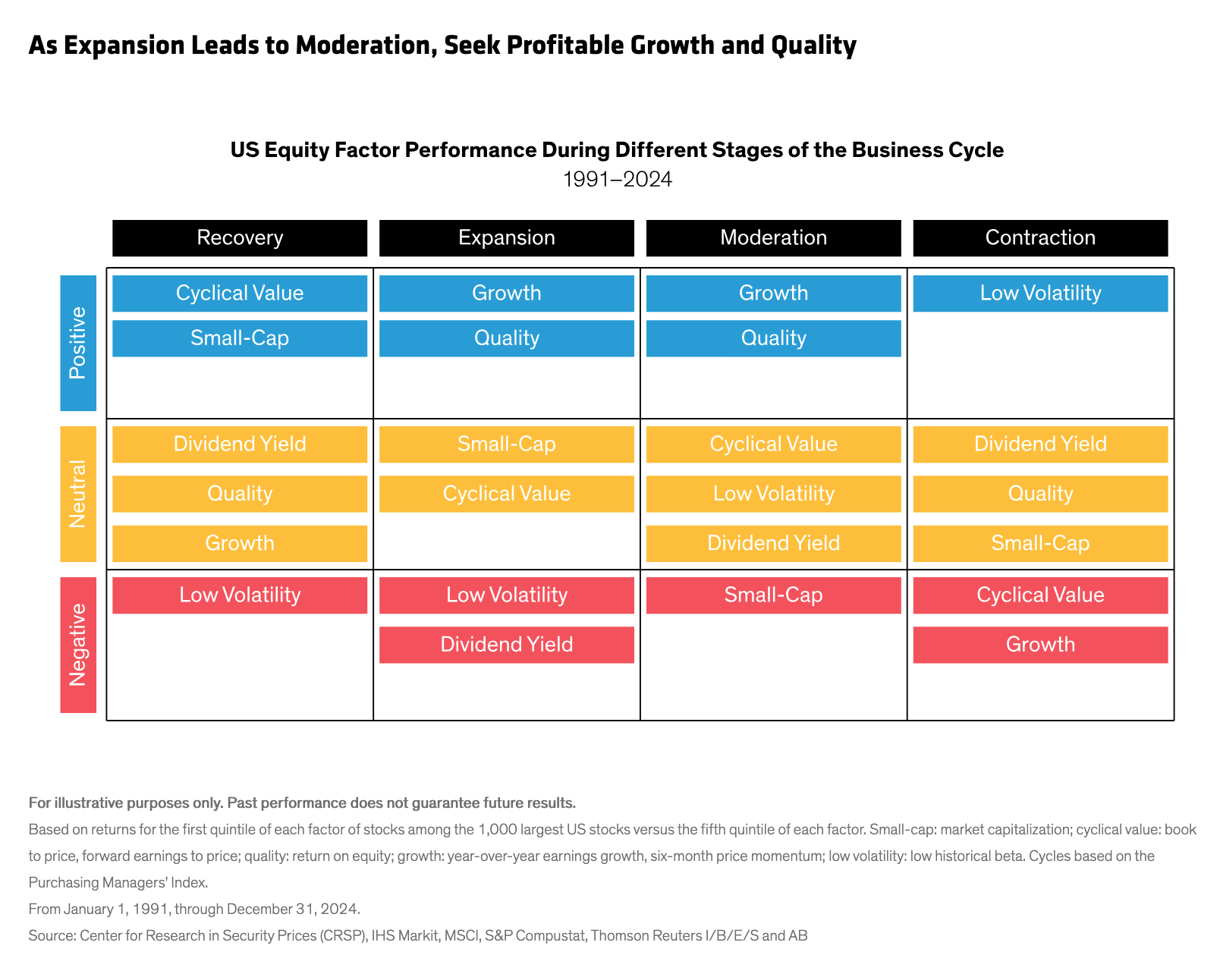

Quality companies tend to outperform throughout most stages of the business cycle (Display)—especially when economic growth moderates—and during bouts of heightened volatility. When these dynamics are in place, investors covet the scarcity premium associated with stocks that offer stable free-cash-flow growth, profits and strong balance sheets—which can be harder to find in a weakening macroeconomic environment.

However, returns of high-quality equities tend to lag during early-recovery phases. In that stage of the cycle, we often see a rally of lower-quality stocks, also known as a dash-to-trash rally. This doesn’t necessarily mean investors incur losses by holding quality stocks in such regimes, because the early recovery stage tends to boost share prices for almost all stocks (akin to “a rising tide lifts all boats”). Since we don’t believe that we are currently in an early economic recovery state, we believe the prospects for high-quality stocks remain favorable.

However, returns of high-quality equities tend to lag during early-recovery phases. In that stage of the cycle, we often see a rally of lower-quality stocks, also known as a dash-to-trash rally. This doesn’t necessarily mean investors incur losses by holding quality stocks in such regimes, because the early recovery stage tends to boost share prices for almost all stocks (akin to “a rising tide lifts all boats”). Since we don’t believe that we are currently in an early economic recovery state, we believe the prospects for high-quality stocks remain favorable.Certain quality factors will shine in different market environments. That’s because there’s a spectrum of quality features that are tied to growth, value and low-volatility vs. high-volatility factors. Knowing which ones are linked to a particular strategy enhances the odds that the return patterns they will experience through the ups and downs of a market will align with an investor’s expectations.

With the right definitions in place, investment teams must follow time-tested, disciplined processes to find companies with high-quality attributes. Portfolios that are dedicated to discovering quality stocks can help investors meet their long-term financial goals, even in the face of short-term volatility and macroeconomic or political uncertainty.

Copyright © AllianceBernstein