by Caglasu Altunkopru & Aditya Monappa, AllianceBernstein

As growth extends to more regions, we see expanding opportunities across countries and assets.

The global economy inched closer to normal growth and inflation levels in 2024, and central banks started easing in many regions. Inflation is now hovering in the 2% to 3% range for most developed markets—a meaningful improvement from the past few years.

Stocks posted strong gains in this environment, hitting record territory despite year-end choppiness. Although a handful of high-flying tech firms still dominate, improving earnings outlooks suggest additional sectors could get some lift in 2025. Policy rates are lower, but longer-term bond yields remain high, thanks to a resilient economy and fears that new US policies could boost inflation.

We believe conditions remain generally positive for risk assets, especially equities. We also see long-term value in bonds, with real yields at multi-year highs. While potential changes to US tariff and immigration policies pose a risk to our outlook of falling inflation, high borrowing rates are likely to constrain pursuit of such inflationary policies. For instance, at the end of 2017 (before US tariffs started to increase during the first Trump administration), US inflation was 1.5% and the policy rate 1.75%; today, inflation is 2.8% and the policy rate is 4.5%.

Regional Growth Map Should Start to Align

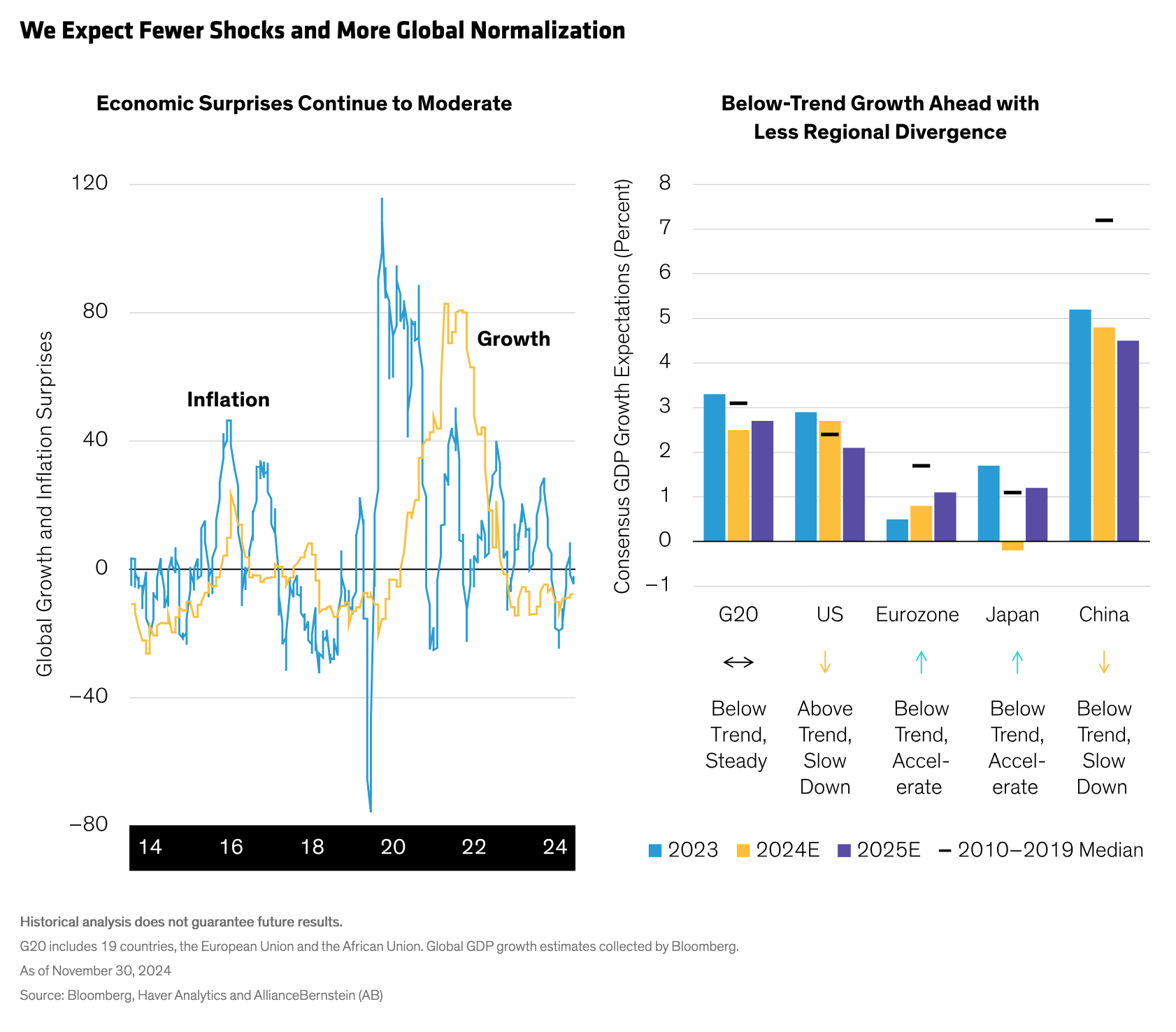

As pandemic-era excesses fade, a more stable and predictable economic environment is emerging—with fewer extreme surprises (Display, left). We expect global growth to improve and edge closer to long-term averages in 2025. While the US is likely to slow from above-trend growth, other developed economies, such as Europe and Japan, should see modest improvement from below-trend growth (Display, right). China should continue to decelerate modestly, given secular headwinds are only partly offset by fiscal support.

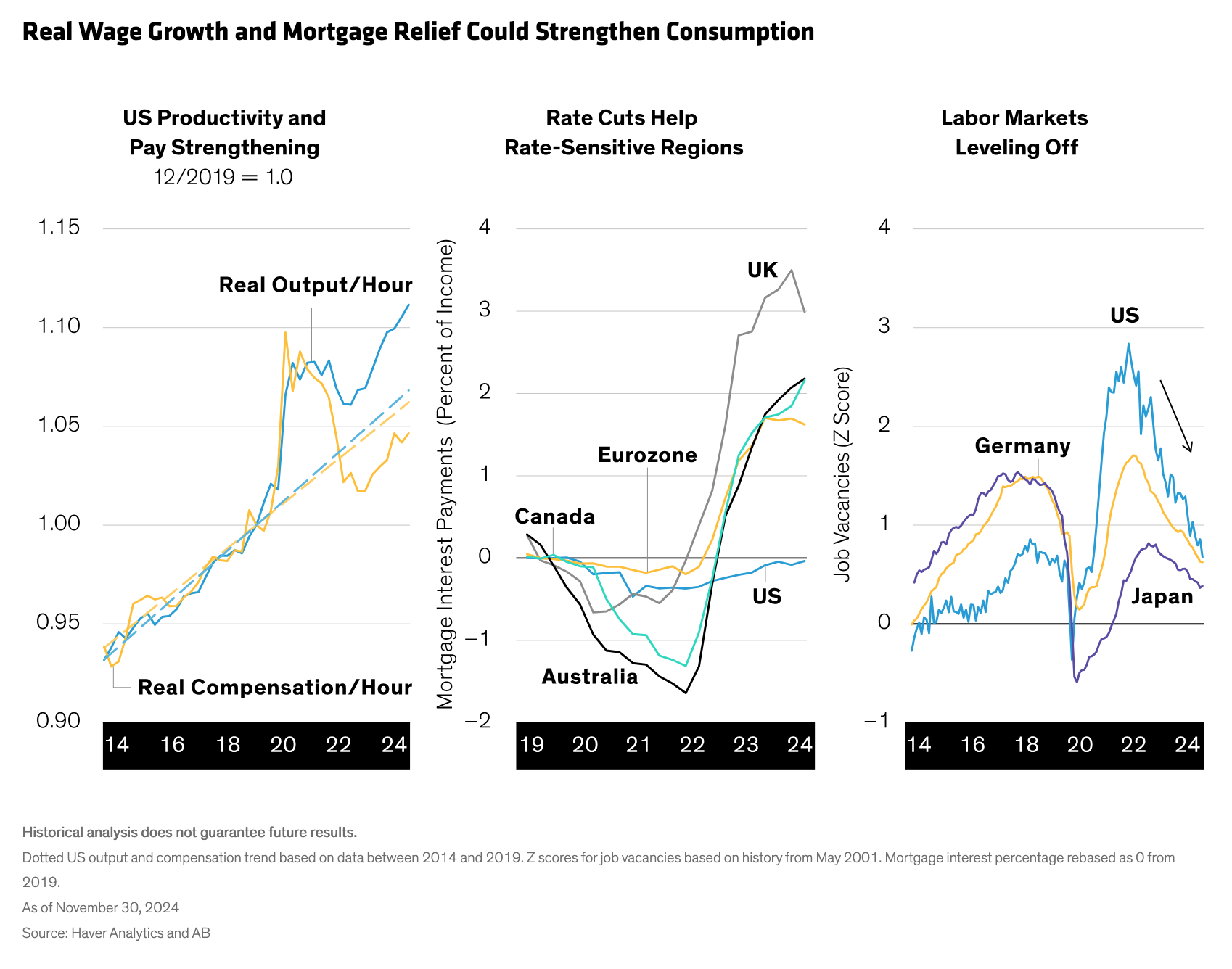

Consumers are playing a key role in continued growth alignment. US household consumption has been robust over much of the past five years as wages grew in real terms, helped by sharp productivity gains (Display, left). Productivity growth was weaker outside the US and real wage and spending power stagnated there. But productivity growth is now firming outside the US, which could help strengthen real wages. Further, high exposure to variable-rate mortgages in Europe, Australia and other regions dented spending power compared to the US—as much as 3% in the UK (Display, center). As rates stabilize or start to moderate, this headwind should fade too.

While labor markets are less tight than in recent years, vacancies across developed markets are generally consistent with modest expansion (Display, right). Taken together, we expect more global alignment in household consumption.

Global Earnings Signal Growth, but Business Investment Is Mixed

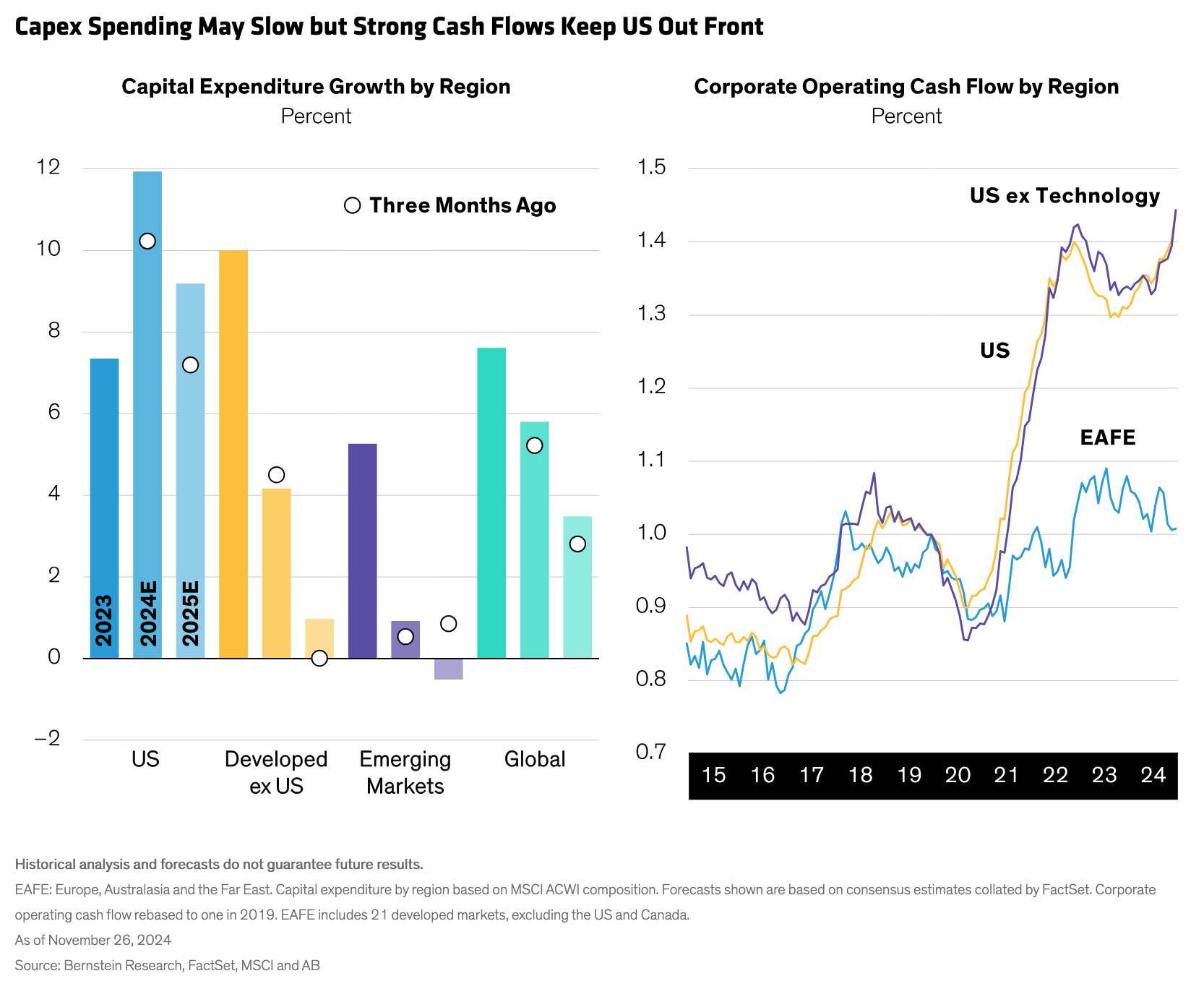

Business sentiment in the US rebounded strongly and capital spending intentions are firming up. Investment growth is slowing outside the US, but a US rebound, led by tech spending, has cushioned the downside to global growth. In 2025, we expect low-to-mid single-digit growth in global business investment (Display, left). The capital expenditure gap between the US and other countries will likely linger, given the generally higher cash generation of US stocks (Display, right) and the ongoing artificial intelligence surge among large tech firms.

US Policy and Deficits Add Uncertainty

Our outlook, of course, is subject to change given several uncertainties in the mix. We’re closely watching policies expected out of the new US administration, which have already led the Fed to slightly adjust its outlook. Higher import tariffs and tighter immigration measures could increase short-term US inflation and drag down global growth. It’s difficult to assess the final impact until the size, breadth and implementation pace are known. We also need to see how firms will respond, and whether they readjust supply chains, or pass through or absorb price increases. Still, we believe policy scope will be limited, considering that politicians may be unwilling to add to already high inflation and interest rates.

Rising concerns on fiscal sustainability are likely to constrain fiscal policy in the US and other developed markets, including the UK, France and Germany. As a result, we don’t anticipate meaningful growth or inflation impacts from government spending.

An Expanding Opportunity Set for Multi-Asset Strategies

We think economic progress across more markets will present broader opportunities for multi-asset investors in 2025. Economic growth supports earnings growth, which tends to be supportive for risk assets, such as equities.

Among developed market equities, we favor exposure to the US, the euro area and Japan. In contrast, emerging markets remain challenged due to secular headwinds to China’s growth. Policy support to rebalance its economy has been disappointing so far, and the prospect of rising trade barriers could amplify problems.

Sovereign Bonds Offer Long-Term Value

Given real yields are near historical highs, we see long-term value in bonds despite near-term uncertainty. With high starting yields, they also offer compelling income potential. We currently favor sovereigns in the UK and Germany, where yields are likely to fall more, relative to other countries.

Corporate credit spreads are now historically tight due to solid fundamentals and a resilient economy. In this environment, we think it makes sense to shift some focus to stocks, seeing the risk-reward profile of equities currently more advantageous.

To sum things up, US economic growth should continue to outpace peers, but we anticipate gradual convergence across developed markets. However, we remain aware that some regions, especially exporters, remain vulnerable to potential changes in US policies. From our perspective, this just makes it more imperative for multi-asset investors to stay flexible and selective as the backdrop changes.

About the Authors Caglasu Altunkopru

Caglasu Altunkopru

Caglasu Altunkopru is Head of Macro Strategy in the Multi-Asset Solutions Group at AB. She was previously a sell-side analyst at AB, covering equity portfolio strategy for six years. Altunkopru joined the firm in 2005, covering the European Household and Personal Care sector, and her team was ranked among the top three in Institutional Investor and Extel surveys. Prior to joining AB, she worked as a management consultant with The Boston Consulting Group, Bain & Co. and McKinsey, serving clients in the consumer goods and financial services sectors. Altunkopru holds a BS in mathematics from the Massachusetts Institute of Technology and an MBA from Harvard Business School. Location: New York

Aditya Monappa is Global Head of the Multi-Asset Business Development team. In this role, he leads a team of investment and product strategists who engage with clients to represent market views and investment strategies for AB’s Multi-Asset Solutions (MAS) business. Monappa is also involved in setting the strategic priorities and goals for the global MAS business. Prior to joining the firm in 2018, he was head of Asset Allocation & Portfolio Solutions for Standard Chartered Bank. As part of that role, Monappa was responsible for the design of global asset-allocation models and multi-asset-class portfolio solutions for both the private and priority segments. He was a key member of the bank’s Global Investment Council and also acted as an advisor to the Discretionary Portfolio Management division. Previously, Monappa was head of Wealth Management Analytics for RiskMetrics Group, responsible for its asset allocation and portfolio construction offering. Prior to RiskMetrics, he worked with J.P. Morgan, first in the Investment Management division, followed by three years with J.P. Morgan Advisory Services, a division of J.P. Morgan Private Bank. Monappa holds an MBA from INSEAD and an MS in financial engineering from Columbia University. He is a CFA charterholder. Location: Singapore