by Russ Koesterich, CFA, JD, Portfolio Manager, BlackRock

In this article, Russ Koesterich discusses why stocks could continue to advance in 2025 despite the potential for a higher interest rate environment.

Key takeaways

Historically, higher rates have exerted downward pressure on stock multiples, i.e. valuations. That said, the relationship has only been significant with extreme moves of 3% or higher. A modest rise of rates on the back of stronger nominal growth (NGDP) would support earnings.

While stocks can move higher, the bond market will continue to matter. Higher rates suggest that equity leadership may continue to reside in companies that are relatively rate insensitive.

While stocks wobbled at year’s end, equities enjoyed another strong year. For the first time since the late 1990’s, stocks posted two consecutive years of 20% or better gains. Still, investors ended the year on a nervous note. Inflation remains sticky and long-term yields elevated. For the calendar year 2024, U.S. 10-year yields climbed roughly 0.60%, driven by a 0.50% increase in real or inflation adjusted rates. This leaves the question: Can stocks continue to advance if rates continue to rise? My own view is yes, assuming any further rise in rates is modest.

There are two reasons equities can survive higher rates: rates and stocks have a complicated relationship, and higher rates are often accompanied by faster economic growth. Historically, higher rates have exerted downward pressure on stock multiples, i.e. valuations. That said, the relationship has only been significant at the extremes. In other words, small changes in rates have not had much of an impact on valuations. In the past, it has been when real rates have reached extremes, around 3% or higher, that stock valuations have often suffered.

Apart from the level of rates is the question of why rates are rising. If rates surge due to concerns over deficit spending markets would be at risk. However, a modest rise on the back of stronger nominal growth (NGDP) would support earnings. Assuming NGDP of 4.5% to 5.0%, earnings have the potential to beat expectations. Even if valuations do slip, stocks can advance on the back of solid earnings growth.

Watch the hedges and market leadership

While stocks can move higher, the bond market will continue to matter. Two rate related issues to watch: stock/bond correlations and the impact of ‘rate beta’ within market leadership.

As stocks have continued to grind higher over the past two calendar years, investors have had to rethink how to hedge those gains. As I have discussed in previous blogs, bonds have become a less reliable hedge. If investors are equally or more worried about rates than a recession, stock/bond correlations are likely to remain positive, making long-term bonds a source of risk rather than risk mitigant.

High rates also suggest that equity leadership may continue to reside in a handful of mega-cap companies that are relatively rate insensitive. This is because those market segments most sensitive to interest rates remain vulnerable. The list includes companies dependent on constantly raising fresh capital, including many small cap names, as well as stocks owned primarily for their dividend yields.

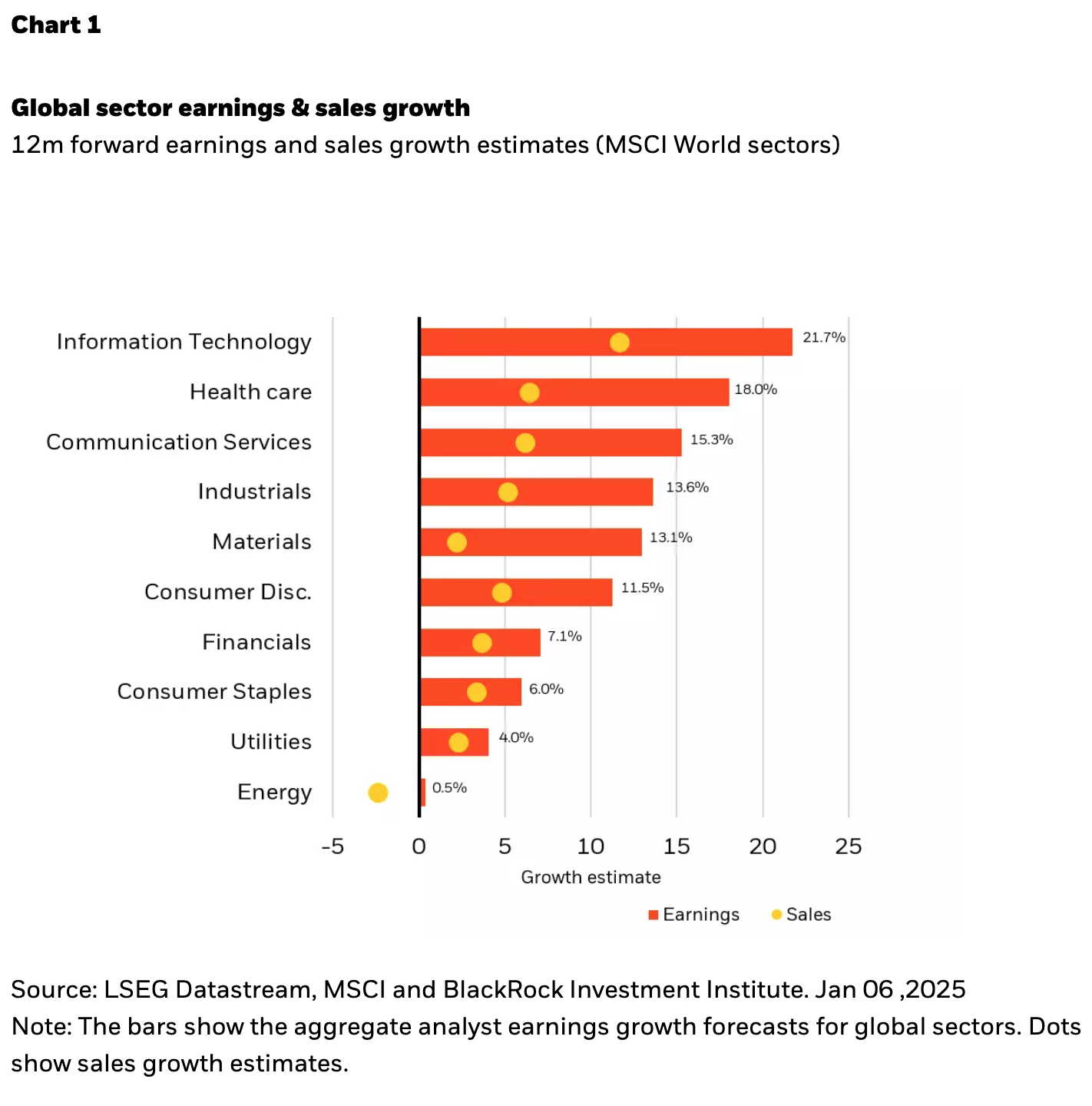

The flip side of this dynamic is that many of the recent leaders will continue to enjoy a relative advantage. Apart from supportive secular trends, many of the mega-cap tech and adjacent names are likely to continue to benefit from low debt, big cash balances and resilient earnings growth (see Chart 1).

The bottom line for investors

I would not sell equities based solely on higher rates. Stocks, at least the large ones that dominate the U.S. indices, have the potential to prove resilient given their strong balance sheets and cash-flow momentum. However, rates will matter in other ways. Even modestly higher rates may result in another year in which leadership resides in a relatively small number of highly profitable, cash-rich companies.

Copyright © BlackRock