by Adam Turnquist, Chief Technical Strategist, LPL Research

Outsized returns, record highs on nearly a weekly cadence, and low volatility were three major themes of price action in 2024. The S&P 500 posted a total of 57 record highs, marking the fifth-highest number of new highs in a calendar year since 1950. Furthermore, the CBOE Volatility Index (VIX) averaged only 15.5 on a daily closing basis in 2024, well below its historical average close of 19.5 and ranking as the 12th lowest average annual VIX since 1990.

Given the mostly one-way direction of stocks last year and the limited degree of drawdowns experienced on the S&P 500, last year’s price action may seem like an outlier. However, after comparing the daily progression of 2024 to the daily progression of every year since 1950, we found several periods that closely resembled last year. As shown in the chart below, the years 1954, 1955, 1958, 1995, 2013, 2017, and 2021 exhibited similar price movements to last year, with correlation coefficients of at least 0.90.

Correlations to 2024 by Year

Source: LPL Research, Bloomberg 01/16/25

Disclosures: Correlation data based on daily price progression of each year, compared to 2024. Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly. The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of the predecessor index, the S&P 90.

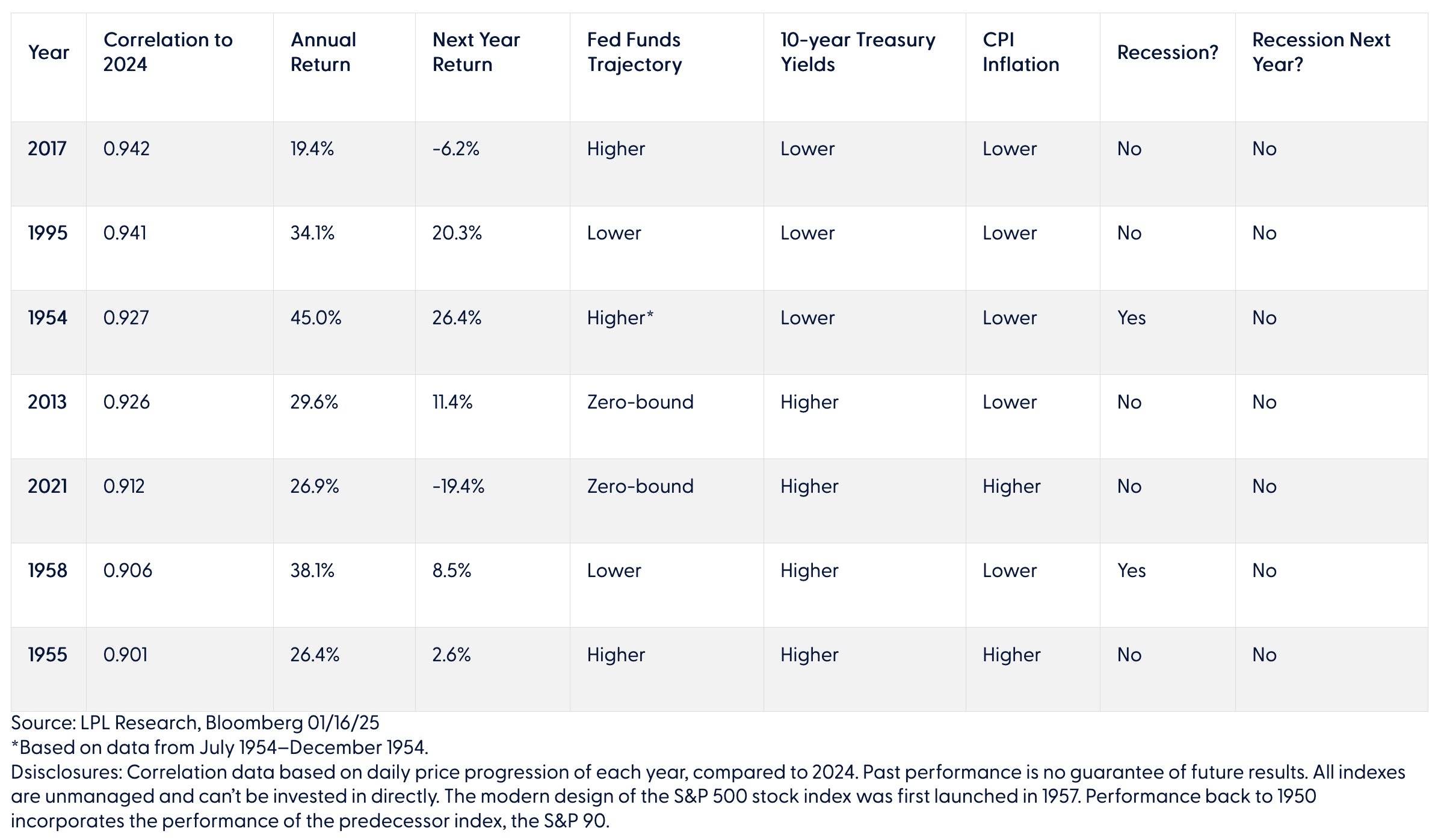

As with any historical comparison, context is key. The table below breaks down each of the highest correlation years to 2024 and summarizes the macro backdrop of each period, including the trajectory of the fed funds rate and 10-year Treasury yields, the inflation backdrop, if there was any overlap with a recession, and how the S&P 500 performed over the following year (the average next year gain was 6.2%, with five of seven years delivering positive returns).

Given the fed funds rate will not be at the zero-bound this year (barring any extreme black swan type of event), our expectations for no recession, and for inflation and the fed funds target rate to continue on a downward trajectory, the years 1995 and 1958 standout as the closest analog to now (although 1958 overlapped with a recession, it ended in April of that year). The following year, the market posted gains of 8.5% (1959) and 20.3% (1995) and avoided a recession. Of course, these observations come with the caveat that correlation data does not imply causation — earnings, the economy, monetary and fiscal policy, interest rates, inflation, and a host of other broader macro factors will ultimately dictate how stocks perform this year.

Lastly, it would be an oversight not to mention 2021, considering the similarities in sentiment, market breadth, and the price action of other asset classes between then and now. Heading into 2022, Wall Street sentiment was fairly optimistic, with strategists predicting another year of gains and earnings growth projected to hit 9%, according to FactSet. However, as the year began, market breadth was notably diverging from the S&P 500, while the dollar and 10-year Treasury yields were reaching multi-year highs. Although this may sound familiar, we are not suggesting that stocks will enter a bear market. Instead, we emphasize the significant impact that macroeconomic conditions can have on equity market returns.

Highest Correlated Years to 2024

Given the high correlations and similar macro conditions between last year and 1958 and 1995, we also analyzed how the following year progressed for each period. The chart below compares the progression of the S&P 500 in 2024 to the 1958–1959 and 1995–1996 timeframes. As highlighted, stocks stumbled out of the gate in 1959 and 1996 before the broader market resumed its uptrend. Price action in 1996 was also notable as momentum stalled after the recovery off the January lows, sending the S&P 500 into a multi-month consolidation phase until the back half of the year, where over half of the year’s 20.3% gain was made.

S&P 500 Price Progression Comparison

Source: LPL Research, Bloomberg 01/15/25

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly.

Summary

Last year was an impressive year for equity markets, and we believe forward momentum will continue this year but at a more moderate pace. History seems to agree, as following year returns after years that were closely correlated to 2024 produced average gains of 6.2%. Simply applying this average to the S&P 500’s December 31 close equates to a year-end target of about 6,250, nearly in line with our 2025 fair value target range forecast for the S&P 500 of 6,275–6,375. On a shorter-term basis, Wednesday’s relief rally produced some technical progress, with the S&P 500 recapturing support at 5,860 but closing just shy of the 50-day moving average (dma) at 5,958. A close above this area of resistance accompanied by an improvement in market breadth metrics, would be a good sign the latest round of selling pressure could be over. Until then, we continue to believe there is risk for a potentially deeper pullback toward the July highs or even the 200-dma.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor's holdings.

This research material has been prepared by LPL Financial LLC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

Copyright © LPL Research