by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

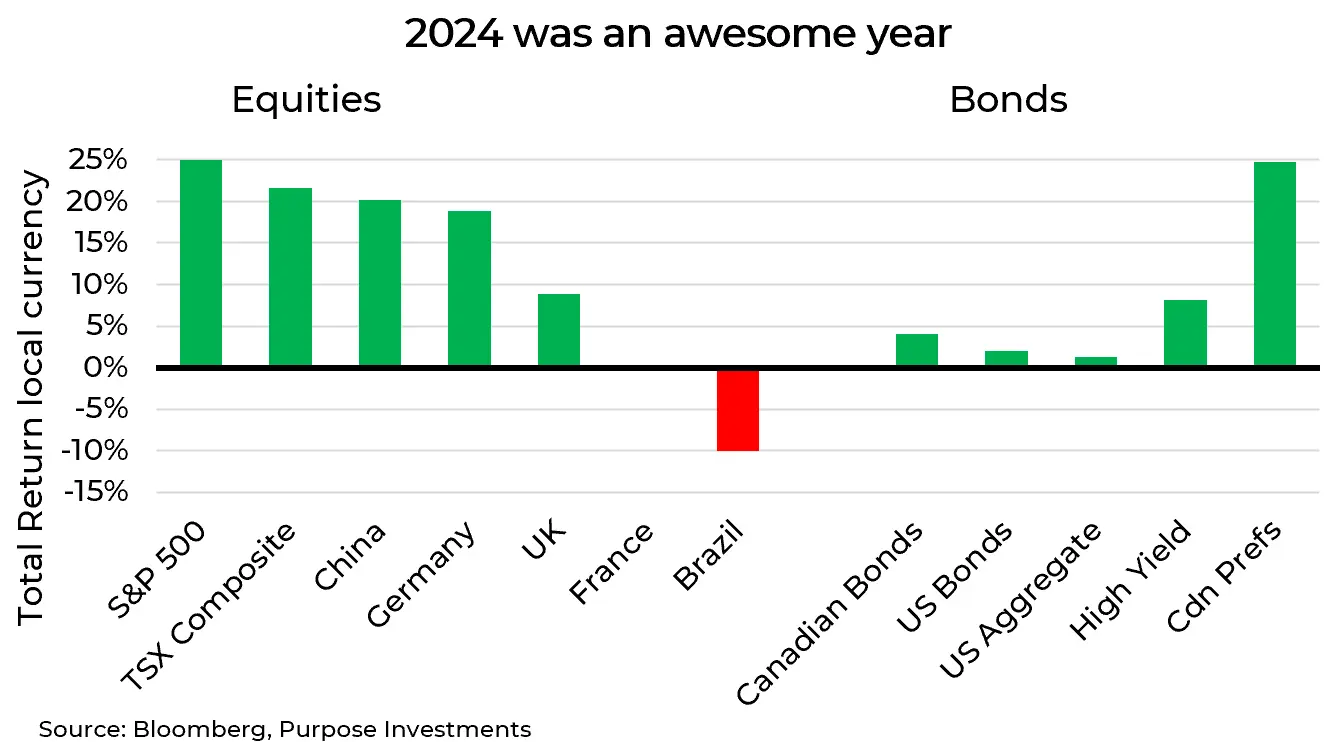

Global markets, measured by the Bloomberg World Index, gained +18%. Once again, America was the star of the majors at +25.5%. But there were many good performers, including Germany (+19%), Japan (+21%), and Canada (+21%). Obviously, there were some laggards—like France (0%) and Brazil (-9%)—but negative equity returns were few and far between in 2024.

Bonds went up as well. The Canadian bond universe rose 4%, besting the U.S.’s 2% gain. However, we’re not sure that having better bond performance than the U.S. really makes up for the relative underperformance of equities over the past few years. As you go down the credit scale, bond returns improve: U.S. high yield rose 8% while Canadian preferred shares were up a whopping 25%.

Key Drivers of Success: The Economy and Inflation

We believe two key factors really contributed to the strong returns of 2024 – the economy and inflation. While there’s no denying the markets and the economy have a loose connection at best, the market likes positive surprises.

Given muted economic forecasts at the start of 2024, the result was better than expected. Of course, there were ups and downs along the way, with data swinging between hot and cold. But overall, the economy proved stronger than anticipated.

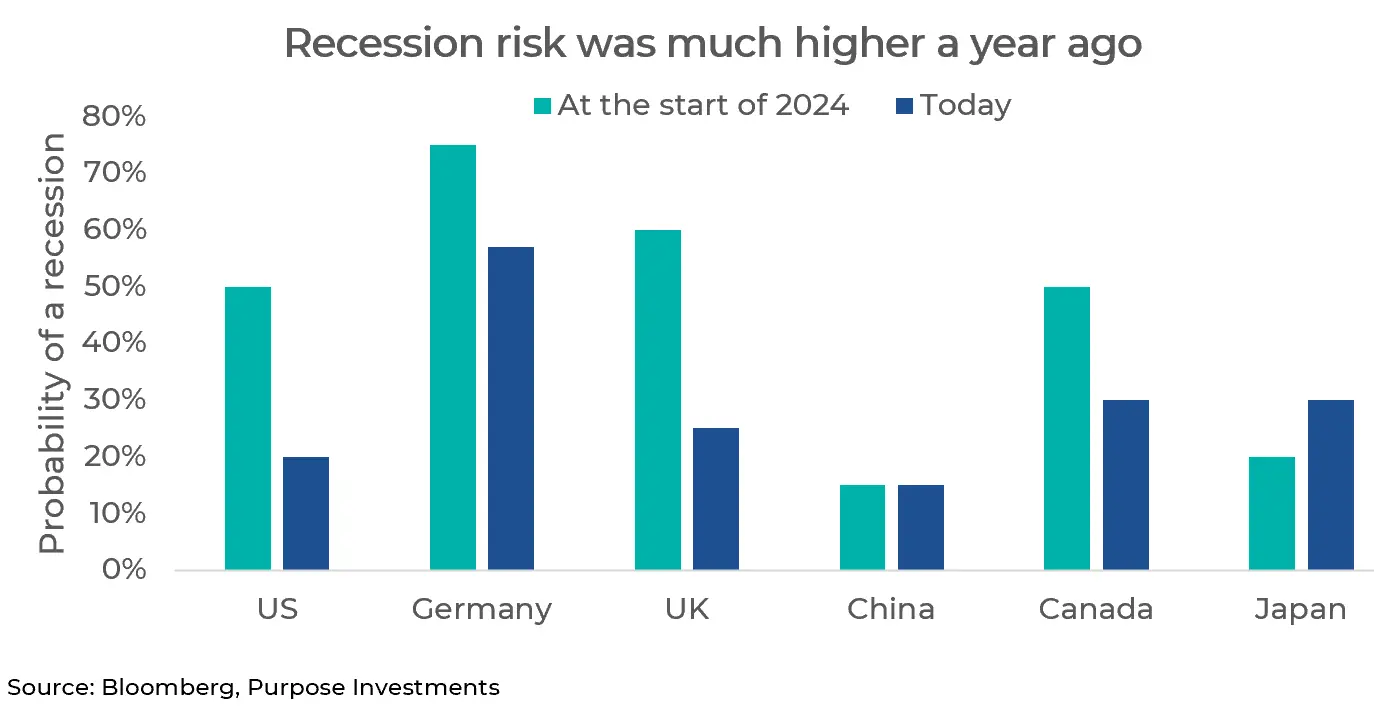

An easy way to see this is the consensus view of recession risk over time. A year ago, there was a 50% chance of a recession in America over the subsequent year; today that is way down at 20%. In fact, recession risk has fallen across most major economies.

Alongside good economic data, inflation continued to cool. While it didn’t ease as much as in 2023, the trend remained in the downward direction, allowing most global central banks to begin cutting interest rates. We can all debate the speed and magnitude of rate cuts on the road ahead, but it's relatively certain the direction is lower. 2024 saw rate cuts combined with easing financial conditions. Add all that up and you have a great year for markets.

The Bumps Along the Way

The S&P 500 did not experience a correction in 2024, which is measured as a 10% decline in prices. This isn’t abnormal, in fact over the past 75 years, about 30% of years were correction-free. The TSX and global equities also avoided corrections. However, this doesn’t mean there weren’t some bumps along the journey.

In April, markets softened when 10-year U.S. Treasury bond yields rose above 4.5%. Historically, this level has been a line in the sand, and when bond yields cross it, the equity market gets a bit bent out of shape. The challenge is that this line is not static and maybe it has moved again as bond yields are around 4.5% gain.

The summer brought a bigger drop. Softening economic data started this bout of weakness, but it was central bank comments that really caused the stir. The softer data in the U.S. resulted in markets pricing in a lot of rate cuts in the coming months from the Federal Reserve.

Meanwhile, the Bank of Japan signalled its intention to move in the opposite direction. Given the amount of global capital allocated along the yen carry trade (i.e., borrow in Japan, invest elsewhere), this triggered a rush for the exit. “Carrymageddon” ensued and global markets tumbled.

There were a few other brief periods of weakness, but markets recovered from these and put in a good year. Perhaps this is even more impressive given other things going on. War continued in Ukraine and conflict escalated in the Middle East. It feels like geopolitical risk is still rather elevated. And there have been a number of big elections with changes in government leadership, adding more volatility or risk to the equation.

Beneath the Surface, Things Were Much More Volatile

The S&P 500 made 57 record highs last year, but that doesn’t mean everything went up. In fact, it may surprise you what did best and worst.

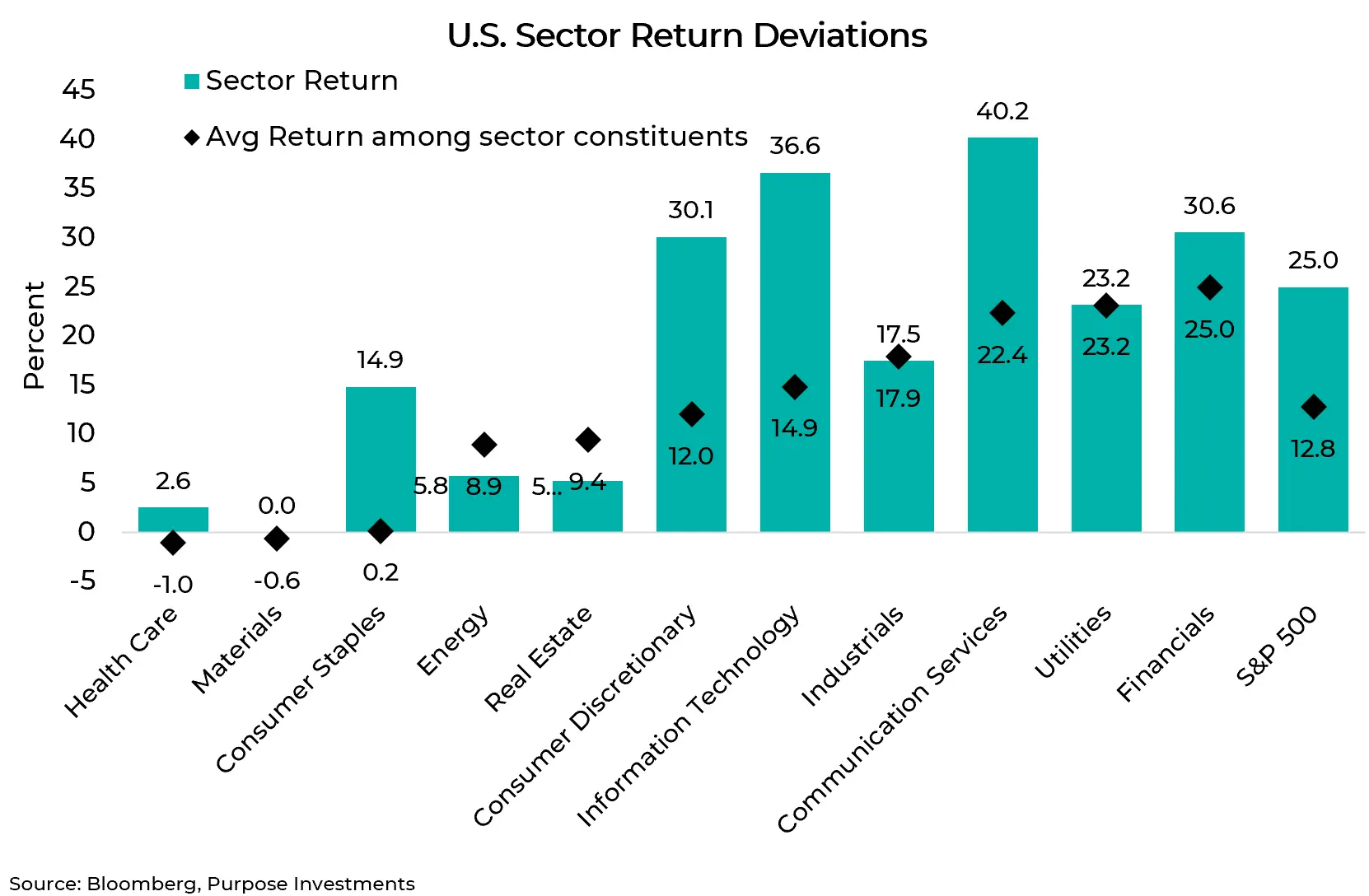

The top-performing sectors for the S&P were Communication Services (+40%) and Information Technology (+37%). Consumer Discretionary (+30%) and Financials (+31%) were among the outperformers as well. Underperformers were global cyclicals such as Materials (-0%) and Energy (+5%) as well as defensives such as Health Care (+3%).

In Canada, the story was very much the same. Information Technology (+38%) and Financials (+25%) emerged as clear leaders, with both demonstrating exceptional momentum in the latter half of the year. Materials (+19%) and Energy (+18%) did much better in Canada than in the U.S. Gold prices and an exceptional year for pipelines helped. Consumer Staples (+17%) provided stable returns mostly because of the continued strength from the grocers.

Conversely, Communication Services (-27% YTD) endured persistent selling pressure, making it the weakest sector of the year. Real Estate (+2% YTD) and Utilities (+9% YTD) also underperformed, weighed down by higher interest rates. These sector trends underscore the strength of growth-oriented areas like IT and Financials while highlighting challenges in rate-sensitive and structurally defensive sectors.

What’s interesting is that despite the strong market returns from a headline level, the average return across the sectors and even the index diverged greatly. In the chart below, we have the U.S. cap weighted sector returns, but we’ve also plotted the average return within each sector for 2024.

On average, Financials were the top-performing sector, with an average gain of 25%. The sector did very well after the election. This contrasts greatly with what we see within the high-flying Tech, Communication Services and Consumer Discretionary returns where the average return within each sector was significantly below cap weighted returns.

Mega-Caps Drive Much of the Growth

The source of this divergence between each sector and its constituents is of course the mega-caps. Telecom services include Meta and Alphabet, while Consumer Discretionary includes Tesla. Mega-cap dominance was a defining theme throughout the year.

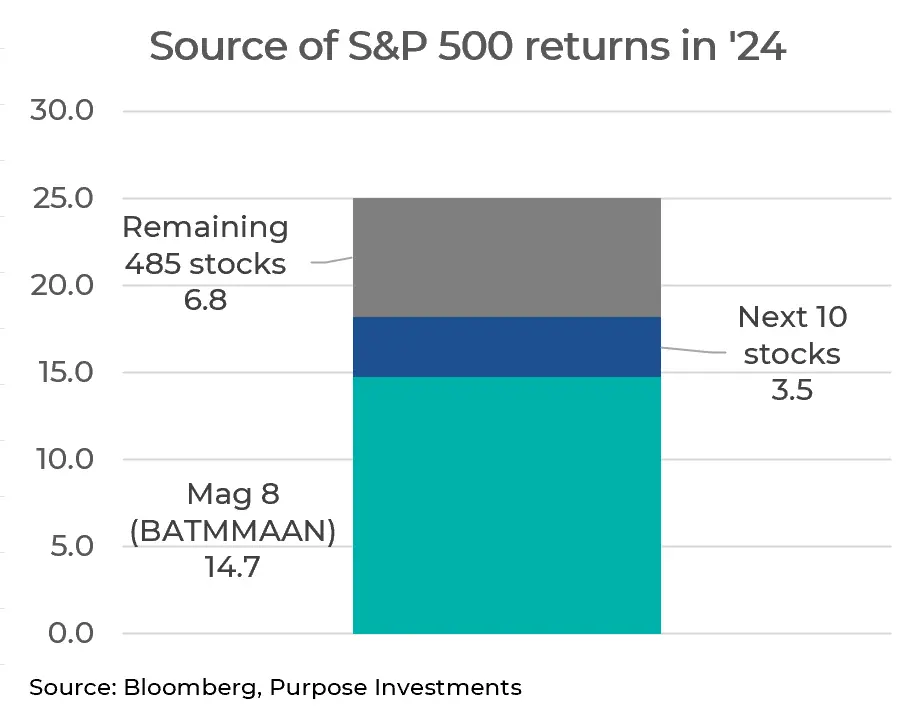

NVIDIA had a staggering return of 171% and was the biggest contributor to the S&P 500 gain. Besides NVIDIA, you had the usual cadre of mega-cap performers with one new addition: Broadcom. Broadcom rose 110% and became a new member of the trillion-dollar club in December. It’s ascension made the Mag 7 into the Mag 8 and even spurred a new acronym.

The BATMAAN stocks (Broadcom, Apple, Tesla, Microsoft, Meta, Amazon, Alphabet, and NVIDIA) have now replaced FANGMAN. This new group accounted for 63% of returns for the S&P 500. The next 10 contributed to 12% to total return with the remaining names in the index contributing just a quarter of the years returns.

It’s interesting when you look at the best-performing stocks—it’s not all tech, but there are several nuclear plays and three industrial companies that more than doubled. We saw a similar picture in Canada, with the top ten stocks driving over 50% of returns. The top ten had your usual names: the big banks (minus TD), Shopify, Brookfield, and the two big pipelines—Enbridge and TC Energy.

With hindsight, it’s easy enough to explain why the winners were on top, but it’s never as easy when you try to look forward. From our vantage point, concentration risk remains alive and well with just so few stocks driving much of the performance. We prefer equal weight primarily to diversify away beyond the mega-cap leaders into 2025.

Beyond Equities and Bonds

When everything goes up, few investors seem to care that correlations remain positive across many asset classes, including equities and bonds. Given elevated cross-asset correlations, the need for diversifiers to construct more resilient portfolios remains important. So, how did they stack up in such a strong year for equity markets?

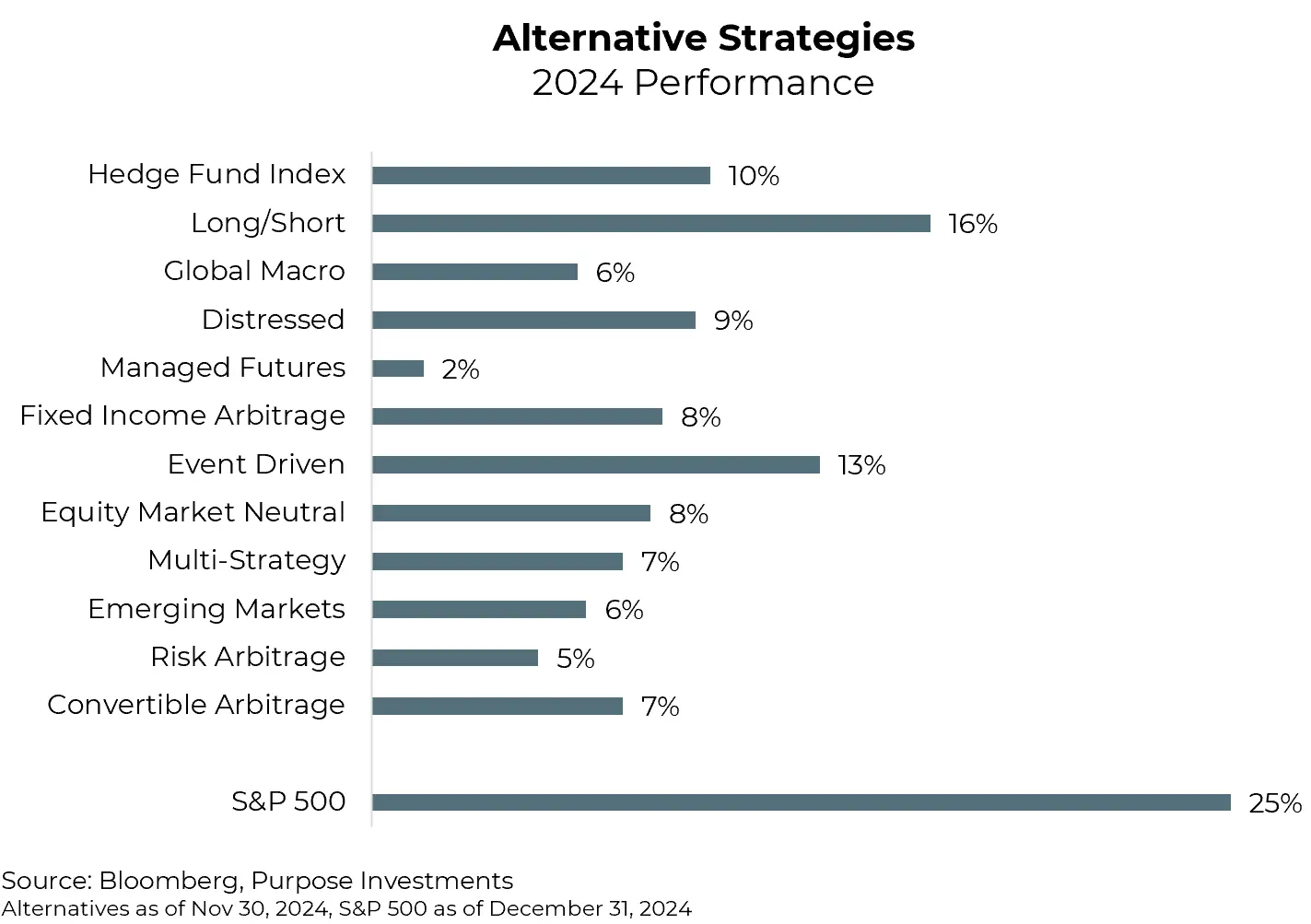

2024 was a solid year for alternatives, with all the strategies across the Credit Suisse Hedge Fund Indices ending in the green. Long/Short strategies came out on top, pulling in a strong 16% return. That said, they struggled a bit to keep up with just plain-old index exposure. Since the market didn’t have many pullbacks, there wasn’t much need for those short positions. Event-driven strategies took second place with a nice 13% return, and distressed assets followed with 9%. But let’s be real, none of them could hold a candle to the S&P 500 in 2024.

Still, it's important to remember the role of diversifiers in the portfolio, which is certainly not to match the returns of the S&P 500. You would not want them to match on the downside, which makes it impossible to do on the upside. Market Neutral posting a return of 8% is not very exciting, but a little bit of growth is appropriate considering the role in the portfolio is to add crisis alpha.

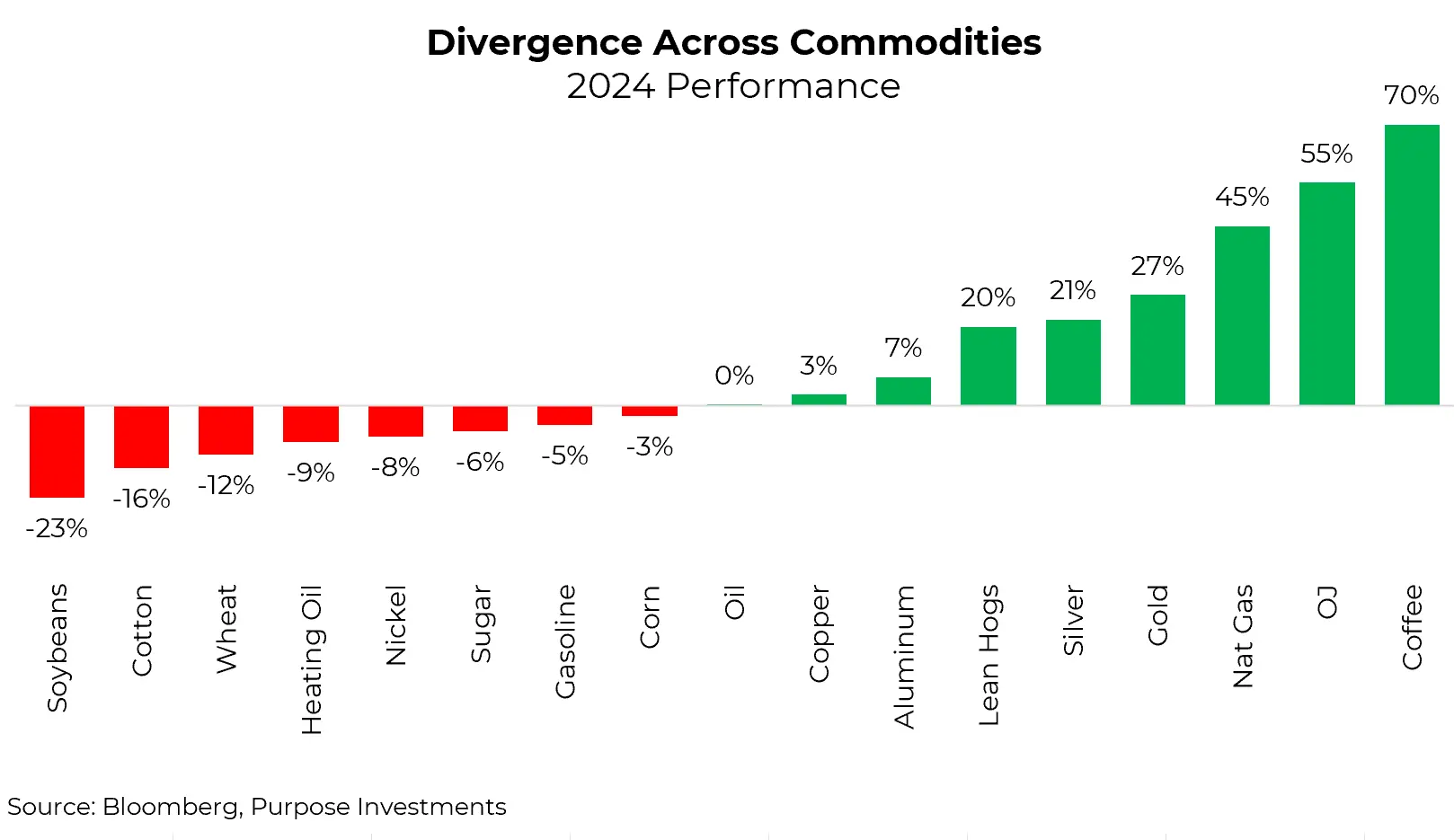

Commodities were also a mixed bag. Soybeans, cotton, and wheat underperformed, while consumables like cocoa (not shown because it's off the chart) coffee, and OJ were incredibly strong.

2024 was an excellent year to be a supporter of gold, surprising most with some solid growth. The yellow metal did more than hold its ground, even amidst what is normally a challenging environment for gold. Declining inflation, a strong USD, and low market volatility couldn’t keep it down. A partial catalyst was steady demand from central banks, particularly in emerging markets, who’ve been shifting their reserves away from the USD. In the end, gold proved to be a reliable asset, offering stability and helping portfolios during uncertain times.

It was a relatively quiet year for crude oil as oil prices ended the year in a very similar position to the end of 2023. Just after Q1, WTI climbed above US$84/bbl but has since been on a retreat. Demand remained strong throughout the year, especially from China, and supply was managed by OPEC+ cuts. There has been an abundance of geopolitical tensions that caused occasional price shifts, but not enough to lead to anything meaningful.

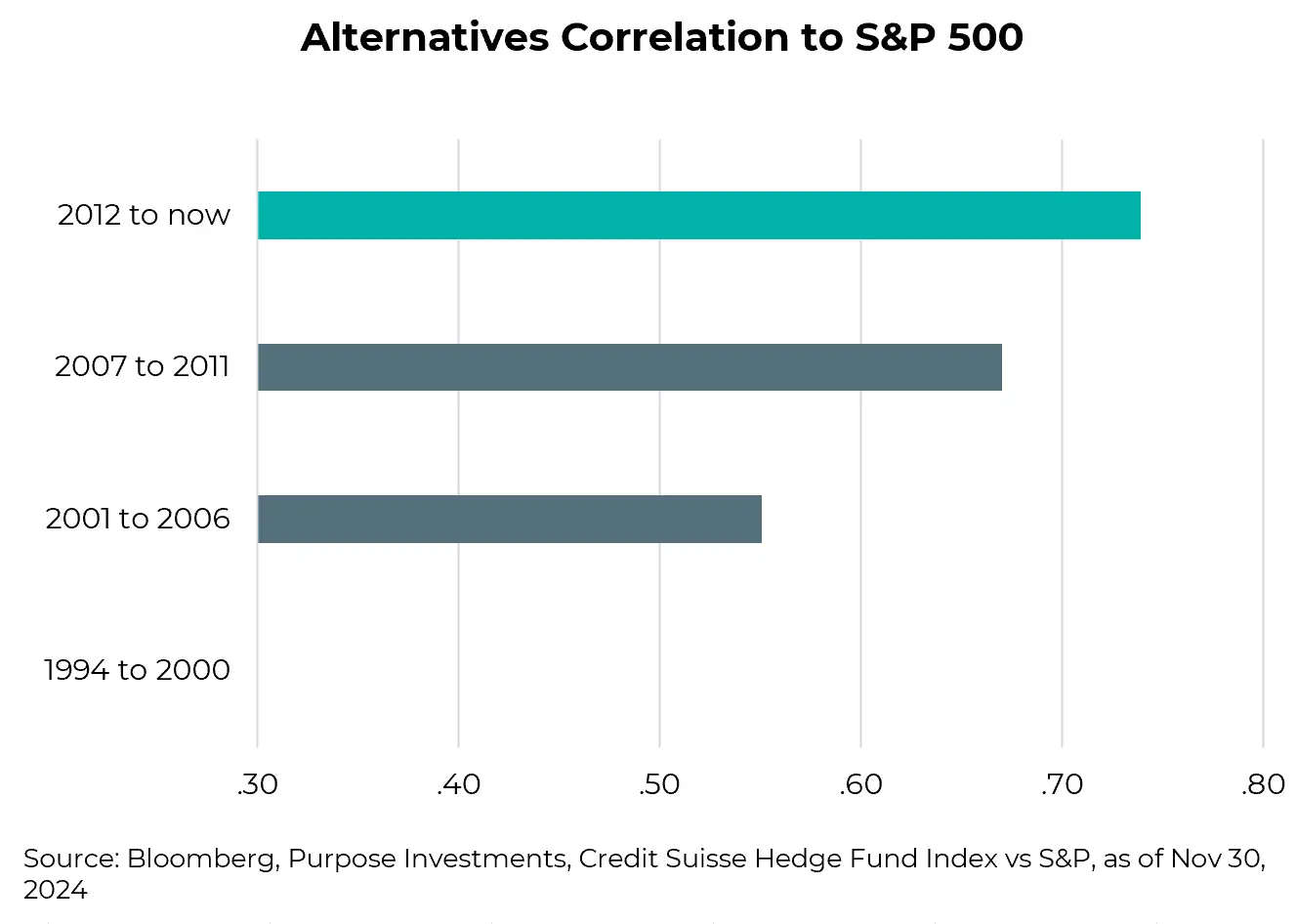

Alternatives, including commodities, have increasingly been finding allocations in portfolios given higher correlations between more traditional equities and bonds. However, correlations of many alternatives to the equity market have also increased over time.

Looking Ahead to 2025: Diversification Challenges

The simple truth is we are investing in a more correlated world than years past, and that makes diversification harder to find. This hasn’t been an issue the past couple years with markets going up, but after two years of outsized returns the need for diversifiers may be opportune heading into 2025.

This could make gold or other volatility management solutions valuable considerations for portfolios. If the goal is to reduce correlation, commodities could be a strong option, with the three-year correlation of commodities to the S&P 500 sitting at roughly 0.30.

However, the biggest challenge for diversifiers in 2025 could be self-inflicted. Concentration or over-reliance on single strategies like private equity or income-driven solutions can increase the risk. It is important to not overlook the broad landscape of diversifiers available for portfolio construction. Remember, keep your diversifiers diversified.

— Craig Basinger, Derek Benedet and Brett Gustafson at Purpose Investments

Get the latest market insights in your inbox every week.

Sources: Charts are sourced to Bloomberg L. P.

The content of this document is for informational purposes only and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained in this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities. No securities commission or similar regulatory authority has reviewed this document, and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable; however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” intend,” “plan,” “believe,” “estimate” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are, by their nature, based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose Investments and the portfolio manager believe to be reasonable assumptions, Purpose Investments and the portfolio manager cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on the FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.