by Bob Elliott, CEO, CIO, Unlimited Funds

Expectations for the US economy coming into a new year have not been this high in quite some time. After several years of pessimism, nearly universal perspective appears to favor continuation of the strong growth and outsized asset price gains experienced in the last few years. Rhetoric by the new administration to further energize growth seems to be adding further fuel to the view that American exceptionalism could continue as far as the eye can see.

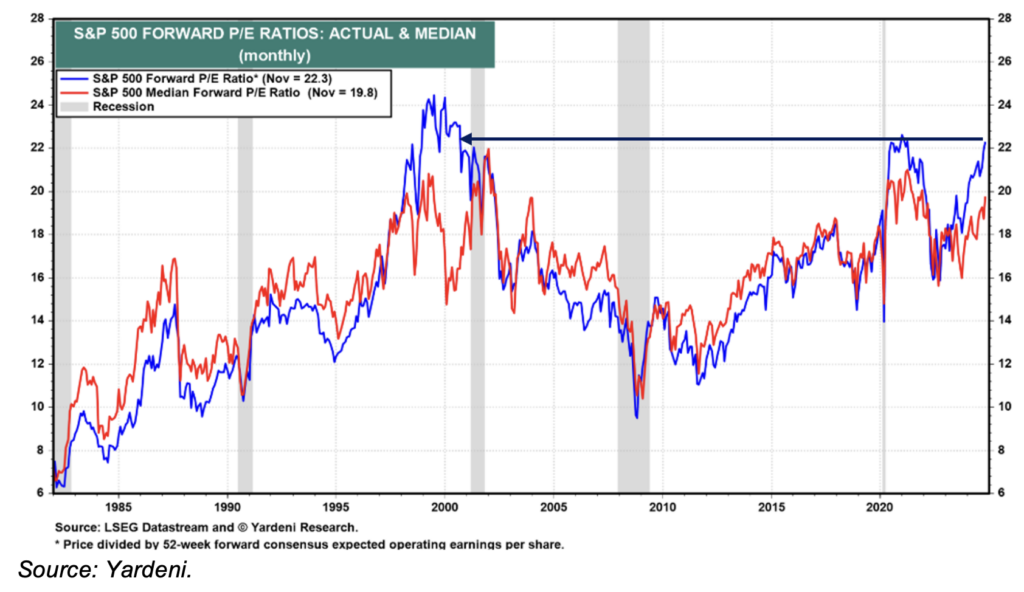

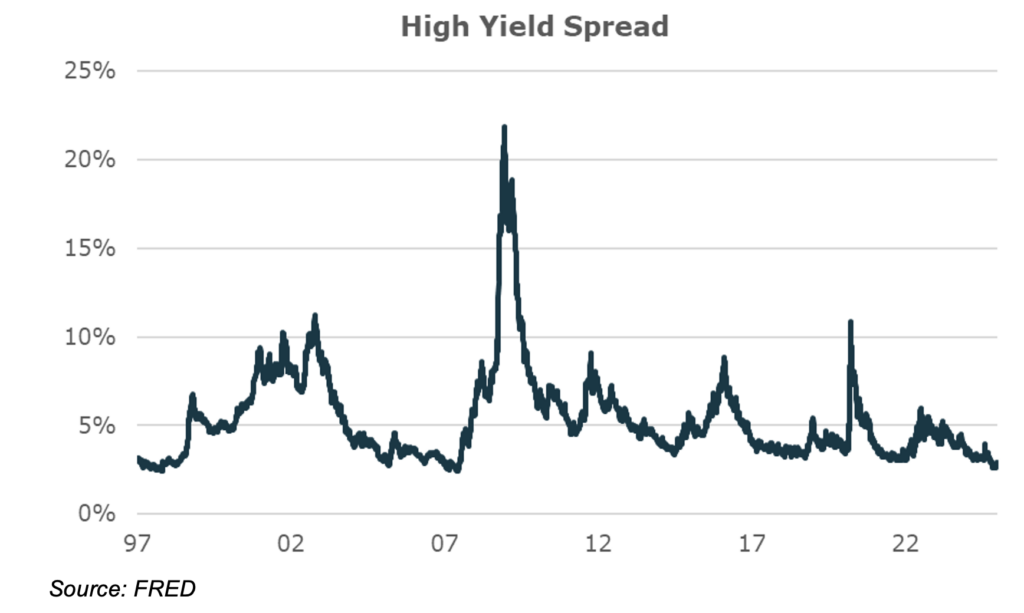

Asset markets have fully priced in this exuberance. Stocks are pricing in forward earnings growth of 17% for 2025 along with PE multiples near all-time highs. Spreads are pushing lows last seen during the pre-GFC days. Short rate markets in the U.S. seem to have settled on the view that the easing cycle is basically over. Real yields are close to cyclical highs. And most forms of speculative assets from crypto to sports teams keep pushing to all-time highs. Almost everything (other than bonds) has been going up and most investors have felt like a genius along the way.

For the last few years, we preceded the market predictions that income-driven expansion would exhibit endurance in the face of higher rates. But that view is now fully priced in, and then some, while signs of cooling continue to build. A review of hard data analysis of production, housing, the labor market, or investment efforts illustrates at least some cooling relative to the strength of the last few years. Recent long rate moves higher also signal potential for tighter financial conditions ahead. Most of the positive momentum today is concentrated on partisan-driven measures of sentiment.

Optimism can inspire greater economic activity, but that is difficult to sustain without supportive macroeconomic realities to keep it going, or policy shifts that make those expectations a reality. Many of the reforms outlined by the new administration have the potential to support a supply-side expansion – for instance reduced regulatory burdens or incentives for small businesses and low-wage workers. Additional tax cuts could also lift business profitability. But other proposed policies like reduced immigration and higher tariffs could create at least short-term constraints.

Markets are pricing in an extremely optimistic scenario of underlying economic momentum further reinforced by a pro-growth, disinflationary policy mix from Washington. Such extremes in optimism are rarely achieved. If history (and the recent stop-gap bill machinations) serve as any guide, achieving new policy objectives is at best uncertain, and almost always harder and slower to achieve than many might hope.

In the euphoric scenario the US economy meets these extremely high expectations, but unfortunately across most financial assets that scenario is already priced in. Given what is priced in and the possible range of outcomes, most investors might be better suited by curbing their enthusiasm about what 2025 will bring.

Tempering expectations favors outperformance of bonds relative to stocks to kick off the year and a short-rate rally – a performance mix that seems likely to look quite a bit different than the start of the last couple years, and for good reason. Expectations priced into markets entering ‘25 are much higher than to kick off ‘23 and ‘24. Below we examine what is priced in relative to the momentum and policy mix ahead.

Euphoric Expectations for US Growth In 2025

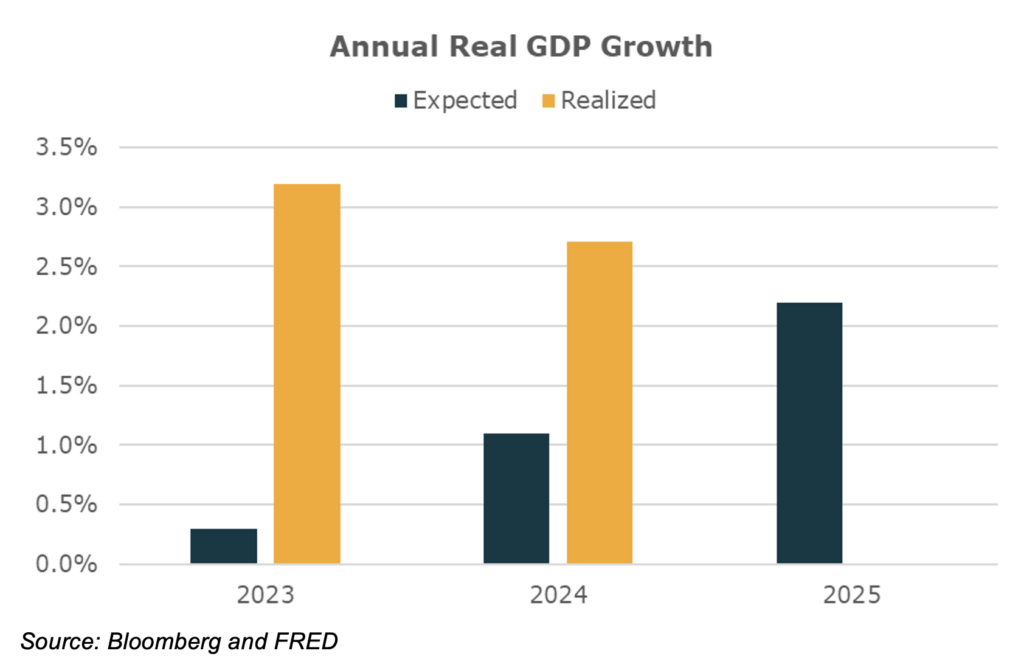

Coming into both ‘23 and ‘24 consensus expectations for the U.S. economy were for very weak economic conditions ahead and as those conditions surprised to the upside, both stocks and credit rallied significantly. Expectations coming into 2025 are quite different – with average forecasts already set at 2.2% making the hurdle to outperformance increasingly difficult.

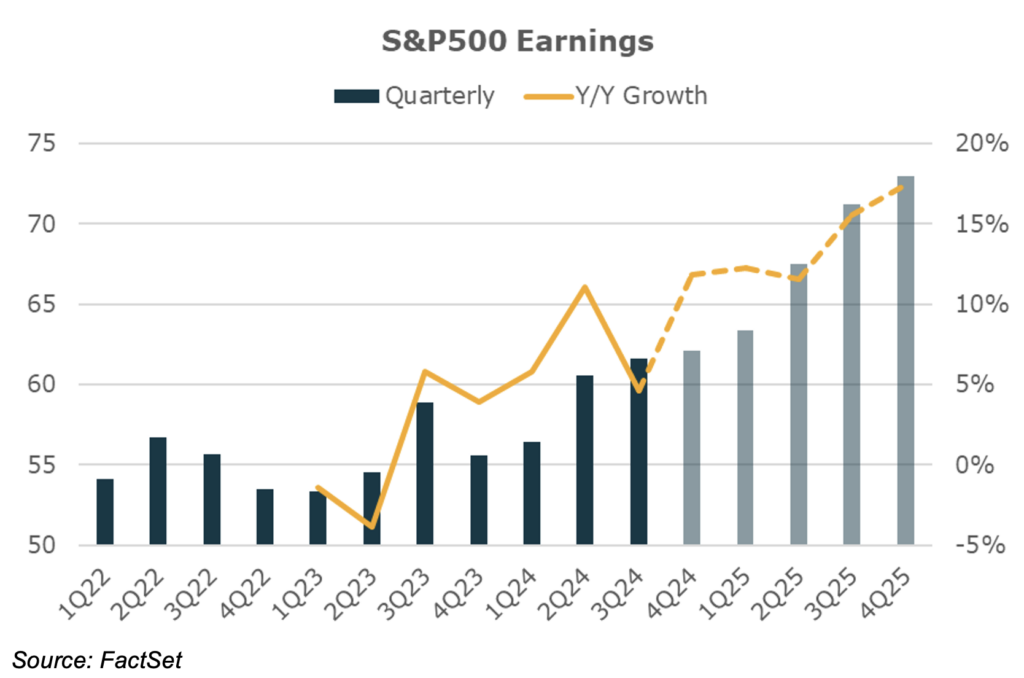

Earnings expectations for 2025 are also meaningfully heightened. After a couple years of relatively modest earnings growth, analysts are penciling out a relative boom of 17% earnings growth this coming year. Even accounting for the typical analyst earnings overstatement, meeting these accelerating earnings expectations likely requires even stronger economic conditions than the last couple years compounded with tax relief.

Valuations are pushing to new highs on top of these very strong growth expectations in the near term. This suggests equity investors are pricing in strong US earnings growth to continue well into the future. The last times a late cycle environment had PEs at these levels was during the tech bubble and 1929. Sell side strategists seem to be piling on to expectations of continued strength, adjusting ‘25 forecasts up at historic rates.

This optimism isn’t just contained to the equity markets, cash corporate bond spreads now reflect some of the lowest pricing of credit risk in decades. While this push lower is somewhat reflective of financing dynamics in the bond market, the picture seems pretty clear that markets are pricing in a benign credit scenario ahead.

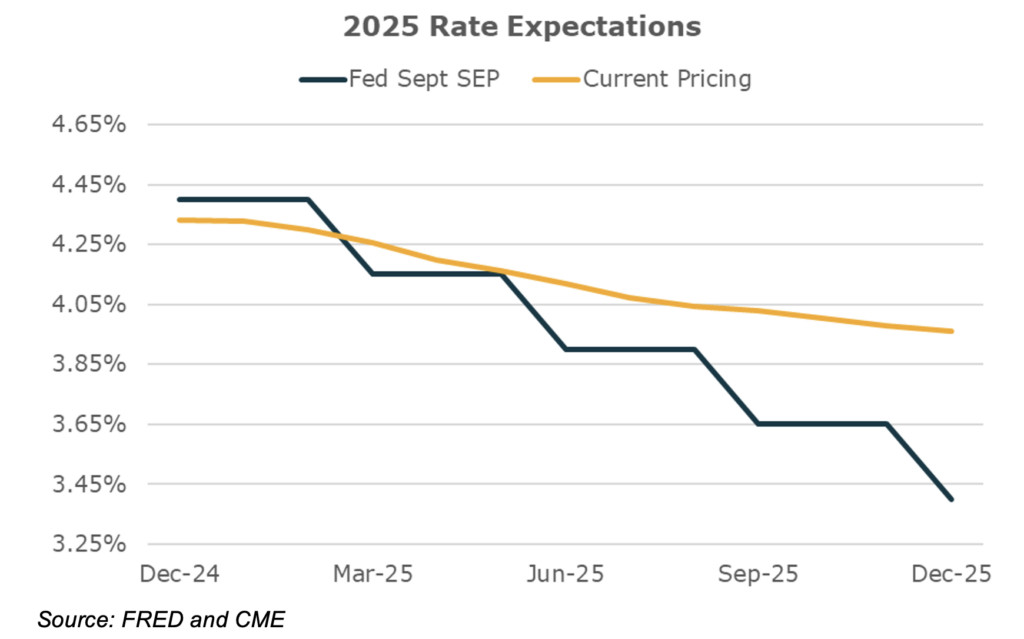

Conditions predictions are so strong at this point, investors have largely priced out additional Fed cuts in 2025, a distinct shift from just a couple weeks ago following the September Fed SEP which penciled out 4 cuts for 2025.

That has in part driven long-end real yields back to near cycle highs along with a modest bear steepening of the curve in the last few weeks to the steepest level in several years. This further reflects strong growth expectations for the economy and potential for tighter monetary policy conditions ahead.

Signs Of Slowing Across The Economy

The U.S. economy has grown much stronger than nearly anyone expected over the last couple of years, delivering 2-3% real growth pretty consistently despite higher rates. Those higher rates have been slowly eroding the momentum in the economy, driving some expansion indicators towards a renewed softening in recent months.

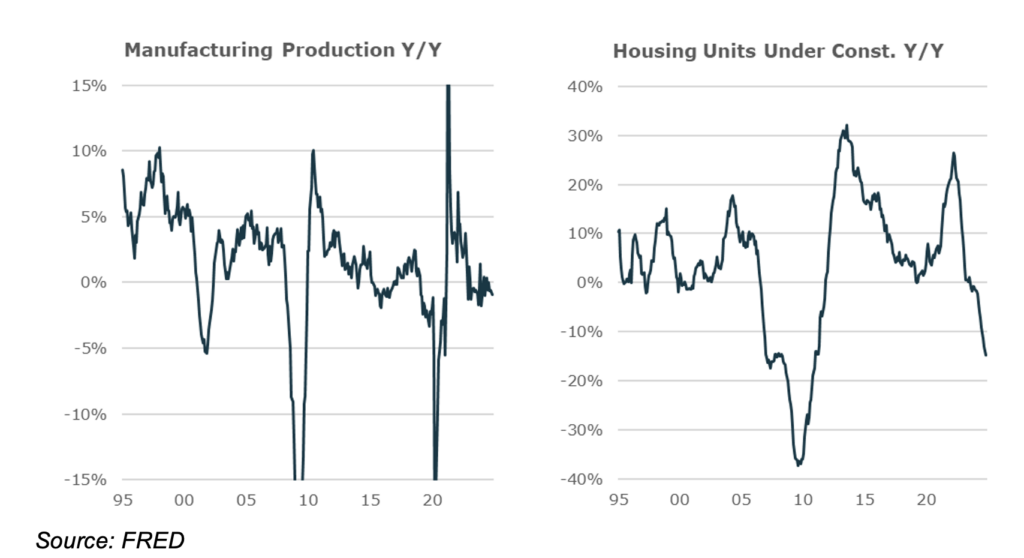

Traditional cyclical leading indicators of economic momentum have softened. While production has been weak for several years now, the collapse in housing construction in the second half of ‘24 has been particularly notable, which displays the type of slowing that typically precedes broader softening.

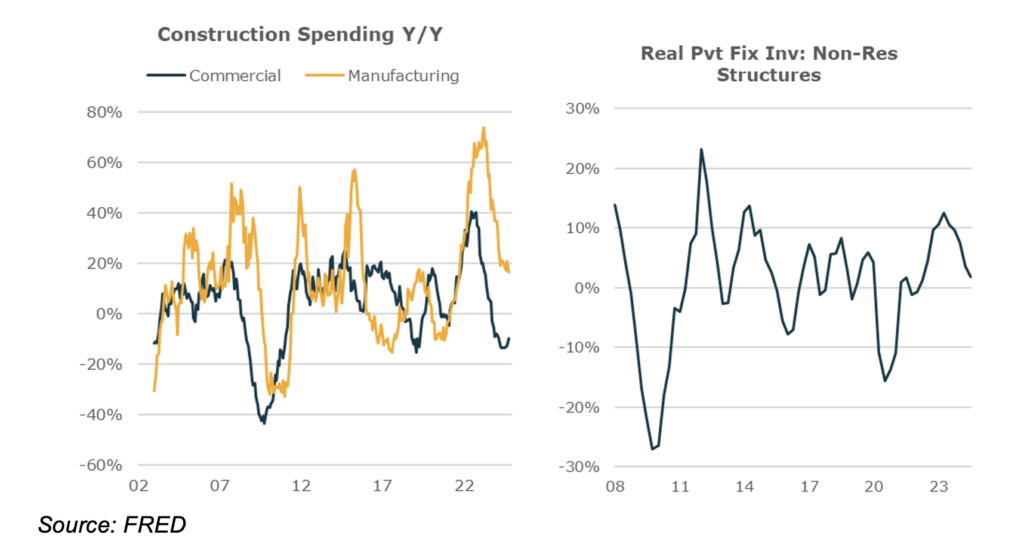

Business investment is also slowing. Commercial structure investment which slowed years ago continues to reach new lows, and more notably manufacturing related investment which experienced CHIPS Act related acceleration has also started to weaken. With these influences, business fixed investment in structures likely could create drag on GDP to kick off 2025.

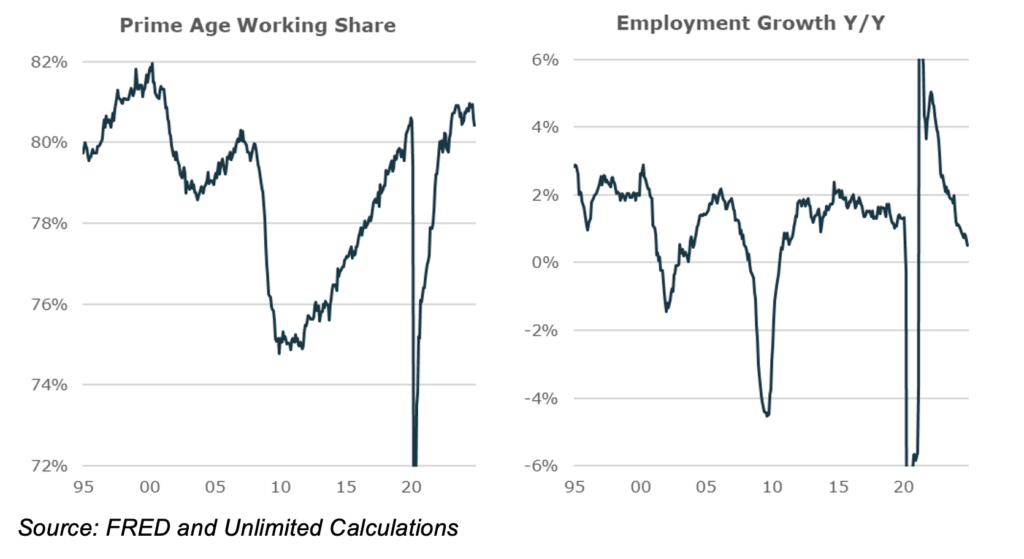

Employment conditions continue to slowly deteriorate. Weakening in several front-end indicators like the hiring rate are making headlines, but even at the macro labor market level we are seeing signs of weakening. The share of prime age workers employed has notably weakened in recent months, and blended employment growth is the softest since early ‘08 (excluding covid).

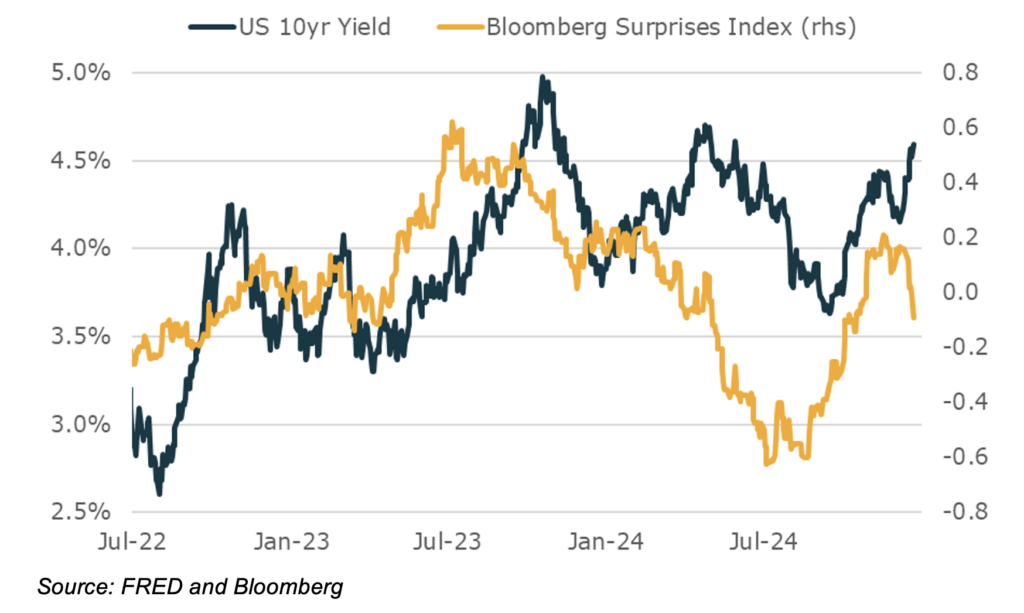

None of these indicators suggest an acute slip into a recession ahead, but what they could add up to is a slow grinding weakening of the U.S. expansion, in line with the sort of slowing typically seen in later cycle environments after years of higher rates. With expectations elevated, it may not be hard to disappoint in the new year given this downward momentum. Already measures of surprises like the Bloomberg Surprises Index have shown some slowing, which has historically aligned with lower bond yields.

Partisan Rise In Optimism

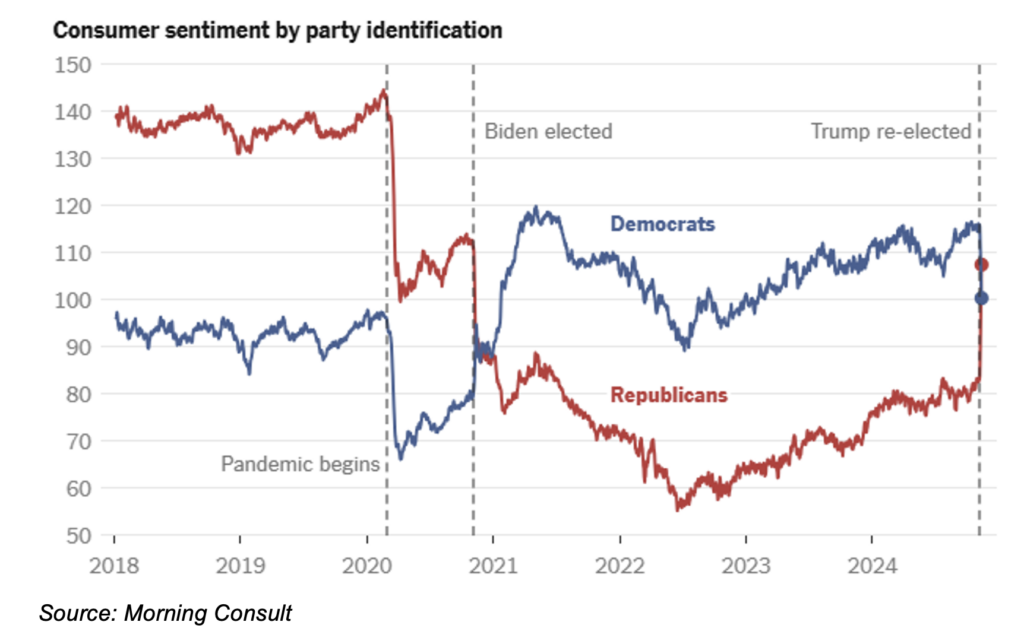

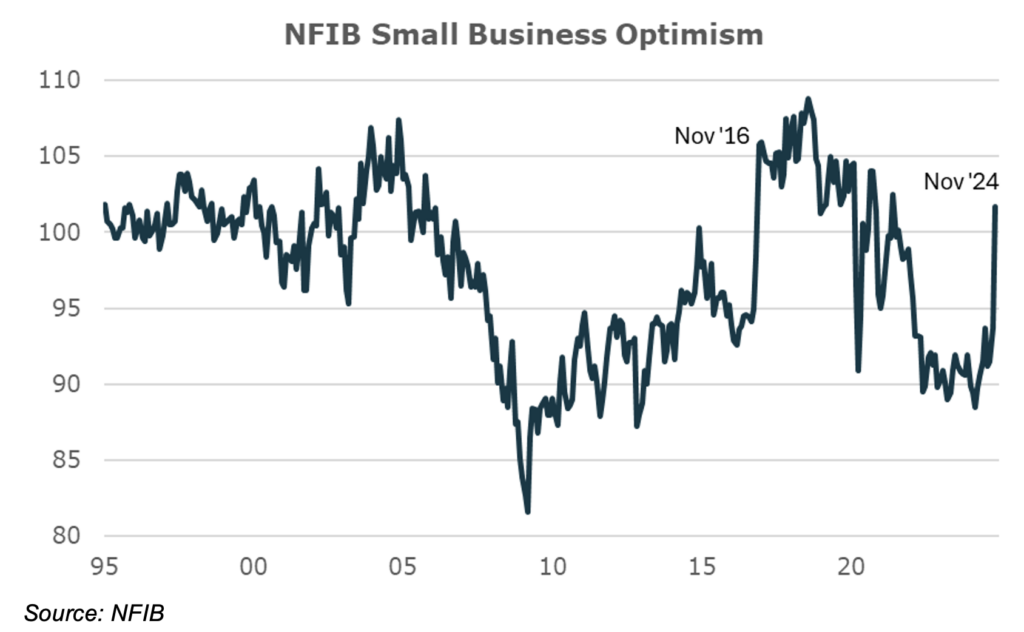

Despite some slowing in the hard data, there has been a notable rise in optimism in recent months. Consumer confidence has moved sharply higher, small businesses are more optimistic, and CEOs haven not been this positive for some time.

Much of this surge in optimism in both consumer and business surveys following the election has been driven by Republican voters’ views rapidly improving in a way that exceeded slumping confidence by Democratic voters. This trend in confidence measures shifts has been present for the past several election cycles.

That seems to be translating into increasing confidence in businesses as well, particularly in small businesses which are more right leaning in the U.S. The NFIB surge seen post-election was last seen in late 2016 with the previous election of a Republican administration. While optimism itself can be beneficial for an economy, the question is whether it translates into actual rises in economic activity. Notably these small businesses suggested increasing “good time to expand” as well as an increase in planned job openings.

Those of us involved in macro markets tend to perceive animal spirits in any economy as challenging to predict. since sources of optimism can rise and fall based on elements outside of traditional macroeconomic factors. Whether this optimism actually drives increased confidence and economic activity remains to be seen. Most likely it will depend on whether the policy mix actually implemented reinforces the promises of pro-growth and disinflation that was common campaign rhetoric.

Uncertain Fiscal Policy Mix Ahead

The translation of U.S. campaign rhetoric to implemented policy is notoriously difficult, which for the new administration is likely to present a challenge even with control of all three chambers (narrowly). The failure to get the desired debt ceiling extension into the continuing resolution in late December is a good reminder that implementing policy requires many voices to come to agreement, even with a single controlling party and strong leadership.

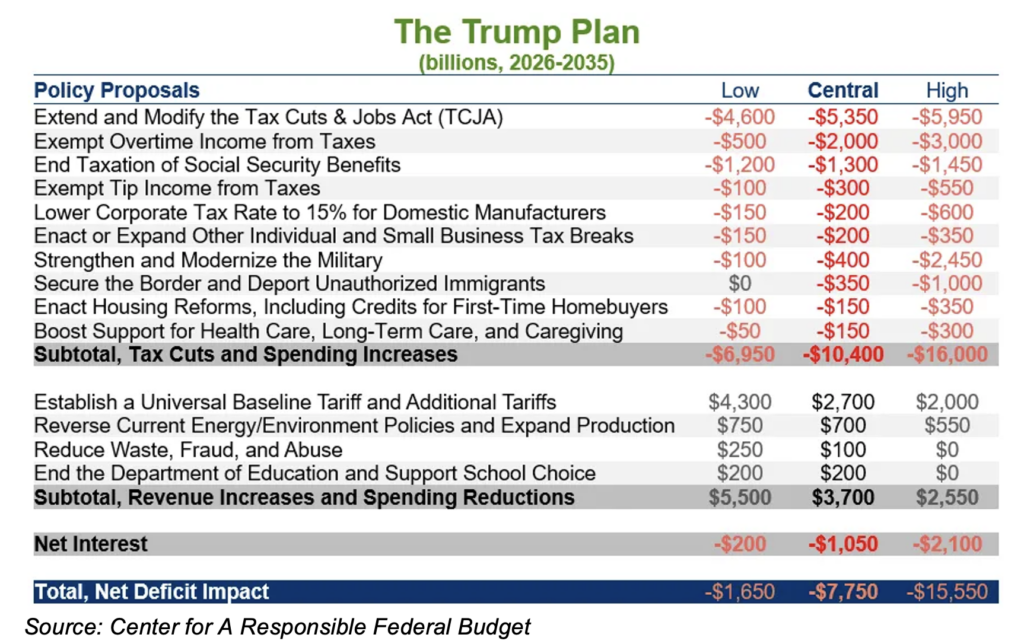

The challenge as a macro investor is significant uncertainty remains about the desired policy priorities. As the table below shows, taking the campaign rhetoric at face value suggests a laundry list of possible policies and a sharply widening deficit. At the same time, those folks selected to leadership positions in economic policy making have expressed some divergence with that outline – for instance suggesting that tariffs move slowly or that bringing the deficit more into balance could be a higher priority.

While many macro commentators have expressed strong opinions about the direction of the policy mix ahead and their consequences, it is important to separate that commentary from partisan views in either direction. Given the significant impacts of these prospective policies and the uncertainties of the possible direction, it is prudent to adopt a wait and see approach. This may feel cautious relative to the overconfident bluster about the future path of policy seen elsewhere, but it is prudent asset management. Given the looming uncertainty making significant risk allocations betting on one direction or another could be perilous, instead fading market expectations that are overly optimistic or pessimistic could offer refuge.

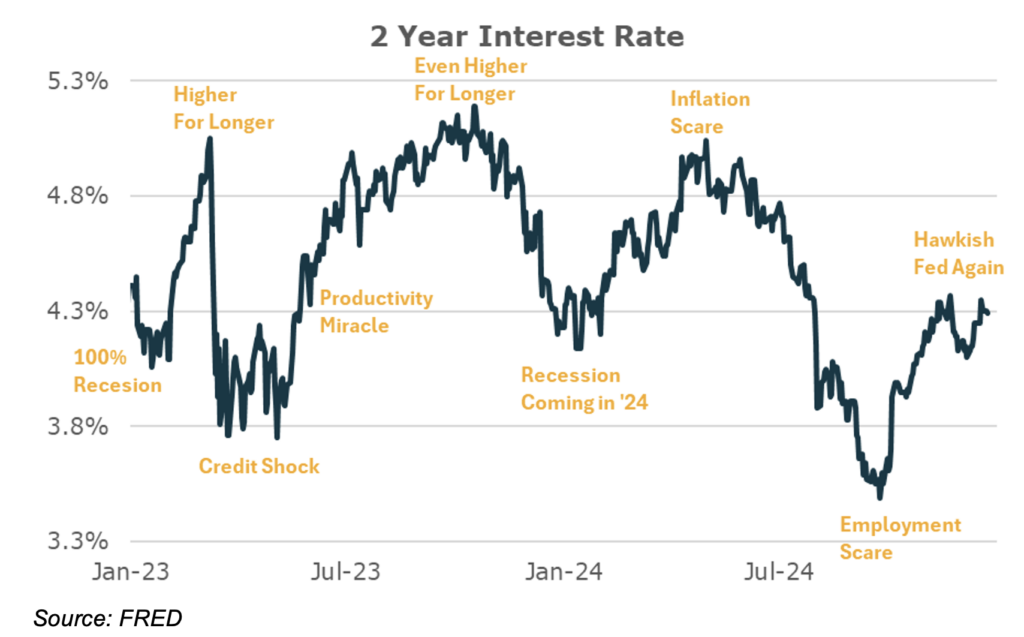

Fading Euphoric Expectations Entering ‘25, Just Like Fading Previously Overly Pessimistic Expectations Entering ‘24

Over the last few years markets have shifted several times from relatively extreme pessimism to pretty extreme optimism about the economy. Short rate pricing is a perfect example of these moves – going from roughly zero cuts expected in ‘24 to seven, back to zero and then to 4 cuts all within a short timeframe. These shifts have been driven by extrapolation of short-term data trends into the future and the anticipation of policy following suit. While sentiment shifted significantly over that time, the reality of the macro economy moved much more slowly, making it better for a trader to fade extreme sentiment rather than chase it.

Last year the pricing of conditions looked too pessimistic, and we benefited from fading those views, predicting stocks were likely to outperform bonds and short rates would sell off. Entering ‘25 sentiment priced into asset markets is pretty close to the antithesis, suggesting pretty extreme optimism for the economy in equity, short-rate, and bond pricing. Companies are anticipated to have their best earnings growth in years. The Fed is expected to stop cutting. And long-term real rates in the mid-2s are consistent with economic conditions last seen in the pre-GFC boom.

Meeting these high expectations is certainly possible if fiscal policy ends up prioritizing a mix of approaches prioritizing pro-growth and disinflation. As an American, I strongly hope for that outcome, but as an investor it is important to dispassionately compare the likelihood of it happening relative to the pricing across financial markets. There remains a great deal of uncertainty and at this point the range of possibilities relative to financial market pricing appears skewed to the downside. That suggests that for the first time in a while, long-term bonds at these levels look compelling relative to stocks (on a risk matched basis) and short rates appears to be an attractive bid given the limited cuts priced in for December ‘25. Nearly the exact opposite of our views headed into ‘24.

*****

Bob Elliott

Bob ElliottCo-Founder and CEO @ Unlimited Funds

Bob Elliott is the Co-Founder and CEO of Unlimited, which uses machine learning to create products that replicate the index returns of alternative investments.

Prior founding Unlimited, Bob was Deputy CIO at Bridgewater Associates where he created many strategies for the Pure Alpha fund across equities, fixed income, credit, exchange rates, and commodities. In his role on the Investment Committee he was holistically responsible for the Pure Alpha foreign exchange portfolio from investment strategy to trade execution. Before that he built and led Ray Dalio’s personal investment research team for nearly a decade. He’s the author of hundreds of Bridgewater’s widely read Daily Observations and directly counseled some of the world’s foremost policymakers and institutional investors on economic and investing issues.

Bob has also served as an advisor and executive at several startups including CircleUp, an investment company focused on early-stage consumer brands. There he revamped the investment strategy for the company’s $150mln venture funds leveraging big data approaches to improve decision making. He was also the co-founder of GiveWell, a startup charity evaluator which now directs more than $500mln in annual contributions.

Bob holds a BA in History and Science from Harvard.

Copyright © Unlimited Funds