"Tariffs rarely provide sustained net economic benefits, especially in closely integrated countries like Canada and the U.S." – Salim Zanzana, RBC Economics

As the specter of U.S. tariffs hovers over Canada’s economy, the country's heavy reliance on its southern neighbour for trade has become glaringly apparent. Should these tariffs materialize, they would test the resilience of Canada’s industries, disrupt tightly interwoven supply chains, and threaten the livelihoods of millions. Salim Zanzana of RBC Economics paints a vivid picture of a nation at the mercy of geopolitical uncertainty.

The U.S.-Canada Trade Lifeline

Canada's dependence on the U.S. as its primary trade partner is staggering. Domestic merchandise exports to the U.S. totaled $548 billion in 2023, accounting for nearly 77% of Canada’s total exports. Energy and motor vehicles dominate the export landscape, with energy products contributing $166 billion and motor vehicles and parts adding another $82 billion. Together, these industries represent over 40% of Canada’s total exports to the U.S..

"These industries export substantial shares of their goods relative to total production, underscoring their heavy dependence on the U.S. market," Zanzana notes. For energy exports, the stakes are particularly high: even with the Trans Mountain pipeline opening access to offshore markets, 88% of Canada’s energy exports still head to the U.S.

The integration between the two nations goes beyond trade volumes. Canadian and U.S. manufacturing chains are deeply intertwined. For example, in the motor vehicle sector, intermediate goods frequently cross the border before being assembled into final products. "The economic consequences of even modest tariff increases would be amplified by this deeply integrated nature," Zanzana explains, highlighting how tariffs could have a compounding economic impact on both countries.

Manufacturing and Energy: Vulnerable Giants

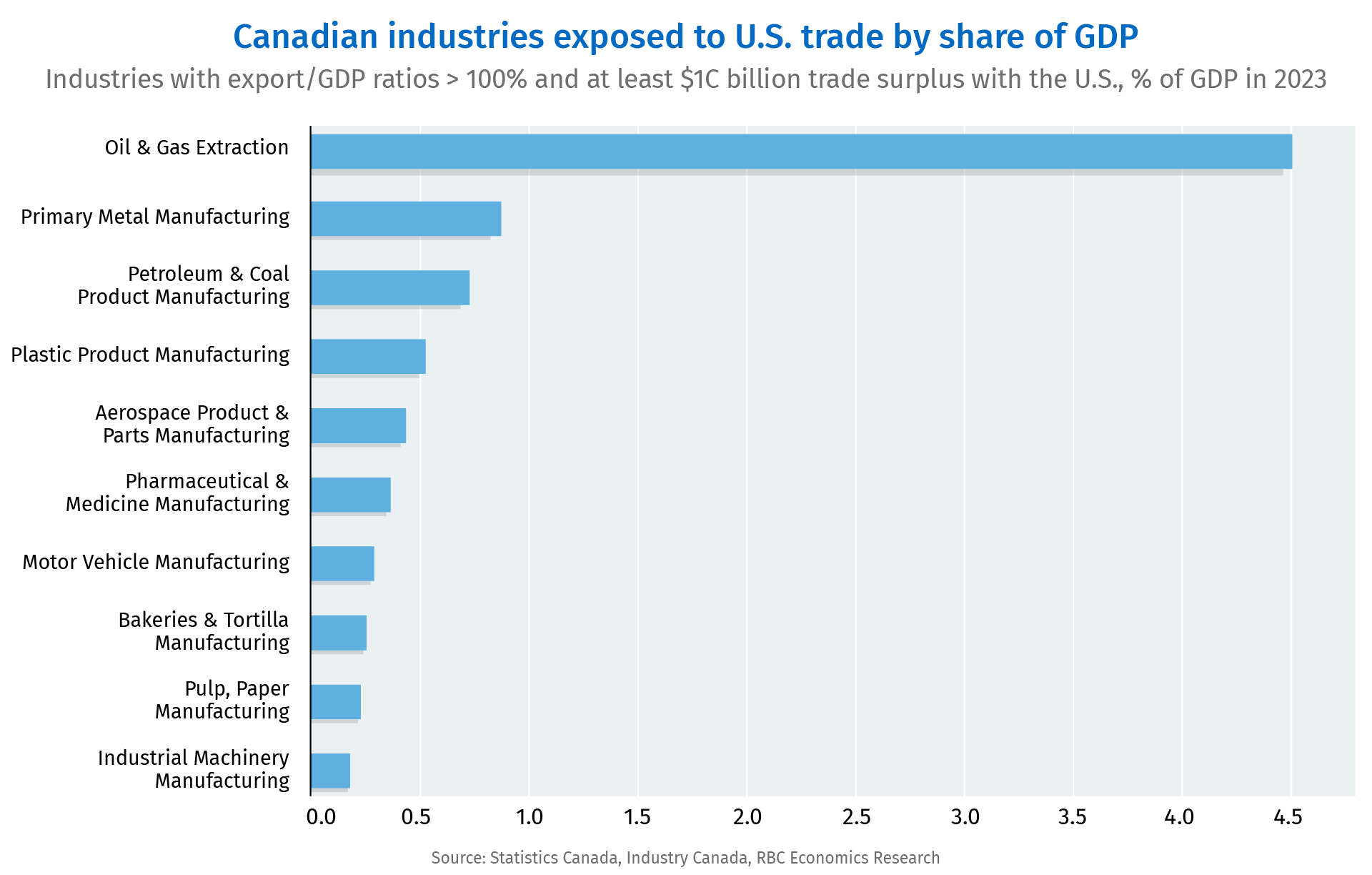

The sectors most exposed to U.S. tariffs—energy, motor vehicles, metals, plastics, and aerospace—are not just economic pillars; they are lifelines for communities in Ontario, Quebec, Alberta, and New Brunswick. Together, these industries contribute 7.4% of Canada’s GDP, surpassing the share of the entire finance and insurance sector.

The labor market implications are equally sobering. "There are an estimated 2.4 million jobs tied to industries that export to the U.S., representing 12% of Canada’s total workforce," Zanzana emphasizes. Any disruption would ripple through these regions, affecting both urban centers and rural communities dependent on export-driven employment.

Regional Unevenness in Impact

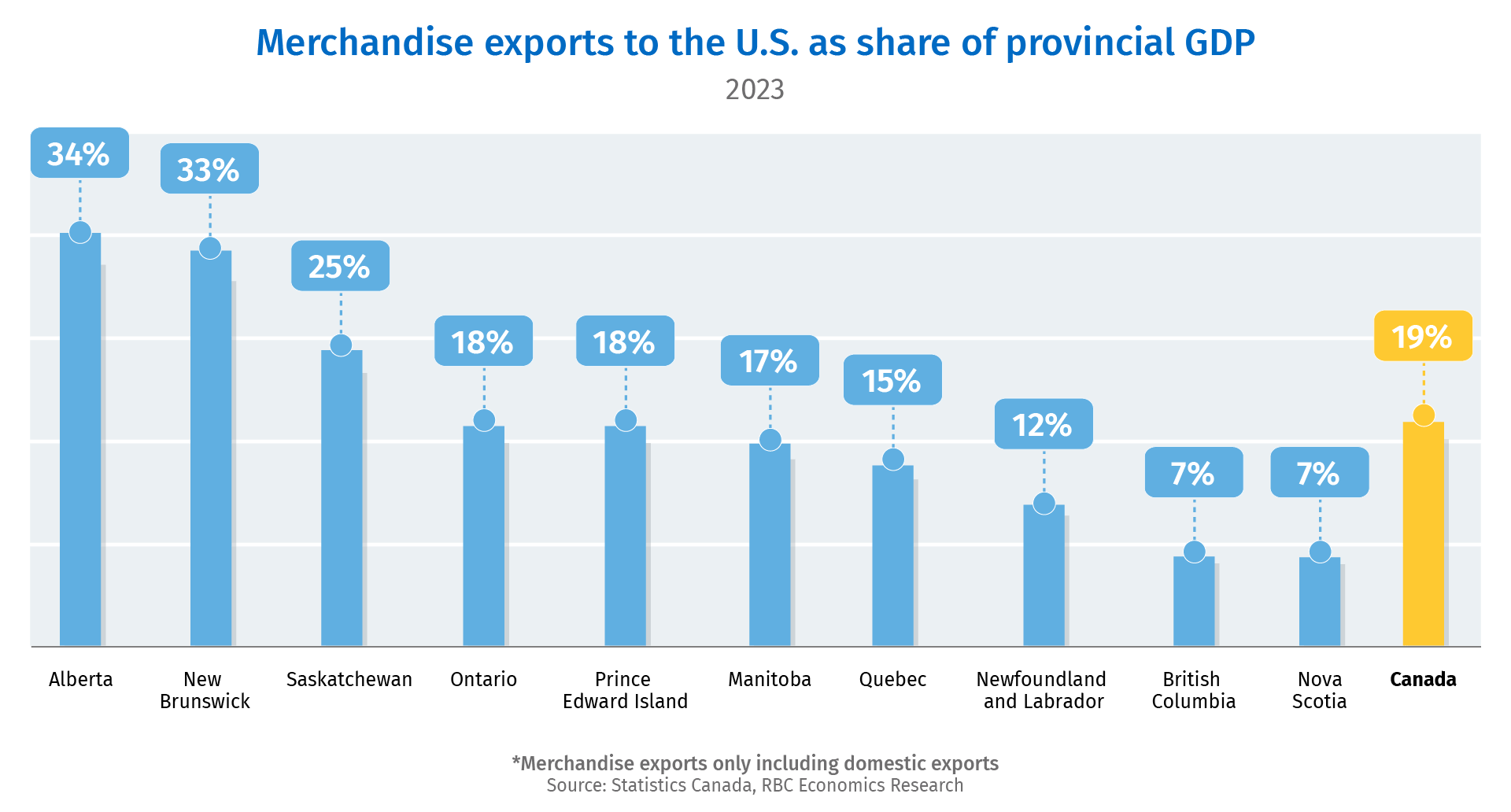

While tariffs would affect the entire nation, their impact would vary across provinces. Ontario and Quebec, with their manufacturing-heavy economies, face significant challenges in motor vehicles, metals, and aerospace. Meanwhile, energy-exporting provinces such as Alberta, Saskatchewan, New Brunswick, and Newfoundland and Labrador would see concentrated impacts in oil, gas, and related sectors.

Interestingly, provinces like British Columbia, with its forestry sector, are less exposed due to a smaller share of exports heading to the U.S. However, even in these regions, secondary effects from disrupted supply chains could pose challenges.

Beyond Trade: The Domino Effect

The implications of U.S. tariffs go beyond direct trade disruptions. Zanzana warns of broader economic consequences: “Higher rates could severely disrupt supply chains, amplify economic uncertainty, and trigger retaliatory measures.” The integrated nature of the North American economy means that costs on one side of the border often translate to higher consumer prices or reduced productivity on the other.

For energy exports, Zanzana highlights an ironic twist: "Increased tariffs would more likely raise costs for U.S. consumers and producers than reduce imports from Canada." This observation underscores how closely linked Canada’s economic health is to its neighbour’s demand for raw materials and intermediate goods.

Key Takeaways

- Critical Trade Dependency: Canada’s reliance on the U.S. for 77% of its exports underscores the vulnerabilities in its trade framework.

- Industries at Risk: Energy, motor vehicles, metals, and aerospace are most exposed, collectively accounting for 7.4% of Canada’s GDP.

- Regional Fragility: Ontario, Quebec, Alberta, and New Brunswick are the provinces most vulnerable to economic shocks from tariffs.

- Labor Market Impact: With 2.4 million jobs tied to U.S.-bound exports, any disruption would have significant ripple effects across Canada’s workforce.

- Integrated Supply Chains: The deeply connected manufacturing and energy sectors would magnify the economic impact of tariffs, potentially harming both Canada and the U.S.

Conclusion: A Delicate Balance

Zanzana’s analysis paints a stark picture of a nation bracing for impact. While Canada has made strides to diversify its trade partners, the reality remains that the U.S. is its largest customer. In a world where economic nationalism continues to rise, policymakers and businesses must weigh their options carefully.

"Tariffs rarely provide sustained net economic benefits," Zanzana reminds us. As Canada prepares for the potential fallout, the focus should remain on protecting the jobs, communities, and industries that form the backbone of its economy.

Source: Zanzana, Salim. "Proof Point: Canadian industries and provinces most exposed to U.S. tariff threat - RBC Thought Leadership." RBC Thought Leadership, 10 Dec. 2024, https://thoughtleadership.rbc.com/canadian-industries-and-provinces-most-exposed-to-u-s-tariff-threat.

Copyright © AdvisorAnalyst