by Sonal Desai, Ph.D., Chief Investment Officer, and Team, Franklin Templeton Fixed Income

Franklin Templeton Fixed Income economists explore the impact of proposed changes to both US tax and tariff policies and the implications for global economies. Central banks continue to address local conditions, with the US Federal Reserve and European Central Bank further easing monetary policy, while the Bank of Japan is hiking its policy rate as it faces elevated inflation.

Executive summary

US economic review

US economy: Taxes and tariffs take center stage

________________________________________________________________________________________

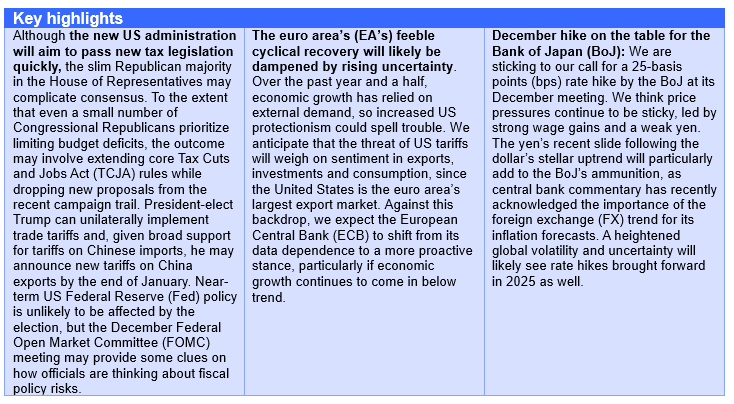

- Come January, Republicans will control the presidency and both chambers of Congress. While this unified control means fewer obstacles to President-elect Donald Trump’s agenda, on fiscal matters he has not exactly received the blank check he might have hoped for. While the Republican Party will ideally want to complete major pieces of legislation within the next two years, a slim majority in the House of Representatives could make it tough to arrive at an easy consensus.

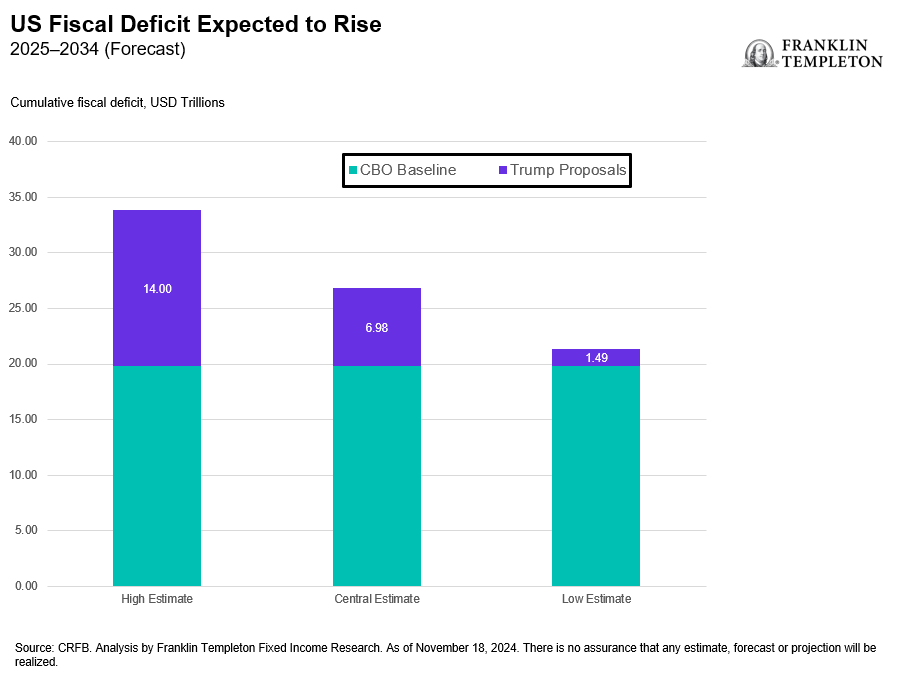

- Budget reconciliation will pave the way for tax legislation to avoid a Democratic filibuster in the Senate. However, measures passed via budget reconciliation will need to be deficit-neutral after 10 years (the Byrd Rule). When the TCJA was first negotiated in 2017, Congressional Republicans decided the cost of the legislation would not exceed US$1.5 trillion over the 10-year budget window. While the total tax cuts in the TCJA were significantly larger than US$1.5 trillion, the law needed revenue raisers to avoid breaching the spending limit. We expect something similar this time as well.

- Do Congressional Republicans have the appetite for deficit spending? The Congressional Budget Office’s June 2024 baseline projection (an unchanged-legislation scenario) already paints a concerning fiscal picture. Moreover, the TCJA passed under different economic circumstances—a sluggish economy, subdued inflation and lower levels of debt. To the extent that even a small number of Congressional Republicans prioritize reducing budget deficits, the result may involve extending core TCJA rules while dropping new proposals from the recent campaign.

- Trade tariffs are an area where Trump can make changes unilaterally. Given fairly broad support for tariffs on Chinese imports, we expect announcements on tariffs to happen soon after Trump takes office. To minimize the impact on US inflation, though, tariffs will likely be differentiated, with a lower rate for items that have fewer substitutes. Meanwhile, Trump’s promise of a 10% tariff across the board certainly bears watching, but there is a large degree of uncertainty on its likelihood and timing.

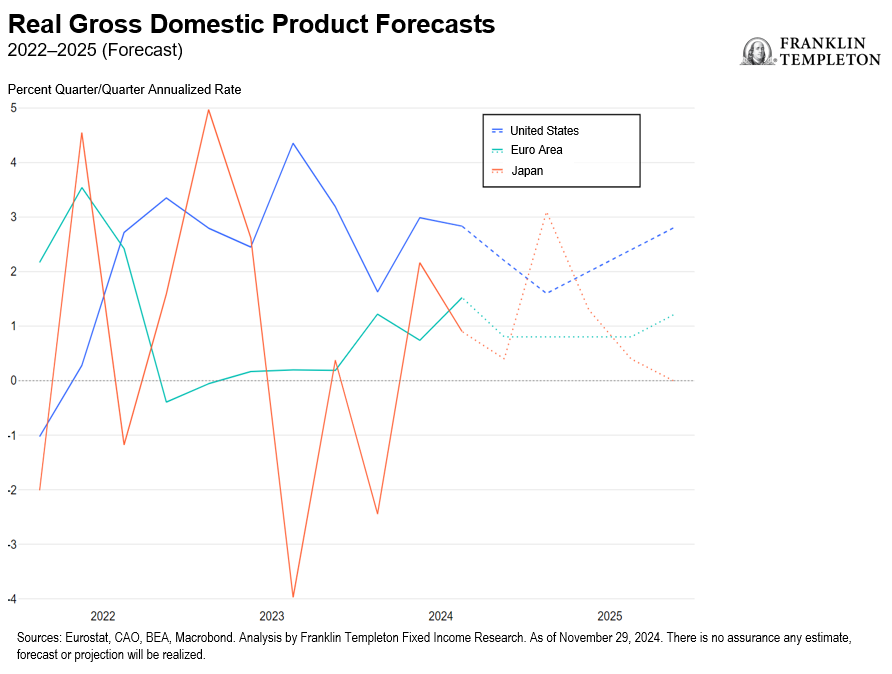

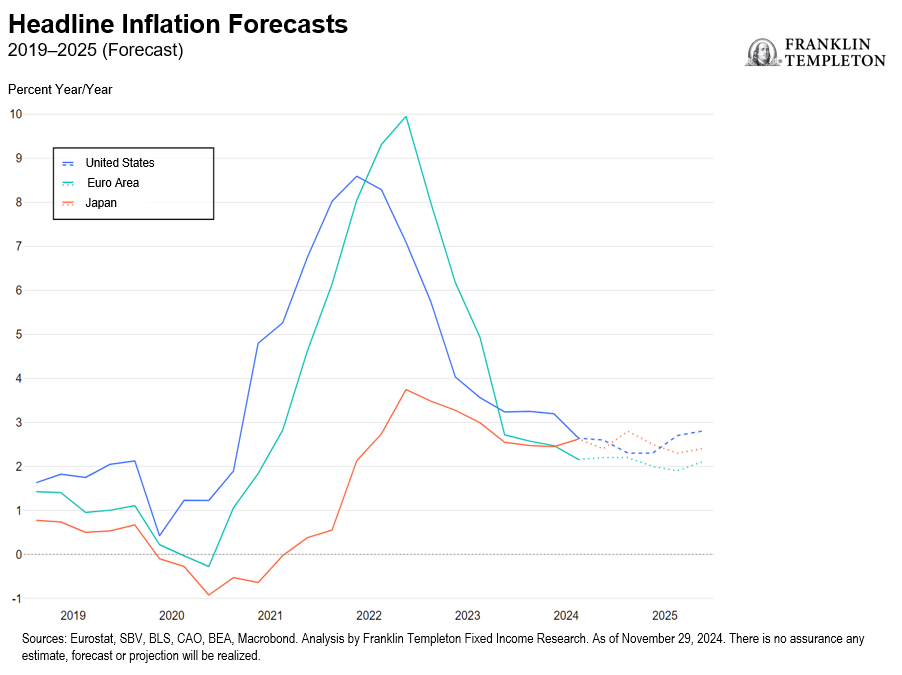

- Near-term Fed policy is unlikely to change because of the election. The US economy continues to grow at or above potential, and while inflation has largely been brought under control, it remains stubbornly above target. We expect one more 25-basis point cut in 2024 and two to come in 2025, although if economic data comes in stronger than expected, we may also see a pause in December.

- The December FOMC may provide some clues on how Fed officials are thinking about fiscal policy risks. The minutes of the December 2016 FOMC meeting—the meeting after the presidential election of that year—show that there was a clear emphasis on fiscal policy. Many policymakers at the time noted that an expansionary fiscal policy would pose upside risks to both growth and inflation, while also necessitating a somewhat tighter-than-anticipated monetary policy and higher neutral policy rate.

European economic outlook

Euro-area economy: An uncertain outlook

________________________________________________________________________________________

- The EA outlook is clouded by uncertainty: The resurgence of trade tensions—particularly with the United States—comes at a delicate time for Europe, as the cyclical recovery from the energy shock and rate hiking cycle is still subdued. Moreover, political turmoil is on the rise, with instability in France and snap elections in Germany. Saving rates remain extremely elevated due to low consumer confidence, which depresses spending, while industrial production continues to contract amid structural weakness. The threat of tariffs raises uncertainty; it weighs on sentiment and disproportionately impacts the already challenged manufacturing sector. Most of the feeble growth recorded in the EA over the last year and a half has come from net external demand, while domestic demand has kept shrinking. Increased uncertainty could weigh on the recovery of the latter and likely mean continued economic weakness going forward.

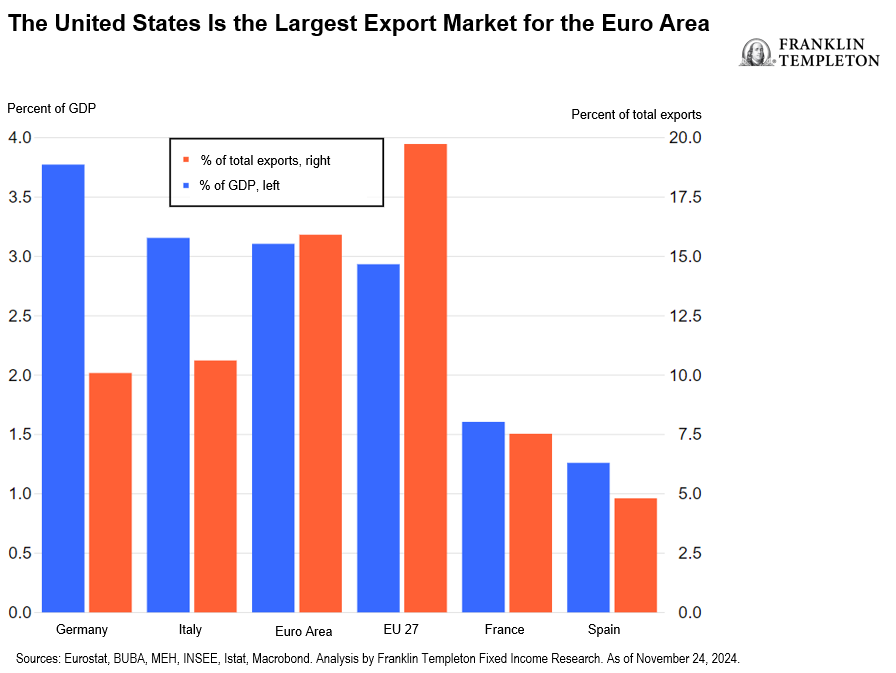

- President-elect Trump’s promised protectionism could spell trouble. EA exports to the United States—its largest export market—account for around 3.1% of gross domestic product (GDP) and approximately 16% of extra-EA exports.1 For sectors like pharmaceuticals, autos and machinery, the US share is even more significant. The new administration’s tariff proposals remain uncertain but could range from a 10% tariff on all imports to a more targeted imposition on select sectors, such as autos and agricultural products. Regardless, the real impact of these trade policies will likely be the increased uncertainty they create. The longer the tension period, the larger the economic drag, especially for countries that are most exposed, like Germany. While we think it is unlikely that the European Union would respond symmetrically to US tariffs, it may leverage other non-tariff trade barriers. The direct inflationary impact will likely be negligible. However, tariffs or trade barriers will certainly be negative from a growth perspective, though the extent remains unclear.

- The ECB remains reactive and not proactive, for now. Medium-term inflationary risks are abating, as moderating wage growth and favorable base effects should ease services inflation in 2025. Some upside risks could stem from a weaker euro and possible energy price volatility. However, we expect the ECB to maintain its “data dependent” stance and deliver 25-basis-point cuts at each upcoming meeting to reach a deposit rate of 2% (around neutral) by June. At this time, we should have more clarity around US domestic and foreign policies and what this will mean for Europe. Nevertheless, a prolonged period of sub-trend growth in the EA, which we currently anticipate, will likely translate into a more proactive ECB over the second half of the year and two further cuts that should take the deposit rate to 1.5% by December 2025.

Japan economic outlook

Japan’s economy: More rate hikes and not less

________________________________________________________________________________________

- Japan’s GDP remains sluggish but private consumption is resilient. Our forecasts for 2025 GDP growth are more favorable, at 1.4% year/year (y/y) compared to the estimated -0.1% y/y in 2024. We base this forecast on robust private consumption supported by strong wage momentum. We expect resilient results in the 2025 Shunto wage negotiations, as in 2024. Firms seem to be moving toward somewhat more generous wage policies. The supplementary budget (~2.0% of GDP) announced for fiscal year 2025 (ending March 2026) should also help support growth through measures such as cash handouts and subsidies to the semiconductor industry. While likely tariffs could be destabilizing for growth, the yen’s weakness would have already offset the impact partially.

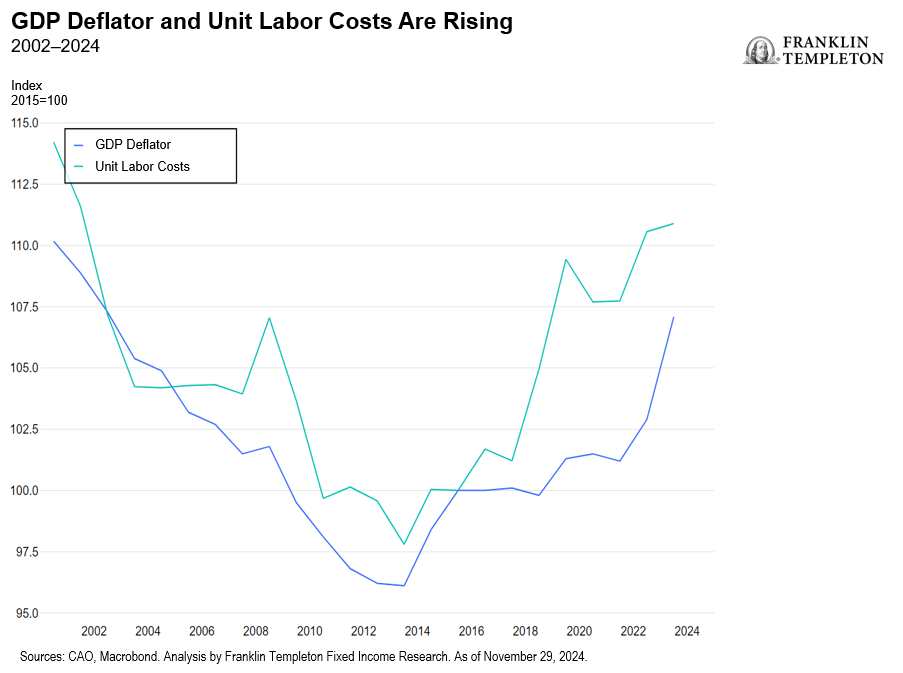

- Inflation should remain sticky, as has been the case so far this year, in line with our assessment. We continue to expect overall inflation to rise into next year given our adjustments to domestic demand, improved wage growth and the likelihood that firms will pass on higher costs onto consumers (as wage costs rise). Expectations suggest core prices will rise as the government is likely to revoke energy subsidies from November/December. We remain comfortable with our 2024 consumer price index (ex-fresh food) forecast of 2.5% y/y, with the global core measure at 2.0%. We retain a similar trajectory in 2025, as we believe strong wage growth will cement stickier services prices.

- We stick to our aggressive BoJ rate hike call, anticipating a December hike of 25 bps. The BoJ will likely take comfort in the fact that private consumption is still resilient thanks to improving household spending and incomes. In its summary of opinions of the October meeting, the BoJ admitted that growth and inflation are on track and that they will be data-dependent in future decisions. A member stated that the “bank should consider further rate hikes after pausing to assess developments in the US economy,” perhaps promoting a December move. BoJ members also pointed to considering the yen’s movements in their forecasts. We are more aggressive than consensus in our expectations for rate hikes. We expect four hikes next year while markets appear to expect one and industry consensus suggests two. Consensus has partially moved toward us, with many houses expecting earlier rate hikes than expected. Overall therefore, we believe there will be more rather than fewer hikes in Japan in the coming months.

Copyright © Franklin Templeton Fixed Income