by Brian Levitt, Global Market Strategist, Invesco

Key takeaways

- Yay or nay? - We’re seeing vastly different interpretations of the economic impact of Donald Trump’s election win.

- Growth potential - I believe that there’s a policy mix of lower taxes and industry deregulation that could augment growth.

- Trade uncertainty - I’m concerned, however, that a period of uncertainty surrounding trade and manufacturing policies could hinder business investment.

Meet the new boss. Same as the old boss. Will investors be fooled again?

I remember Trump’s “red wave” victory in 2016. At the time, markets were optimistic about an era of higher growth driven by tax cuts and deregulation. Wall Street analysts predicted higher interest rates and cyclical stock outperformance. It all sounded promising, but it didn’t quite pan out. While the stock market posted significant gains, it was led by the same growth stocks that had outperformed during the previous administration.1

By 2018, concerns about global economic growth and uncertainties related to the administration’s trade policies were driving the market. The US Federal Reserve (Fed) even felt compelled to cut interest rates. The 10-year Treasury ended the term lower than it had started.2 Although the COVID-19 pandemic played a role, the 10-year US Treasury rate had already fallen to 1.5% by the third quarter of 2019, well before it.

Will Trump 1.0 be a predictor? Forecasting the incoming Trump administration’s impact on the economy feels like a Rorschach test. Some may see tax cuts and the unleashing of animal spirits, while others may interpret trade wars and fiscal consolidation as weights on growth. As for me, I’ll focus on interpreting the direction of the economy and the path of monetary policy. I believe the current environment of stable US growth3 and easing policy should be good for markets, even if the Trump trade loses some steam.4

Americans declared that change had to come, but as The Who sang, “history ain’t changed.”

It may be confirmation bias but …

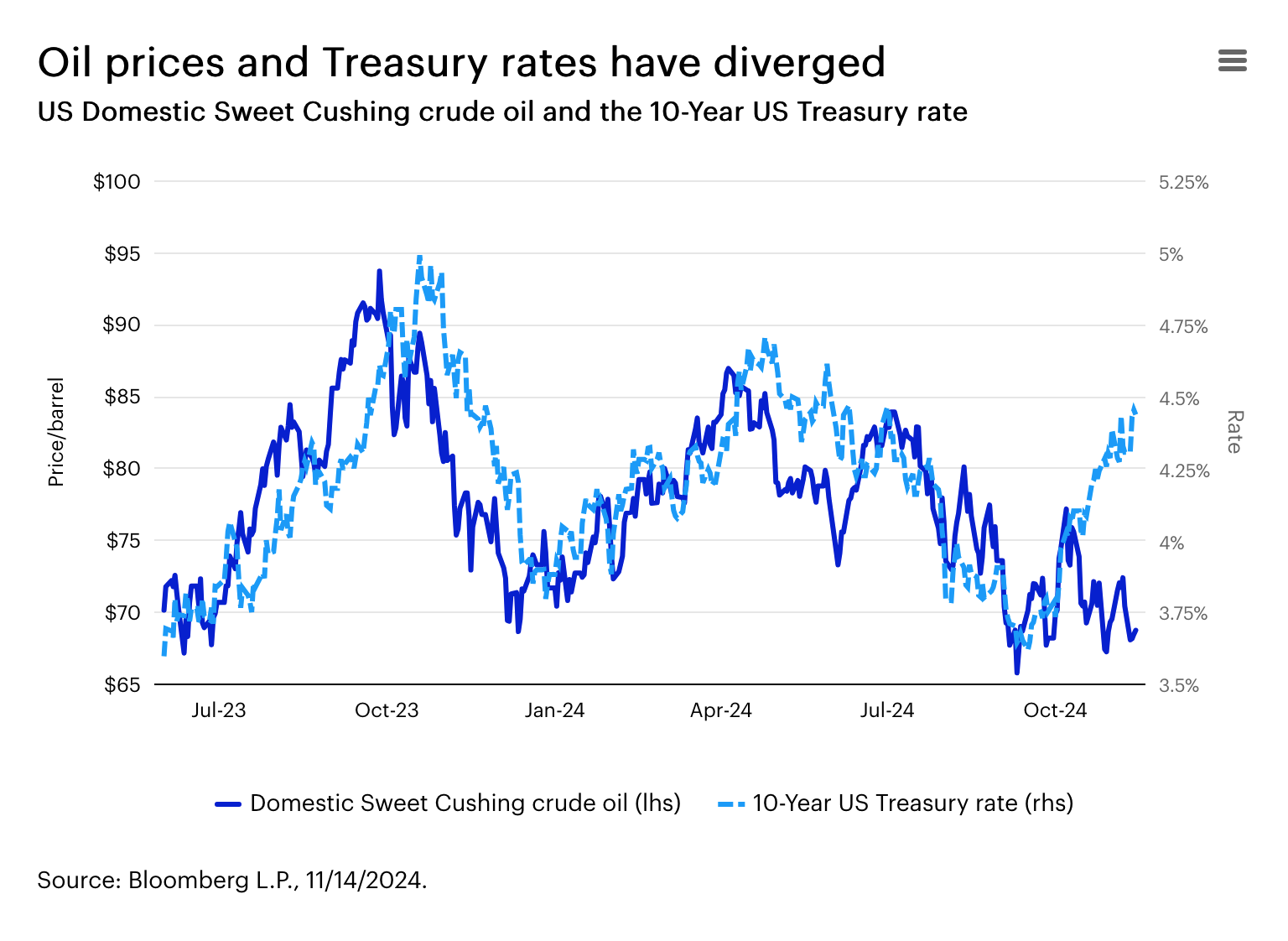

… the dynamics in the oil market suggest that US Treasury rates are unlikely to keep rising. The US bond market appears to be expecting a nominal growth environment that may not be manifesting. Recently, an interesting divergence has emerged between oil prices and US Treasury rates.5 Oil prices have fallen as supply continues to outweigh demand.6 Peaks in oil prices in September 2023 and April 2024 preceded peaks in the 10-year US Treasury rate.7 It wouldn't be surprising for this pattern to repeat.

It was said (part 1)

"We are going to be broke really quickly unless we get serious about dealing with our spending issues."

— Paul Tudor Jones, billionaire hedge fund manager8

No, we are not! The “broke really quickly” remarks from titans of US finance were not helpful (or accurate) in 2009, and they aren’t helpful now. Comments like these give investors the impression that the US government will resemble a certain Hollywood star who went broke spending millions on medieval castles, exotic pets, and dinosaur bones. That’s not how it works. Governments don’t go broke, particularly those that borrow money in their own currencies.

A government can always print more money to fund spending. Yes, that could be inflationary. We just lived through it. The COVID-19-driven spending binges under the Trump and Biden administrations resulted in a short-term spike in the inflation rate.9 The Fed was forced to act by raising interest rates until the rate of inflation returned to the Fed’s comfort level.

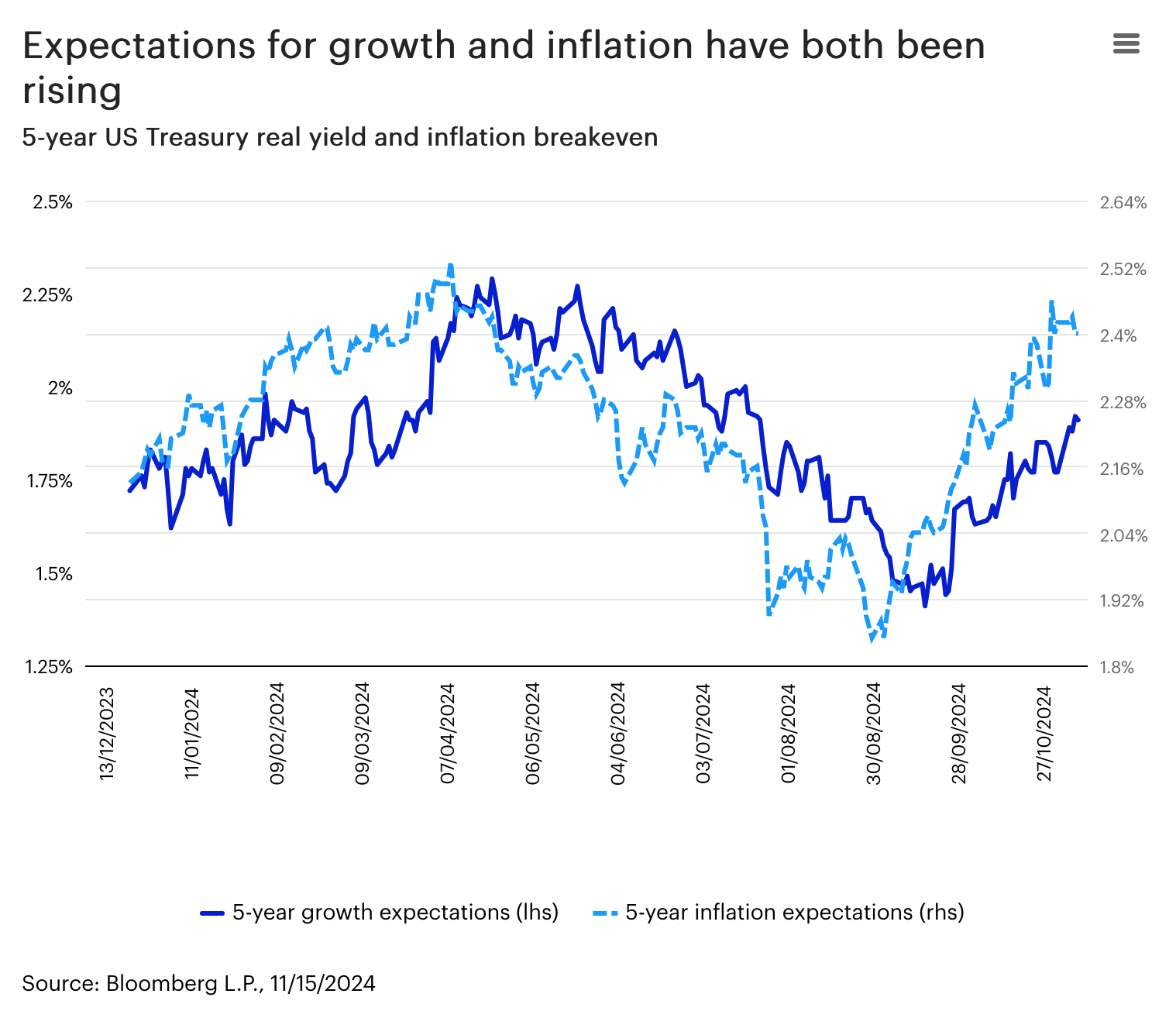

What if the so-called bond vigilantes (bond market investors who protest monetary or fiscal policies considered inflationary by selling bonds) show up to teach the Fed or Congress a lesson? I suppose it could happen, but it seems unlikely with US inflation expectations benign10 and US government spending as a percentage of gross domestic product in line with its long-term average.11 If this changes, then bond vigilantes could force Congress or monetary policy authorities to change course. See the Liz Truss moment in the UK as an example.12 Nonetheless, in a battle between the bond vigilantes and the Fed, I would choose the Fed every time.

Let’s stop it. The country isn’t going broke. These concerns should, by now, sound like a broken record to investors.

It was said (part 2)

“I feel sorry for Donald Trump because, just like George W. Bush in 2000, he is coming into the office at the peak of a massive price bubble in the equity market.”13

— David Rosenberg, founder of Rosenberg Research

Rosenberg has caused a stir with his warnings. My thoughts:

- Rosenberg doesn’t want to be known as a permabear, but he has tended to lean bearish. For example, he forecasted a prolonged depression in the 2010s.

- Valuations aren’t timing tools. Among Rosenberg’s concerns is that given that the equity risk premium (the S&P 500 Index’s earnings yield minus the 10-year US Treasury yield) is close to zero, investors are taking on risk and not being compensated for it. The equity risk premium, however, was negative throughout the 1990s, a decade in which the S&P 500 Index advanced by more than 400%.14

- The S&P 500 Index is trading at a premium to its long-term average, but the higher valuations tend to be concentrated in the top names.15 The S&P 500 Equal Weight Index is trading at a price-to-earnings ratio of 20.2x, compared to its since-inception average of 19.4x.16 I’d hardly call that a bubble.

Since you asked

Q: Why are you skeptical about the incoming administration’s policies resulting in a higher level of economic growth?

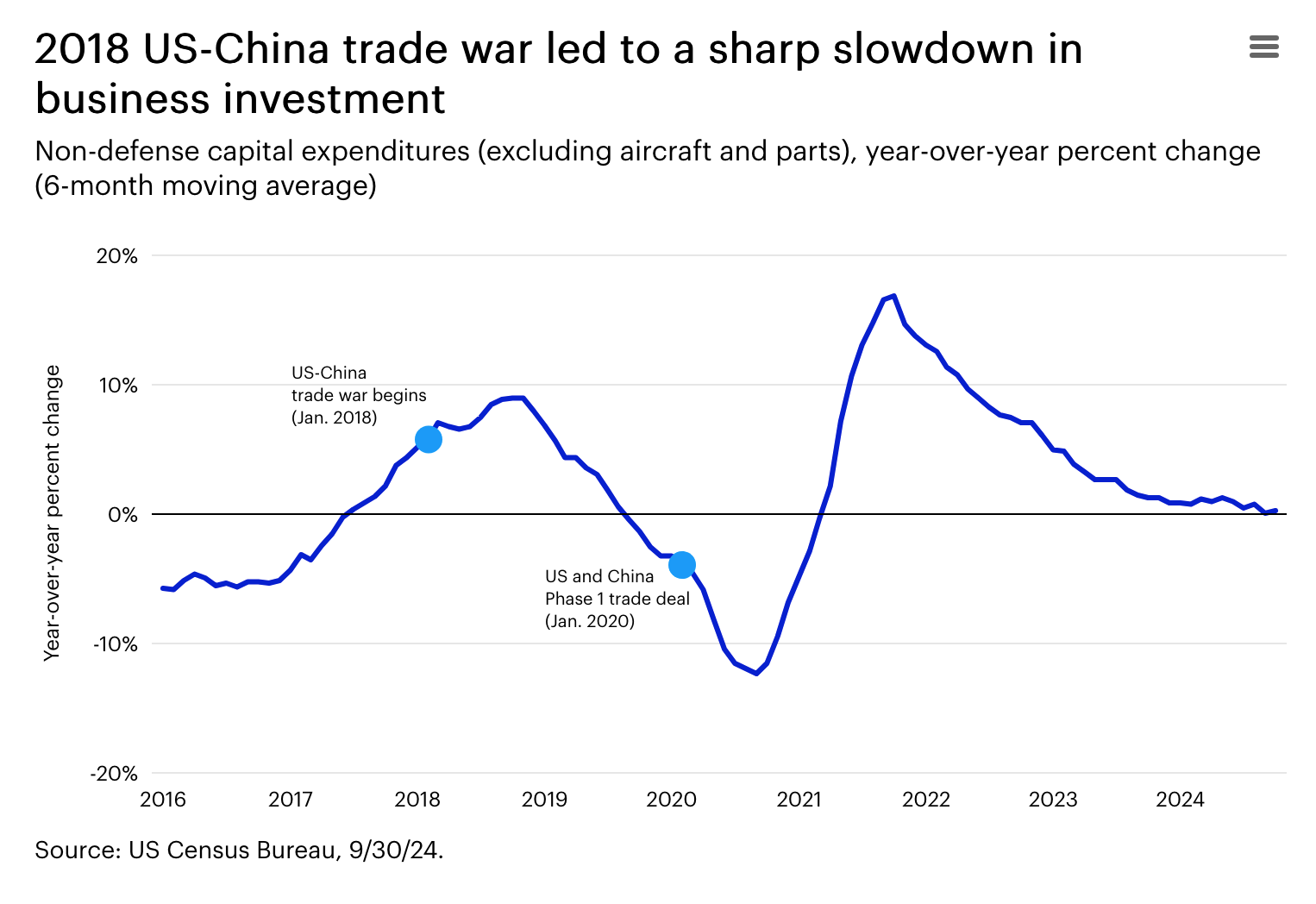

A: I believe that there’s a policy mix of lower taxes and industry deregulation that could augment growth. I’m concerned, however, that a period of uncertainty surrounding trade and manufacturing policies could hinder business investment. For example, the ambiguity of the US-China trade war in 2018 led to a sharp slowdown in business investment and a short-term bear market in US stocks.17 Businesses can likely adjust to rising tariffs and shifting industrial policies, but clarity will be critical.

Phone a friend

Isn’t there a lot of cash on the sidelines, and won’t that be a boon to the US stock market? I posed the question to James Anania, Invesco Investment Strategist.

His response: Although money market fund assets are at an all-time high,18 it’s a mistake to assume that cash will suddenly move to other parts of the market when interest rates come down. Over the course of the Fed’s hiking cycle, the $1.35 trillion households invested in money markets was nearly equal to the $1.22 trillion taken out of deposit accounts ($1.22 trillion).19 As a result, the total amount of cash held by households hardly changed during this period. What changed was where households kept their cash.

Unlike the yield on a deposit account, set by the bank where the account is held, money market yields reflect the short-term interest rate set by the Fed. Since money markets have largely yielded more than deposit accounts over the past few years, investors have simply moved their cash to where it could earn a higher return.

Cash (bank deposits + money markets) currently accounts for 15% of household financial assets, directly in line with the 30-year median.20 At the same time, stocks now account for a record high 42% of household financial assets.20 This means that unless investors plan on reducing their broader allocation to cash, it’s unlikely that lower rates will result in assets migrating out of money markets and into other asset classes in any meaningful way.

On the road again

My travel stories have always detailed my work adventures. This month, I’m switching it up. My travels took me to Łódź, Poland, to visit the homeland of my father-in-law’s parents (Mozsek and Shariam) and brother (Jack). We visited their house and the site of the business that Mozsek owned and operated prior to fleeing the country in 1939, weeks before the German invasion. We also made ourselves stand at the Radegast train station, which served as the Umschlagplatz (collection point) for transporting many of Mozsek’s and Shariam’s family members and thousands of others from the Łódź ghetto to Chełmno and other extermination camps.

My father-in-law was the first in his family to walk the streets of Łódź in 85 years. It was a special moment to watch him swell with pride as he surveyed the life that his parents had built in their beautiful town. As the author Alex Haley said, “In all of us, there is a hunger, marrow-deep, to know our heritage — to know who we are and where we have come from. Without this enriching knowledge, there is a hollow yearning. No matter what our attainments in life, there is still a vacuum, an emptiness, and the most disquieting loneliness.” I was honored and thrilled to stand with my father-in-law as he filled that vacuum.

*****

Footnotes

1 Source: Bloomberg L.P. Significant gains is based on the performance of the S&P 500 Index. Market leadership is based on the outperformance of the Russell 1000 Growth Index over the Russell 1000 Value Index during the years of the Obama administration and the years of the Trump administration.

2 Source: Bloomberg L.P.

3 Source: Bloomberg L.P., Conference Board, 10/31/2024, based on leading economic indicators.

4 The Trump trade is generally viewed as one in which cyclical, value, and smaller-capitalization stocks outperform.

5 Source: Bloomberg L.P., based on West Texas Intermediate Crude and the 10-year US Treasury rate.

6 Source: US Department of Energy, 10/31/24.

7 Source: Bloomberg L.P., based on West Texas Intermediate Crude and the 10-year US Treasury rate.

8 Source: CNBC, “Paul Tudor Jones says market reckoning on spending is coming after election: ‘We are going to be broke,’” 10/22/24.

9 Source: US Bureau of Labor Statistics, 10/31/24. Based on the US Consumer Price Index.

10 Source: Bloomberg L.P., 10/31/24. Based on the 10-year US Treasury inflation breakeven.

11 Source: US Bureau of Economic Analysis, 9/30/24.

12 The "Liz Truss moment" refers to her brief and tumultuous tenure as the Prime Minister of the UK for just 45 days in 2022, making her the shortest-serving one in UK history. Her time in office was marked by significant economic turmoil, largely due to her government's mini budget, which included unfunded tax cuts that spooked financial markets and led to a sharp rise in borrowing costs. This economic instability ultimately led to her resignation.

13 Source: The Globe and Mail, “Why I feel sorry for Donald Trump,” 11/13/24.

14 Source: Bloomberg L.P., based on the return of the S&P 500 Index from 1/1/1990‒12/31/1999. Indexes cannot be purchased directly by investors. Past performance does not guarantee future results.

15 Source: Bloomberg L.P., based on the price-to-earnings ratios of the top 10 companies in the S&P 500 Index.

16 Source: Bloomberg L.P., 10/24. Based on the price-to-earnings ratio of the S&P 500 Equal Weight Index from 1/1/2009‒10/31/2024 to October 2024.

17 Source: US Census Bureau, Bloomberg L.P., based on nondefense capital expenditures (excluding aircraft and parts) and the performance of the S&P 500 Index. The S&P 500 Index fell 19.8% peak to trough from 9/21/ 2018‒12/24/2018.

18 Source: Investment Company Institute, 11/18/24.

19 Source: Federal Reserve Economic Database (FRED). Financial accounts of the US; balance sheets of household and nonprofit organizations, Q1-1994‒Q2-2024, latest data available, as of 11/11/24.

20 Source: US Federal Reserve, 10/31/24.

Copyright © Invesco