by Vinay Thapar, CFA, Co-Chief Investment Officer and Senior Research Analyst—US Growth Equities; Portfolio Manager—Global Healthcare, AllianceBernstein

Healthcare companies often grab headlines for their exciting drug innovations. But we think the focus should be on business fundamentals.

Healthcare stocks can conjure up images of clinical trials, blockbuster drugs and supersized marketing campaigns. But that’s a one-dimensional way of viewing a fast-growing, dynamic sector—and a risky way to invest. For investors looking to avoid the roller-coaster ride, we recommend a different approach: evaluating companies based on their business acumen—not their drug pipeline.

High-profile drug breakthroughs get a lot of attention, and for good reason. At the height of the pandemic, the race was on for a COVID-19 vaccine that could save lives and hasten a return to normalcy. How about a drug that can treat Type 2 diabetes and help you lose weight? There’s a reason GLP-1 drugs are so popular. And who doesn’t want to invest in the cure for cancer, Alzheimer’s and any number of other devastating illnesses?

It's a Long Road from Phase I to the Finish Line

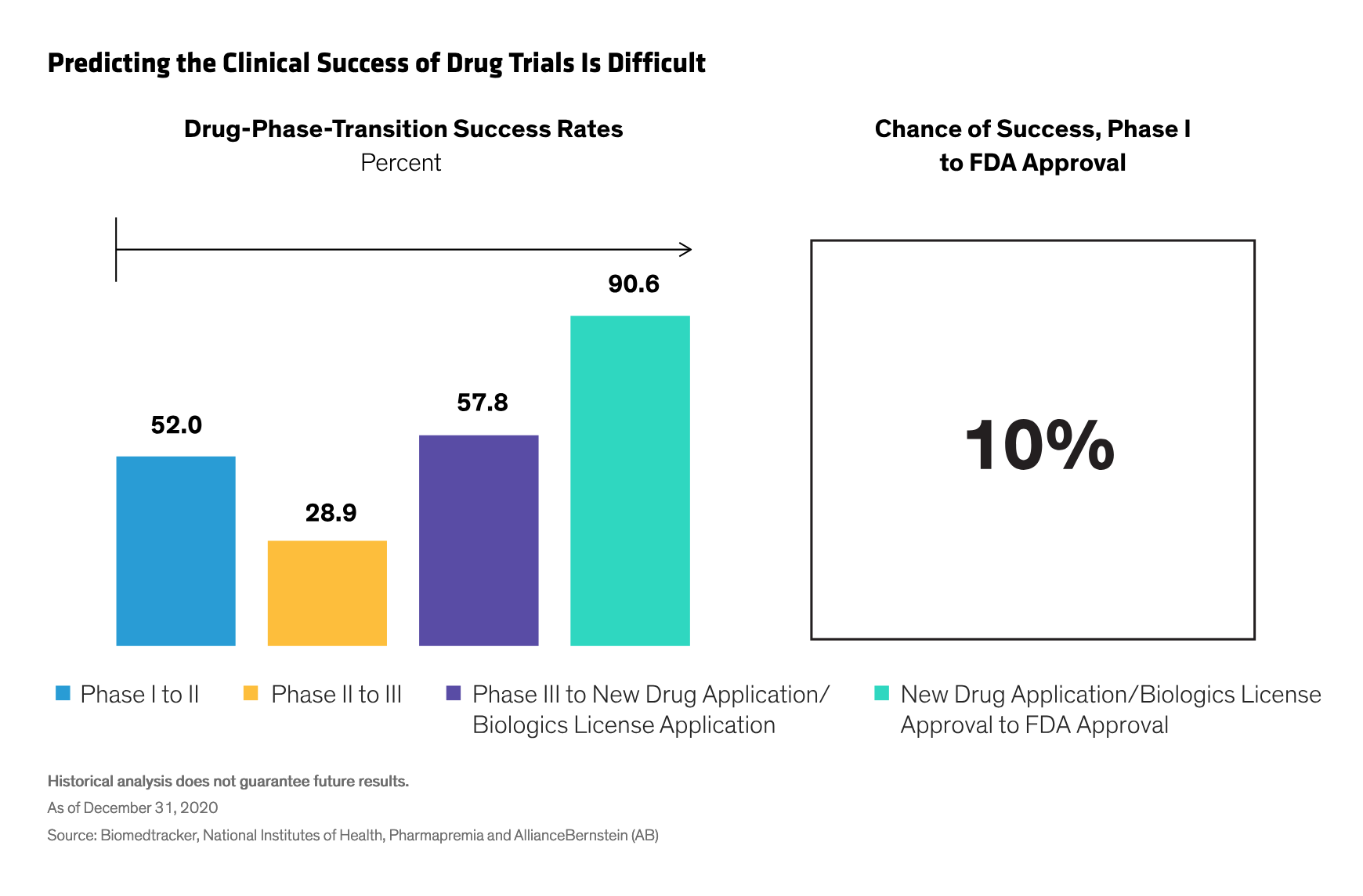

Unfortunately for investors, it’s notoriously difficult to handicap outcomes as a drug passes through the various stages of the development pipeline. In fact, the likelihood that a drug in human trials will complete the journey from Phase I to final approval by the Food and Drug Administration (FDA) is a mere 10% (Display). Put another way, the failure rate for developing a drug is 90%, a figure that doesn’t include the extensive pretrail process that can stop a drug from moving into Phase I. That’s a challenging investment proposition, to say the least.

A case in point: In November 2020, when Pfizer and Moderna first announced their breakthrough COVID-19 vaccines, there were 236 COVID-19 vaccines in various stages of development. Only three were given FDA approval for use in the United States. More than 90% of the vaccines under development failed to get the FDA’s blessing.

This isn’t to say that drug trials aren’t worthy of investors’ attention. Pharmaceutical breakthroughs have the potential to change lives and generate enormous profits for companies and their shareholders. But the outcomes are highly unpredictable. Ideally, the drug pipeline should provide an optionality—a potential bonus—but not a core reason for investing in a company.

So what should investors be looking for instead? Healthcare businesses with strong, sustainable business models have the same hallmarks as firms in other sectors. These include clean balance sheets, high—or at least improving—returns on capital, and strong reinvestment rates. When a company earns profits above its cost of capital and then reinvests those profits, our research suggests that the business is more likely to have staying power.

Paying for the Pipeline Can Mean Paying the Piper

It’s also critical to monitor valuations—and what’s driving them. Investors shouldn’t pay a premium for pipeline drugs that may never see the light of day. When you’re not paying for the pipeline, positive clinical results can still boost a company’s stock price—that’s the optionality. But the effect of disappointing results should be muted because pipeline expectations were never baked into the price to begin with. By contrast, stock valuations tightly tethered to drug pipelines can be buffeted with volatility if clinical results disappoint.

Currently, we think several drug developers are worth watching. One such firm is working to treat cystic fibrosis—an inherited, life-threatening condition that can cause severe damage to the lungs, digestive system and other organs. Another is producing a market-leading treatment for pulmonary arterial hypertension. But their appeal isn’t tethered to the potential of these new products; both have a strong core businesses, yet neither company’s investment prospects depend on clinical trial success, in our view.

Healthcare Has Opportunities Beyond Pharma

Of course, there’s a lot more to healthcare than drug development. We see opportunities in diagnostics, which are accelerating on the strength of human genome sequencing. In addition, minimally invasive therapies and robotics are helping hospitals increase patient turnover while containing costs. Telemedicine has also received a boost, as a growing number of patients seek to consult with doctors virtually. Firms in these growth areas offer investors access to promising technologies without the risks inherent in forecasting hot drug prospects.

As always, we believe healthcare is best accessed through active management. Using fundamental research, skilled managers can identify companies with a higher-than-average likelihood of clinical success—without being dependent on it. And by evaluating corporate leadership, active managers can spot companies with strong R&D track records and a history of innovation and profitability.

Sure, a big drug breakthrough can be a boon for investors. But if scientists struggle to predict successful drug developments, why would investors be able to do any better? Over the long run, it’s the business itself—and not the pipeline—that wins the day.

Vinay Thapar is a Senior Vice President and Co-Chief Investment Officer for US Growth Equities and a Portfolio Manager for the Global Healthcare Strategy. He is also a Senior Research Analyst, responsible for covering global healthcare. Before joining the firm in 2011, Thapar spent three years at American Century Investments as a senior investment analyst responsible for healthcare. Prior to that, he worked for eight years at Bear Stearns in the Biotech Equity Research Group, most recently as an associate director. Thapar holds a BA in biology from New York University and is a CFA charterholder. Location: New York

Copyright © AllianceBernstein