by Dina Ting, CFA, Head of Global Index Portfolio Management, Franklin Templeton

With a soft landing in sight, Head of Global Index Portfolio Management Dina Ting, explains why resilient US economic growth alongside currently low valuations for mid-cap stocks can spur future gains in this underallocated market segment.

While the US Federal Reserve has yet to declare a victorious soft landing, the economy has improved markedly from just two years ago. Inflation has cooled substantially and the labor market has returned to a more sustainable path. “The risks to our goals are now balanced,” Federal Reserve Bank of San Francisco President Mary Daly said recently. “… data dependence does not mean being data reactive. It means looking forward as the information comes in and projecting how we think the economy will evolve.”

For Daly, this refers to optimal monetary policy. For investors, this can be taken as a cue to stay disciplined and diversified. And in a declining rate-cycle environment, this brings into focus the merits of the often-overlooked US midcap-stock segment. The underallocation is clear: Investments in large-cap mutual funds and exchange-traded funds (ETFs) are roughly nine times greater than those in mid-cap mutual funds and ETFs.1

In recent months, however, we’ve seen a rotation away from the “magnificent” but overvalued technology darlings and toward what we consider more attractively valued midcaps, which feature lower risk profiles than small caps and yet have faster growth prospects than their larger peers.

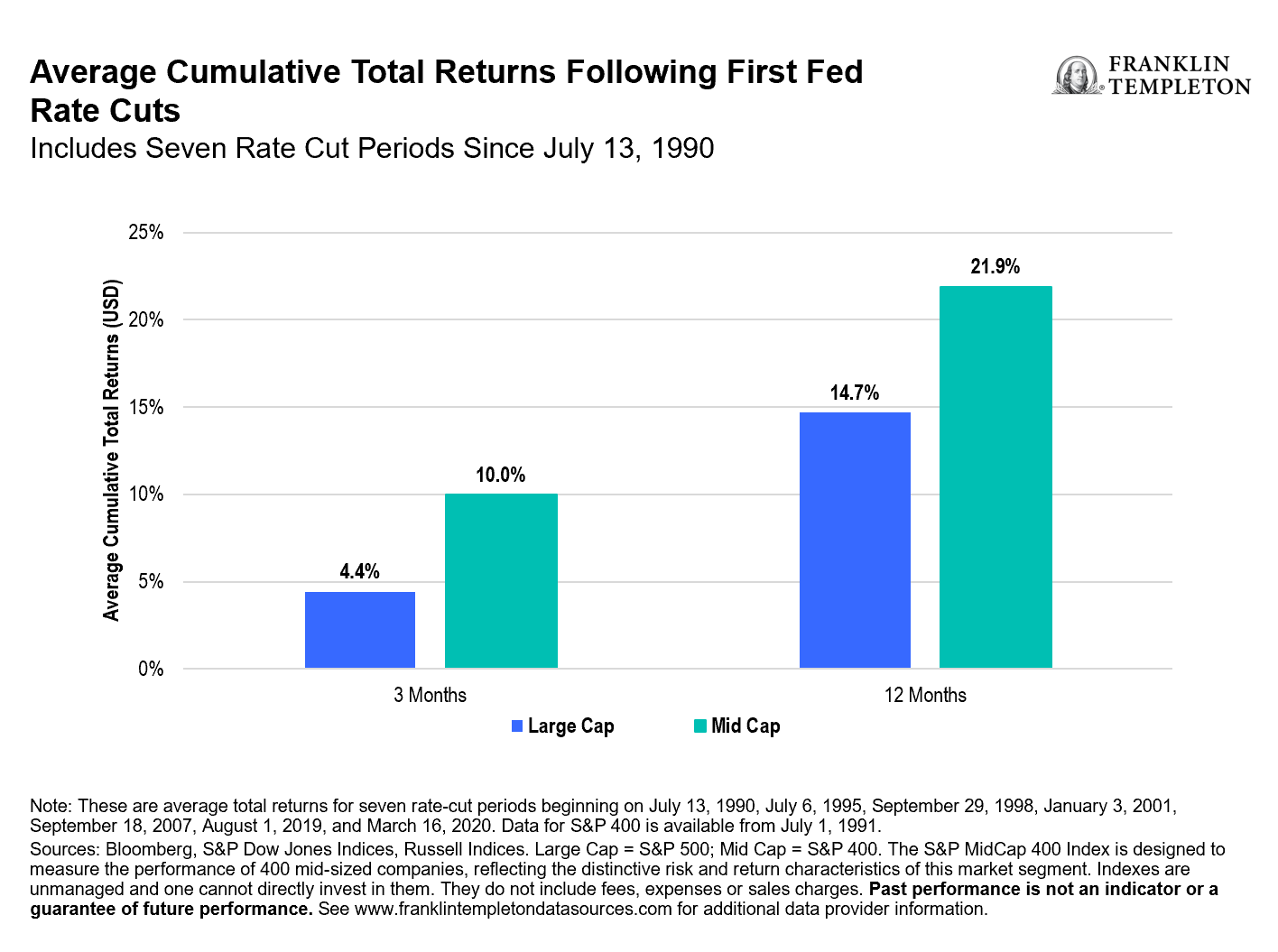

Since the end of the second quarter, US mid-cap performance (as measured by the Russell MidCap Index) has outpaced that of both large- and small-cap stocks (as measured by the Russell 1000 Index and Russell 2000 Index, respectively).2 Zoom out further and the asset class appears to us even more appealing for long-term investors, with mid-cap stocks (as measured by the S&P MidCap 400 Index) having outperformed their large-cap and small-cap counterparts (as measured by the S&P 500 Index and S&P Small Cap 600 Index, respectively) over the past three decades.3 In particular, it’s worth noting the average outperformance of midcaps following seven rate-cut periods since the mid 1990s as shown in the following chart.

Exhibit 1: Equity Total Returns Following First Fed Rate Cuts

A rate-cutting cycle tends to foster a stimulative environment since smaller firms tend to borrow more than larger companies. With rate cuts setting the stage for lowered debt servicing costs, we believe this could serve as a catalyst for improved mid-cap earnings, and generally view this as an opportunity for investors to plug gaps in allocation exposure given the potential for a mid-cap comeback.

For some perspective on the valuation opportunity, midcaps in late October were trading at 20.6x, a relative discount to large-cap stocks, which have been trading higher (at 24.6 times earnings) than their 20-year average (of 19.4x).4

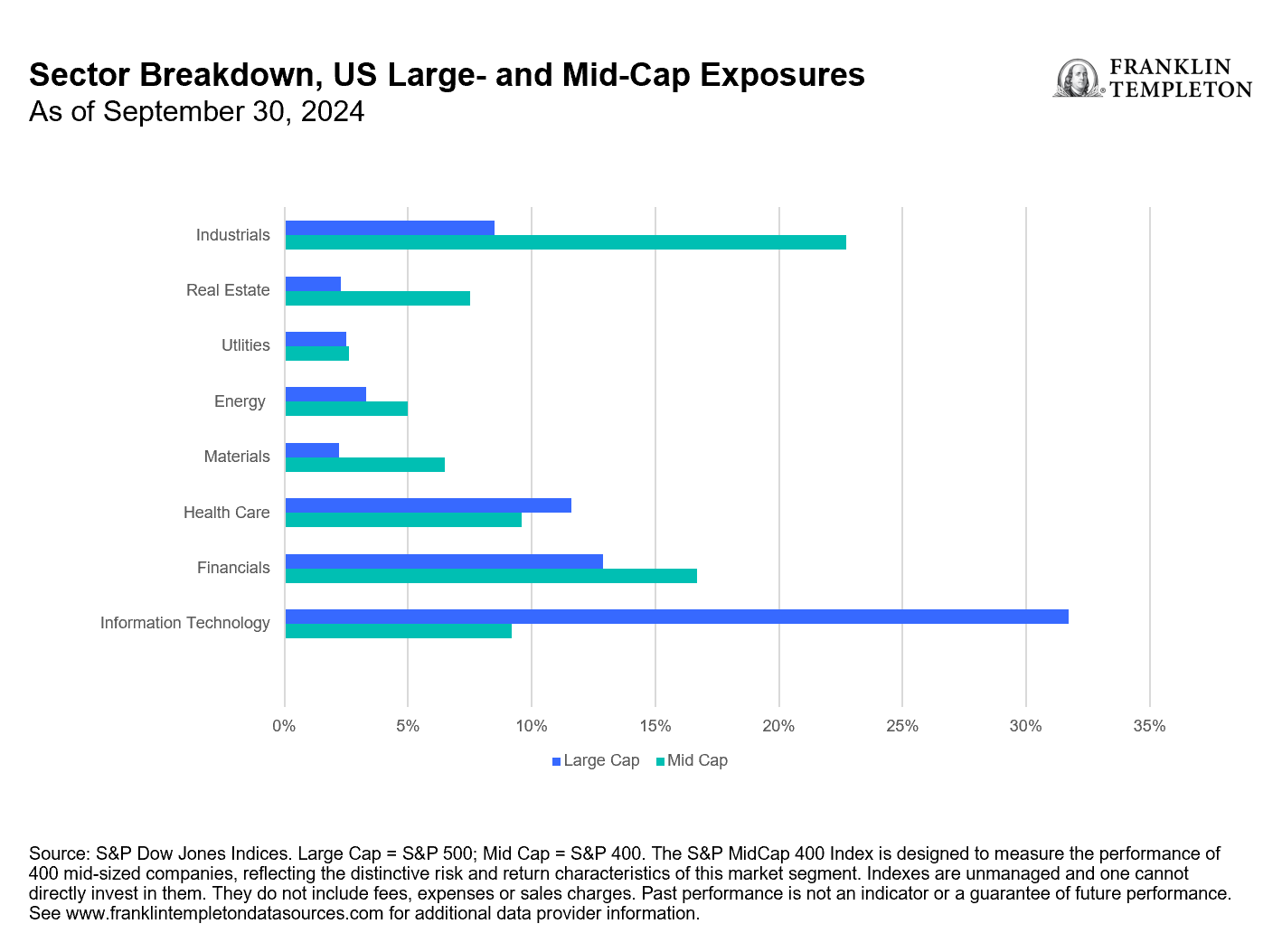

Another attractive characteristic is the relative sector diversification of midcaps to large caps. Given ongoing artificial intelligence (AI) concentration concerns, it’s worth noting that at the end of September, technology holdings comprised more than 31% of the S&P 500 Index and more than 34% of the large-cap focused Russell 1000 Index compared to just about 9% of the S&P 400 Index and 12% in the Russell MidCap Index.5

And while utility companies were the best performers (+29% total returns year-to-date through October 14, 2024) for the mid-cap index, they held the lowest weighting within large-cap benchmarks. Industrials and materials sectors, which are underrepresented in the large-cap universe, may also be poised for expansion considering recent US stimulus bills aimed at building-out US manufacturing capabilities.

This is not to say AI-related firms may not still see impressive growth, but the pace of growth may decelerate and open the door for other segments of the market to shine, as smaller firms become less hampered by debt.

Exhibit 2: MidCaps Sector Breakdown

Boosted in part by soft landing hopes, midcaps have been enjoying improved earnings guidance and we’ve seen several companies on a positive growth trajectory. According to FTSE Russell, more than two dozen constituents rose through the ranks from the Russell 2000 to join the Russell MidCap Index during this year’s portfolio reconstitution, with the highest number and weight of graduates coming from the technology industry.

To end on an optimistic note and quote from Fed President Daly: “A durable and sustained expansion allows everyone to thrive, and history tells us it is possible.”

*****

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. Equity securities are subject to price fluctuation and possible loss of principal. Small- and mid-cap stocks involve greater risks and volatility than large-cap stocks. Large-capitalization companies may fall out of favor with investors based on market and economic conditions.

ETFs trade like stocks, fluctuate in market value and may trade above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns. ETF shares may be bought or sold throughout the day at their market price on the exchange on which they are listed. However, there can be no guarantee that an active trading market for ETF shares will be developed or maintained or that their listing will continue or remain unchanged. While the shares of ETFs are tradable on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Brazil: Issued by Franklin Templeton Investimentos (Brasil) Ltda., authorized to render investment management services by CVM per Declaratory Act n. 6.534, issued on October 1, 2001. Canada: Issued by Franklin Templeton Investments Corp., 200 King Street West, Suite 1500 Toronto, ON, M5H3T4, Fax: (416) 364-1163, (800) 387-0830, www.franklintempleton.ca. Offshore Americas: In the U.S., this publication is made available by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906. Tel: (800) 239-3894 (USA Toll-Free), (877) 389-0076 (Canada Toll-Free), and Fax: (727) 299-8736. U.S.: Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com. Investments are not FDIC insured; may lose value; and are not bank guaranteed.

Issued in Europe by: Franklin Templeton International Services S.à r.l. – Supervised by the Commission de Surveillance du Secteur Financier – 8A, rue Albert Borschette, L-1246 Luxembourg. Tel: +352-46 66 67-1 Fax: +352-46 66 76. Poland: Issued by Templeton Asset Management (Poland) TFI S.A.; Rondo ONZ 1; 00-124 Warsaw. Saudi Arabia: Franklin Templeton Financial Company, Unit 209, Rubeen Plaza, Northern Ring Rd, Hittin District 13512, Riyadh, Saudi Arabia. Regulated by CMA. License no. 23265-22. Tel: +966-112542570. All investments entail risks including loss of principal investment amount. South Africa: Issued by Franklin Templeton Investments SA (PTY) Ltd, which is an authorised Financial Services Provider. Tel: +27 (21) 831 7400 Fax: +27 (21) 831 7422. Switzerland: Issued by Franklin Templeton Switzerland Ltd, Stockerstrasse 38, CH-8002 Zurich. United Arab Emirates: Issued by Franklin Templeton Investments (ME) Limited, authorized and regulated by the Dubai Financial Services Authority. Dubai office: Franklin Templeton, The Gate, East Wing, Level 2, Dubai International Financial Centre, P.O. Box 506613, Dubai, U.A.E. Tel: +9714-4284100 Fax: +9714-4284140. UK: Issued by Franklin Templeton Investment Management Limited (FTIML), registered office: Cannon Place, 78 Cannon Street, London EC4N 6HL. Tel: +44 (0)20 7073 8500. Authorized and regulated in the United Kingdom by the Financial Conduct Authority.

Australia: Issued by Franklin Templeton Australia Limited (ABN 76 004 835 849) (Australian Financial Services License Holder No. 240827), Level 47, 120 Collins Street, Melbourne, Victoria 3000. Hong Kong: Issued by Franklin Templeton Investments (Asia) Limited, 62/F, Two IFC, 8 Finance Street, Central, Hong Kong. Japan: Issued by Franklin Templeton Investments Japan Limited. Korea: Issued by Franklin Templeton Investment Advisors Korea Co., Ltd., 3rd fl., CCMM Building, 101 Yeouigongwon-ro, Yeongdeungpo-gu, Seoul, Korea 07241. Malaysia: Issued by Franklin Templeton Asset Management (Malaysia) Sdn. Bhd. & Franklin Templeton GSC Asset Management Sdn. Bhd. This document has not been reviewed by Securities Commission Malaysia. Singapore: Issued by Templeton Asset Management Ltd. Registration No. (UEN) 199205211E, 7 Temasek Boulevard, #38-03 Suntec Tower One, 038987, Singapore.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

Copyright © 2024 Franklin Templeton. All rights reserved.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

__________

1. Source: Morningstar, as of September 30, 2024. Compares Morningstar large-cap blend/growth value categories vs. mid-cap blend/growth value categories.

2. Source: Bloomberg, as of October 21, 2024. The Russell MidCap Index measures performance of the 800 smallest companies in the Russell 1000 Index. The Russell 1000 Index is a US stock market index that tracks the highest-ranking 1,000 stocks in the Russell 3000 Index, which represent about 93% of the total market capitalization of that index. The Russell 2000 is a small-cap US stock market index that makes up the smallest 2,000 stocks in the Russell 3000 Index. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future performance. See www.franklintempletondatasources.com for additional data provider information.

3. Source: Bloomberg, as of October 21, 2024. The S&P MidCap 400 Index is designed to measure the performance of 400 mid-sized companies, reflecting the distinctive risk and return characteristics of this market segment. The S&P Small Cap 600 Index seeks to measure the small-cap segment of the US equity market. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future performance. See www.franklintempletondatasources.com for additional data provider information.

4. Source: Bloomberg, as of October 23, 2024. There is no assurance that any estimate, forecast or projection will be realized.

5. Source: S&P Dow Jones Indices and FTSE Russell, as of September 30, 2024.

Copyright © Franklin Templeton