by Jeffrey Rosenberg, Sr. Portfolio Manager, Systematic Fixed Income, BlackRock

Key points

- An era of flouted rules: The resilience of labor markets in the US may be confining the Sahm Rule as the latest in a series of “flouted rules.” Among the other rules are the inverted yield curve and persistently soft purchasing manager survey data which have—at least so far—erroneously guided expectations for a recession while actual data has continued surprising those expectations to the upside.

- How restrictive is policy? Better-than-feared economic performance again raises the possibility that policy is not as restrictive as the Fed fears, potentially pushing back on the extent and pace of the Fed’s “normalization” cutting cycle. Bond markets are again repricing what appear to have been exaggerated hopes for deeper interest rate cuts, undermining recent bond performance both outright and as diversifiers.

- Middle East uncertainty adds to hedging efficacy uncertainty: Middle East uncertainty adds to ongoing political uncertainty, unwinding the downward trend in oil prices that has helped headline inflation and consumer sentiment. Beyond near-term uncertainty, the prospects for hedging effectiveness across the maturity spectrum may matter more for portfolio construction and bond allocations.

An era of flouted rules

We are investing in an era of flouted rules. The tendency to blindly follow these rules has led investors towards prematurely de-risking and over-estimating the likelihood of recession. Historically reliable, leading recession indicators including surveys of manufacturing and service purchasing managers turned recessionary nearly two years ago. Similarly, the yield curve inversion as well as our preferred modified version of that indicator—the aggregate spread, which includes the excess of inflation over unemployment to that inversion—began signaling a recession over two years ago. Partly referencing these rules and inputs, consensus views on recession probabilities peaked last year around this time. They subsequently fell all throughout Q4 of last year and into this year.

The unique characteristics of the post-pandemic economy and recovery lie to blame for most of the ahistoric economic experience that has pushed back on these historically derived recession indicators. Fed Chair Jay Powell referenced this dynamic in the July Federal Open Market Committee (“FOMC”) press conference stating:

Let’s remember that this pandemic era has been one in which so many… apparent rules have been flouted… because this situation really is unusual or unique in that so much of this inflation came from the shutdown of the economy and the resulting supply problems in the face of, admittedly, very strong demand.”

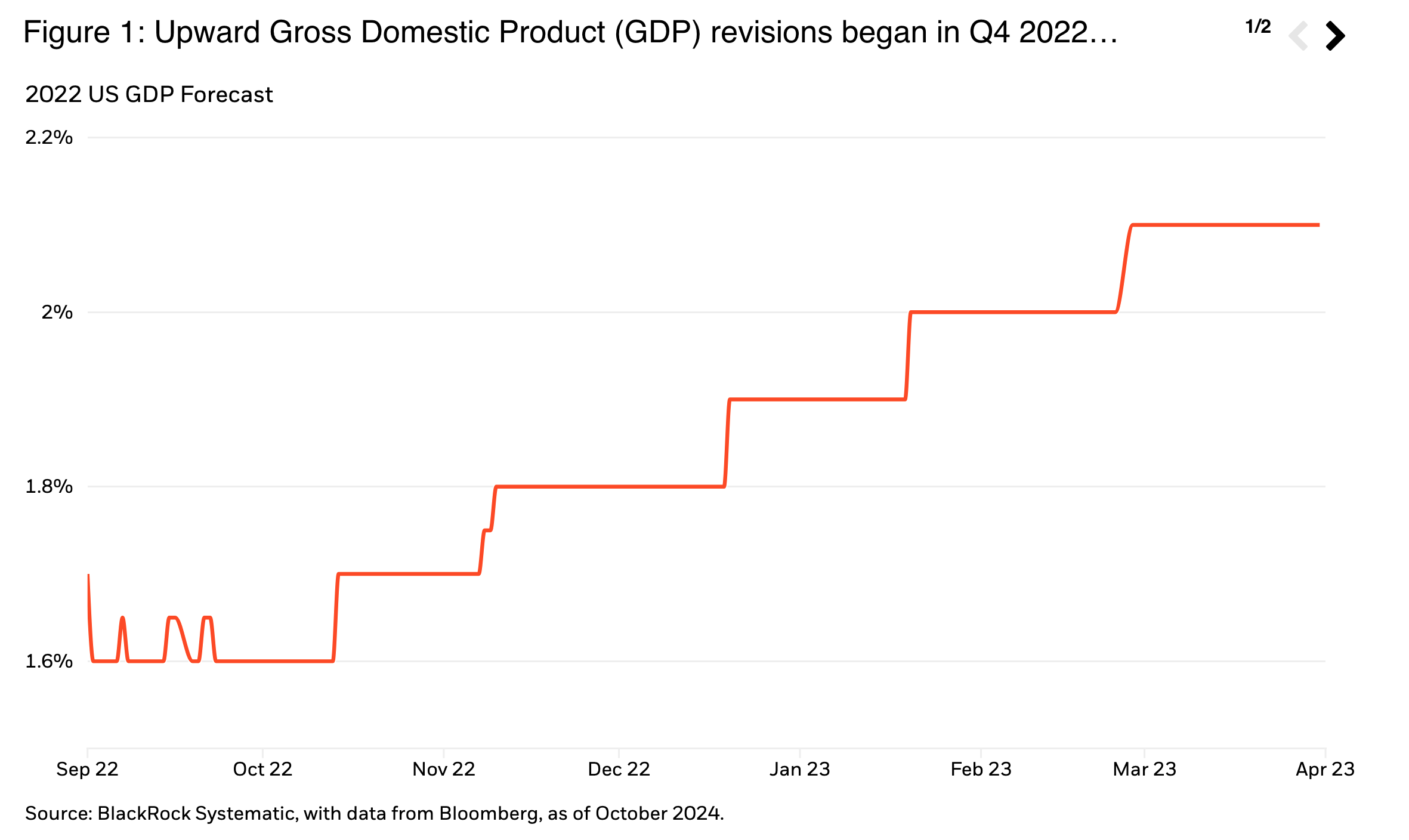

The outcome of these flouted rules has been a consistently lower estimate of expected growth by economists and the market that has needed to be revised upwards since Q4 2022 (Figure 1).

Given this, it might be surprising that another rule, the Sahm Rule—stating that a 50bps increase in the three-month average of the unemployment rate above its 12-month low predicts all historical recessions—wasn’t met with a more skeptical greeting.

Nevertheless, it coincided with a slowdown in payrolls, a rise in initial jobless claims, and a preliminary benchmark revision of establishment survey data which revised down twelve months’ worth of establishment payrolls by 818,000, or just under 70,000 per month. This was substantially greater than the ~300,000 expected downward revision. In aggregate, these dynamics contributed to increased fears of recession and expectations for Fed interest rate cuts. At the time in early August, the revisions added to the notion of both a slowing and overstatedly strong labor market—something that Powell explicitly acknowledged in his September FOMC press conference.

Hoping to temper expectations for even deeper cuts, which at the time the bond market had already begun aggressively pricing, Fed Governor Christopher Waller’s speech titled “The Time Has Come” tried to lay out expectations both for the size of the first cut and the committee’s thought process on the path ahead. He stated, “I believe we should be data dependent, but not overreact to any data point, including the latest data.” In doing so, he addressed the market’s preoccupation with recession risk signaled by rules such as the Sahm Rule, citing three key reasons to not blindly follow these recession rules:1

- Rules are nothing more than a mechanical, statistical description of past economic outcomes. They do not seek to explain what economic forces drive the relationship between data, nor are they based on the totality of economic data.

- Recessions occur when a major shock hits the economy. In the absence of a large negative shock, an inversion of the yield curve or a triggering of the Sahm Rule doesn’t necessarily mean we are entering a recession.

- Recession rules typically pick up demand-driven recessions. Most of the increase in the unemployment rate is from workers entering the labor force and not finding jobs right away. As a result, the recent rise in the unemployment rate appears to be more of a supply-driven phenomenon rather than demand-driven.

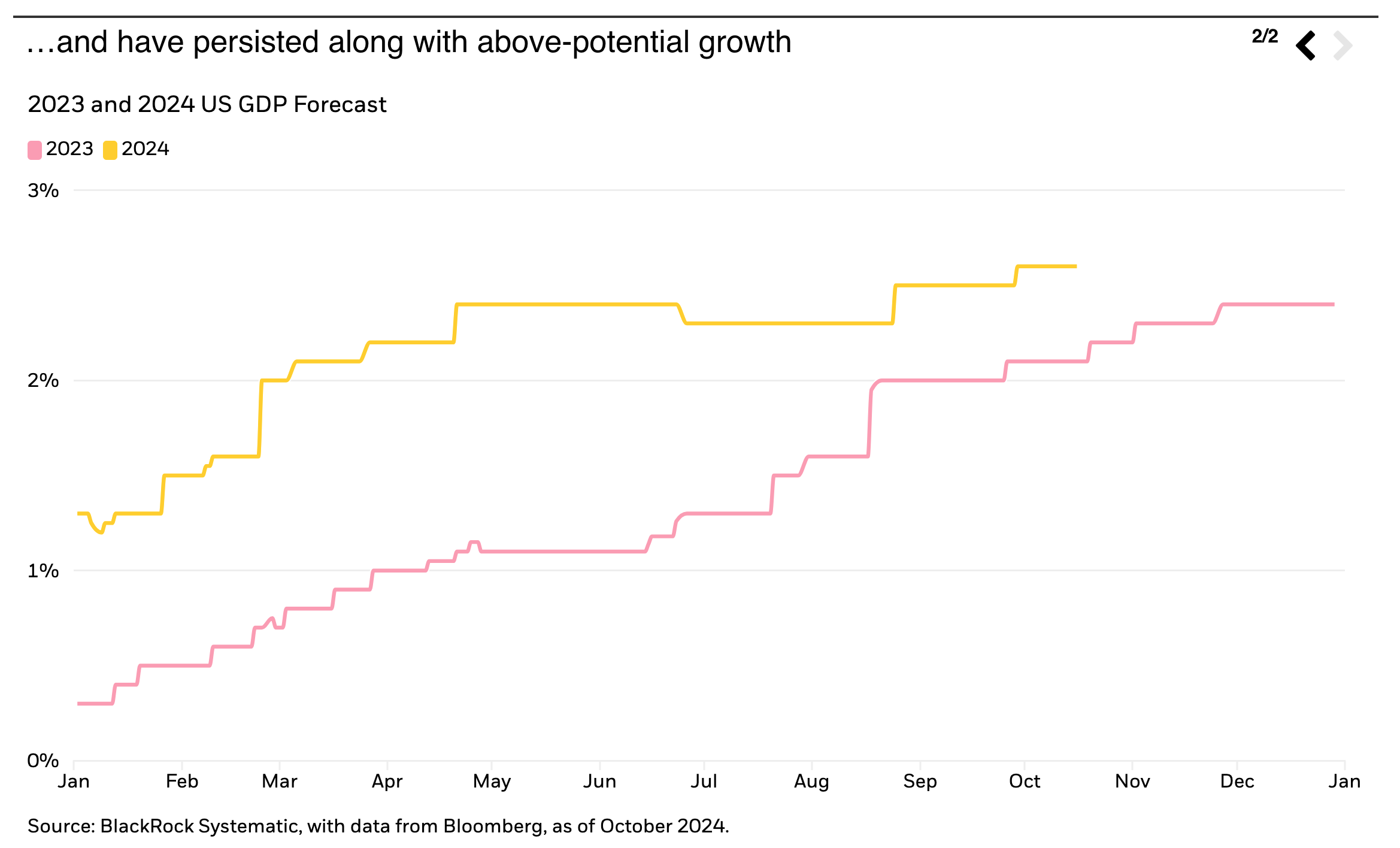

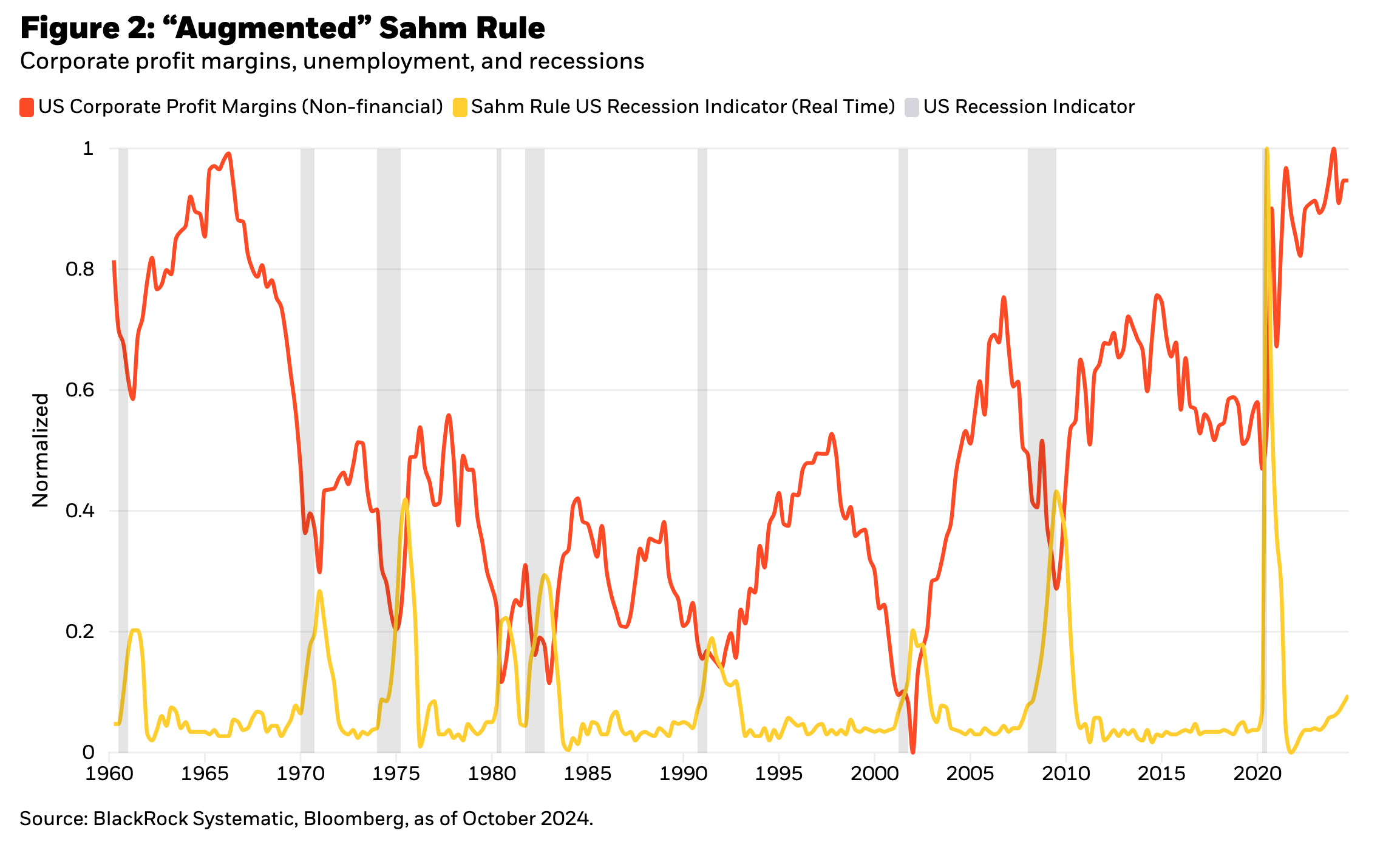

To add to these points, Figure 2 illustrates what we call the “Augmented Sahm Rule” which includes corporate profit margins alongside the rising unemployment rate. In doing so, we attempt to address the third point in Waller’s critique—that increasing unemployment best predicts a recession when it's demand-driven rather than supply-driven. By adding in corporate margins, we can see that in almost all cases of rising unemployment predicting the onset of a recession, it is also accompanied by falling corporate margins. Falling corporate margins can signal a decline in demand is leading to the shedding of workers that indicates the onset of a recession more accurately than rising unemployment on its own.

As Figure 2 highlights, the big outlier in the current environment is corporate margins are rising not falling. Now, that characteristic itself may be a victim of the same post-pandemic issues plaguing these other rules. As the post-pandemic nature of corporate margins and profitability displays a high degree of concentration, a small number of companies may be holding up the picture of aggregate profitability—masking greater vulnerability beneath the surface. The dichotomy of performance between large cap and small cap stocks suggests that this is a possibility.

Nevertheless, the overall stronger economic picture and the general interpretation of supply-side rather than demand-side considerations likely accounts for the greater rationale behind the rise in the unemployment rate. And although exceptionally volatile month-to-month in the household survey, the recent tick down in the unemployment rate to nearly rounding down to 4.0% (4.05% unrounded) also suggests that fears over the Sahm Rule predicting a recession again appear to be unfounded.

How restrictive is policy?

With payroll growth post the September jobs report (released October 4th) now averaging 186,000 over the past three months, initial jobless claims again falling (and appearing to have previously increased based on residual seasonality rather than signal), and the substantial upward recent revisions to Gross Domestic Income (GDI), both recession fears and Fed cut expectations are being rapidly reassessed.

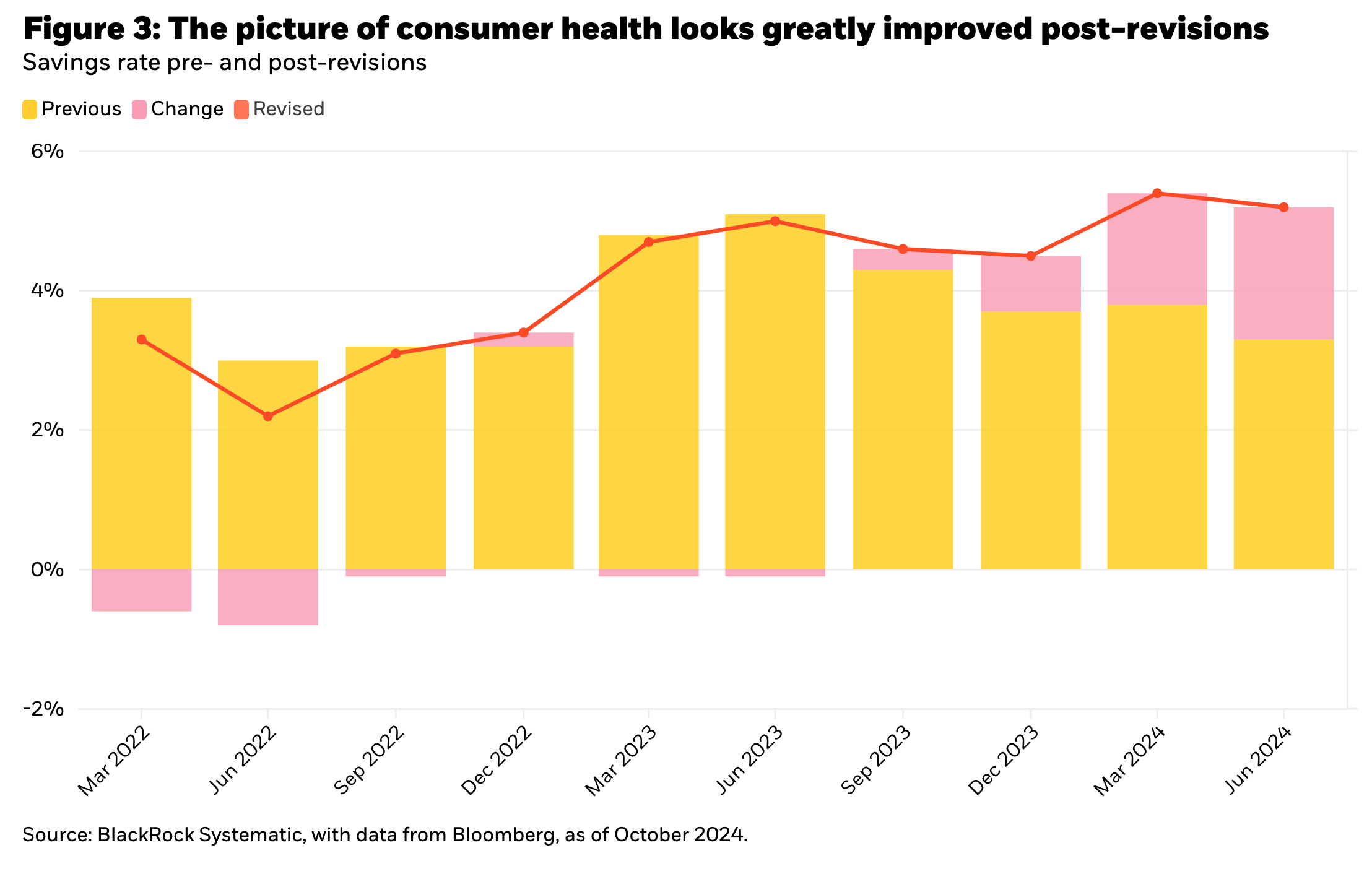

Preliminary GDI releases had been showing growth at less than half the estimates of Gross Domestic Product (GDP). That lent credence to concerns that growth was being overstated, suggesting that future growth would falter as savings were being depleted at a rapid pace.

However, initial measurements in the national accounts can be significantly revised as new and more complete data comes in. In the case of Figure 3, the revisions completely changed the contour of the savings rate, and the potential support for future consumption from a consumer that no longer appears so over-extended.

Though rising unemployment may yet signal an eventual recession as it has in past cycles, the “era of flouted rules” scenarios suggest that the uniqueness of post-pandemic economics may be more at play.

If so, an additional consideration should be given to the restrictiveness of current monetary policy, as the belief in both sufficiently restrictive and even overly-restrictive policy stands behind FOMC participants’ forecasts for nearly 200bps of policy rate reductions by the end of next year. The Fed and FOMC participants have said much about the need for policy normalization due to progress on inflation, the desire to avoid a hard-landing, and the need to recalibrate policy before labor markets weakness accelerates.

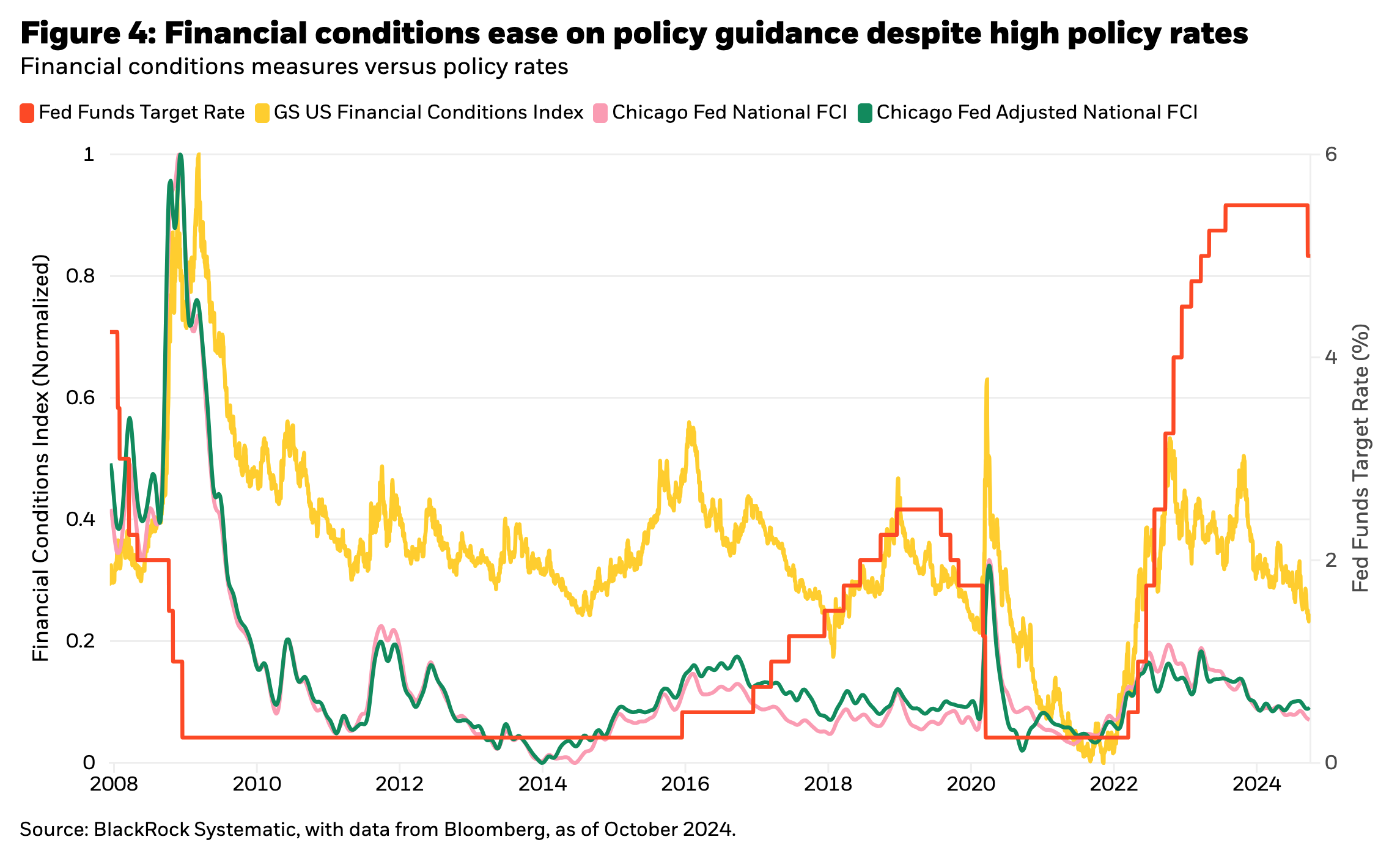

Less has been mentioned about the role of financial conditions (and even less about the role of the Fed’s balance sheet) in the transmission of monetary policy. The persistence of above-potential growth suggests several possibilities: the degree of interest sensitivity in the economy is lower post-pandemic, the neutral rate of interest is higher post-pandemic, or the impact of signaling a desire to cut rates back to a pre-pandemic sense of normal has led to much easier financial conditions than would be expected given the current policy rate (Figure 4). All of these may be at play, accounting for less restrictive policy.

Middle East uncertainty + Fiscal policy uncertainty = Hedging efficacy uncertainty

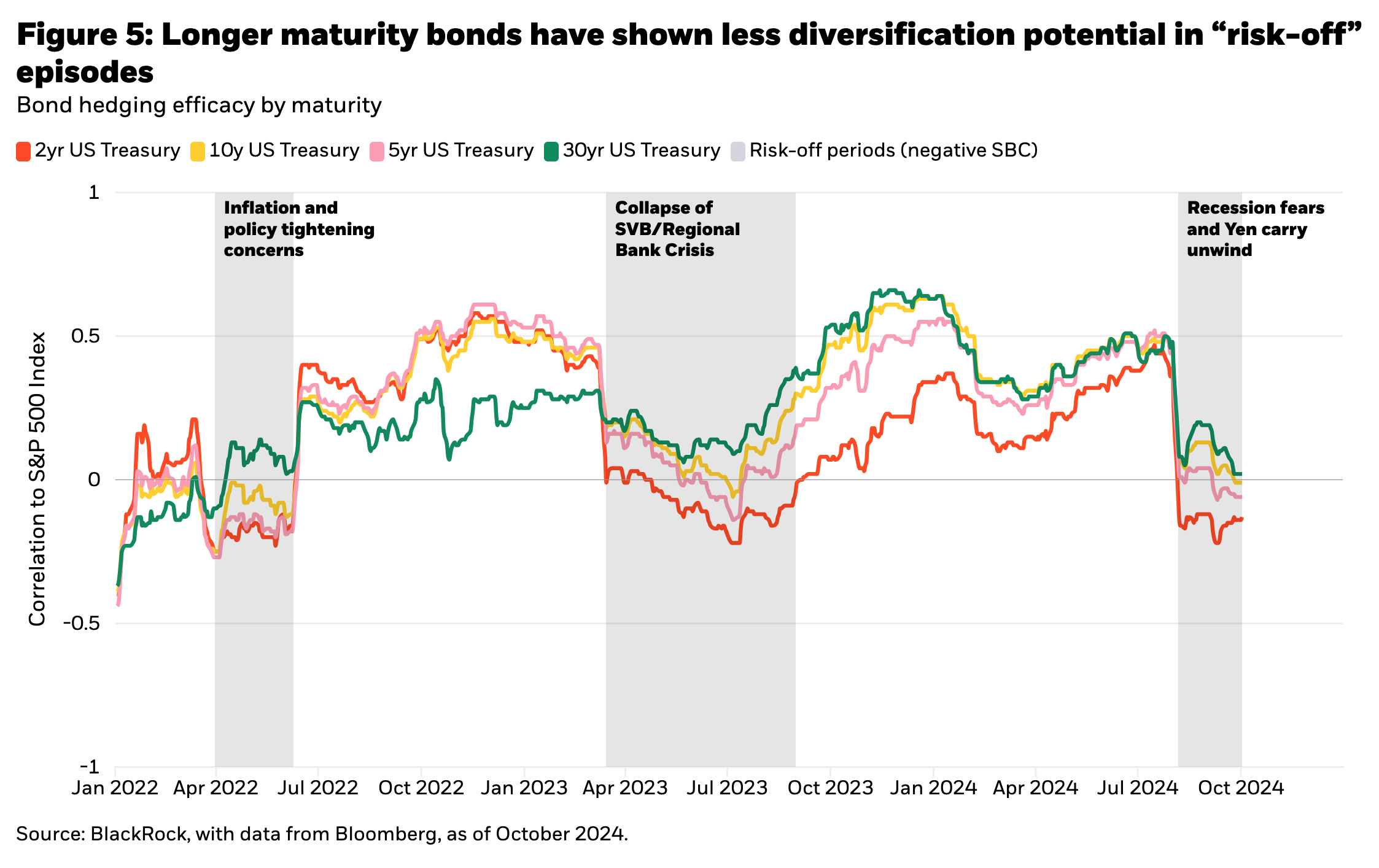

Middle east uncertainty adds to a theme we have discussed before: the uncertainty in the future efficacy of bonds as a hedge during the next major stock downturn. In prior quarterly outlooks, we have discussed how the fiscal policy backdrop—with a significantly higher level of debt and deficits in today’s world—requires greater Treasury debt issuance. With the Fed’s balance sheet policies no longer as expansionary as they were post-Global Financial Crisis (GFC) or post-COVID, and as the Treasury finds itself unable to surge T-bill issuance to absorb the excess, private market participants may find themselves being asked to finance a substantially larger amount of debt than in prior cycles. At the same time, the premium for holding longer maturity debt remains depressed by historical comparisons. These dynamics could lead to greater pressure for higher yields and wider term premiums on longer maturity debt. This can result in differing bond performance by maturity, with shorter maturity yields falling more in line with a recessionary Fed easing cycle. Consequently, longer-term debt may underperform as a diversifier for equity exposure.

Increases in oil prices related to Middle East uncertainty represent another potential challenge. Falling headline inflation had supported yield levels and declining inflation concerns in the near-term. Most of that decline can be traced to supply considerations rather than demand considerations with OPEC signaling the potential for scrapping production limits outweighing the impact of potential demand growth from China stimulus and US growth resilience.

However, the potential for war-related supply disruptions undercuts those previous trends with rising prices reflecting some of those potential future supply impacts.

For bonds, that presents a challenging prospect of risk-off with rising headline inflation. Though the Fed tends to look through short-term increases in food and energy prices, instead favoring core measures of inflation, the impact on the longer-term versus shorter-term interest rate reaction could be further differentiated by the conflicting forces of potential Fed cuts due to demand destruction (from an oil price shock, financial conditions tightening) and the longer-term impact of rising headline inflation making the “last mile” of reaching the 2% inflation target that much more difficult.

This suggests a different degree of hedging efficacy based on maturity as we have seen in several recent “risk off” episodes for equities. Figure 5 highlights the correlation of stock and bond returns by bond maturity. In each period of correlations declining, corresponding with equities declining, the strongest bond performance was led by the shortest maturities. This is a traditional “flight to quality” response where shorter maturity yields decline more than longer maturities, which is more typical of bond market performance when the Fed funds rate is further from zero. It is also something we may see more of in an environment of oil price induced risk off. This is something for investors to consider when looking for ballast in bond portfolios.

Conclusion

The Sahm Rule may be the latest in a series of “flouted rules” following stronger-than-expected labor market data. The unique characteristics of the post-pandemic economy have continued to push back on long-standing recession indicators so far, leading investors to recalibrate expectations for significant rate cuts.

Less attention has been given to the question of how restrictive monetary policy really is, with FOMC participants forecasting nearly 200bps of policy rate reductions by the end of next year. The impact of easing financial conditions on the transmission of monetary policy could constrain the Fed’s ability to deliver on those cuts, potentially challenging bond market performance.

At the same time, investors may want to consider the implications of fiscal policy challenges and conflict in the Middle East on bond performance and hedging efficacy across the maturity spectrum which may matter more for portfolio construction as we look ahead.

Copyright © BlackRock