by Brian S. Wesbury – Chief Economist & Robert Stein, CFA – Deputy Chief Economist, First Trust Portfolios

There are two types of economists in the world…demand-siders and supply-siders. Without digging too deeply, one huge difference shows up in government policy. Supply-siders want low tax rates, high savings rates (and investment), and minimal regulation. Why? Because wealth and higher living standards come from entrepreneurship and invention – i.e. Supply.

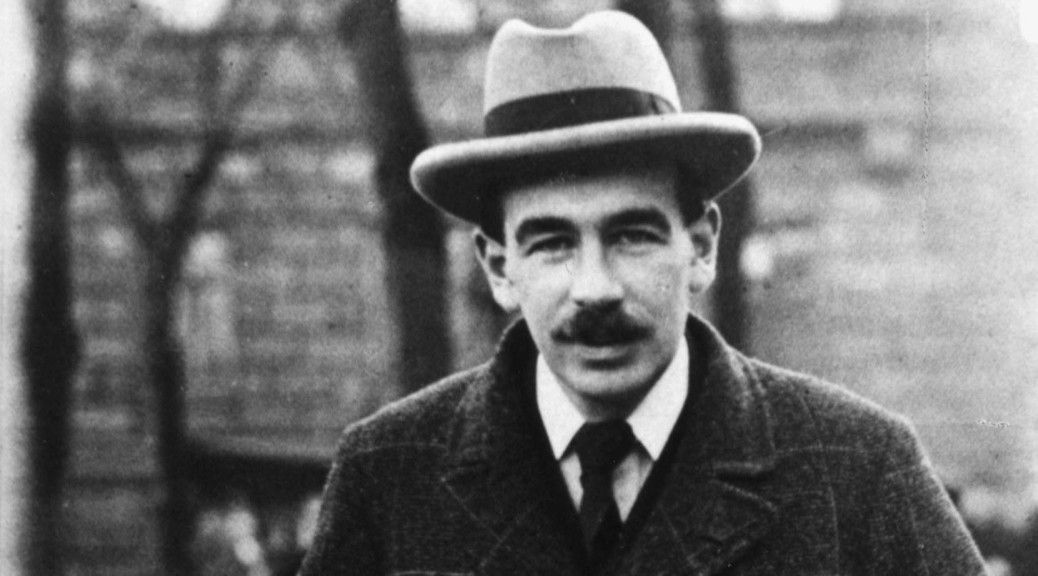

Demand-siders think the way to boost growth is to boost “Demand.” John Maynard Keynes is the father of modern demand-side thought, arguing that if the pace of economic growth is too slow the government can step in to “stimulate demand” by running or expanding a government deficit.

A tenet of Keynesianism is that growth is best achieved by taxing money from those with higher incomes because they have a “higher propensity to save,” and giving it to those with lower incomes because they have a “higher propensity to consume.”

No wonder politicians love Keynes. It’s an economic theory that sanctions giving taxpayer resources directly to people under the theory that this will boost overall economic growth. At least in the short run according to the Keynesians – less economic growth and fewer jobs are worse than deficits. (And the long run doesn’t matter, they say, because we’ll all be dead, anyhow.)

The policy response to both the Financial Crisis and COVID was Keynesianism on steroids. Clearly, politicians of both parties have rallied behind the Keynesian flag in the past 16 years. As Richard Nixon once said,“We are all Keynesians now.”

Nixon may have been right if we apply that statement to politicians. But Friedman, Hazlitt, Mises, Hayek, and others continually pointed out the damage from this short-term, demand-side thinking would be immense and the stagflation of the 1970s proved them right and the politicians wrong. Like then, we think we have reached “peak Keynesianism” again!

The fiscal well is now running dry. The federal budget deficit was 6.2% of GDP in Fiscal Year 2023 and came in about 6.4% of GDP in FY 2024, which ended two weeks ago. To put this in perspective, the US did not run a budget deficit of more than 6.0% of GDP for any year from 1947 until the Great Recession and Financial Panic of 2008-09. Not during the Korean War, not during the Vietnam War, not during the Cold War. But now we did it two years in a row without a war and with the unemployment rate averaging 3.8%.

These deficits were made possible, in a large way, by having the Federal Reserve monetize the debt. At the same time the Fed held interest rates artificially low, meaning the actual cost of these deficits was masked. But, like the 1970s, inflation appeared due to easy money and now interest rates are up. The interest on the national debt has soared from a modest 1.5% of GDP in FY 2021 to what is likely 3.0% of GDP in FY 2024.

This means that if we hit a recession anytime soon, policymakers will find it very hard to rely on a Keynesian response. Deficits and interest payments are already too high!

At the same time, a Keynesian-motivated redistribution scheme to try to boost spending also faces a major hurdle. The personal saving rate – the share of after-tax personal income that is not consumed – was 4.8% in August. That’s well below the 7.3% average in 2019, prior to COVID, and less than half the savings rate of 12% that the US had in 1965. What this means is that trying to boost consumer spending by taking from Penelope to pay Paul will probably not work, either.

Put it all together and it looks like the traditional tools Keynesians like to use when economic troubles hit will not be available if the US runs into economic trouble. We see it everywhere. Evidently, the Secret Service, FEMA, and border security all need more money.

The system has reached Peak Keynesianism. Like the late 1970s and early 1980s, it is time to change course. The good news is that because of democracy, this can happen any time.

Brian S. Wesbury – Chief Economist

Robert Stein, CFA – Deputy Chief Economist

Click here for a PDF version

Copyright © First Trust Portfolios