by Kristina Hooper, Chief Global Market Strategist, Invesco

Key takeaways

- Consumer concerns - There is concern about US consumers, but I expect to see improved consumer sentiment thanks to lower oil prices and improving real wages.

- Weakening or normalizing? - Business owners and consumers may lament the “weakening” of their economies, but I believe it’s just normalizing as a result of central bank tightening.

- Excitement in China - Chinese policymakers announced significant monetary and fiscal stimulus that could have a substantial positive impact on the economy.

Market-watchers can often get myopic. But if we focus too closely on just one or two data points, we may not see the forest for the trees. That’s why I think it makes sense to take a step back and look at the global economy in terms of some important themes. Chief among them: the normalizing US economy, diverging consumer sentiment in Europe and the UK, easing monetary policy in major Western economies, and encouraging stimulus in China.

The US economy is normalizing, by design

The US Federal Reserve (Fed) wanted to cool down a hot economy to get inflation in check. In particular, it wanted to see tight labor markets loosen. Now that is happening. However, we saw the impact of that last week when the Conference Board’s US Consumer Confidence Index fell to 98.7 in September from 105.6 in August — its largest drop since August 2021.1 This caused a negative reaction from the stock market.

The Conference Board’s chief economist explained, “Consumer confidence dropped in September to near the bottom of the narrow range that has prevailed over the past two years. Consumers’ assessments of current business conditions turned negative while views of the current labor market situation softened further. Consumers were also more pessimistic about future labor market conditions and less positive about future business conditions and future income.”1

This seemed to me to be much ado about not much, for a couple of reasons:

- Even though the Conference Board’s expectations sub-index declined from August, itremained above 80 (a reading below 80 usually signals a recession ahead).

- While consumers said they were worried about the economy in this survey, that hasn’t seemed to deter them from spending – albeit more selectively.

- Just three days later, we got a different story on consumer sentiment from the University of Michigan Survey of Consumers. Its measure of consumer sentiment actually rose in September and is at its highest level in the last five months.2 Its expectations sub-index also rose. There was a slight increase in concern about the labor market but that was offset by improved expectations for personal finances and the overall economy.

In fairness, there has been some weakening of the consumer — we’ve heard that articulated by companies in recent earnings calls. In particular, lower-income households are feeling the pain. But the US economy remains resilient, and I expect to see improved consumer sentiment reflected in all major surveys going forward, helped by lower oil prices and improving real wages.

Consumer psychology has diverged in Europe and the UK

Economic data in the eurozone is not as positive as in the US – for September, the flash eurozone services Purchasing Managers’ Index (PMI) is at a 7-month low, and the flash eurozone manufacturing PMI is at a 9-month low.3 But interestingly, we are seeing an improvement in consumer sentiment despite political uncertainty in a number of European economies. Flash readings of consumer confidence in the euro area and the European Union both rose 0.5 points from the previous month — almost reaching its long-term average. In the September survey, consumers were significantly more optimistic about their households’ expected financial situation.4

UK consumers don’t share the improved optimism of euro area consumers. In fact, the GfK Consumer Confidence Survey showed substantial improvement in consumer confidence until September, when it dropped materially. I suspect the new Labour government’s warnings about the fiscal situation in the UK, and ensuing trepidation over the release of the autumn Budget, has played a role in tamping down consumer sentiment. However, I think it’s important to note that flash PMIs for both manufacturing and services in the UK remained in expansion territory for September.

My takeaway is that what we are seeing is really just normalizing of Western developed economies as a result of central bank tightening. I also think this softening will be shallow and brief, and that we are likely to see an economic re-acceleration, first for the US and then followed by other developed economies, as a result of monetary easing and real wage growth.

Monetary policy is easing in major Western developed economies

I believe the easing we’ve seen so far is just the start. As Chicago Fed President Austan Goolsbee said last week, “If we want a soft landing, we can't be behind the curve.” In the same speech, he anticipated “many more rate cuts over the next year.”5

It’s important to note that inflation concerns are largely in the rearview mirror for central banks. For example, last week’s reading of the Fed’s preferred gauge of inflation — US core Personal Consumption Expenditures (PCE) — offered no surprises; the Fed’s target appears in sight. And euro area consumer inflation expectations for the year ahead was 2.7% in September, down from 2.8% the previous month.6 Three-year ahead inflation expectations fell to 2.3%, down from 2.4% in the previous month.6 We’ve seen a similar scenario in other Western developed economies; inflation expectations are well anchored.

So now, central banks are free to react to signs of weakness with more easing. For example, last week there were calls for the Bank of Canada – which has already enacted three rate cuts in consecutive meetings – to do more because there are concerns that economic growth is falling below Bank of Canada forecasts. In other words, central banks are now free to normalize monetary policy and focus on economic growth.

Japan is also normalizing monetary policy, but in the other direction. However, it has been careful to go slow and not disrupt financial markets, which should be supportive of economic growth as well.

Excitement builds around stimulus in China

Chinese policymakers announced significant monetary and fiscal stimulus that could have a substantial positive impact on the economy. The People’s Bank of China’s rate cuts are significant and should have a positive impact on the Chinese economy. More importantly, the monetary stimulus will be accompanied by very substantial fiscal stimulus. While we don’t have a lot of details about the fiscal stimulus, the size alone is encouraging. Last week’s China equity rally was powerful and suggests this is what investors have been hoping for.7 What’s more, Chinese stocks are attractively valued, in my view, and I would not be surprised to see a continued positive impact as more details are released.

Looking ahead

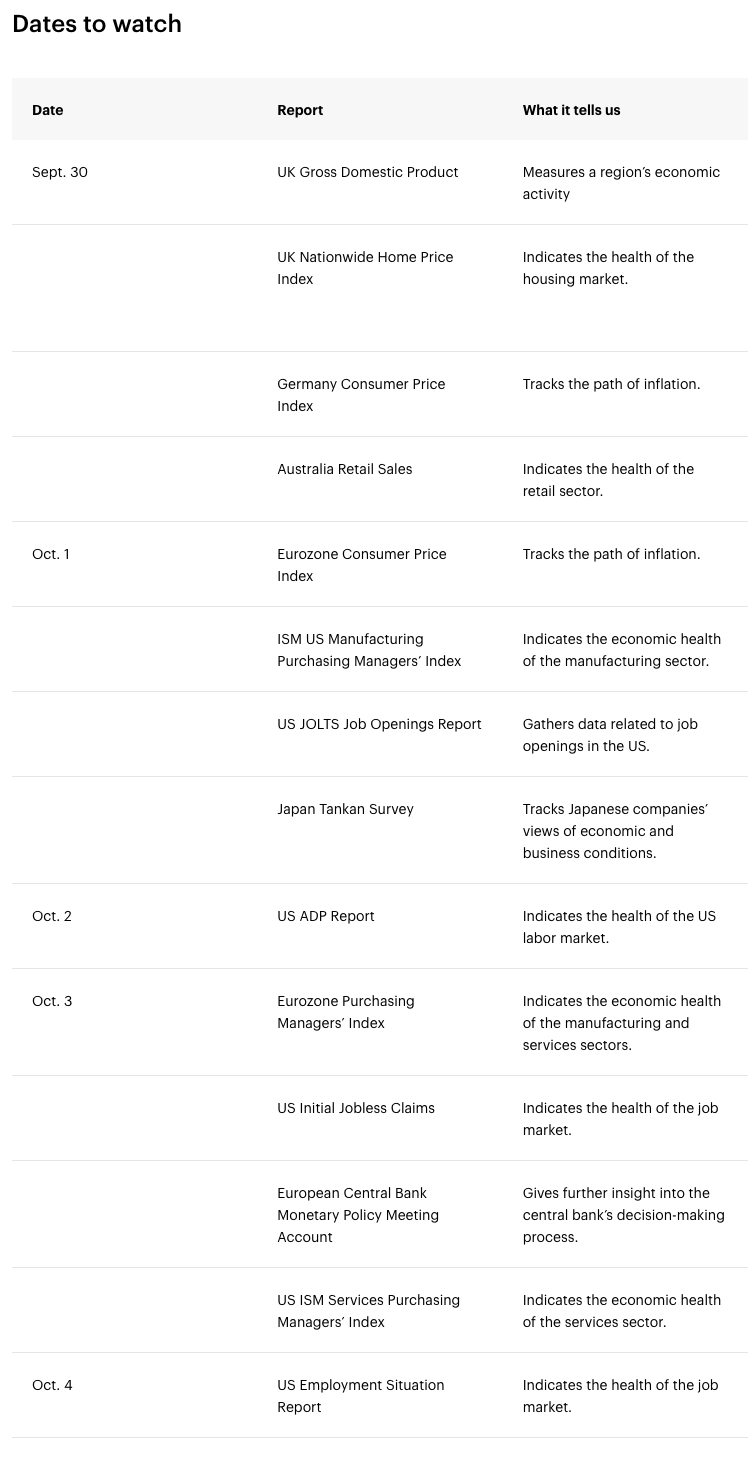

The key economic data releases this week are UK gross domestic product (GDP), the US Job Openings and Labor Turnover Survey (JOLTS) job openings report, various Purchasing Managers’ Index (PMI) surveys and the US employment report on Friday. And of course, US initial jobless claims have taken on far more importance now that attention has turned away from inflation and to the health of the labor market.

Footnotes

1 Source: The Conference Board as of Sept. 24, 2024

2 Source: University of Michigan Survey of Consumers, Sept. 27, 2024

3 Source: S&P Global/HCOB, as of Sept. 25, 2024

4 Source: European Commission, Sept. 27, 2024

5 Source: Reuters, “Fed's Goolsbee sees 'many more' rate cuts ahead,” Sept. 23, 2024

6 Source: European Central Bank, as of Sept. 24, 2024

7 Source: Bloomberg, L.P. The MSCI China Index was up 17.2% for the week ending Sept. 27, 2024. The MSCI China Index captures large- and mid-cap representation across China H shares, B shares, Red chips, P chips, and foreign listings (e.g., ADRs). Past performance is no guarantee of future results. An investment cannot be made directly in an index.

Copyright © Invesco