by Research Team, MFS Investment Management

With 100 years of investing experience, MFS has the unique ability to provide insight into the lessons we have learned that can help our clients meet their investment objectives.

The cyclical nature of financial markets has always presented a challenge to investors. While there is clear evidence that investing can be a powerful way to build wealth over the long term, bear market phases can result in investors either avoiding the market or selling out, often at the worst possible time. However, taking a long-term view and learning from history can lead to successful outcomes for those investors who are prepared.

Time is an investor’s greatest asset

Investors are bombarded with information. Most of it is noise, often a distraction, but rarely significant in the long run. Over 55,000 public companies around the world report quarterly results, creating short-term signals that may or may not reflect a company’s long-term success or failure.1 This explosion of information coincides with an increase in reactive and tactical investors as well as a significant decrease in holding periods for equities.2

Over the past 100 years, we have found that taking a long-term view enables us to tune out the noise and focus on information that aligns with the goals of our clients. Some companies need time to achieve strategic goals, while others have an established business model worthy of long-term ownership. Since 1924, our long-term investing philosophy has been integral to our investment process, and we believe the strength of our research team gives us the conviction and patience to let investment ideas play out over time.

History has shown that time can be an investor's greatest asset in building wealth and purchasing power, as evidenced by the average 10-year returns for various types of portfolios shown below as compared to cash and inflation.

Over the past 100 years, we have found that taking a long-term view enables us to tune out the noise and focus on information that aligns with the goals of our clients.

Question to Consider

- Are your investment managers’ processes aligned with your time horizon? Are they incentivized to take a long-term view when it comes to your portfolio?

Fundamentals matter

In 1924, company information was hard to come by. The Securities and Exchange Commission did not exist, and companies were not required to disclose even basic information. This lack of information was a problem for investors, so in 1932, MFS created one of the first in-house investment research teams to find and analyze information to help us make better investment decisions, and we have taken that approach ever since.

While the world has changed, our focus on fundamentals, such as business model durability, financial health, profitability and valuation, has not.

Why are fundamentals so important? Over the past century, we have found that understanding a company’s fundamentals is the best way to assess its future earnings potential, and analysis has shown that earnings are the most important driver of stock market returns.

Over the past century, we have found that understanding a company’s fundamentals is the best way to assess its future earnings potential.

While the benefits of fundamental analysis may be obvious, at times some investors disregard fundamentals completely. But at MFS, fundamentals are the bedrock of our research process. To meet the complex and ever-changing dynamics of global markets, business cycles, technological advancement, sustainability concerns and increasing regulation, the firm has over 300 investment professionals around the word, who share their insights and ideas across our investment platform to help create better investment outcomes for our clients.

Question to Consider

- Do your managers apply fundamental analysis to consider issues that drive long-term earnings growth for the companies they invest in?

Focus on value, not just price

In our personal lives, we sometimes overpay for a product we want rather than gathering information to make the best decision. This behavior is often seen in markets when investors pay up for a hot stock without fully assessing its value. We have learned that a disciplined valuation approach is critical to long-term investment success.

Why should you care about valuations? As seen in the chart below, valuation historically has been a good predictor of returns: Historically, low starting P/Es have tended to lead to higher future returns. The converse is also true: High starting P/Es tend to result in lower future returns. That said, sometimes valuations are high for the right reasons, and our fundamental approach helps us determine whether a stock is trading at a fair price.

Learning from experience is a critical part of our valuation discipline. Estimates of a company’s value are based on many assumptions, which sometimes don’t play out as expected. As students of the market, MFS constantly learns from the past and tries to apply those learnings as we contemplate future decisions.

Question to Consider

- What is your manager's valuation process, and how does it impact portfolio construction and buy and sell decisions?

Diversification has worked

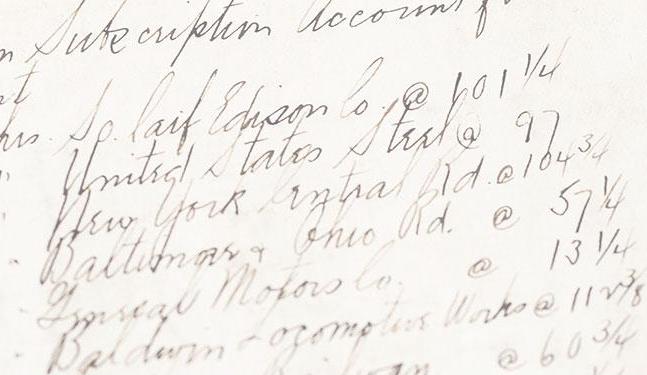

Helping ordinary investors diversify was the idea behind MFS creating the first open-end mutual fund in the United States — Massachusetts Investors Trust (MIT). At a time when a diversified portfolio was beyond the means of most, for about $250, an investor could buy a share in MIT, which held about 50 companies, including railroads, utilities, car makers and food producers.

Today, diversification is more complex with multiple dimensions including asset class, sector, industry, geography and currency.

We believe disciplined active strategies can use different levers to drive excess returns through diversification.

But diversification doesn’t end there. We believe disciplined active strategies can use different levers to drive excess returns through diversification. Within fixed income, active managers can use alpha levers such as sector, quality and security selection along with duration and yield curve positioning. Within equities, managers can use factor, style or valuation tilts to drive excess return. Understanding how managers use these levers to drive excess returns can help investors create a more diverse portfolio by combining managers that focus on different sources of alpha.

While diversification does not guarantee a profit or protect against a loss, at its core diversification is about managing risk. We think investors can benefit by diversifying sources of return.

Question to Consider

- Is your portfolio diversified across sectors, regions and asset classes, as well as potential sources of alpha?

Balance opportunity and risk

Market downturns are a natural part of investing and happen more often than you might think. There have been 25 bear markets over the past century, but they tend to be short lived, lasting about 10 months on average. The past has taught us that market downturns often give us opportunities to deliver long-term outcomes to our clients. We have done this by managing risk on the downside and taking advantage when the market overreacts.

We believe high-quality companies with durable earnings tend to be less impacted in down markets than low-quality companies. Consider the chart below. If the stock market is down 20%, a 25% return is needed to get back to even. A portfolio that is down 15% in that same market needs only a 17% return to break even.

We have also learned that downturns often provide the opportunity to capitalize on price declines. Our investment team can see what has changed during a market downturn and identify companies that may be attractive long-term buying opportunities.

In fixed income, our teams can use changing credit and rate environments to reallocate risk to areas they believe will be compensated. For example, our analysis has shown that credit spread cycles are becoming shorter in length and more frequent. While this increased volatility could be seen as a negative, we believe it gives us the opportunity to incrementally increase or decrease credit risk based on the relative attractiveness of different bond market segments. Building liquidity as spreads tighten and then redeploying that liquidity into opportunity areas when spreads widen is a core philosophy of our fixed income teams.

Question to Consider

- Are risk management and managing the downside cornerstones of your managers’ philosophy?

Disruption is constant

Every generation has its disruptors, and over the past 100 years MFS has invested through countless examples. Television was invented in the 1920s but did not see widespread use until the 1950s. Cable brought hundreds of channels in the 1980s, yet today streaming services are taking share. Along the way incumbents were challenged, and new companies and industries came to be.

Our approach to AI has been the same as our approach to countless technological disruptions over the years — research the issues thoroughly, ask why we should or shouldn't own a company, and invest thoughtfully.

This serves as a reminder that while new technologies are always developing, the long-term impact is not always immediately clear. Today for example, the effects of artificial intelligence (AI), on companies are still unknown. Our approach to AI is the same as our approach to countless technological disruptions over the years — research the issues thoroughly, question why we should or should not own a company and invest thoughtfully.

Question to Consider

- What is the structure of your asset manager’s research team, how is information shared across sector and industry teams? Does the manager have the breadth and depth of resources to analyze disruption across impacted industries?

Teams over individuals

Teamwork is at the heart of everything we do at MFS. In today’s complex global markets, successful investment can be achieved only by using as wide a range of expertise as possible. The past 100 years have taught us that allocating capital responsibly relies on a culture of teamwork. We believe that teams of diverse thinkers contribute different perspectives. This helps us better understand and incorporate all financially material factors into our analysis, which we believe fosters better investment outcomes.

Question to Consider

- Are you able to leverage the collective experience of your extended team to learn from the past to better serve your stakeholders?

Aiming for the goal

Investment professionals must be attuned to ongoing changes but grounded in a process and philosophy that can withstand the test of time. These lessons learned from a century of investing have helped us keep our focus on allocating capital responsibly over the long term for our clients.

These lessons learned from a century of investing have helped us keep our focus on allocating capital responsibly over the long term for our clients.

End notes

1 Source: World Federation of Exchanges, Market Statistics, February 2024.

2 Sources: WFE, IMF. Average US equity holding period as measured by NYSE and NASDAQ market capitalization divided by total turnover value declined from 5 years in 1975 to 10 months in 2022.

The S&P 500 Stock Index measures the broad US stock market.

Standard & Poor's® " and "S&P® " are registered trademarks of Standard & Poor's Financial Services LLC ("S&P") and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC ("Dow Jones") and have been licensed for use by S&P Dow Jones Indices LLC and sublicensed for certain purposes by Massachusetts Financial Services Company ("MFS"). The S&P 500® is a product of S&P Dow Jones Indices LLC, and has been licensed for use by MFS. MFS's product(s) is not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P, or their respective affiliates, and neither S&P Dow Jones Indices LLC, Dow Jones, S&P, their respective affiliates make any representation regarding the advisability of investing in such product(s).

The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice. No forecasts can be guaranteed.