by Jamie Coleman, Senior Strategist, Strategy and Insights Group, MFS Investment Management

A review of the week’s top global economic and capital markets news.

As of midday Friday, global equities traded near record levels amid aggressive steps by Chinese officials to reverse the country’s economic malaise. The yield on the US 10-year Treasury note rose 3 basis points to 3.76% while the price of a barrel of West Texas Intermediate crude oil slid over $4 to $67.80 amid speculation that Saudi Arabia will focus on recouping lost market share in the months ahead. Volatility, as measured by futures contracts on the Cboe Volatility Index (VIX), rose to 18.3 from 16.2 a week ago.

MACRO NEWS

China ramps up stimulus

After months of piecemeal measures designed to shore up economic confidence, China this week responded to increasing societal pressure and undertook a series of impactful policy steps. The first moves were focused on monetary policy. They were followed days later by promises of fiscal support, some specifically targeting the equity market. The combination was more forceful than many expected, setting off a wave of short-covering in Chinese equity markets. Later in the week, the country’s Politburo, with unusual focus on the economy, said it will extend more support, including fiscal stimulus, to prevent further declines in the housing sector. That’s the first time policymakers have explicitly targeted the property market. On Friday, the Chinese central bank implemented the cuts previewed on Tuesday, lowering a number of key policy rates. Taken together, the initiatives undertaken suggest an increased sense of urgency from Beijing and have grabbed the market’s attention. On the week, the Shanghai Composite Index rose nearly 13%.

Harris, Trump sharpen economic agendas

US Vice President Kamala Harris, the Democratic nominee for president, pledged to use government might to support domestic manufacturing and ward off competition from China, a key feature of what she terms the “opportunity economy.” Harris proposed billions in new tax credits for domestic manufacturing and wants to offset the cost of the tax credits by raising taxes on US companies’ foreign earnings. For his part, GOP nominee Donald Trump’s plan calls for tax breaks for foreign manufacturers to incentivize them to shift operations to the United States from overseas while threatening them with tariffs if they fail to comply. Trump has dubbed the policies “the new American industrialism.” Analysts note that much of Harris’ agenda would require congressional approval while Trump’s tariff-centric approach could be implemented unilaterally under the authority ceded to the executive branch by Congress.

PBOC not only central bank to cut rates

Last week’s half-point interest rate cut from the US Federal Reserve and this week’s series of easing steps from the People’s Bank of China have garnered the bulk of the headlines, but they weren’t the only central banks to trim policy rates this week. Those that cut rates — all by a quarter point — include the Swiss National Bank, Sweden’s Riksbank, the Bank of Mexico and the central banks of both the Czech Republic and Hungary. However, the Reserve Bank of Australia kept rates unchanged and suggested that policy will remain on hold for now.

QUICK HITS

With the end of the US government fiscal year approaching on 30 September, Congress passed a stopgap measure to fund government operations through 20 December, avoiding a shutdown amid general election campaigning.

US personal income rose a less-than-expected 0.2% month over month in August, while spending rose a weaker-than-forecast 0.2%. The core PCE price index rose 0.1% from the month before while it edged up 0.1% from a year ago to 2.7%.

French Prime Minister Michel Barnier on Sunday said he would avoid broad tax hikes, opting instead for tax increases for high earners.

The Conference Board’s gauge of consumer confidence decreased 6.9 points to 98.7, the biggest drop since August 2021, data out Tuesday showed. The survey showed that consumers feel jobs are becoming harder to get.

On Wednesday, Canadian Prime Minister Justin Trudeau survived a no-confidence motion.

The Biden administration said this week it may ban Chinese connected-vehicle technology in the US.

Bank of England Governor Andrew Bailey said this week that interest rates will come down gradually but that he doesn’t expect them to return to very low levels.

Expectations are building for a port strike affecting terminals on the US East and Gulf coasts next week. About 45,000 workers could be impacted. A shutdown could disrupt about 36% of US imports, 40% of exports and roughly 8% of global trade. However, the specter of a strike caused many companies to front-load holiday orders earlier in the year, potentially limiting the fallout from a short-term shutdown.

According to the OECF, countries must raise taxes to tackle their growing debt problems.

Irish Prime Minister Simon Harris said that Ireland’s recent €14 billion tax windfall resulting from Apple’s loss of an EU tax-law case will be used to fund housing, energy and water infrastructure.

Moody’s warned this week that if deficits continue to be ignored, the US’ Aaa rating will be thrown into doubt. The credit rating agency lowered its outlook for the US to negative in November. Current debt dynamics would be unsustainable and inconsistent with a Aaa rating if no policy actions are taken to correct course, Moody’s said.

Hurricane Helene lashed Florida’s Gulf Coast overnight, making landfall as a Category 4 hurricane. Millions in Florida, Georgia and South Carolina were left without power.

US equities, as measured by the S&P 500 Index, closed at record highs on Thursday.

Japan’s ruling Liberal Democratic Party held a leadership election on Friday and selected Shigeru Ishiba as its new party head and Japan’s prime minister. Ishiba is seen as supportive of the Bank of Japan’s policy normalization efforts, though his rival was not, which prompted a flurry of currency volatility this week ahead of the vote.

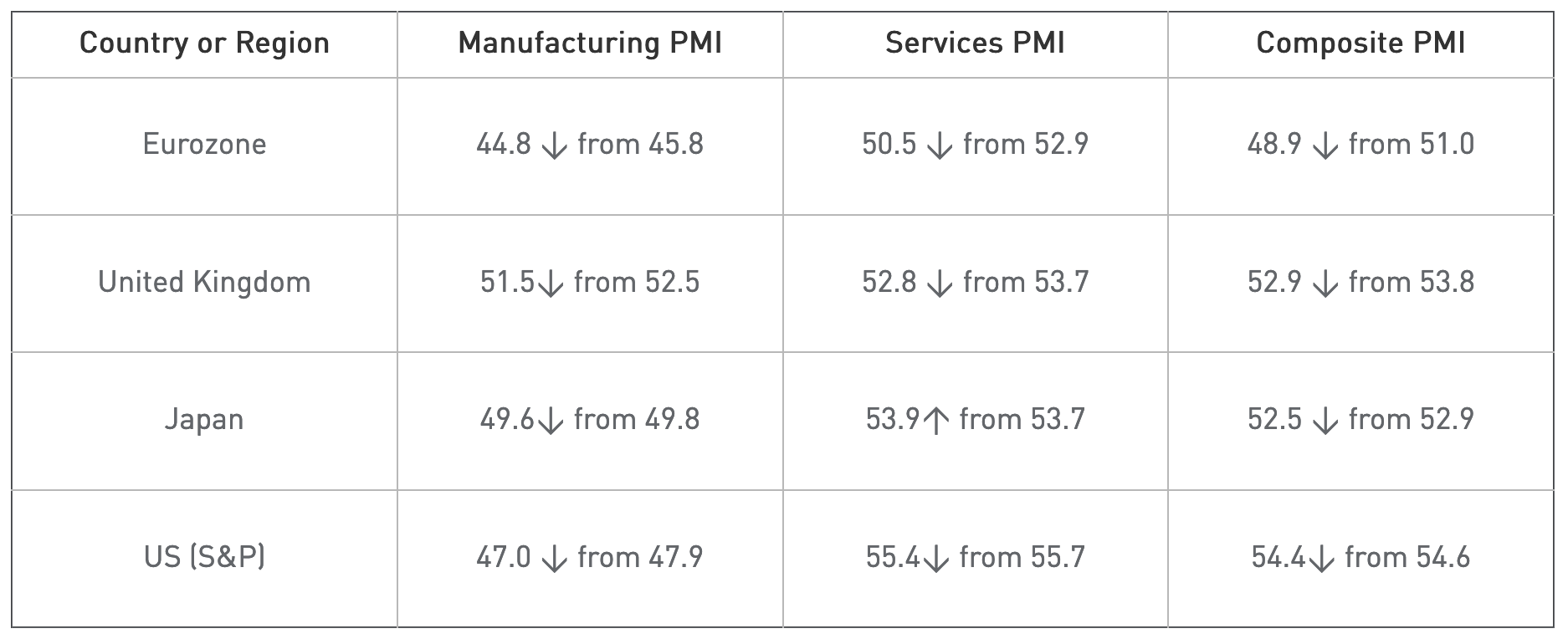

S&P Global released preliminary purchasing managers’ indices for September this week. The Olympics-inspired bounce in Europe’s services sector faded sharply this month, dragging the composite reading below 50.

THE WEEK AHEAD

Monday: Japan industrial production and retail sales. German and United Kingdom GDP

Tuesday: manufacturing purchasing managers’ indices, eurozone PMI, US JOLTS data

Wednesday: eurozone unemployment

Thursday: services and composite PMIs

Friday: US employment report

Stay focused and diversified

In any market environment, we strongly believe that investors should stay diversified across a variety of asset classes. By working closely with your investment professional, you can help ensure that your portfolio is properly diversified and that your financial plan supports your long-term goals, time horizon and tolerance for risk. Diversification does not guarantee a profit or protect against loss.

*****

The information included above as well as individual companies and/or securities mentioned should not be construed as investment advice, a recommendation to buy or sell or an indication of trading intent on behalf of any MFS product.

Securities discussed may or may not be holdings in any of the MFS funds. For a complete list of holdings for any MFS portfolio, please see the most recent annual, semiannual or quarterly report. Full holdings are also available on the individual Fund Summary tab in the Products section of mfs.com.

The views expressed in this article are those of MFS and are subject to change at any time. No forecasts can be guaranteed.

Past performance is no guarantee of future results.

Sources: MFS research, Wall Street Journal, Financial Times, Reuters, Bloomberg News, FactSet Research, CNBC.com.

This content is directed at investment professionals only.

Copyright © MFS Investment Management