by Brian Levitt, Global Market Strategist, Invesco

Key takeaways

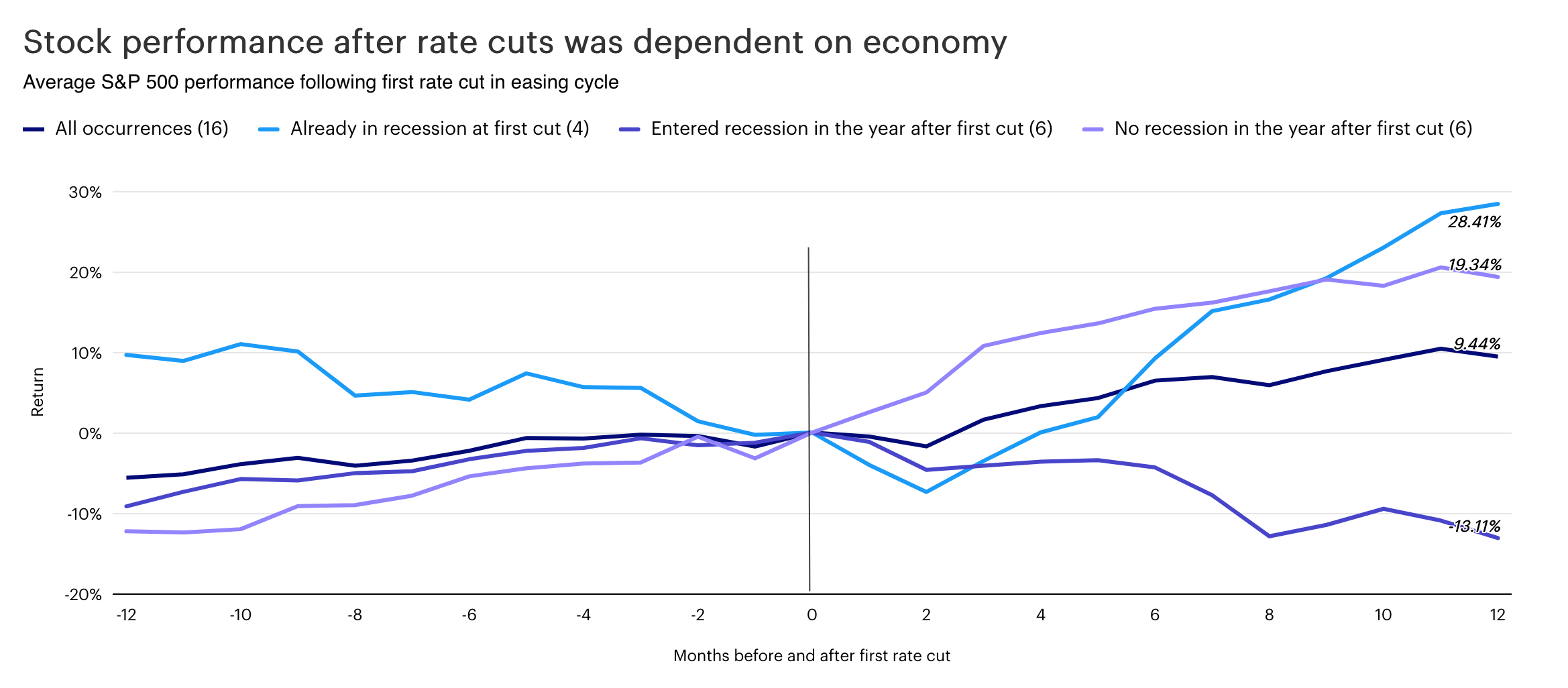

- Economy impacts market - The market performed better if there wasn’t a subsequent recession or if the economy was already in recession during easing.

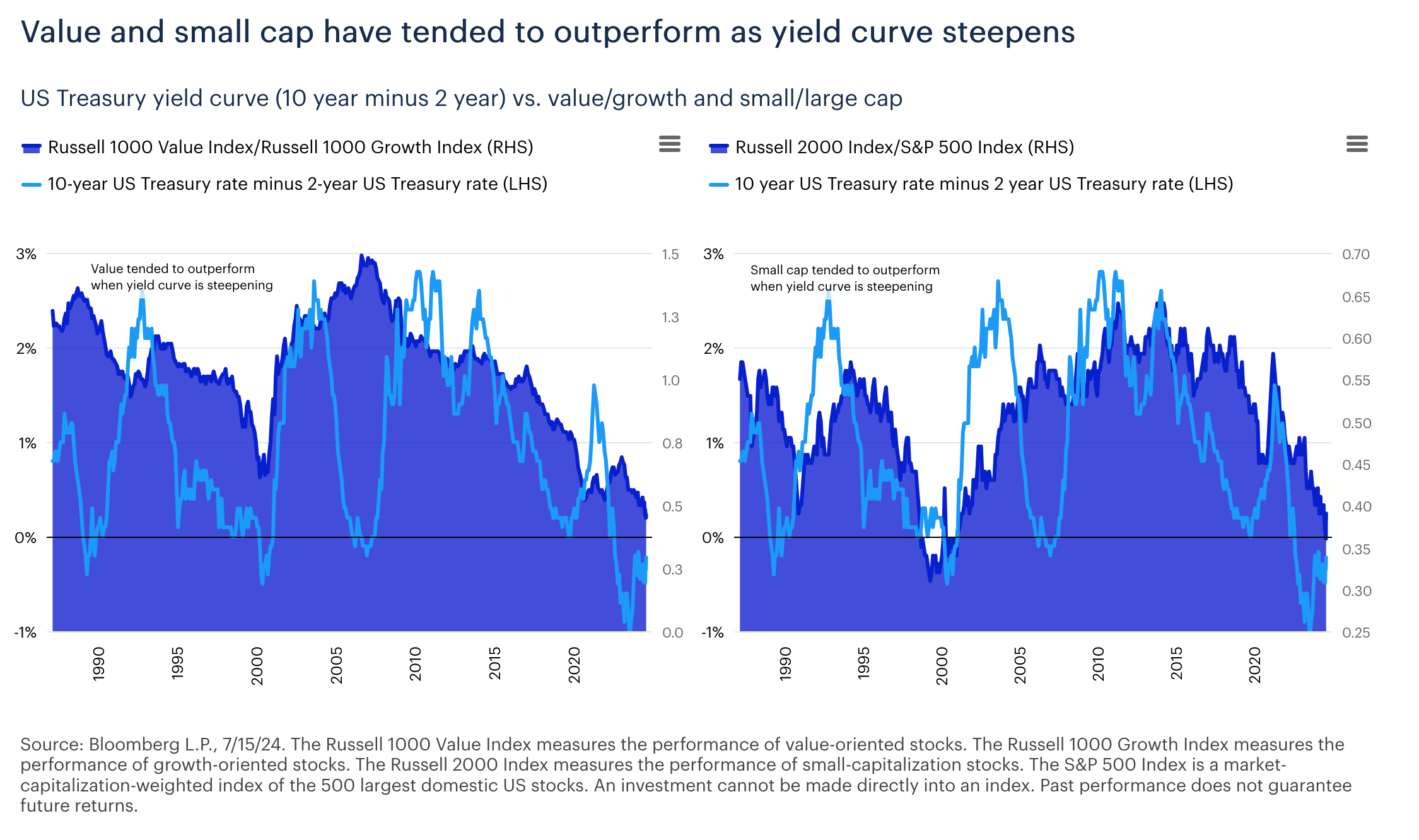

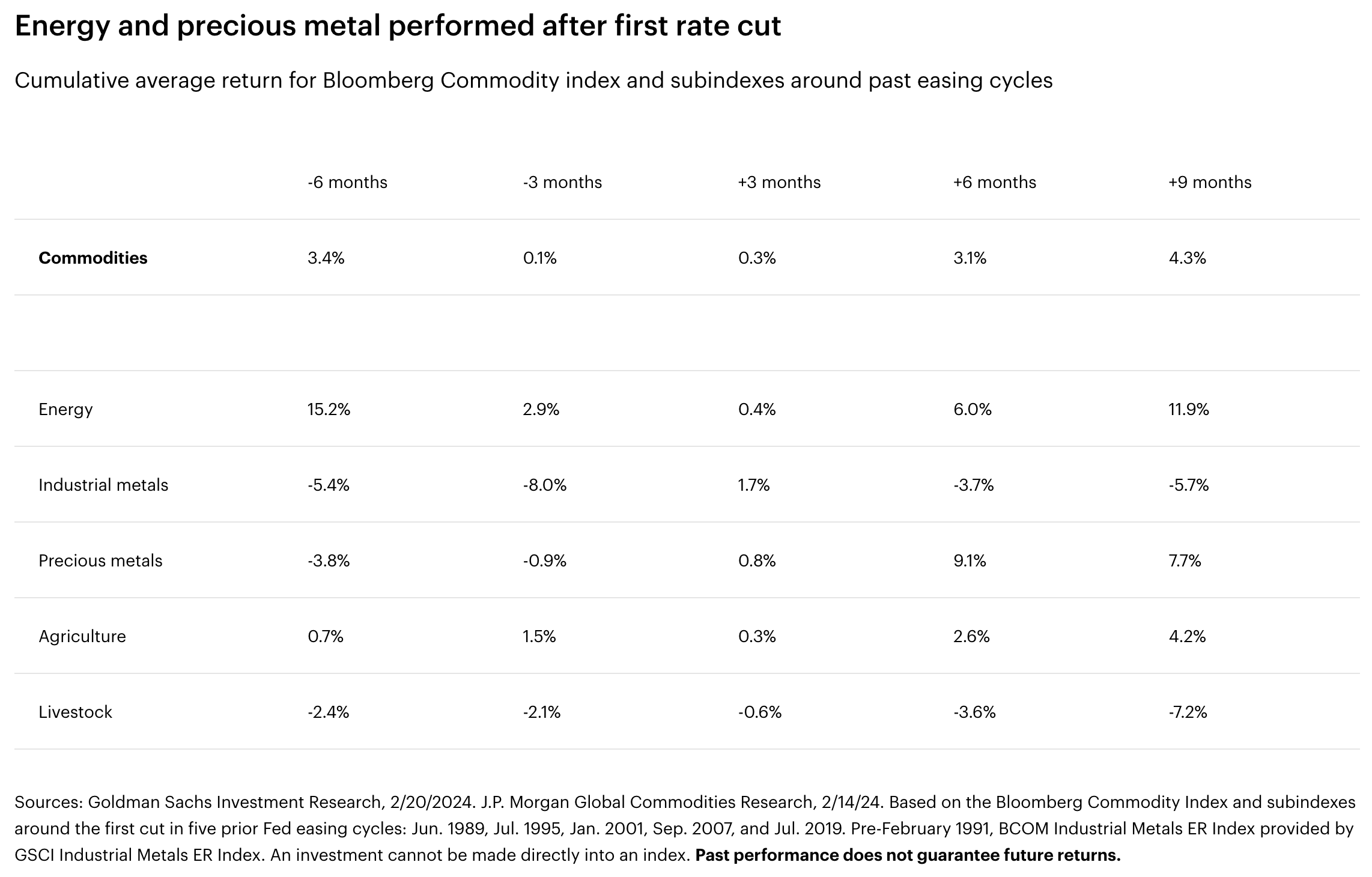

- Stocks that have benefited - Value and small-cap stocks and energy and precious metal commodities performed after past rate cuts.

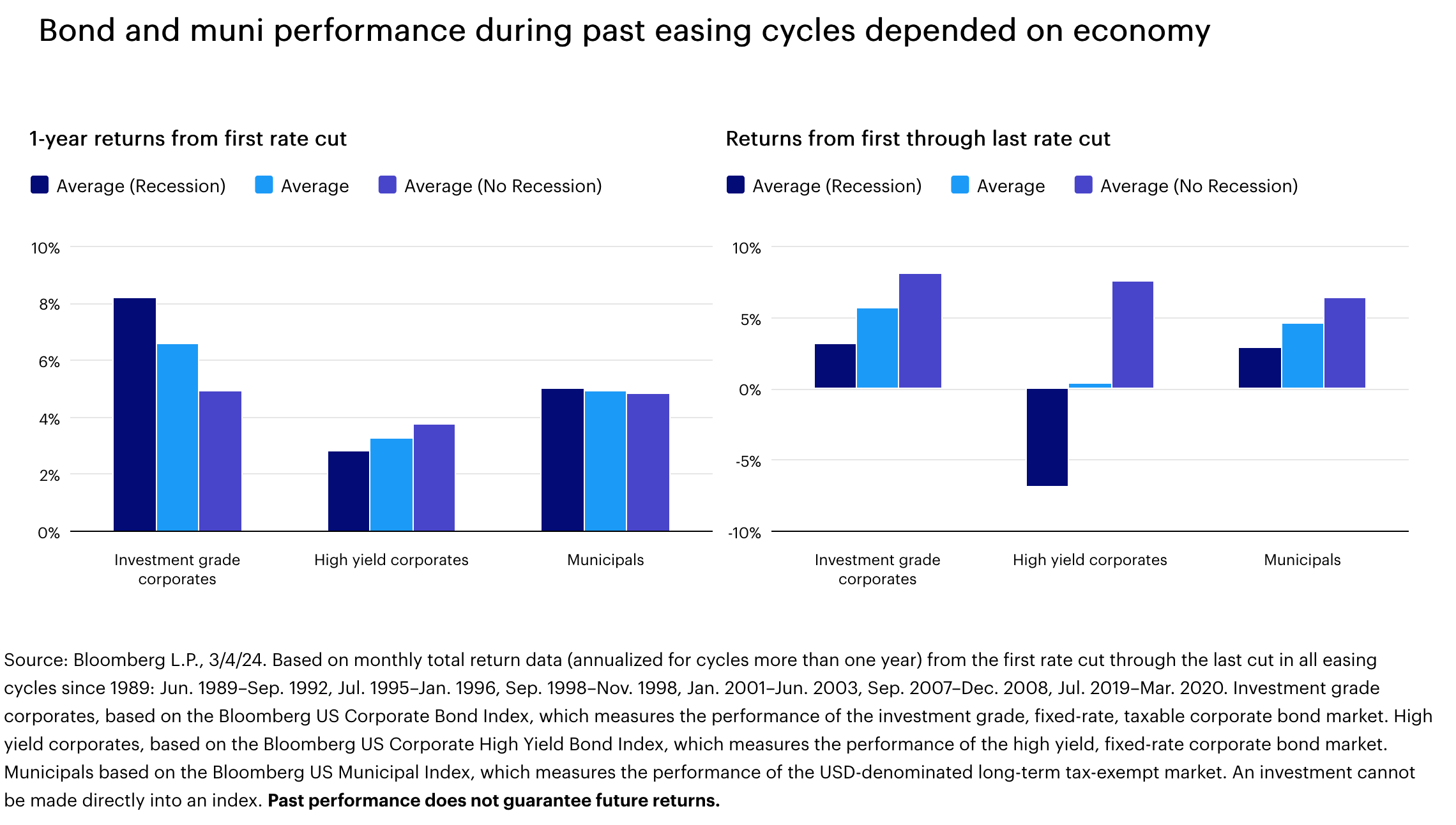

- Bonds that have outperformed - Longer-term Treasuries, investment grade corporate bonds, and municipals have had positive returns during easing cycles.

Now that the Federal Reserve (Fed) has cut interest rates, everyone is wondering what rate cuts mean for markets and investments. A look back at history provides some insight. Here are my key takeaways after analyzing the data.

1. Stocks did well if economy avoided a recession

The performance of stocks during past easing cycles was dependent on the state of the US economy. (See chart below.) The US stock market has historically posted strong returns after the start of an easing cycle if the economy didn’t fall into a recession within the next 12 months or if it was already in a recession at the start of the easing cycle. For example, the Fed raised rates by 300 basis points over the 12 months ended February 1995 before ending its tightening cycle. The US economy didn’t enter a recession, and the market performed well over the subsequent year.

2. Value and small cap have benefitted as yield curve steepens

Value-style and small-cap stocks have been sensitive to the shape of the yield curve. As short rates fall and the yield curve steepens, which has tended to happen after interest rate cuts (see yield curve section below), value and small caps have historically performed well over the subsequent years. (See chart below.) That’s because smaller businesses tend to be funded by debt and can potentially benefit from lower borrowing costs. Lower rates can also lead to reinvigorated economic activity, which may serve as a catalyst to unlock value in the market.

Commodities are widely priced in US dollars, meaning a weakening of the dollar in response to lower interest rates may be a tailwind for commodity prices. The price of oil and gold, specifically, tend to be sensitive to changes in interest rates. (See chart below.) Commodity prices, however, aren’t solely determined by the direction of rates. They may also be influenced by macro factors such as economic growth and micro forces like inventories and weather.

Short-term interest rates have historically fallen more than long-term rates around prior easing cycles, resulting in a steepening of the yield curve.1 This may be a looming challenge for investors in short-term Treasuries and cash-like instruments. The comparatively large downward moves in short rates around the start of easing cycles may create reinvestment risk.

5. Longer-term bonds have outperformed after first rate cut

Intermediate-term US Treasuries, on average, have outperformed short-term US Treasuries in the 12 months following the first interest rate cut in an easing cycle, returning 6.12% and 4.72%, respectively, on average. As with stocks, performance has been dependent on the state of the economy. Intermediate Treasuries’ outperformance (7.73%) over short-term Treasuries (3.16%) on average was driven by the returns during recessions. In instances when the economy didn’t enter a recession, short-term US Treasuries (6.27%) outperformed intermediate term (4.51%) on average.2

6. Credit and municipal performance depended on backdrop

Investment grade corporate bonds and municipals have posted positive returns during easing cycles, although returns have tended to be higher when the economy didn’t enter a recession. (See chart below.) High yield corporate bonds have been especially sensitive to economic downturns, as default rates tend to rise in recessions.

Decision time

The decision to cut interest rates is a tricky one. Easing too much or too soon could reignite inflation, while easing too little or too late could have consequences for economic growth. The economy has clearly shifted away from inflation and towards growth. The market appears to be primed for a so-called “soft landing,” which is a slowdown in economic activity that doesn’t lead to a recession. That’s our base case. There’s the risk, however, that the Fed tightened policy by too much and is late to ease conditions. The resilience of the economy (or lack thereof) is likely to have significant implications for near-term market returns.

Footnotes

1 Source: Bloomberg L.P., 6/30/24.

2 Source: Bloomberg L.P., 6/30/24. Based on monthly total return data in the 12 months after the first rate cut in all easing cycles since 1989: Jun. 1989, Jul. 1995, Sep. 1998, Jan. 2001, Sep. 2007, and Jul. 2019. Intermediate US Treasuries based on the Bloomberg US Treasury Intermediate Index, which measures the performance of USD-denominated, fixed-rate, nominal debt issued by the US Treasury. Short US Treasuries based on the Bloomberg US Short Treasury Index, which measures the performance of US Treasury bills, notes, and bonds under 1 year to maturing. An investment cannot be made directly into an index. Past performance does not guarantee future returns.

Copyright © Invesco