by Derek Benedet, Portfolio Manager, Purpose Investments, Richardson Wealth

Summary: In this Ethos, we share a bit of our process for being prepared for potential outlier events and how we may trade them. It’s like an NFL playbook for various scenarios. We think about potential events in a calmer environment with the goal of making better decisions in the heat of the moment.

What will you do if the market tumbles 8% in October, a month known for having above-average volatility? You are probably thinking you will put some cash to work and buy that dip! Okay, well the market dropped 9% from mid-July till early August. Did you do some buying then? Making a portfolio change is always challenging. During upward market swings, greed becomes a more prominent emotion, just as fear does during downward swings. Very, very seldom do these emotions help results or decision-making.

Worse yet is the narrative. When the market is down, financial news is certainly tilted towards doom and gloom. When it’s up, there is more euphoric messaging about how AI or something else is going to change the world. The takeaway: financial news, X, or whatever your source is, likely exacerbates that fear/greed emotion. Tweets and comments on August 5 included many saying the bear market had started or the world was ending. Whoops.

And then there is the time. If you are inclined to make a change during a big market move, it takes time to become comfortable with the portfolio change, research and analyze it, rationalize the decision, and then implement it. If it’s a model change for many clients, that takes even more time. All this contributes to a more buy-and-hold approach: position a portfolio for what you believe will happen in the coming months, quarters, or years.

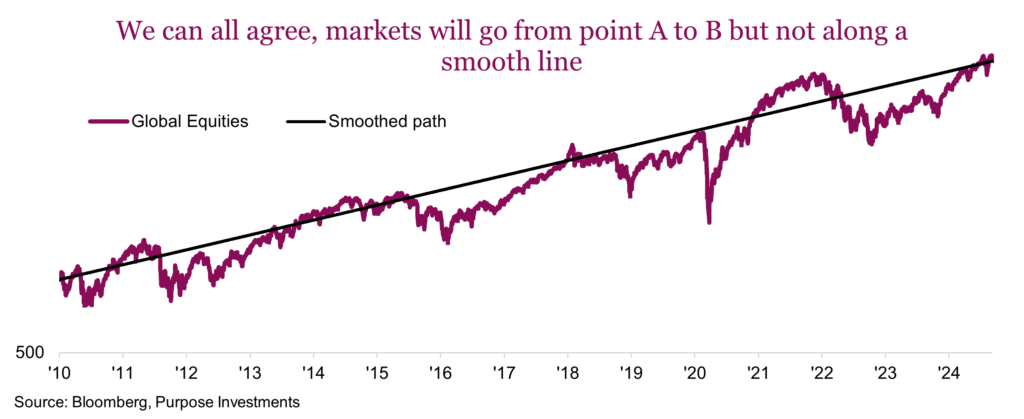

But markets never move in a straight line, and there will be big oscillations, up and down, along the journey. These moves can create opportunities to add value to a portfolio by being a bit tactical, even if just around the edges. So, how can we overcome decision paralysis due to emotions, somehow navigate the noise from financial media, and implement a change in a timely, thoughtful manner?

Portfolio playbook: Think about it now to be more prepared for later

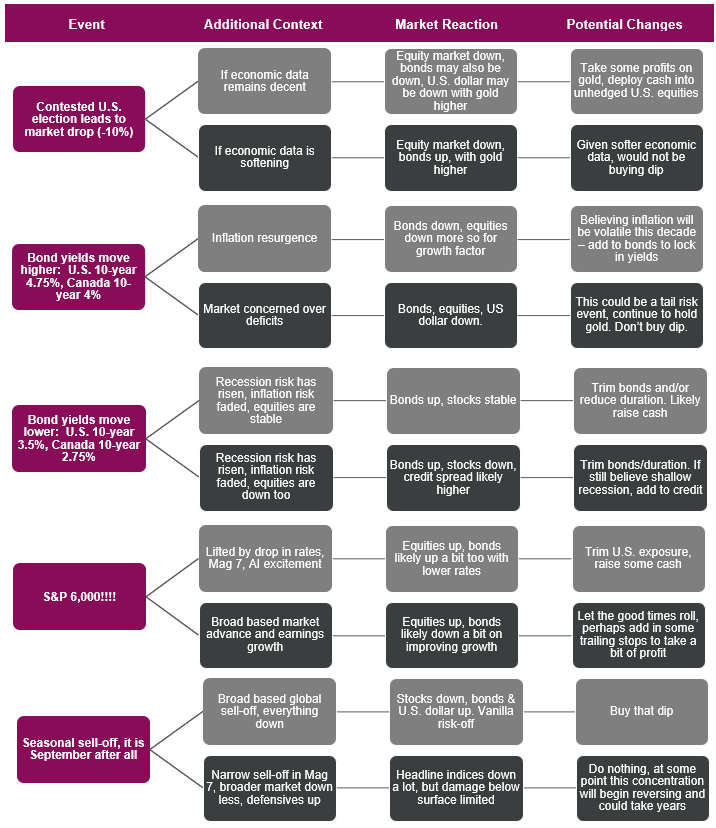

Today, the S&P 500 is at 5,500. What would you do if it reaches 6,000 before year-end? That would be up over 25% this year. What would you do if it tumbles down to 5,000 in the fall months? That is a drop of about 9% from here. Pre-conceiving a few broad scenarios can really help the decision-making when/if that moment happens. We are not saying it should be automatic or easy, but working through some scenarios in advance will help lighten the load if it happens, which may improve the implementation speed or decision-making process.

Portfolio managers will use this approach in equity portfolios with revisit levels. They are not triggers but rather levels the team will re-assess, which could lead to selling, trimming, adding, or buying. But today we are talking multi-asset portfolios. So, the potential scenarios are more market or economic events that might change our thinking in one direction or another, and result in a change in our multi-asset portfolios tilts or exposures. It is not a wholesale change, as the portfolio’s core is predicated on a longer-term view and objective. Rather it is smaller changes around the edges as markets create what could be opportunities.

Considering these events ahead of time and how we may trade improves our process during what could be a stressful time. Please note, it almost never works out as envisioned, but can often have some similarities. These are not forecasts; more things could happen and impact how we consider reacting.

Note: These are sample scenarios and potential portfolio ideas for illustrative purposes only. Any actual portfolio changes are subject to many additional considerations in real-time.

Final thoughts

We find considering different outcomes ahead of time lightens the load when we are considering a portfolio change in the moment. The number of scenarios can really expand, as can the additional context characteristics. We believe the more thinking you can do ahead of time in a calmer environment, the better your decision-making will be when things go crazy or reach extended levels. Of course, many scenarios may never trigger, but it is still better to be prepared in case the market doesn’t simply move up in a steady, smooth line.

Copyright © Richardson Wealth

*****

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Richardson Wealth Limited for information purposes only.

*This report is authored by Craig Basinger, Chief Market Strategist at Purpose Investments Inc. Effective September 1, 2021, Craig Basinger has transitioned to Purpose Investments Inc.

Disclaimers

Richardson Wealth Limited

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth Limited or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Richardson Wealth warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.

The particulars contained herein were obtained from sources which we believe are reliable but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Richardson Wealth or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.

Richardson Wealth Limited, Member Canadian Investor Protection Fund.

Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.