Equity Investors Need Conviction in Underweights.

by Christopher W. Marx, Global Head—Equity Business Development, Teresa Keane, Managing Director—Equities, Robert Milano, Senior Investment Strategist and Head—EMEA Equity Business Development, AllianceBernstein

Portfolio managers should always have good explanations for their underweight positions. These days, it matters more than ever.

Equity portfolio managers love to talk about the stocks they own. But they don’t usually talk as much about the stocks that they don’t own. In highly concentrated markets, where a small group of huge stocks is driving returns, having conviction in underweight positions is essential.

Underweights always affect a portfolio’s relative returns versus a benchmark. For years, however, portfolio managers weren’t really pressed to explain why they don’t own certain companies. In diversified market environments, underweights just didn’t matter as much to relative performance.

Underweights Can Hurt in Concentrated Markets

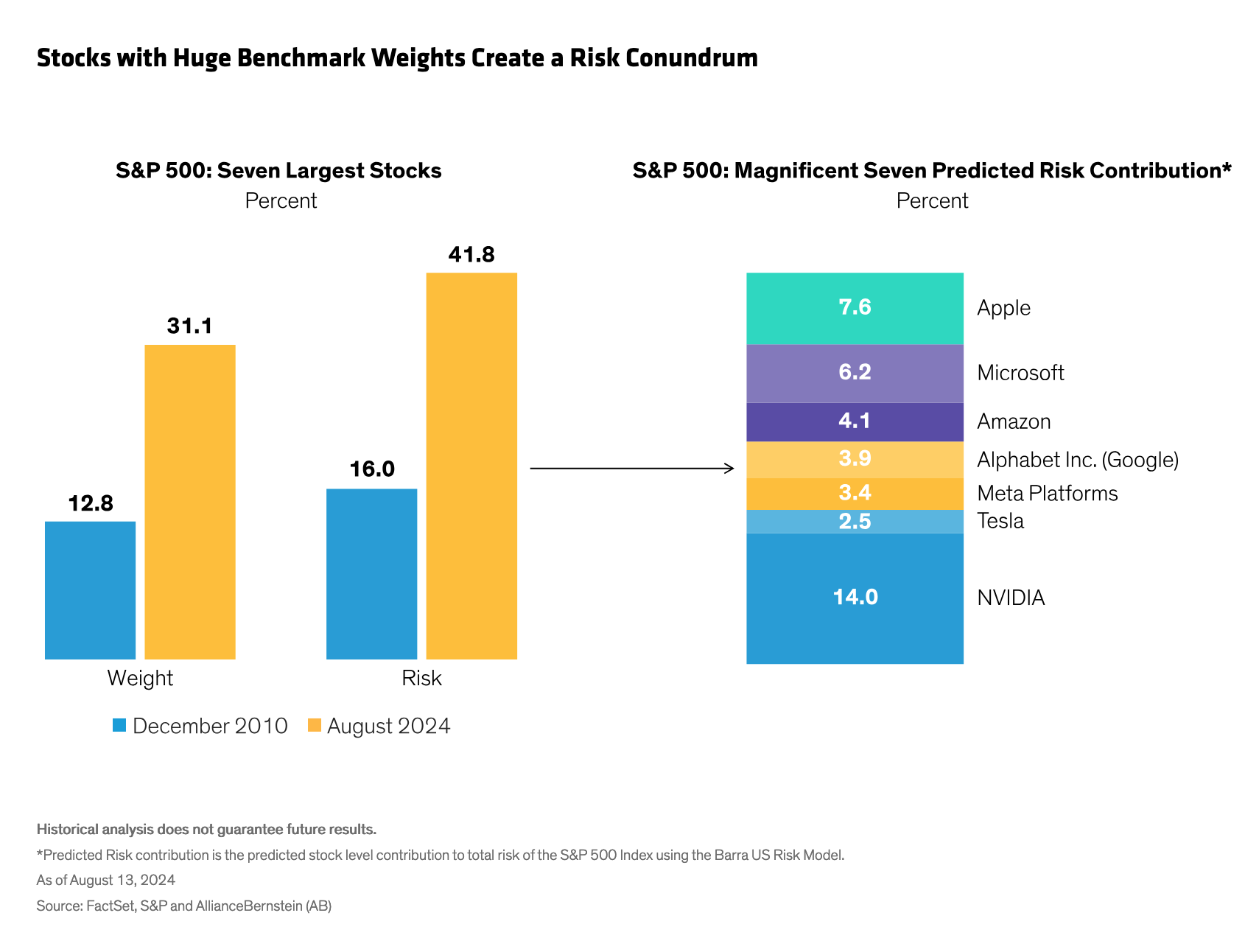

That’s changed in recent years. First came the so-called FAANG stocks, then the Magnificent Seven. The latter group—Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA and Tesla—comprised a combined 31.1% of the S&P 500 and 21.6% of the MSCI World Index as of August 16. They’ve also driven market returns disproportionately since late 2022. While returns within the group have diverged recently, active managers who didn’t hold at least benchmark weights across the seven megacaps had an inherent disadvantage over the last two years. The predicted total risk contribution of these seven stocks to the S&P 500 Index reached 41.8% in August—more than 2.5 times greater than the top seven stocks in 2010 (Display). For growth investors, the conundrum is magnified. Technology stocks comprise nearly 50% of the Russell 1000 Growth Index today; technology and communications services companies combined account for more than 60% of that index.

For growth investors, the conundrum is magnified. Technology stocks comprise nearly 50% of the Russell 1000 Growth Index today; technology and communications services companies combined account for more than 60% of that index.

What’s Different This Time?

Market concentration isn’t new. We’ve seen it before in different forms. At the end of the dot-com bubble in March 2000, technology stocks accounted for almost 50% of the Russell 1000 Growth and nearly a third of the S&P 500. Before the global financial crisis in 2008, financials made up about 40% of the MSCI World Value Index.

However, even when considering those episodes, it’s uncommon for such a small cohort of stocks to be such a disproportionately large weight of the index. For example, from September 1989 to July 2024, the 10 largest stocks in the S&P 500 averaged 21.2% of the index, compared to 34.4% today. So in recent decades, equity portfolios didn’t have to worry as much about how large underweights in individual stocks might affect returns.

Not anymore. Gone are the days when a portfolio manager could simply say, I don’t like the stock, so I won’t own it. Today, not owning a megacap like Apple or NVIDIA could create the biggest relative risk position in the portfolio, and as such, requires a commensurate level of conviction.

Investment Philosophy Matters

So how can an active portfolio manager justify taking that kind of risk? We think it all comes down to the investment philosophy that underpins a stockpicking process.

Clients purchase active portfolios based on its investing philosophy. For example, a growth portfolio might be rooted in a belief that profitable companies with reinvestment opportunities can unlock the power of compounding returns. A low-volatility equity portfolio could be based on a philosophy that sees quality companies as a way to help reduce downside risk but also participate substantially in rising markets.

These philosophies inform a stock selection process. Growth portfolios might target companies with high-quality features such as return on assets or consistency of earnings growth. Value-oriented portfolios won’t buy stocks with high price tags and should deploy clear criteria to identify catalysts that might prompt a stock’s rerating.

In a disciplined portfolio, all overweight and underweight positions should be rooted in the investment philosophy. Similarly, the philosophy and its execution should inform the patterns of performance and risk that investors expect from the portfolio.

Periodic Underperformance Is the Price of Admission

Sometimes, a strategy may miss out on an impactful market trend due to its philosophy, which can shake an investor’s conviction in the portfolio.

Consider the dot-com boom. In the late 1990s, when technology companies surged to lofty valuations, value equity portfolios underperformed. If a value portfolio bought pricey dot-com stocks just to keep up with the market, it would likely have been breaching the guidelines promised to investors. When the dot-com bubble burst, many value portfolios outperformed, as markets rewarded undervalued companies that were left out of the dotcom craze.

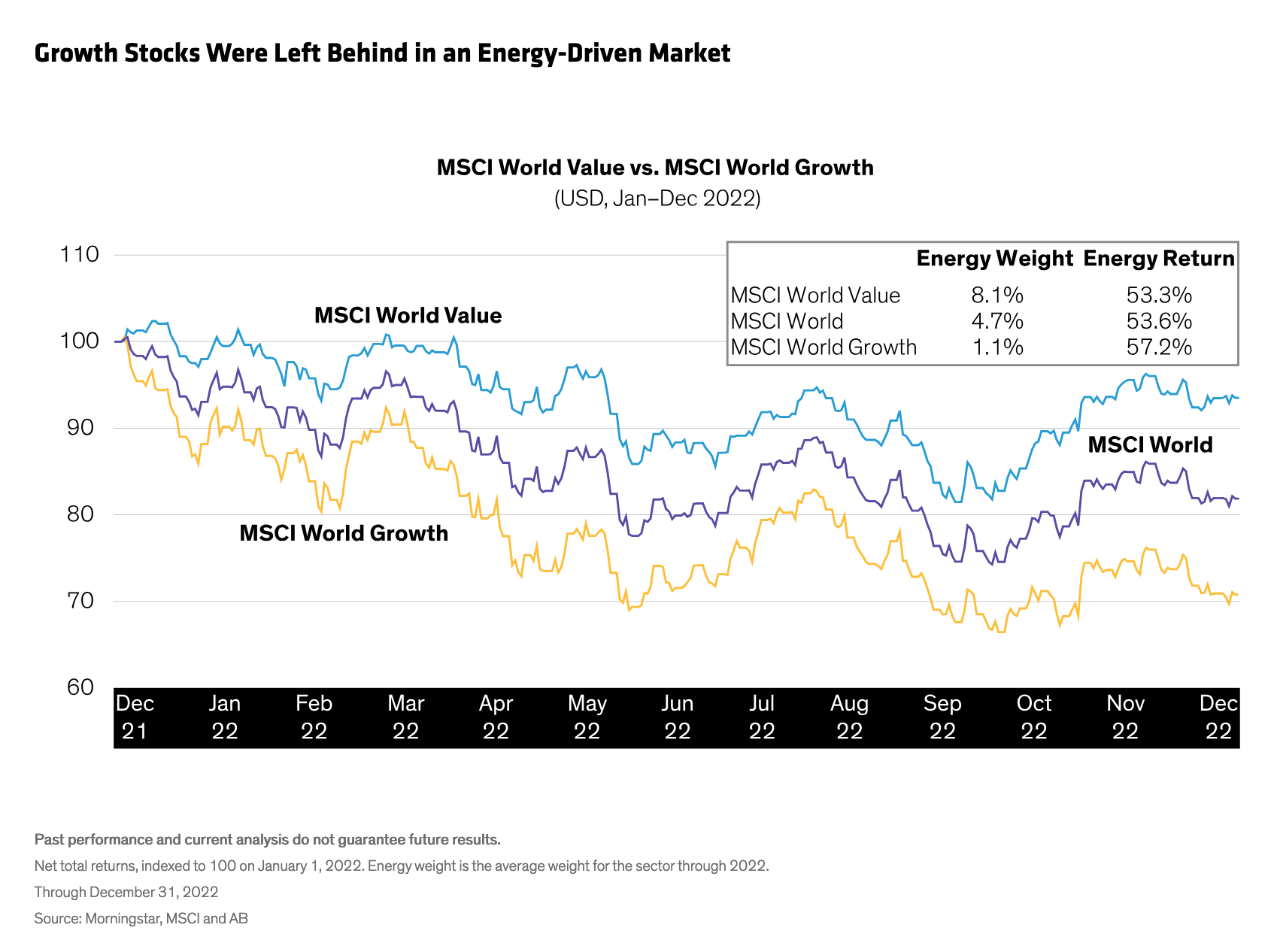

More recently, the energy crisis sparked by Russia’s invasion of Ukraine is another case in point. In 2022, energy stocks surged for several months as oil and gas prices spiked. Energy stocks are commonly held in value portfolios, but growth portfolios were left behind (Display). At the time, most growth investors would never have expected their portfolios to take large positions in the lower-growth, more cyclical energy sector. In other words, periodic underperformance is the price of admission for equity strategies with well-defined investment philosophies.

Today’s markets present unique challenges. That’s because the concentration is in a much healthier set of companies than at other times in history. The Magnificent Seven companies include great businesses, but some of the constituents may not fit with active equity philosophies and processes—even for some growth managers. Portfolio managers face a tricky balancing act: they must adhere to what defines an attractive stock, based on their philosophy, while also delivering on the risk characteristics of the overall portfolio. As a result, in today’s highly concentrated market, you might find that the portfolio’s biggest risk is in a stock it doesn’t own.

Developing Conviction in What You Don’t Own

So how can equity managers cope?

First, equity portfolios that avoid or underweight a megacap stock must develop a robust thesis for the position in line with the investing philosophy. Does the future earnings potential justify the current valuation? Is its business quality as strong as perceived? Do you think the company’s capital investments in AI are likely to deliver a sufficient long-term return on investment? Are the company’s managers good stewards of capital? Answering questions like these can help determine whether it belongs in the portfolio or not.

Second, investors who underweight a giant stock must continue to monitor its progress. In some cases, evolving evidence may require a rethink. Portfolio managers must be open to changing course and adding a stock when warranted, even if strong gains have been missed.

Third, look for different ways to capture the growth potential of the megacap stocks elsewhere. Given strong recent performance, Magnificent Seven valuations have risen. Equity investors may find opportunities to buy holdings in other AI-driven companies that benefit from the same trends but are much cheaper, for example in the software industry or in emerging markets.

Challenge Your Manager

Clients, too, should think proactively about underweights. Challenge your portfolio manager to articulate the rationale behind large underweight positions; question why held positions are more attractive to understand their fundamentals and relative valuations; and ensure that all these decisions align with the portfolio’s philosophy.

Deploying an active investment philosophy requires consistency and discipline—even when it doesn’t seem to be working as expected. By reinforcing the rationale behind an investing philosophy with transparent communication, we think investors can gain confidence in a portfolio’s ability to capture long-term return potential without taking excessive risks via oversize positions in a small group of very large stocks.

The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

Copyright © AllianceBernstein