by Jared Franz, Gerald Du Manoir, Chris Buchbinder, John Queen & Steve Watson, Capital Group

With global equity markets selling off sharply in the first few days of August, investor sentiment has quickly shifted from exuberance to apprehension. Concerns about softening U.S. economic growth, high interest rates and technology sector valuations have combined to shake confidence in a market that was previously priced for perfection.

At such times of stress in the markets, it’s important to take a step back, review the fundamentals, and determine whether the current volatility is perhaps an overreaction or an expected correction after a long stretch of strong returns.

Here are five views from Capital Group investment professionals assessing the latest, fast-changing market developments.

Macro view remains positive

Jared Franz, U.S. economist

We're in the summer season where market liquidity is low and so markets generally overshoot based on positive and negative news. That's unlikely to change in the next few weeks so I'd expect more volatility to come.

On the economic side I'm not seeing anything in the data that would suggest a sharp drop-off or a change in the fundamentals of the U.S. economy. Most of what I'm seeing is a slump in the pace of economic activity, but not necessarily a contraction.

A flagging economy is generally consistent with weakening labour markets and wages, which have the effect of slowing the pace of consumption. That said, if we continue to see economic data weakening across the board, consistent with U.S. unemployment rising above 4.5% to 5.0%, I think that would lay the groundwork for more interest rate cuts from the U.S. Federal Reserve than the market has priced in right now. Another key change and difference versus three to six months ago is the pace of economic activity in Europe and China, which has been much slower of late.

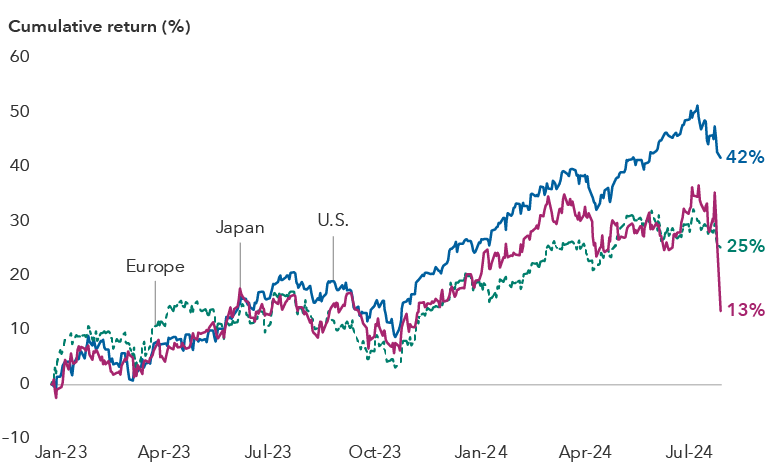

Global equity markets have experienced a strong run-up until now

Sources: MSCI, RIMES, Standard & Poor's. Returns are cumulative total returns in S&P 500 Index, MSCI Europe and MSCI Japan from January 1, 2023, to August 5, 2024. August 5 data is based on intraday values.

Even with a modestly slowing economy, U.S. corporate earnings have been robust. Overall, equity markets remain reasonably priced with the S&P 500 Index trading at a multiple of 20.8 times 12-month forward earnings, and even the Magnificent Seven (ex-Tesla) at 27.8 times, as of August 2. And even though the market selloff has been at least partly triggered by worry that the Fed may be behind the curve in lowering rates, the fact is that we are at the beginning of an easing cycle with both nominal and real interest rates that are not exceedingly high by historical standards.

Taken altogether, this feels more like a serious pocket of turbulence rather than a full-blown contraction.

Equity markets were primed for a fall

Gerald Du Manoir, portfolio manager, Capital Group International Equity Fund™ (Canada)

We have witnessed a period of hyperconcentration where the market was suggesting that only a few companies deserved to be trading at higher multiples. Investors were very focused on themes. Going forward, I expect the market to be more focused on company fundamentals, regardless of the theme, whether it is artificial intelligence (AI) or weight loss drugs, or value or growth.

In the last few years, a number of solid companies’ valuations compressed as the market focused on tech and AI. Many of those companies have held up relatively well recently. I think this correction is telling us is that, going forward, it will be crucial to focus on company fundamentals. A balanced and diversified approach will be essential. And, eventually, the fundamentals will reassert themselves.

AI entering a zone of disillusionment

Chris Buchbinder, portfolio manager, Capital Group U.S. Equity Fund™ (Canada)

A correction in AI-related stocks was to be expected. There has been a great amount of enthusiasm around AI, just as there was around the internet in 2000. I think AI is absolutely real and will change all of our lives in dramatic ways over the next five to 10 years. But I also think we are entering a zone of disillusionment. With any growth trend, there is a period when fundamentals may slow, and while they may end up being great over the long term, you can get extreme reactions in the market.

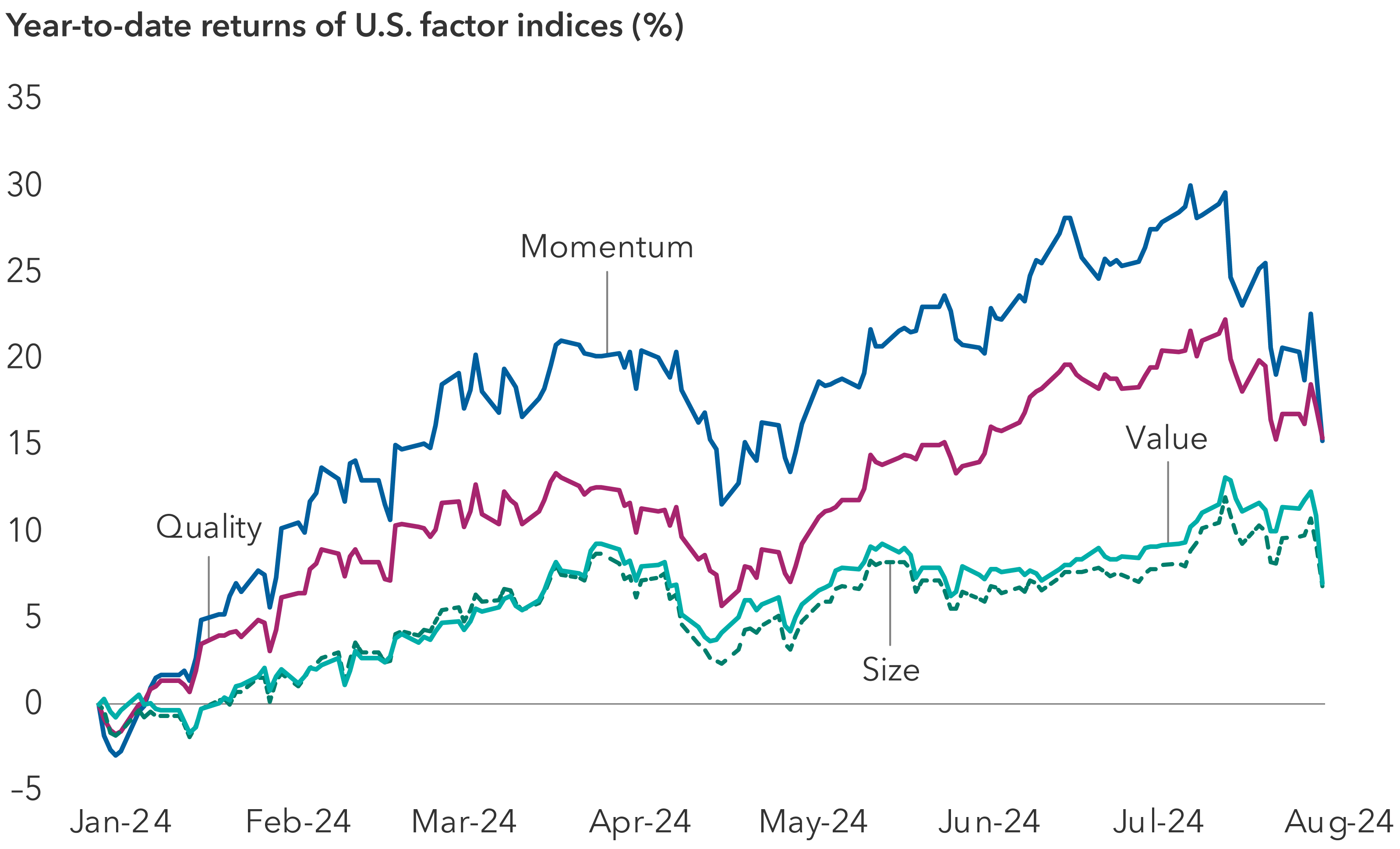

Indeed, while the recent equity market selloff has been swift and powerful, it has been most acute among so-called momentum stocks, or stocks whose share prices have been trending in one direction for a period. Many dividend payers and quality companies, or those companies with visible near-term cash flow generation, have held up relatively well.

Momentum stocks have taken the brunt of the selloff

Source: MSCI. Factor indices are components of the MSCI USA Index. Returns shown are total returns from January 1, 2024, through August 2, 2024. Returns are in USD.

Bonds holding up amid stock market plunge

John Queen, fixed income portfolio manager

Rates markets offered some respite during this broad equity downturn, as U.S. Treasuries rallied significantly in reaction to Friday’s jobs report. Investors seeking shelter amid heightened recession fears pushed Treasury yields down significantly last week, while equities fell and credit spreads widened. (Bond yields move inversely to prices.)

These market moves follow a weaker-than-expected payroll report in the U.S. on Friday showing slower job growth and an unemployment rate that rose to 4.3% from 4.1% in June, triggering the Sahm Rule, which states that such a rise in the unemployment rate from a trough has never occurred without a recession. Last week, the Fed held rates steady at a range of 5.25% to 5.50% for the eighth consecutive time. Fed chair Jerome Powell signaled that cuts could come as soon as September, but markets are questioning whether a standard 25-basis-point reduction will be too little too late.

With higher starting yields across the curve, bonds have been able to do what they are meant to do when equities sell off. The negative correlation between bonds and stocks serves as a reminder of the importance of diversification and the role of fixed income in investors’ portfolios.

Friday’s job numbers continued to show moderation and might show us on a path to real weakness and recession, but it is not clear we are on one yet. Given the violent swings we have seen year to date due to individual economic data releases and market expectations for rate cuts, we believe it is prudent to remain forward-looking and focused on the bigger picture when identifying the right time to adjust positions.

Japan provided initial sparks for global selloff

Steve Watson, portfolio manager, Capital Group Capital Income Builder™ (Canada)

A spike in the value of the Japanese yen may also be contributing to market volatility in the U.S. Last week, the Bank of Japan surprised markets by raising its benchmark interest rate 15 basis points to 0.25% — its highest level since the global financial crisis — and announced a plan to pare back its quantitative easing program. This led the yen to appreciate significantly against the U.S. dollar.

The impact has been felt by Japanese equity markets, which fell sharply, and it could be filtering through to the U.S. The yen has been a currency of choice for many investors executing so-called carry trades, in which they borrow in a low-yielding currency to invest in other higher yielding currencies or assets. With the yen rebounding dramatically, investors in these trades could be selling other assets, including U.S. stocks, to find liquidity to cover their losses and fund capital calls. However, it is difficult to quantify the magnitude of any such effect.

Some would say that the recent strength of the Japanese yen has caused investors in Japan to shift out of the Magnificent Seven stocks, which has led the U.S. market down. Perhaps so. But I’d say a more probable answer is that U.S.-listed growth stocks just got too expensive and now need some time to correct.

Meanwhile, Japanese stocks have rallied over the past year on expectations of improving fundamentals. Companies have come under pressure from regulators to improve overall financial health, leading many to dispose of non-core businesses. Against this backdrop, some investors worry that Japan’s central bank may have tightened policy too soon.

Jared Franz is an economist with 18 years of investment industry experience (as of 12/31/2023). He holds a PhD in economics from the University of Illinois at Chicago, a bachelor’s degree in mathematics from Northwestern University and attended the U.S. Naval Academy.

Gerald Du Manoir is an equity portfolio manager with 34 years of investment industry experience (as of 12/31/2023). He holds a degree in international finance from the Institut Supérieur de Gestion in Paris.

Chris Buchbinder is an equity portfolio manager with 28 years of investment industry experience (as of 12/31/2023). He holds bachelor's degrees in economics and international relations from Brown.

John Queen is a fixed income portfolio manager with 34 years of investment experience (as of 12/31/2023). He holds a bachelor's degree in industrial management from Purdue.

Steve Watson is an equity portfolio manager with 36 years of investment experience (as of 12/31/23). He has an MBA and an MA in French studies from New York University as well as a bachelor's degree from the University of Massachusetts.

Copyright © Capital Group