by Chris Buchbinder, Equity Portfolio Manager, Capital Group

Investor enthusiasm for artificial intelligence has gripped the financial markets and shows no signs of loosening its hold.

Semiconductor giant NVIDIA, the leading maker of AI chips, has seen its U.S. stock soar 150% in the first half of the year, boosting the company’s market value to US$3 trillion and briefly making it the largest company in the world. Tech giants Microsoft, Amazon and Broadcom, among the most visible participants in the AI build-out, have also seen their shares rally.

With its potential to turbocharge productivity across the economy, generative AI clearly is a critical concept for us all to understand, not only from the perspective of how we live our lives and operate our businesses but also from an investing perspective.

As much as I believe in AI’s long-term potential, I’ve learned to be skeptical when stocks run this far, this fast. I was an analyst covering telecom companies in the late 1990s during the tech and telecom boom. I remember seeing the tremendous excitement over the internet’s potential to transform the economy. Unfortunately, there was a disconnect between that immediate investor enthusiasm and the real economic benefits that ensued years later.

This was an important lesson for me. The internet has since had a major impact on economic activity, but the returns didn't show up right away — and investors became impatient.

Here are four risks I am thinking about as I consider AI-related investments in my portfolios.

1. Investors often overestimate technology’s near-term impact

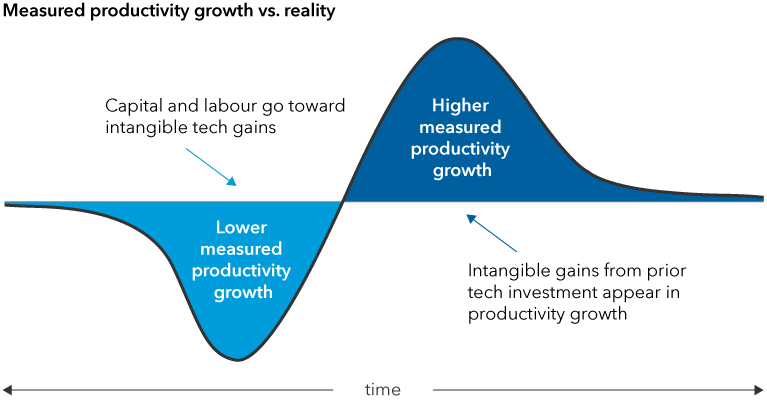

We tend to overestimate the impact that technological innovation will have in the near term but underestimate its impact over the longer term. This can be explained by the productivity J curve. When technology is introduced, companies and investors become excited by its transformative potential and invest heavily in building out infrastructure.

Productivity gains from new technologies often take years to surface

Sources: Capital Group, MIT Initiative on the Digital Economy. The productivity “J curve” illustration shows the lag effect that the introduction of new technology can have on total factor productivity (TFP). TFP is measured as the change in aggregate economic output that is not associated with changes in either capital or labor input and approximates the impact of technology change.

But adapting to new tools for productivity gains takes time. New technology can be a drag on productivity as enterprises and individuals continue with old processes while learning and integrating new ones. As a result, it can be several years before tangible economic benefits are realized.

I believe 10 years from now AI will have transformed the way we do business. But that doesn’t mean that returns will show up immediately or that AI is a one-way escalator up for companies. It is also a cycle, and it will be subject to the same psychology and laws of economics that we've seen in other innovation cycles.

2. The pace of capital investment will depend on results

Tech giants Microsoft, Meta, Alphabet and Amazon have invested tens of billions of dollars in AI infrastructure. Much of this has been spent on semiconductors and other materials needed for the build-out of data centres. For these so-called hyperscalers (companies that represent the leading providers of internet and cloud platforms) to continue spending at such elevated levels, I expect they will need to see a tangible return on their investment in the form of revenue and, ultimately, profit growth.

Tech giants are investing heavily in AI and other capital projects

Sources: Capital Group, FactSet, Standard & Poor’s. “Big Tech’s proportion of total capex” represents total capital expenditures by Alphabet, Amazon, Meta and Microsoft as a percentage of total capital expenditures by companies in the S&P 500 Index. Data as of June 30, 2024.

Will we see returns from AI unfolding over the next year or two? I expect that for some companies we will but for many others we won't. It seems likely that there will be hiccups along the way for companies whose stock prices are already reflecting future AI-related growth expectations.

I've seen this movie before. The market and companies become very enthusiastic about a growth opportunity and invest significantly toward that opportunity. In this case that means spending heavily on AI-related infrastructure. When the market changes its mind and decides spending is a bad thing, the companies will eventually line up and begin to cut spending. That is not the mindset that you see right now with AI-related investments, but when the market changes its mind, you will eventually see that mindset permeate the industry and spending will come down.

The market did in fact punish some leading growth companies in 2022 that were spending aggressively because the return on investment wasn’t there. Meta, the parent of Facebook, notably responded by declaring 2023 a year of efficiency, and it took aggressive steps to cut spending. Today I think that spirit of efficiency still exists across big tech. I expect that these companies will be more disciplined on investments and profit orientation than they have in the past, and that they will eventually show discipline with respect to AI-related spending. If so, this could result in flattening capex but profit and margin surprises over the next several years.

3. Resource constraints could further slow the AI rollout

Building out AI infrastructure requires many resources, not least human talent. This includes not only people who can build the foundational models on which generative AI depends, but those who know how to deploy them at enterprises. AI also requires a great deal of electricity to operate its data centres.

As a result, demand for energy is soaring — pressuring the grid. Hyperscalers have turned to nuclear energy providers to help meet their enormous power needs. In March, Amazon purchased a data centre from Talen Energy to access nuclear power from a nearby Talen plant in the state of Pennsylvania. Last June, Microsoft struck a deal with Constellation Energy to supply one of its data centres in Virginia with nuclear power.

Potential capacity constraints suggest that AI data centres may not be able to grow as quickly as some expect over the next several years.

4. Bubbles can inflict a lot of pain

Has AI entered bubble territory? I don’t know, but we are getting increasingly close to one. As I mentioned earlier, my experience as a telecom analyst in the late 1990s gave me a front row seat for the expansion and bursting of the tech and telecom bubble, so I know how painful the downsides of these market cycles can be. I also know that the cycles tend to occur even if much of the long-term promise ends up being realized, whether with respect to the internet in the 1990s and 2000s or AI today.

Unlike the 1990s tech bubble, recent tech stock gains have been supported by earnings growth

Sources: Capital Group, FactSet, Standard & Poor's. The S&P 500 Information Technology comprises those companies included in the S&P 500 that are classified as members of the GICS® information technology sector. Forward P/E represents the ratio between stock prices and the forward 12-month consensus earnings per share estimate. The two years prior to the dot-com bubble represents the 24 months ended February 29, 2000. The last two years is the 24 months ended June 30, 2024.

To be clear, the excitement over AI stocks is different than the 1990s bubble. For starters, NVIDIA and other tech giants have recorded strong earnings growth in recent quarters and have more valuation support than the leading stocks had in 2000. But I do expect we will reach a zone of disillusionment at some point over the next 12 to 24 months where growth stalls. Despite what has been a strong persistent trend, some leading AI stocks stand the chance of sustaining steep pullbacks. What’s more, it’s not always clear at the start of a major innovation cycle which companies will emerge as long-term winners, so it is important that investors be mindful of the risks.

Even if AI meets the most optimistic expectations of its potential, investors can lose a fair amount of money along the way. When the 2000 tech and telecom bubble burst, many companies went out of business; others sustained steep declines in market value. It took years for some to recover. Back in the late 1990s, Cisco Systems, the maker of networking hardware and telecom equipment for the internet, saw its shares soar, making it the most valuable company in the S&P 500. After the bubble burst, shares plummeted nearly 80% as telecom companies cut spending. The company has yet to recover to its highs of that period.

The bottom line

Today we're in a period of heightened enthusiasm for AI, and I don't question that enthusiasm. I think AI will be spectacular and very important. But I believe that at this point in the cycle investors should be selective and carefully consider the risks.

Chris Buchbinder is an equity portfolio manager with 28 years of investment industry experience (as of 12/31/2023). He holds bachelor's degrees in economics and international relations from Brown.

Copyright © Capital Group