by Larry Adam, CIO, Raymond James

The S&P 500 is off to its best start to the year since 2019.

Having hit 31 record highs since January and up more than 15% year to date, the S&P 500 is off to its best start to the year since 2019 and the best start to an election year ever, driven by mega-cap tech stocks and artificial intelligence (AI) tailwinds. NVIDIA’s meteoric gains and 10-for-1 stock split briefly propelled the company’s market cap above $3 trillion, surpassing Microsoft as the most valuable public company in the world.

“Tech, Communication Services, and Consumer Discretionary remained center stage as market performance concentration continued — S&P 500 minus mega-cap tech was down,” said Raymond James Chief Investment Officer Larry Adam. “The market continues to rally on weaker economic data but we caution that a slowing economy could dampen earnings growth and hamper the market in the near term.”

Economic growth has moderated – a good sign to those looking to trust recent, improving inflation numbers. For fixed income, this has helped the Bloomberg U.S. Aggregate Bond Index claw back its year-to-date losses.

The year started with expectations for the Federal Reserve to cut interest rates three times beginning in the middle of the year, but higher than expected inflation early in the year halted those hopes. The Fed once again chose to hold rates steady in June and revised its projections to signal only one rate cut this year. However, if inflation continues to cool, we may see two.

The Consumer Price Index (CPI) printed 0.0% in May – a surprise to the markets, which were expecting a 0.1% increase. The core CPI also came in lower than market expectations, up 0.2%.

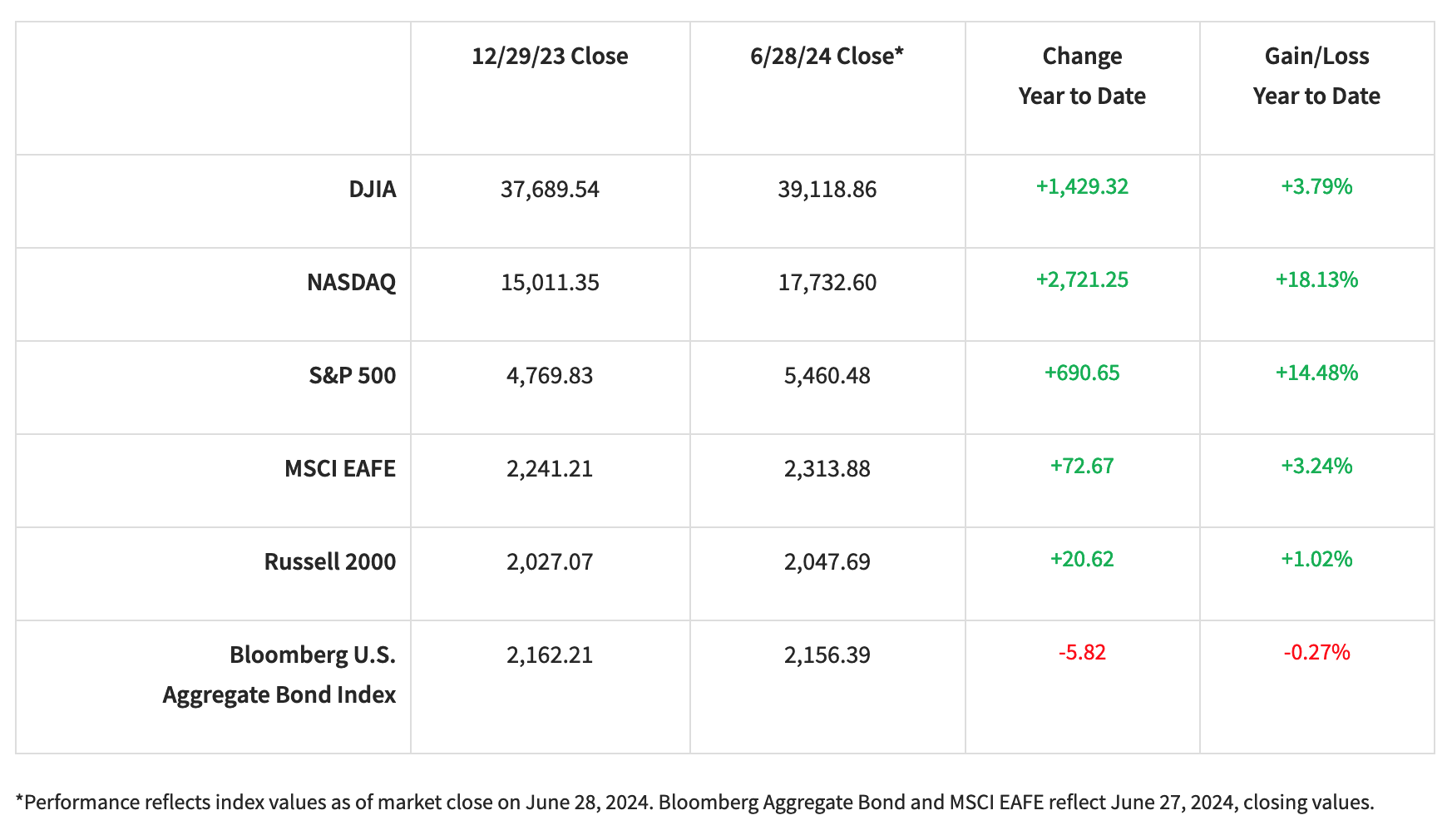

We’ll dig further into the details below, but first a look at the numbers year-to-date:

While tech mega-caps have dominated performance in the S&P 500 this year, last month we saw the first significant pullback and possibly the end of AI stocks’ rocket-like growth. The question now is: If the leaders take a breather, will the whole market decline or will the laggards get enough action to keep the Index relatively flat?

Labor market holds up, home sales slow down

Nonfarm payrolls grew by 273,000 jobs in May while the household survey showed a decline of 403,000, bringing U.S. unemployment up to 4% for the first time since January 2022. The disparity isn’t entirely unusual, but looking at both surveys together creates a clearer picture of the strength of the labor market.

Existing home sales declined in May, but that weakness is yet to be reflected in existing home sale prices, which continue to rise despite the increase in inventory. New home sales declined more than expected with the increased inventory bringing new home sales prices down. In April, both housing starts and housing permits were also lower than expected, indicating that the market for new homes as well as residential investment is weakening.

PCE signals inflation may be continuing to decline

After a lower-than-anticipated CPI, the bond market waited with bated breath for the Personal Consumption Expenditures (PCE) Index. A lower than expected PCE report on Friday marked a directional trend of significance that will likely lead investors to get ahead of lower interest rates, putting additional pressure on the Fed.

More tech and trade restrictions imposed on China

The U.S. intensified efforts to restrict China’s access to advanced chip technology last month, focusing on high-bandwidth memory (HBM) and gate all-around (GAA) chip technology, both of which are crucial for AI applications. Japan and the Netherlands coordinated with the U.S. to impose additional tech and trade restrictions on China, which could lead to volatility in the global semiconductor industry.

June also marked significant progress in U.S. nuclear energy policy with the passage of the ADVANCE Act, aimed at revitalizing the nuclear industry and maintaining global leadership in nuclear technology.

Oil market remains range-bound amid continued risks

The global oil market remained in a relatively tight trading range last month, with Ukraine’s drone strikes against Russian oil infrastructure having only a modest effect on supply and violence in the Middle East still a headline risk. On the demand side, the International Energy Agency and OPEC released conflicting forecasts, with OPEC calling for double the demand growth forecasted by IEA.

Uncertainty in France; progress in the UK

Developments in the euro area dominated the international investment backdrop in June, with French President M. Emmanuel Macron’s decision to dissolve the country’s lower house National Assembly and hold snap elections surprising both regional politics and the market. Whatever the result of those elections, leaders will be tasked with addressing the deterioration of the country’s public finances in the aftermath of the pandemic and regional energy crisis of 2022.

In contrast, the UK economy is faring comparatively well, as headline inflation hit the 2% target after three years, which will serve as a tailwind for whichever party wins the July 4 election. Still, the Bank of England has voted to maintain the key base interest rate at 5.25% until the incoming government’s plan for pursuing its policy agenda becomes clear.

The bottom line

With the S&P 500’s dogged run and the looming election, it’s normal for investors to ponder the best course of action. Navigating all-time highs is part of the journey – they don’t always mean a correction is imminent, but rather signal a healthy and growing economy. Even if a correction does occur, taking a long-term view will generally yield better results.

Investing involves risk, and investors may incur a profit or a loss. All expressions of opinion reflect the judgment of the authors and are subject to change. There is no assurance the trends mentioned will continue or that the forecasts discussed will be realized. Past performance may not be indicative of future results. Economic and market conditions are subject to change. The Dow Jones Industrial Average is an unmanaged index of 30 widely held stocks. The NASDAQ Composite Index is an unmanaged index of all common stocks listed on the NASDAQ National Stock Market. The S&P 500 is an unmanaged index of 500 widely held stocks. The MSCI EAFE (Europe, Australasia and Far East) index is an unmanaged index that is generally considered representative of the international stock market. The Russell 2000 is an unmanaged index of small-cap securities. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. An investment cannot be made in these indexes. The performance mentioned does not include fees and charges, which would reduce an investor’s returns. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility. Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors. U.S. government bonds and Treasury notes are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury notes are certificates reflecting intermediate-term (2 -10 years) obligations of the U.S. government. Companies engaged in business related to the technology sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. MAGMAN stocks is a term used to describe six of the current largest and least volatile technology companies listed on the NASDAQ – Microsoft, Apple, Google, Meta, Amazon and Nvidia.

Material created by Raymond James for use by its advisors.

Copyright © Raymond James