by Alister Hibbert, Managing Director, BlackRock Fundamental Equities

Market indexes can be a useful barometer of long-term performance. But the investment opportunity set need not start and end there. Fundamental Equities investor Alister Hibbert uses an unconstrained approach in seeking to identify those rare companies that stand out from the pack.

Key takeaways

- An unconstrained equity strategy uses a benchmark-agnostic approach in seeking to assemble a portfolio of market-leading stocks.

- Fundamental-based analysis drives investment decisions and results in high-conviction positions with potential to outgrow the market across time.

- It’s a long-term, differentiated approach in a market increasingly dominated by short-termism.

What is unconstrained equity investing?

An unconstrained investing approach gives professional portfolio managers the ability to construct a portfolio free from the prescriptions and dispositions of a market benchmark. The aim is to build a differentiated portfolio of investments with the potential to provide outcomes that are distinct from those offered by the broader market.

Alister Hibbert, Co-Portfolio Manager of the BlackRock Unconstrained Equity Fund (MAEGX), describes benchmarks as an “artificial construct” when it comes to stock selection. His approach to unconstrained investing entails not simply tilting away from a benchmark but starting from “a blank sheet of paper to build the very best portfolio we can based on individual company analysis.”

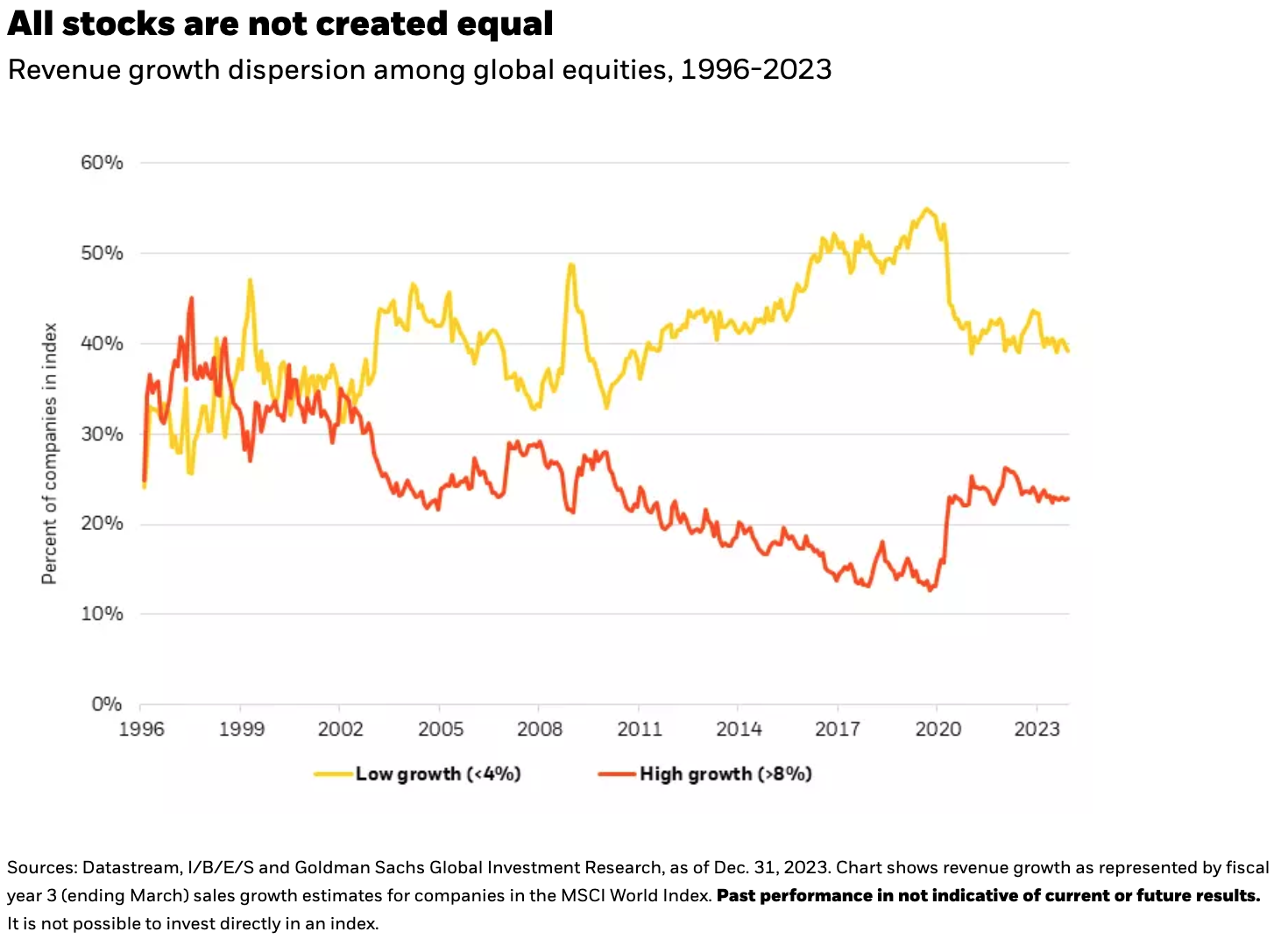

The opportunity to apply that analysis and parse potential winners and losers is compelling today given wide market dispersion. The chart below shows the percent of high-growth versus low-growth companies in the MSCI World Index across time, with the current gap large enough to suggest potential for skilled stock picking to strive to generate outperformance.

Because relatively few businesses meet the strict criteria that Mr. Hibbert and his team seek, they typically invest in just 20-30 companies with the goal of maintaining their positions across time to fully benefit from what they view as exceptional long-term growth prospects.

“We aim to give our investments the time to compound their returns while avoiding the distraction of short-term opportunism,” he says. The team prioritizes a deep focus on company fundamentals that ignores the daily distractions of benchmark noise and the temptation to trade on near-term news flow.

And in fact, history suggests it is company fundamentals, such as earnings growth and dividends, that account for the lion’s share of return across time. See chart below.

Does greater concentration mean greater risk?

A smaller group of holdings does imply that declines in any one can have a larger impact on overall portfolio return. Yet the inherent nature of an active approach seeks to mitigate this risk by allowing portfolio managers to center their research intensity on what they see as the highest-potential stocks.

In the funds Mr. Hibbert oversees, including the new BlackRock Long-Term U.S. Equity ETF (BELT), his stance is one of a long-term business stakeholder willing to weather short-term hiccups in pursuit of long-term outperformance. “Truly great businesses dominate industries over multiple years, not quarters,” he says.

Yet the team’s rigorous approach to fundamental research means they will disinvest if the structural outlook for a business and, therefore, the long-term investment thesis deteriorates.

Why now for a high-conviction, unconstrained approach?

In recent decades, new investment vehicles alongside information abundance, rapid processing times and human attention constraints have all contributed to a shortening of investment horizons in public equity markets. In many ways, it defies the age-old wisdom in “time in” versus “timing” the markets ― because despite a broader tendency toward shortening, the long-term power of compounding remains intact. This creates inefficiencies ― and an opportunity for long-term investors to capitalize. Heightened dispersion in the growth outlook for businesses also makes this a favorable environment for fundamental-based stock pickers.

An unconstrained, high-conviction approach like the one Mr. Hibbert describes applies a long-term lens to identify those rare companies that are market leaders today and have the underlying business strength to remain leaders 10 years from now. It’s a differentiated approach in a market increasingly dominated by opportunism and short-termism.

Investors looking to outsource stock selection might favor such a portfolio, or those who are already broadly diversified and seeking a new source of risk and return to complement their broader portfolio.

As useful as benchmarks are, there is great thinking and investment capability to be realized beyond their borders. An unconstrained approach can help unlock that untold potential.

Copyright © BlackRock Fundamental Equities