by Thorsten Winkelmann, Chief Investment Officer—Europe and Global Growth, & Marcus Morris-Eyton, Portfolio Manager—Europe and Global Growth, AllianceBernstein

Today’s industrial business models offer surprising sources of consistent earnings growth.

Investors seeking growth in European equities might be discouraged by the lack of technology titans that dominate US markets. But Europe is home to a different type of growth, thanks to industrial companies that offer diverse sources of return potential.

When investors think about growth stocks, industrials aren’t usually the first thing that comes to mind. Industrial businesses are often perceived to be tied to macroeconomic cycles—hardly the types of companies that equity investors associate with consistent, long-term growth.

Gauging the Growth Profile

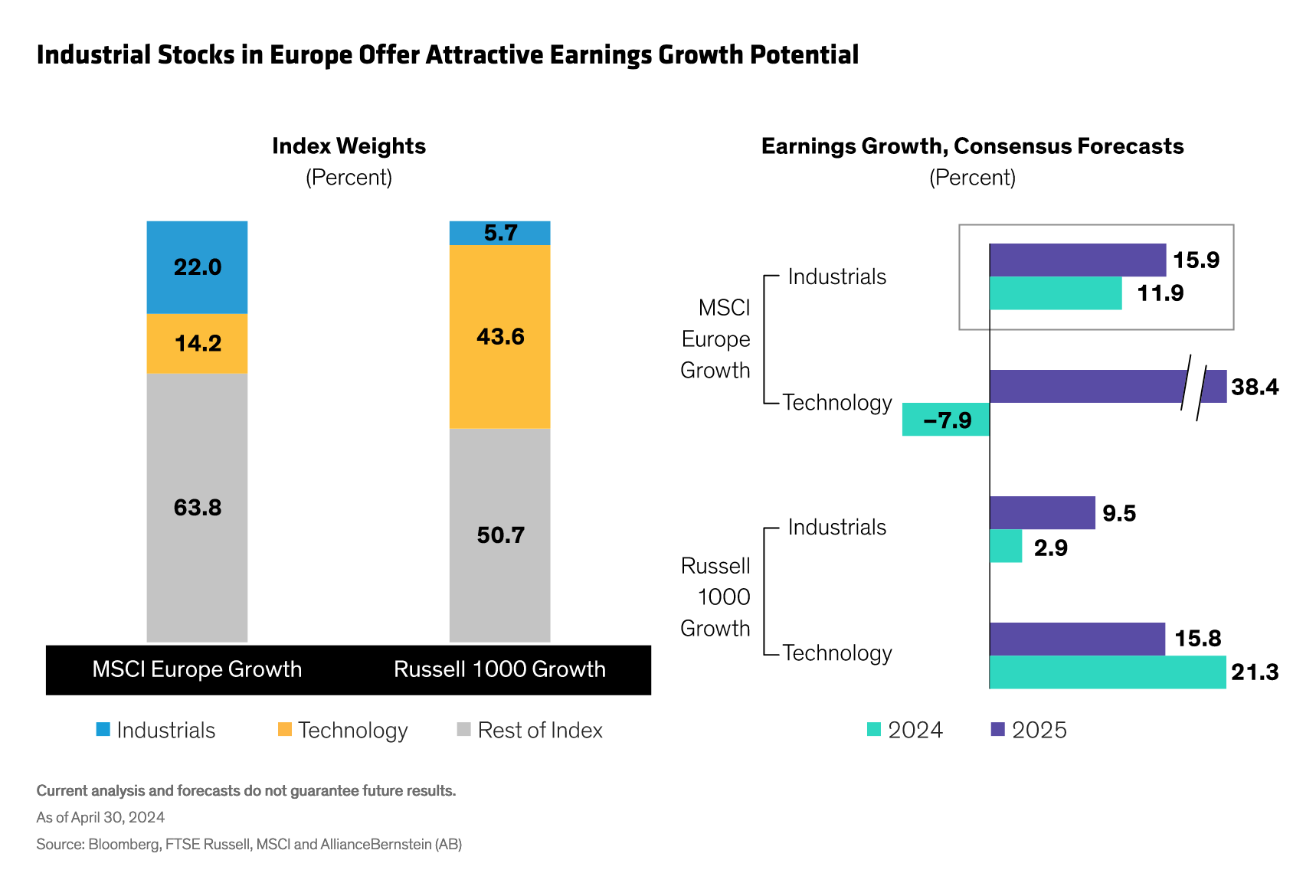

But in Europe, that perception isn’t quite right. In fact, industrials are the largest sector in the MSCI Europe Growth Index with a 22% weight (Display). That’s nearly four times the weight in the comparable US benchmark, where the Russell 1000 Growth Index is technology heavy.

As a sector, European industrials offer solid and improving earnings growth. Consensus earnings estimates for industrials in the MSCI Europe Growth Index are expected to increase from 11.9% in 2024 to 15.9% in 2025 (Display). That’s in line with next year’s earnings estimates for the US technology sector. In the European growth benchmark, the technology sector includes only 15 stocks and is dominated by two large companies, so earnings can be volatile.

But how can a growth-oriented investor know that an industrial stock isn’t cyclically exposed? We think it all comes down to a company’s business model and its specific product or service offering. For example, companies that are leaders in niche industrial markets with little competition often enjoy consistent growth by virtue of strong market shares and competitive advantages that underpin pricing power.

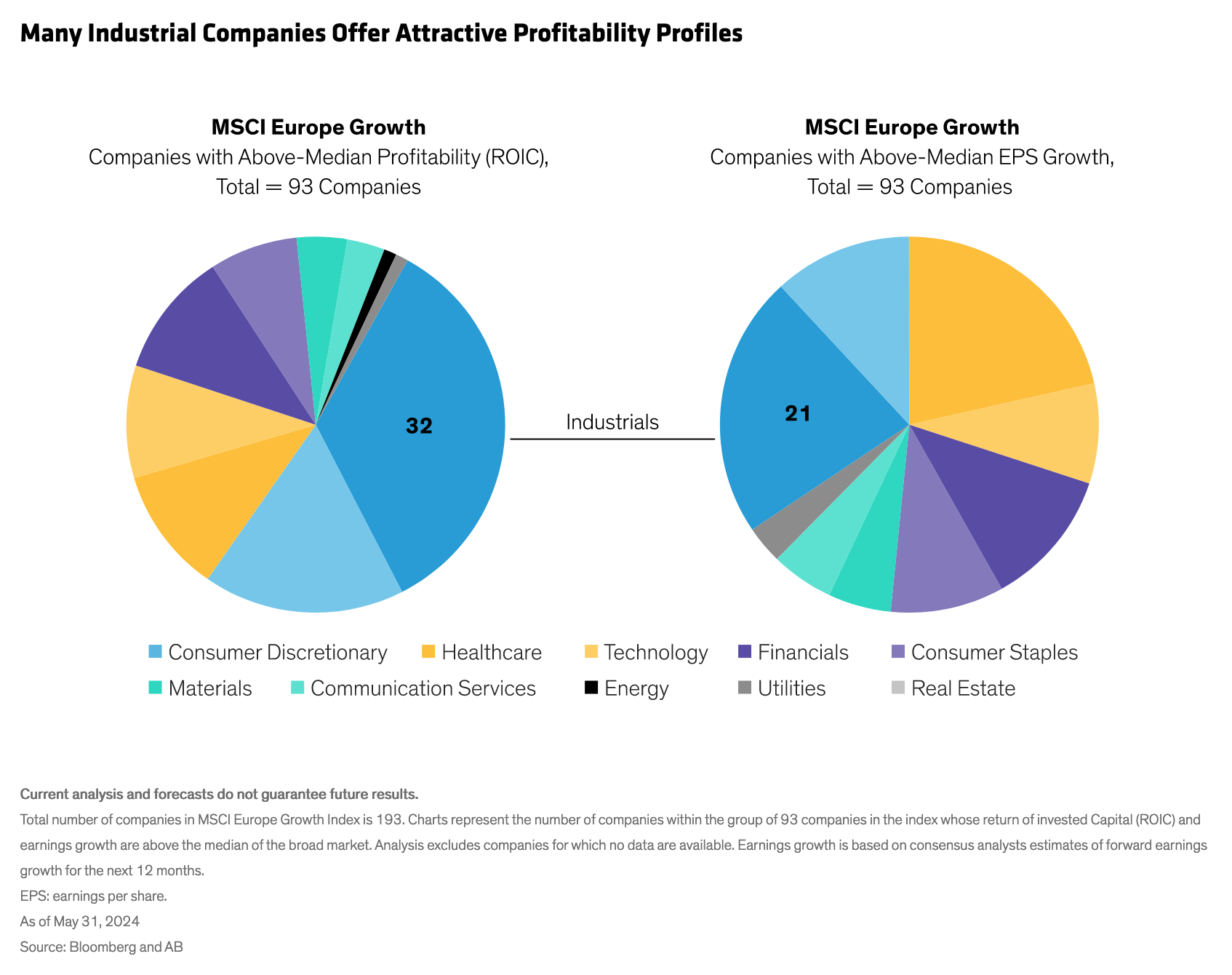

Profitability metrics provide valuable intelligence. Our research suggests that there are more companies with above-median profitability and earnings growth in the European industrial sector than in any other European growth sector (Display). High return on invested capital is a good indicator of underlying business quality, which helps support structurally above-market earnings and cash-flow growth through the business cycle.

Three Attractive Business Models

Within the sector, we see three business models that can provide durable sources of long-term growth potential.

Services and spare parts providers. For some firms, selling the initial industrial tool or machine is often just the gateway to a stream of longer-term cash flows. Industrial workhorses require a regular supply of spare parts and services to keep them humming without interruption. Spare parts and services are typically not discretionary items; they generate recurring purchases and often must be bought from the original equipment manufacturer, which means they command high margins.

Look for clues in revenues. We distinguish between revenues driven by capital expenditures (capex) and operating expenditures (opex). Capex orders are big onetime purchases, such as a massive mining machine, and are more sensitive to macroeconomic cycles. In contrast, opex represents recurring spending, like the spare parts or servicing for mining equipment, which tends to be much less exposed to the business cycle.

The Weir Group, based in Scotland, manufactures mining equipment such as slurry pumps, which transport waste from mining operations. The company generates about 80% of its revenue from the aftermarket, as these machines require spare parts several times per year during their 15-year product lifecycle. Given that the Weir Group’s market share is much larger than its nearest rival, the company’s business model offers resilient growth potential through macrocycles. And since the slurry pump is essential to keep the mine running, customers are willing to pay a premium to buy original Weir parts rather than cheaper competitors’ products.

Serial acquirers and consolidators. In fragmented market segments, some companies can augment a competitive edge with strategic acquisitions. That might involve buying small local competitors and then stepping up purchases of regional and even global businesses.

Beijer Ref is a serial acquirer. The Swedish company sells heating, ventilation and air-conditioning systems and generates most of its revenue from recurring maintenance and spare parts. Its organic growth has benefited from demand for energy efficiency and environmentally friendly refrigeration systems. Meanwhile, Beijer Ref has acquired more than 50 companies since 2004, providing the company with more scale, which it can use to secure better pricing from suppliers and deepen its competitive moat. When executed successfully, bolt-on acquisitions can be valuable drivers of additional growth along with organic development of the business.

Digital transformers. The line between technology and industrials is blurring. Many industrial products are being adapted for the digital age with connectivity devices, data-capture sensors and software capabilities. Europe might not have AI leaders like the ones in the US. But European industrial businesses are enabling AI, such as manufacturers of electrical cables, switchgears, circuit breakers and transformers used in data centers and the wider electrical grid. These companies provide advantages for investors: you don’t need to bet on a specific AI technology leader, since these industrials benefit from the broader AI growth trend.

France’s Schneider Electric is one of Europe’s biggest beneficiaries of the surge in demand for AI and data centers. The company supplies many of the electrical products and much of the software that keep data centers working. Data centers now represent 23% of Schneider Electric’s order backlog, and its customers are outlining spending plans for the next five years. Software has become a bigger component of Schneider Electric’s increasingly digital business, which has helped improve margins and provide a clearer view of future revenue growth.

Visibility Supports Consistent Return Potential

These types of growth drivers aren’t mutually exclusive. Serial acquirers like Beijer Ref can also benefit from recurring revenue from spare parts. Digital transformers like Schneider Electric have also made strategic acquisitions. Industrial companies with one or more of these business model features offer attractive investment opportunities, in our view.

Mapping out the right parameters can unearth exciting industrial firms that bear little resemblance to the capital-intensive smokestacks of the past. And by applying a consistent fundamental research framework, selective equity investors can discover industrial businesses with much clearer visibility of their paths to future growth—and long-term returns.

The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

About the Authors

Thorsten Winkelmann is Chief Investment Officer of Europe and Global Growth. Prior to joining AB in 2024, he spent more than 20 years at Allianz Global Investors, where he was CIO of the Global Growth team and a portfolio manager for the Global Equity Growth and Europe Equity Growth strategies. Previously, he was a portfolio manager within the European Equity Core and Multi-Asset teams. Winkelmann holds an MA in economics from the University of Bonn. Location: Frankfurt

Marcus Morris-Eyton is a Portfolio Manager for Europe and Global Growth. Prior to joining AB in 2024, he was a portfolio manager at Allianz Global Investors, which he joined in 2011. Morris-Eyton also worked as a discretionary sales manager at Allianz Global Investors in London, and in equity research at Credit Suisse. He was named one of the Top 40 Under 40 Rising Stars in Asset Management by Financial News in 2015. Morris-Eyton holds a BA with first class honours in English and philosophy from the University of Leeds. He is a CFA charterholder. Location: London