by John Lynch, Chief Investment Officer, & Team, Comerica Wealth Management

After a soft inflation reading in May, the Federal Reserve reduced rate cut projections for this year. Stocks and bonds rallied, choosing to ignore the message from monetary officials.

Executive Summary

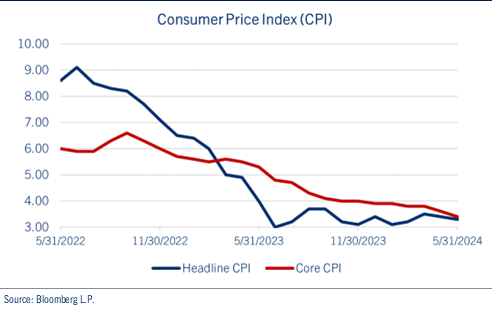

- The Consumer Price Index (CPI) report for May, which was released only hours before the FOMC decision, revealed that both headline and core inflation cooled more than forecast. Headline inflation slowed to 3.3% from a year earlier and was flat from the prior month.

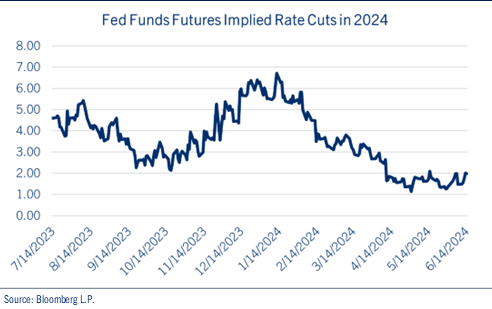

- As widely anticipated, the Fed left interest rates unchanged during last week’s FOMC meeting. Fed Funds Futures markets have largely brushed off the Fed’s hawkish projections. The markets are now pricing in two cuts this year, adding roughly 1/2 cut from the week prior.

- The yield on the 10-year Treasury note fell ~25 basis points over the course of the past week. We are closely monitoring the yield on the 10-year as reductions in this benchmark rate often act as a “pseudo-Fed cut,” easing financial conditions for loans and risk assets.

While election-related headlines may grab investors’ attention this summer, we will be focusing on fundamentals including inflation, earnings and interest rates when positioning our clients’ diversified portfolios.

Download the Weekly Market Update

Inflation

The Consumer Price Index (CPI) report for May, which was released only hours before the FOMC decision, revealed that both headline and core inflation cooled more than forecast. Headline inflation slowed to 3.3% from a year earlier and was flat from the prior month. The biggest improvement came from energy prices, which declined due to demand concerns. Core CPI, which excludes the volatile food and energy components, slowed to 3.4% annually, its lowest reading since mid-2021. See chart: Consumer Price Index (CPI).

The last two CPI reports appear to show the disinflationary trend is resuming, giving credence to the idea that the setbacks to start the year were just seasonality effects, as companies typically try to raise prices early to see if they will stick.

Federal Reserve

As widely anticipated, the Fed left interest rates unchanged during last week’s FOMC meeting. However, new economic projections reveal a higher inflation forecast with monetary officials now expecting only one rate cut this year, compared to three cuts forecasted in March. The updated forecasts reflect the higher-than-expected inflation readings during the first quarter of the year, most of which was released after the Fed’s March projections.

It is difficult to determine the extent to which Fed members incorporated the latest CPI report into their projections. Fed Charmain Jerome Powell indicated that members had the ability to adjust their forecasts following the release of the CPI report but also noted that very few did so. Fed Funds Futures markets have largely brushed off the Fed’s hawkish projections. The markets are now pricing in two cuts this year, adding roughly 1/2 cut from the week prior. See chart: Fed Funds Futures Implied Rate Cuts in 2024.

We suspect it may be challenging, though, to make significant progress on the annual rate of inflation during the second half of this year. The month-over-month inflation data was slow from May through December last year, increasing by an average monthly change of less than 0.2%. Since those months will be rolling off the annual inflation prints as new monthly data is released, the tougher comparisons could make it more difficult for the Fed to gauge progress on YOY price measures.

Fixed Income

Similar to fed funds futures, the bond market also discounted the Fed’s messaging. Indeed, the yield on the 10-year Treasury note fell ~25 basis points over the course of the week. We are closely monitoring the yield on the 10-year as reductions in this benchmark rate often act as a pseudo-Fed cut. Since this rate influences loan pricing for many parts of the economy, movements can have an immediate influence on financial conditions for borrowers in the real economy and also impact the discount rate for risk assets. A further move in the benchmark yield toward 4.0% could benefit stocks, assuming the driver isn’t fear of recession. See chart: U.S. 10-Year Treasury Yield.

Though equities rallied on the Fed’s statement, we continue to view the fixed income market cautiously. As we wrote in our Midyear Market Outlook, investors are encouraged to maintain diversified strategies while keeping interest rate sensitivity (duration) at benchmark levels and embracing credit quality. With this stance, we believe portfolios can benefit from elevated coupons while also mitigating the volatility associated with fears of geopolitics/recession (bond yields lower) and expanding federal deficits (bond yields higher).

While election-related headlines may grab investors’ attention this summer, we will be focusing on fundamentals including inflation and interest rates when positioning our clients’ diversified portfolios.

Be well and stay safe!

IMPORTANT DISCLOSURES

Comerica Wealth Management consists of various divisions and affiliates of Comerica Bank, including Comerica Bank & Trust, N.A. Inc. and Comerica Insurance Services, Inc. and its affiliated insurance agencies.

Comerica Bank and its affiliates do not provide tax or legal advice. Please consult with your tax and legal advisors regarding your specific situation.

Non-deposit Investment products offered by Comerica and its affiliates are not insured by the FDIC, are not deposits or other obligations of or guaranteed by Comerica Bank or any of its affiliates, and are subject to investment risks, including possible loss of the principal invested.

Unless otherwise noted, all statistics herein obtained from Bloomberg L.P.

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Wealth Management does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Wealth Management personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Wealth Management, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.

Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The investments and strategies discussed herein may not be suitable for all clients.

The S&P 500® Index, S&P MidCap 400 Index®, S&P SmallCap 600 Index® and Dow Jones Wilshire 500® (collectively, “S&P® Indices”) are products of S&P Dow Jones Indices, LLC or its affiliates (“SPDJI”) and Standard & Poor’s Financial Services, LLC and has been licensed for use by Comerica Bank, on behalf of itself and its Affiliates. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services, LLC (“S&P”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings, LLC (“Dow Jones”). The S&P 500®® Index Composite is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, or their respective affiliates and none of such parties make any representation regarding the advisability of investing in such product nor do they have any liability for any errors, omissions, or interruptions of the S&P Indices.

NEITHER S&P DOW JONES INDICES NOR STANDARD & POOR’S FINANCIAL SERVICES, LLC GUARANTEES THE ADEQUACY, ACCURACY, TIMELINESS AND/OR THE COMPLETENESS OF THE WAM STRATEGIES OR ANY DATA RELATED THERETO OR ANY COMMUNICATION, INCLUDING BUT NOT LIMITED TO, ORAL OR WRITTEN COMMUNCATION (INCLUDING ELECTRONIC COMMUNICATIONS) WITH RESPECT THERETO. S&P DOW JONES INDICES AND STANDARD & POOR’S FINANCIAL SERVICES, LLC SHALL NOT BE SUBJECT TO ANY DAMAGES OR LIABILITY FOR ANY ERRORS, OMISSIONS, OR DELAYS THEREIN. S&P DOW JONES INDICES AND STANDARD & POOR’S FINANCIAL SERVICES, LLC MAKE NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIM ALL WARRANTIES, OR MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE OR AS TO RESULTS TO BE OBTAINED BY COMERICA AND ITS AFFILIATES, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE S&P INDICES OR WITH RESPECT TO ANY DATA RELATED THERETO. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT WHATSOEVER SHALL S&P DOW JONES INDICES OR STANDARD & POOR’S FINANCIAL SERVICES, LLC BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE, OR CONSEQUENTIAL DAMAGES INCLUDING BUT NOT LIMITED TO, LOSS OF PROFITS, TRADING LOSSES, LOST TIME OR GOODWILL, EVEN IF THEY HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, WHETHER IN CONTRACT, TORT, STRICT LIABILITY, OR OTHERWISE. THERE ARE NO THIRD-PARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS BETWEEN S&P DOW JONES INDICES AND COMERICA AND ITS AFFILIATES, OTHER THAN THE LICENSORS OF S&P DOW JONES INDICES.

“Russell 2000® Index and Russell 3000® Index” are trademarks of Russell Investments, licensed for use by Comerica Bank. The source of all returns is Russell Investments. Further redistribution of information is strictly prohibited.

MSCI EAFE® is a trademark of Morgan Stanley Capital International, Inc. (“MSCI”). Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

FTSE International Limited (“FTSE”) © FTSE 2016. FTSE® is a trademark of London Stock Exchange Plc and The Financial Times Limited and is used by FTSE under license. All rights in the FTSE Indices vest in FTSE and/or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE Indices or underlying data.comerica.com/insights

Copyright © Comerica Wealth Management