by Karen Watkin, CFA, Portfolio Manager—Multi-Asset Solutions & Edward Williams, Investment Strategist—Multi-Asset Solutions, AllianceBernstein

We think today’s market landscape calls for a different mix in multi-asset income strategies.

Coming into 2024, many income investors expected falling inflation, slowing economic growth and rate cuts that would boost bond returns—a view that spurred record flows into investment-grade bonds. With rate cuts—at least in the US—on the back burner for now, that story has yet to play out. Adjusting to that reality has pushed bond yields even higher, leaving returns largely flat so far this year.

Equity markets, meanwhile, have rallied—the S&P 500, for example, is up nearly 10%. While risk-averse investors or those with a hearty appetite for yield may not want to step fully into equities, those seeking income with upside growth potential may want to consider a global multi-asset income approach.

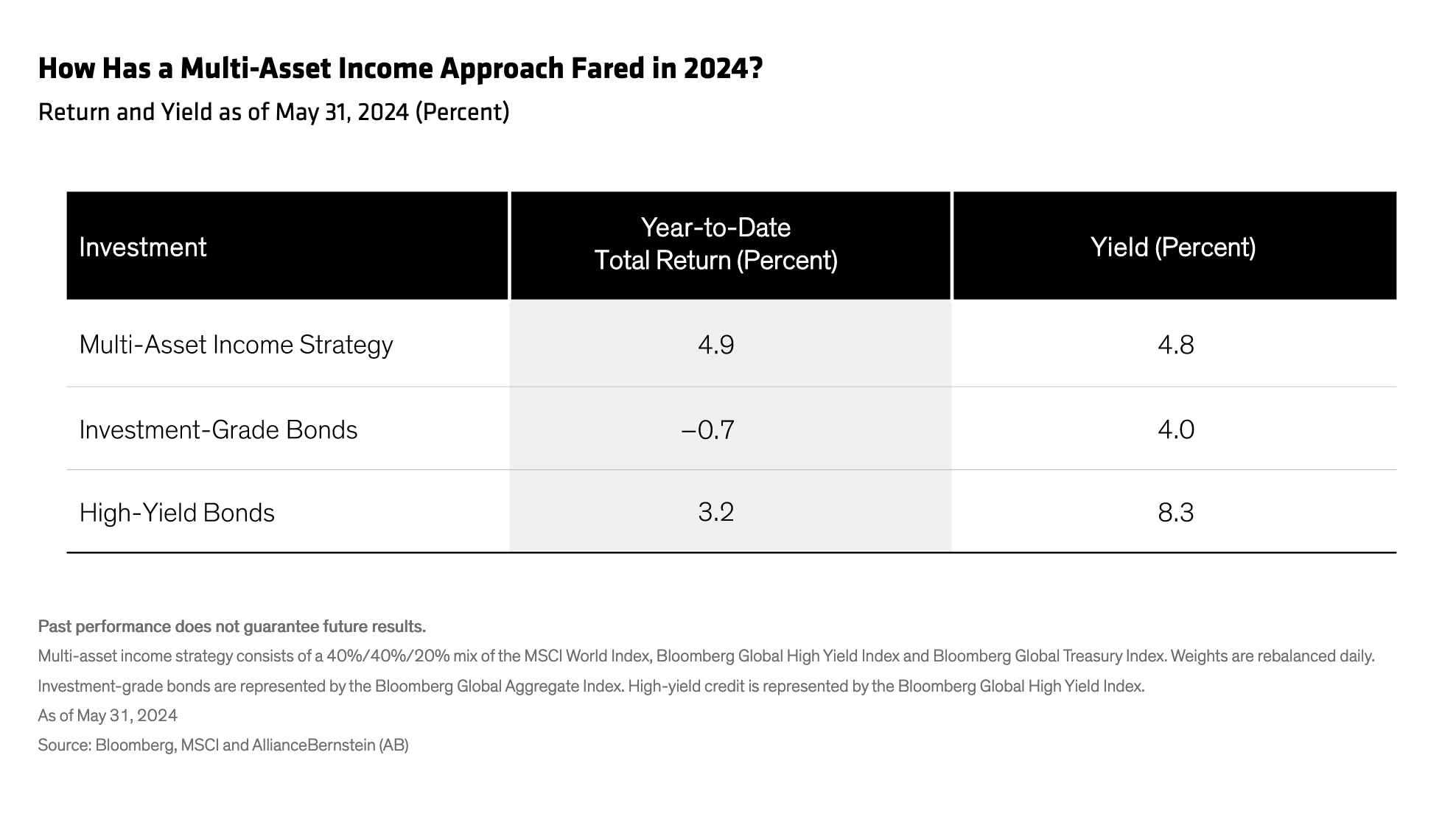

So far this year (Display), such a strategy, combining equities, credit and government bonds, would have outperformed high yield and investment-grade credit while also delivering a healthy yield of 4.8%. That’s a substantial advantage over the 4% yield of global investment-grade bonds.

Higher Bond Yields Support a Different Mix

Higher Bond Yields Support a Different Mix

Despite a slow start to the year for bonds, fixed income still provides much more yield today than it has in years and will likely get a long-awaited boost when rate cuts eventually come. For investors seeking to combine income and growth, we believe that a multi-asset strategy with the income power of bonds and growth potential of stocks may be a potent combination.

But in our view, the mix that worked yesterday needs retooling for today’s reality, with a different macro and market environment.

Bond yields are no longer near the bottom of the barrel as they were in mid-2020, when the yield on the 10-year US Treasury was just over half a percent; today, at a whopping 4.5%, it’s more than seven times higher. The rest of the bond world has taken the ride to higher yields, so income investors don’t have to stretch as much into higher-risk bond segments or hunt as intently for alternative yield sources to generate attractive income. This is particularly important given that we’re likely in the latter stages of the economic cycle.

Less Need to Lean into Income in Equity Exposure

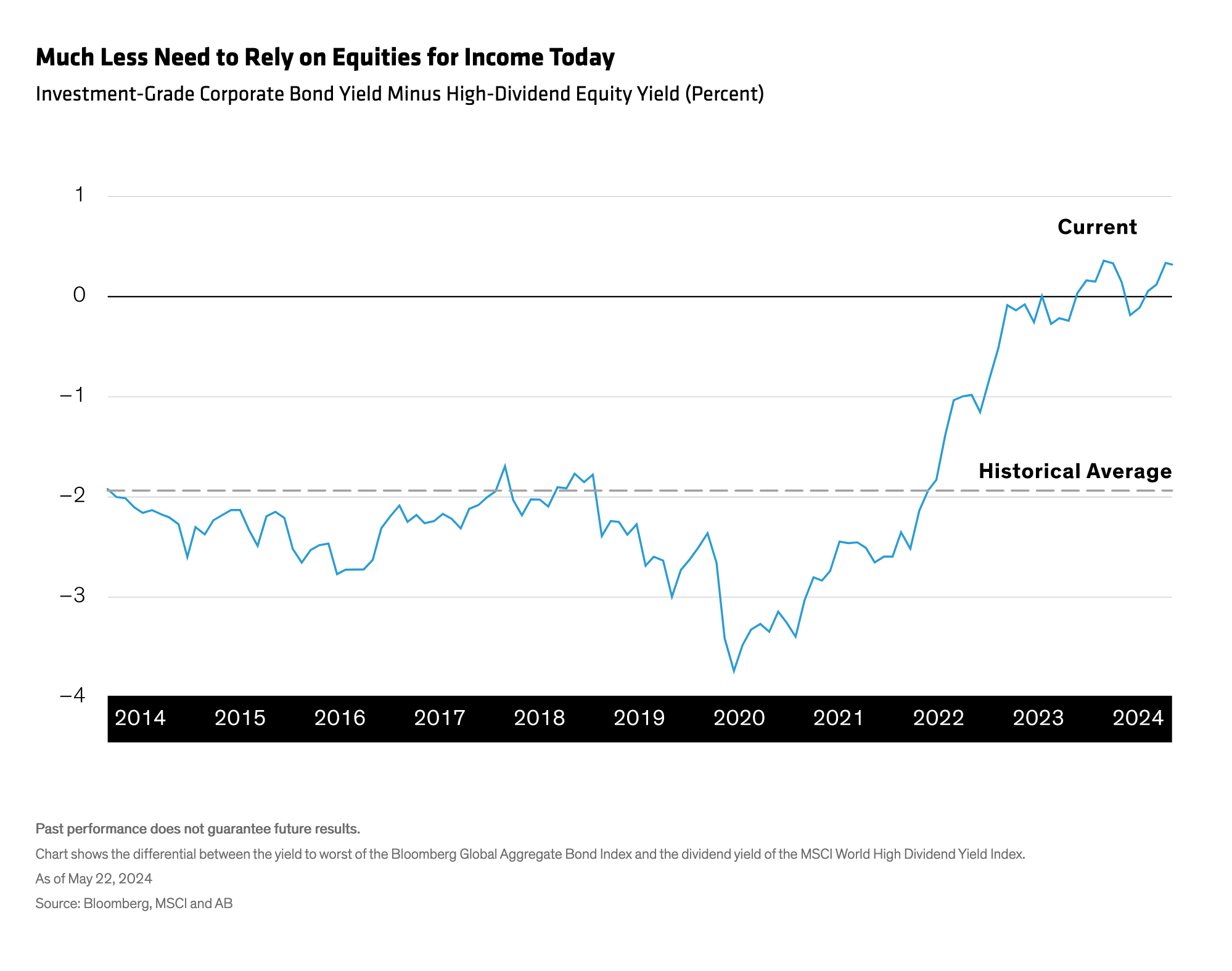

With bond yields so attractive today, we see much less need to rely on equities for income generation than in the past (Display). Five years ago, in a lower-yield world, typical multi-asset equity allocations tilted heavily toward dividend-paying stocks—utilities, consumer staples, energy and the like—in an effort to squeeze extra income out of the equity building block.

We think investors that stick to that same approach today might be leaving equity upside potential behind. From our perspective, many multi-asset income strategies still have a substantial tilt toward dividend payers and the value style that’s geared more for income than growth, which has generally not been rewarded in the current market landscape.

Instead, we think it makes sense to shift to a more core-like equity foundation that combines income-generating ability and exposure to secular growth potential. Historically, quality sources of earnings growth have tended to possess better upside potential than dividend-focused stocks and may continue to perform well when economic growth is slowing.

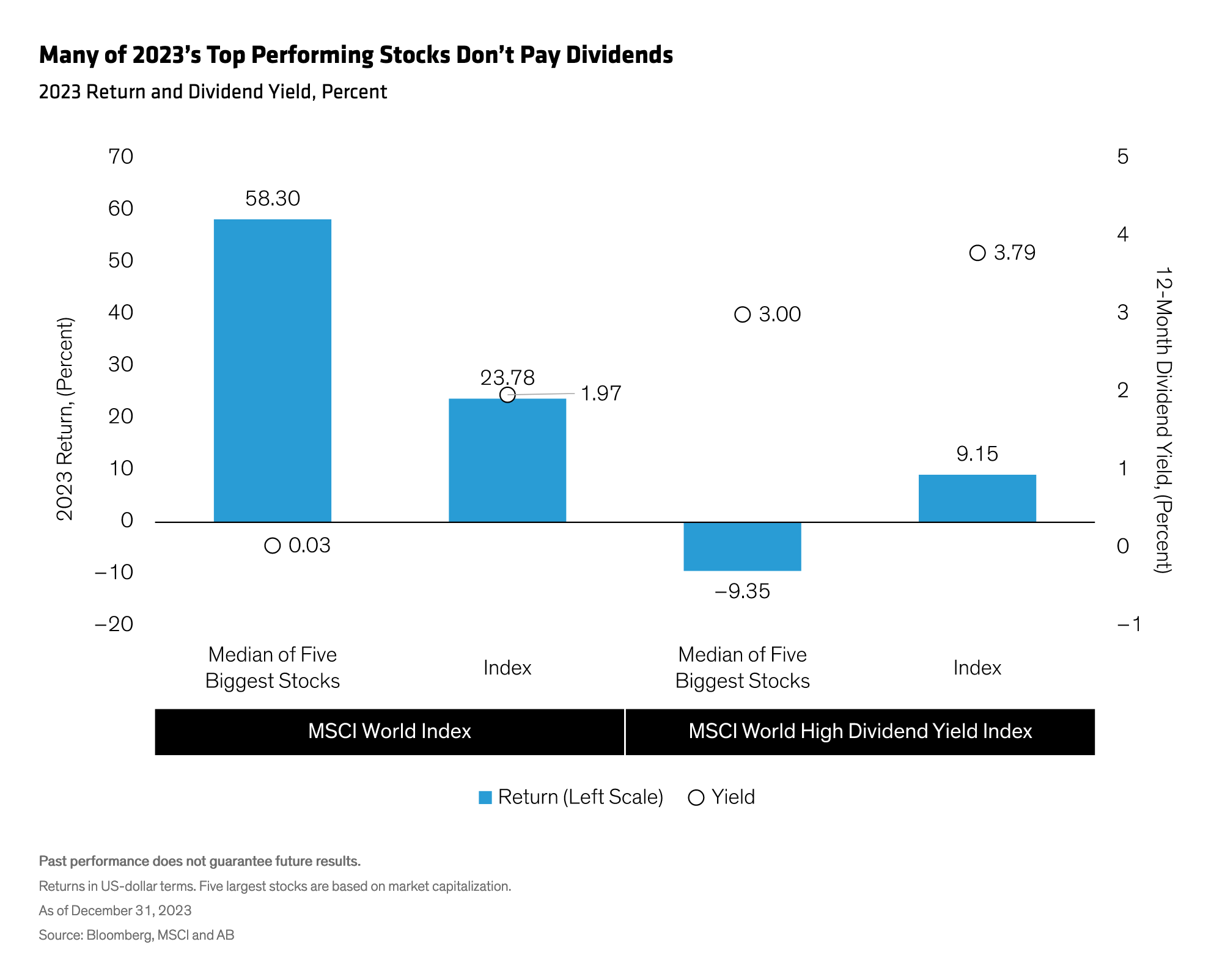

This approach likely reduces yield on the equity side: the MSCI World Index yielded just under 2% at the end of 2023 versus 3.8% for the MSCI World High Dividend Yield Index. But with higher income readily available in bond markets, we believe that multi-asset income investors should consider tilting their equity allocation to those stocks with stronger growth prospects. The MSCI World handily outpaced its high-dividend counterpart in 2023 (Display), but many of the index’s largest stocks don’t offer attractive yields, so strategies focused purely on high dividends would likely exclude them—along with their upside.

Still Needed: A Cushion Against Equity Downturns

It’s also important to incorporate a cushion in case of equity market downturns, and that’s where government bonds come in. Historically, US Treasuries and other developed-market sovereign bonds have generally exhibited a low correlation to equity markets—they’ve zigged when stocks have zagged. This nature has made them reliable counterbalances when equity markets tumble.

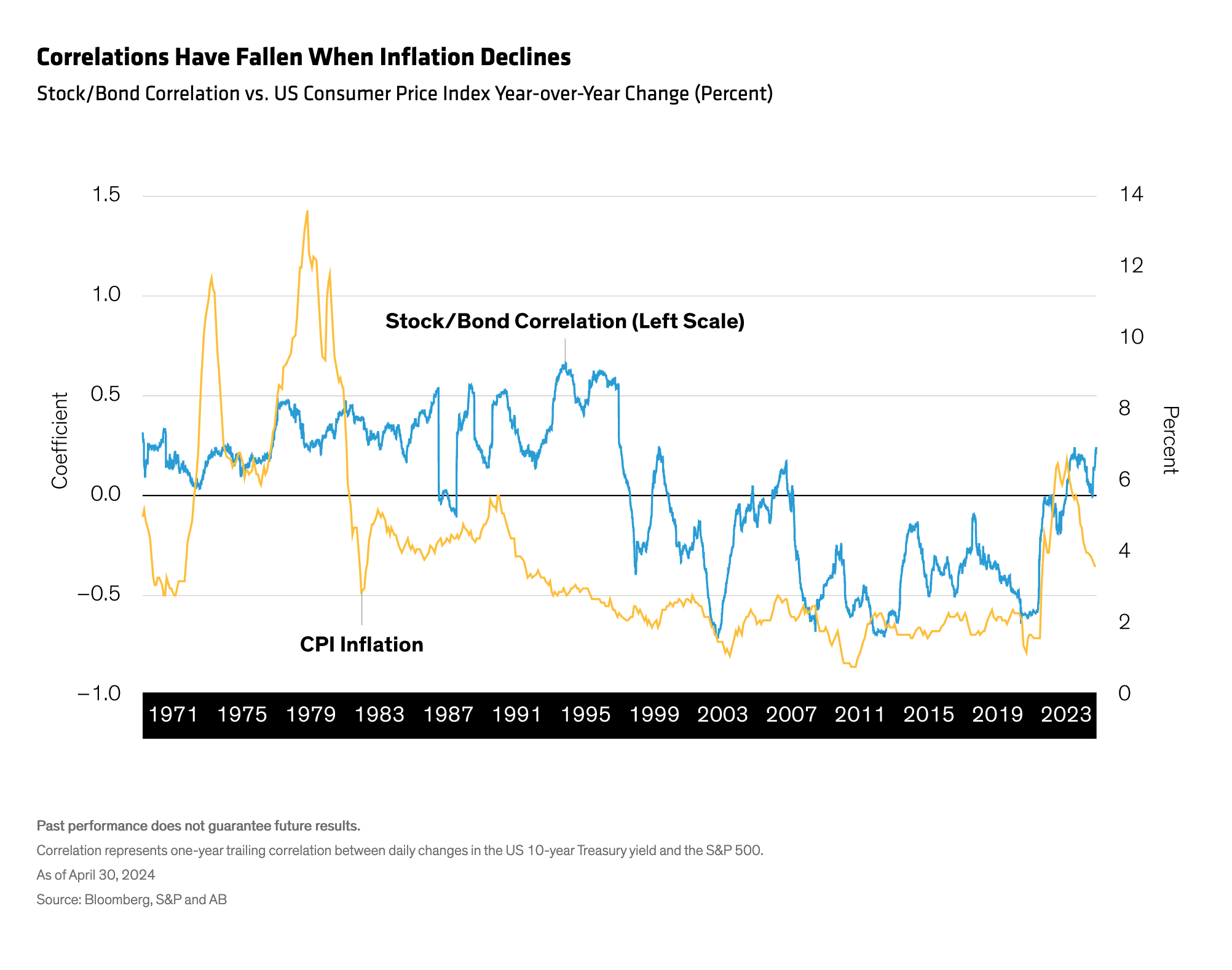

While bonds’ failure as an equity diversifier in 2022 left few places for investors to hide, we expect correlations to re-establish themselves as inflation returns to more normal levels—which has historically been the case (Display). Also, if surges in political risk lead to a risk-off shift in markets, we expect duration exposure through government bonds will be a useful tool in multi-asset design.

From a big-picture perspective, we believe that a multi-asset approach can be an effective one for investors looking to harness the yield potential of bonds and the growth potential of equity markets. But macro and market environments evolve, so the design of that mix needs to be dynamic.

In our view, today’s market regime calls for tapping into higher yields via higher-quality bonds while evolving from a pure income focus to a quality growth emphasis in the equity component. As we see it, this construction avoids applying yesterday’s multi-asset income design to today’s market landscape.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

*****

About the Authors

Karen Watkin is a Senior Vice President and Portfolio Manager for the Multi-Asset Solutions business in EMEA. Along with being Portfolio Manager for the All Market Income Portfolio, she is responsible for the development and management of multi-asset portfolios for a range of clients. From 2008 to 2011, Watkin was portfolio manager for the Index Strategies Group, responsible for the development and management of AB’s custom index strategies for institutional clients in EMEA. She joined the firm in 2003, after spending three years as a management consultant in the Capital Markets Group at Accenture. Watkin holds a BA in economics with European study from the University of Exeter and is a CFA charterholder. Location: London

Edward Williams is a Vice President and Investment Strategist within the Multi-Asset Solutions team, where he is responsible for the business development of AB’s Luxembourg income-thematic multi-asset strategies. Williams joined AB in 2020 when he was based in Hong Kong, supporting client activity across Asia, before relocating to London and into his current role. Prior to joining AB, Williams spent six years working at Fidelity International across a range of roles in Europe and Asia, including as an investment specialist, focusing on Fidelity’s risk-managed and outcome-orientated multi-asset solutions. He holds a BA in economics from the University of Reading. Location: London