by Sonal Desai, Ph.D., Chief Investment Officer, Franklin Templeton Fixed Income

Franklin Templeton Fixed Income CIO Sonal Desai discusses where she thinks the real policy rate lies in the United States and how this informs her outlook for US Treasury yields over the medium to long term.

What is r-star, or r*, and how much does it matter for the outlook for bond yields and market interest rates?

It matters because in setting monetary policy, the US Federal Reserve’s (Fed’s) estimate of r* also guides it. The Fed’s estimate of r* is the real policy rate (as opposed to the nominal fed funds rate) that would be neither contractionary nor expansionary when the economy is at full employment and inflation at its 2% target.1 Call it the “real neutral” rate. The consensus view is that r* had experienced a secular decline and might have moved back up somewhat in recent years—but is that view correct?

Fed Governor Christopher Waller and former New York Fed President William Dudley recently gave some contrasting perspectives.2 Of the two, Dudley’s comes much closer to what I have been arguing for the past 2-3 years—namely that the neutral rate is a lot higher than the Fed and the markets think. In this note, however, I want to go further and offer a different perspective on how to look at the past decades and what they mean for the future outlook on rates.

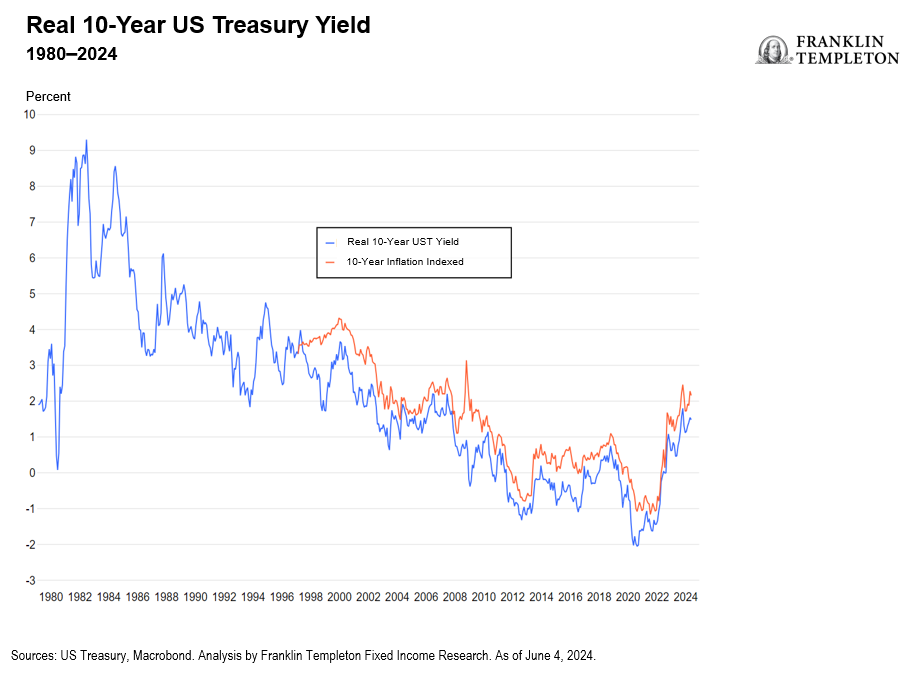

R*, is unobservable, but, as Waller notes, we have two distinct ways of gauging it. The first is to look at the inflation-adjusted 10-year US Treasury (UST) yield:

At first glance, this seems to indicate a downward trend in r* since the early 1980s, followed by a rise in the last four years. However, a different gauge of the neutral rate is the real return on capital, which shows no declining trend whatsoever.

Waller focuses on the real UST yield as the most meaningful proxy of r*, and reasons that something must have happened to drive a divergence between the real return on capital and the real yield on USTs. Waller argues that five factors boosted demand for USTs: globalization of capital markets, a buildup of official reserves, demand from sovereign wealth funds, population aging, financial regulation, and the Fed’s purchases of USTs. Waller reasons that all these five factors will continue to keep r* low, with loose fiscal policy increasing UST supply the only contrast.

Dudley dismisses out of hand the idea that this is a useful way to look at r*, since by definition r* must be closely linked to economic fundamentals, such as productivity. As I have been arguing for quite some time now, Dudley also observes that since growth has remained robust even as the Fed hiked the fed funds rate, r* must have risen, so that the current stance of monetary policy is only mildly restrictive.

But here is where I want to offer a different perspective. Both Dudley and Waller buy into the idea that r* was in secular decline until recently; and yet neither one of them can point to any change in underlying growth. In fact, changes in growth fundamentals, such as productivity, should have impacted first and foremost the real rate of return on capital, which as we saw did not budge. I will instead suggest, somewhat controversially, that r* might in fact never have been in secular decline. Let’s take a second look at the real UST yield chart:

- Notice, first of all, that the downward trend is artificially accentuated by the huge jump at the very beginning of the sample period, from 2% to over 9%. Longer-term estimates of r* indicate that from the 1950s to the global financial crisis (GFC) it averaged about 2%, so this spike is an outlier (see my previous article “On My Mind: The structural shift that wasn’t”). The real UST yield then stepped down during the 1980s as policymakers tamed high inflation; throughout the 1990s it was stable in the 2%-4% range.

- There is another discrete step down between 2000 and 2003, from about 3.5% to about 1%. This coincided with a major easing of monetary policy in response to the popping of the dot-com bubble and ensuing recession. The real UST yield then trended back up to about 2% until …

- … the GFC triggered another massive expansion of monetary policy, and the real UST yield fell again from over 2% in 2007 to below zero by 2013. R* then rose back until…

- … we got the COVID-19 recession and another round of even more dramatic monetary policy expansion, which sent the real UST yield back down.

- Finally, once monetary easing first stopped and then slowly reversed, the UST yield rate went back up quite sharply, until it is almost back to where it was at the start of the sample.

I am not arguing that r* was always stable; it fluctuated with economic fundamentals. But underlying economic fundamentals did not change enough to push the real neutral rate down from 2% to near-zero in a durable, structural manner. What we see in the UST real yield chart, in my view, is mostly the impact of repeated rounds of massive monetary policy easing, boosting demand for USTs and driving their real yield down. In other words, massive Fed purchases have historically played a defining role in the movements of real UST yields. I think the neutral rate, the famous r*, is now probably at 2%-2.5%, in line with its long-term average from the 1950s to the eve of the GFC—especially given that we are seeing a rising investment trend and some signs of a pickup in productivity.

This has two implications. First, that current Fed policy is not overly restrictive and disinflation progress will remain gradual. Second, that the next Fed rate-cutting cycle will likely be short and shallow.

Now let’s think about the outlook for nominal UST yields. If I am right, and r* is about 2%-2.5%, then once inflation is at the Fed’s target (2%), the fed funds rate should be at 4%-4.5%. Then we have to add term and risk premium,3 which averaged about 1.3 percentage points in the two decades preceding the GFC. And now we also have a massive persistent fiscal deficit that the congressional budget office projects will keep boosting UST supply for the next decade. After the next Fed easing cycle has played out, therefore, in the medium and long term I expect UST yields will drift back up, with levels greater than 5% looking more than plausible.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high-yield bonds are subject to greater price volatility, illiquidity and possibility of default.

*****

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information, and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S.: Franklin Resources, Inc. and its subsidiaries offer investment management services through multiple investment advisers registered with the SEC. Franklin Distributors, LLC and Putnam Retail Management LP, members FINRA/SIPC, are Franklin Templeton broker/dealers, which provide registered representative services. Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

______________________________________________________________________________

1. Let me further clarify how r* relates to the fed funds rate, the policy interest rate set by the Fed, which is now at 5.25%-5.50%. The Fed currently estimates r* at 0.6%. This implies that once inflation is back at its 2% target, and the economy is running at potential with full employment, the fed funds rate should be set at 2.6% (= 0.6% r* + 2% inflation). If r* is significantly higher than 0.6%, as both Dudley and I believe, the fed funds rate should be correspondingly higher.

2. Source: “Some Thoughts on r*: Why Did It Fall and Will It Rise?” Remarks by Christopher Waller Member Board of Governors of the Federal Reserve System at the Reykjavik Economic Conference Reykjavik, Iceland. May 24, 2024.

3. Definition: Term premium: is the amount by which the yield-to-maturity of a long-term bond exceeds that of a short-term bond. Risk premium: is the investment return an asset is expected to yield in excess of the risk-free rate of return.

Copyright © Franklin Templeton Fixed Income