by Carl R. Tannenbaum, Chief Economist, Vaibhav Tandon, & Ryan Boyle, Northern Trust

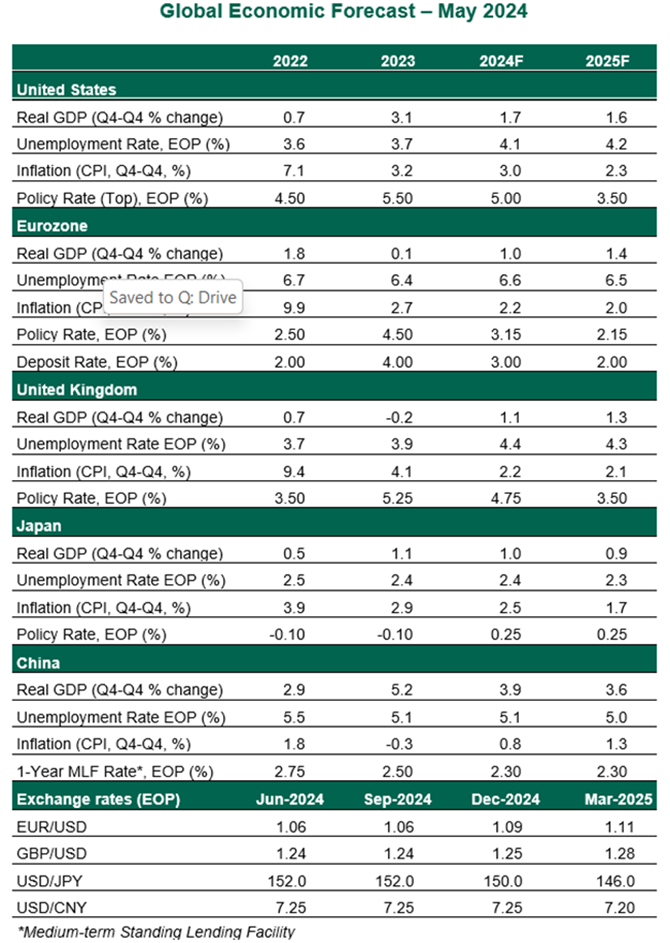

The Northern Trust Economics team shares its outlook for growth, employment, inflation and interest rates in major markets.

After having suffered hardships last winter, spring is finally here for the Europeans as both the common currency bloc and the U.K. returned to growth in the first quarter of 2024. Conditions are warmer on the other side of the Atlantic and cooler in the east.

Inflation is now within sight of central bank targets, but sticky service prices amid tight labor markets have prompted caution among monetary policy setters. But we think major central banks are close to the tipping point for easier interest rates.

Major economies are expected to record steady but below-potential growth this year, alongside continued disinflation. Soft landings are still within reach. That said, geopolitical rivalries and political uncertainty have the potential to cause significant turbulence along the way.

Following are our thoughts on how major markets are faring.

United States

- Real gross domestic product (GDP) growth cooled in the first quarter to an annualized rate of 1.6% from 3.4% in the prior quarter. But the underlying momentum was not as soft as the headline suggests. Final domestic demand remained strong as the volatile inventory and net trade components dragged growth down. Consumer spending has been the foundation of the current expansion, and it has not yet cooled.

- U.S. inflation resumed its downward trend, with the headline consumer price index (CPI) decelerating one-tenth to 3.4% year over year in April. Excluding food and energy, core CPI fell two-tenths to 3.6%, its lowest reading in three years. However, shelter and service costs remain strong. The Fed acknowledged the “lack of further progress” on inflation and offered no hints on the timing of a rate cut at its May meeting. We expect a first cut in September, conditional on inflation remaining tame. The Fed also announced a slower pace of quantitative tightening starting in June.

Eurozone

- After stalling in 2023, real GDP in the euro area grew 0.3% during the first quarter. The expansion was broad-based across the four core member states, but not across sectors. Services were the key driver of growth amid persistent industrial malaise. Incoming data has been positive, reinforcing signs that the recovery will sustain in the second quarter. Labor markets are still resilient, while disinflation is on track. Moderating prices, positive real wages and falling interest rates will keep the economy growing.

- The European Central Bank is on track for a June cut. But given the divergent views within the Governing Council over the speed and magnitude of reductions, the path of policy easing beyond that is unclear. With inflation improving and growth momentum to remain sluggish, we expect a total of 100 basis points of cuts in 2024.

United Kingdom

- Real GDP in Britain expanded 0.6% in the first quarter of 2024, the strongest growth in nearly three years. All major components except gross capital formation contributed to growth. Business surveys are showing that the recovery is taking root, but inflationary pressures have even deeper roots. Wage inflation is hovering close to 6% year over year. However, the labor market is slackening, with the unemployment rate rising notably to 4.3% in March from 3.9% in January 2024. This should presage further moderation in price pressures.

- The Bank of England (BoE) held its policy rate unchanged in May, with two members voting to cut rates immediately and no hawkish dissents. The shift in voting pattern along with other dovish signals point to a change in sentiment at the central bank and a summer interest rate cut. We think the BoE will wait for more confidence that inflation is moving sustainably to its target. We forecast a first cut at the August meeting followed by one more in the fourth quarter.

Japan

- The Japanese economy continues to struggle to find a solid footing, with real GDP shrinking at an annualized rate of 2% in the first quarter of 2024. The weakness was broad-based across external and domestic demand; a temporary suspension in auto production did not help. The strong results from spring wage negotiations should enable the economy to bounce back. Gains in exports will be gradual, as waning pent-up demand for automobiles will partially offset the boost from chip cycle upturns.

- The Bank of Japan (BoJ) maintained its policy rate at its April meeting. The formation of a virtuous cycle of prices and wages should drive the BoJ to take rates further into positive territory this autumn. While recent pressure on the yen will not be the direct trigger for a rate hike, its impact on inflation will strengthen the case for further policy normalization.

China

- The Chinese economy regained some momentum at the start of the year, but the recent outperformance will prove to be transient. The production-led boost to growth will fade as industrial destocking gets underway. Money and credit data disappointed in April, underscoring weakness in loan demand. Retail sales slowed further, while trade faces rising tariff hurdles.

- The housing market remains a key area of concern. Property sector activity slid further in April, with construction, starts and sales all declining at a double-digit year over year pace. Continued weakness prompted policymakers to unveil a suite of support measures, including purchases of housing inventory by local governments. Digesting housing inventory could help stabilize activity, but the program will require vast funding if implemented at scale.

Copyright © Northern Trust