by Ryan Boyle, Senior Economist, Northern Trust

However we measure inflation, we see an incomplete recovery.

Last week, we discussed the ways that inflation measures can be selectively interpreted to fit a narrative. Readers of that article raised an even simpler question: Why are there multiple readings of inflation in the first place?

In the U.S., there are two leading gauges. The consumer price index (CPI), published by the Bureau of Labor Statistics, garners attention (in part) because it is more timely, usually published two weeks after the end of the month. The Bureau of Economic Analysis follows a fortnight later by issuing a price index based on personal consumption expenditures (PCE).

A major distinction between the two is their treatment of substitution. Price indices reflect a weighted average of goods and service costs which aim to reflect the spending of a median household. The CPI basket is rebalanced only annually (a recent upgrade from a cycle of every two years). The PCE weights are adjusted every month, based on actual spending. When consumers change their behavior, PCE rebalances quickly.

The Federal Reserve also prefers PCE because it is more comprehensive, capturing a wider set of prices paid by more consumers. PCE can be restated as more information is collected, while CPI is only revised to account for seasonal factors.

Neither measure is a full account of all spending. They are built from different Census Bureau aggregations that approximate total economic activity. The PCE is derived from business surveys such as the Monthly Retail Trade Survey and Quarterly Services Survey. This gives the PCE a more complete view of business transactions. The CPI utilizes the Consumer Expenditure Survey, which polls a sample of households. Assembling the CPI requires interviews and self-monitoring that are prone to under-reporting of activity.

Inflation measures are best understood as trends with a wide scope.

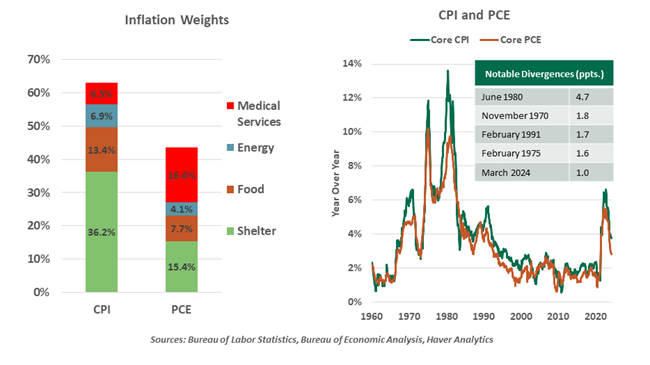

The differing approaches yield different component weights, which can lead to widely different trends. The cost of shelter is notoriously difficult to approximate, and CPI is more sensitive to that category. The sources also differ in some of their methods and assumptions. Several of CPI’s more volatile categories stand out for having a different approach than PCE:

- Healthcare: PCE includes all medical goods and services purchased by employer-provided health insurance to approximate the cost of healthcare. CPI reflects households’ out-of-pocket purchases of medical goods and uses sector profits as a proxy for insurance costs.

- Airfare: CPI examines a fixed set of air routes, while PCE uses airline passenger revenues and miles traveled.

- Used vehicles: CPI tracks auto dealers’ reported sale prices of a sample of used vehicles, while PCE uses dealers’ wholesale and retail sales data to impute price trends.

In normal times, the two indices track each other closely. In intervals of high inflation, however, they diverge. Inflationary bouts change our behavior; as an example, high cattle costs motivate consumers to buy less beef and more pork and poultry. PCE reflects this kind of substitution, leading to a more subdued outcome.

At present, core (ex-food and energy) PCE of 2.8% stands much closer to the 2% inflation target than CPI’s 3.6%. Both show inflation in a better state now than it was in 2022. But by any measure, the journey to stable prices still has a long way to go.

Copyright © Northern Trust