Listen on The Move

Dennis Mitchell, CEO, CIO at Starlight Capital joins us this episode to discuss various topics including the impact of interest rates, the potential for rate cuts, portfolio construction for the period ahead - which will be marked by the persistent threat of inflation and higher rates for longer, the importance of proper pension-like diversification, and the rising risks of geopolitical instability, and authoritarianism, and ensuing political risk ahead. He expresses optimism about the long-term trends in private real estate, infrastructure, and equity markets. He also highlights the need for education and due diligence in investing in these asset classes. However, he expresses concern about the rise of authoritarianism and the erosion of democracy, which could have negative consequences for global markets and standards of living. We explore the current investment climate and the need for a shift in portfolio construction. Dennis Mitchell emphasizes the importance of considering and adding private assets and alternative asset classes with the objective of building resilient portfolios. Mitchell highlights the need for a diversified approach that goes beyond traditional 60-40 portfolios. We discuss the benefits of adding private equity, private real estate, infrastructure, commodities, and private credit. He emphasizes the critical need for enhanced financial education and the role of financial institutions in providing innovative investment solutions. We also get into the misconceptions about private assets and the importance of understanding the risks and returns associated with different asset classes.

Takeaways

- Investors should consider diversifying their portfolios with private real estate, infrastructure, and equity assets to replicate the strategies of large pension plans.

- The Canadian market has recently opened up to alternative and real asset investments, providing more options for investors.

- Investors need to understand the benefits of diversification and the importance of long-term returns.

- Geopolitical risks, such as conflicts in the Middle East and Russia-Ukraine tensions, can undermine political stability and impact global markets.

The rise of authoritarianism poses a threat to democracy, free markets, and innovation. - The world has become smaller and more dangerous, with the potential for catastrophic consequences if leaders abdicate their roles or fail to address emerging challenges.

- The investment climate is influenced by geopolitical events and economic cycles, which create opportunities to allocate capital to different sectors and geographies.

- Traditional 60-40 portfolios are outdated, and investors should consider allocating more to alternative asset classes.

- Private assets, such as private equity, private real estate, infrastructure, commodities, and private credit, offer opportunities for long-term returns and diversification.

- Financial education is crucial for investors to understand different asset classes and make informed investment decisions.

- Financial institutions have a responsibility to provide innovative investment solutions and be accurate stewards of the economy.

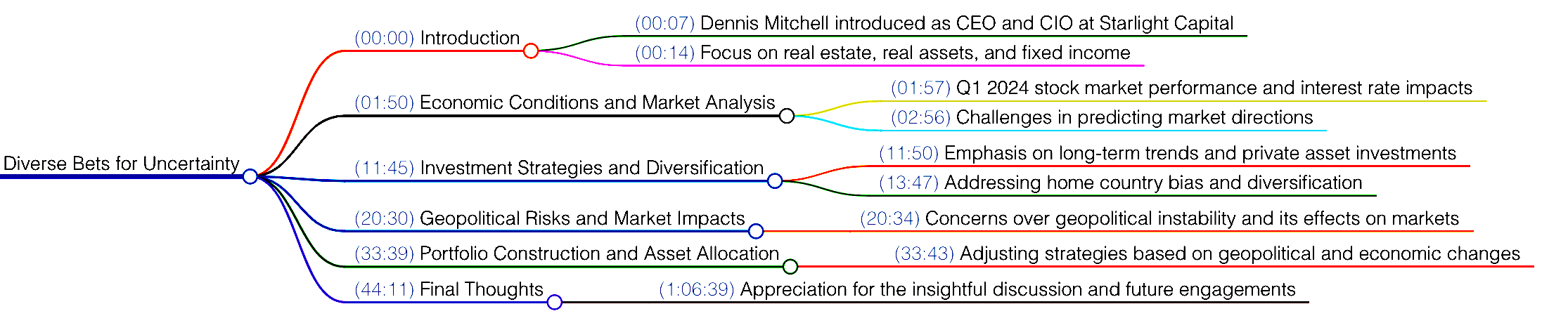

Chapters

- Introduction and Setting

- The Impact of Interest Rates and Rate Cuts

- The Canadian Market and Inflation

- The Importance of Diversification and Investing in Private Assets

- The Risks of Authoritarianism and Erosion of Democracy

- The Impact of Politics and Populism on Global Markets

- The Danger of Geopolitical Conflicts and Authoritarianism

- The World's Smaller and More Dangerous Nature

- The Current Investment Climate

- The Decline of Traditional 60-40 Portfolios

- The Role of Financial Education and Institutions

Where to find Dennis Mitchell & Starlight Capital

Dennis Mitchell on Linkedin

Starlight Capital's Thought Leadership

Copyright © AdvisorAnalyst