by John Lynch, CIO, & Team, Comerica Wealth Management

The U.S. dollar has been on a wild ride driven by volatility in liquidity flows and sentiment. We look for the recent currency pressures to ease in the months ahead, as liquidity is poised to surge, easing pressure on bond yields and equity prices.

Executive Summary

- The trade-weighted U.S. Dollar Index (DXY) rose to its highest levels in decades, surging to the ~115 range in the autumn of 2022 as inflationary pressures soared and fears of extensive monetary tightening proliferated. Over the past 18 months, market sentiment improved, driven by confirmation that the worst of the inflation readings were behind us and hopes that the extent of Federal Reserve rate hikes were nearing an end.

- The dollar spiked higher in recent months, driven by a decline in net liquidity and geopolitical concerns, forcing bond yields higher and equity prices lower.

- A study by Strategas Research Partners notes that a combination of actions by the U.S. Treasury and the Federal Reserve should boost net new liquidity by >$250 billion in the months ahead, potentially decreasing dollar demand, easing pressure on bond yields and boosting support for U.S. equities.

Of course, valuation and U.S. deficit spending remain significant longer-term concerns, yet the imminent liquidity surge will likely find its way into economic activity and risk assets in the months and quarters ahead.

Download the Weekly Market Update

U.S. Dollar

The greenback has been on quite a ride over the past few years.

To be sure, as inflationary pressures soared and fears of extensive monetary tightening proliferated, the trade-weighted U.S. Dollar Index (DXY) rose to its highest levels in decades, surging to the ~115 range in the autumn of 2022. Not surprisingly, that period also coincided with the recent low point for the U.S. equity market, as the S&P 500® Index reached its weakest level since the onset of the global pandemic. See chart: U.S. Dollar Index (DXY).

In the period following the market volatility in late-2022, market sentiment improved, driven by confirmation that the worst of the inflation readings were behind us and consequently, hopes that the extent of Federal Reserve rate hikes were nearing an end. To be sure, monetary policy has been on hold for several consecutive meetings with market interest rates remaining elevated, though off the cyclical highs from last summer. This pattern resembles the persistence of inflation, which remains well below recent peaks, but still above the Fed’s target (2.0%) for price stability.

As a result, the U.S. dollar index (DXY), which measures the strength of the dollar against a basket of major currencies, has climbed ~5.0% year-to-date (YTD). Global investors pared back their expectations for Fed rate cuts this year as the U.S. economy appears poised for moderate growth.

Implications of Currency Strength

Throughout the market volatility over the past few years, the U.S. dollar has played a crucial role.

Indeed, dollar strength can help lessen domestic inflationary pressures, as the costs of imports declines for the consumption-driven U.S. economy. An added benefit for those able to travel overseas is that costs are driven lower by the strength of the greenback relative to foreign currencies. More important, though, is that dollar strength signals global confidence in the U.S. as a safe haven and reiterates the greenback’s status as the world’s reserve currency.

Another factor to consider is the impact the dollar has on international economies and markets. To be sure, dollar strength can weigh on currency pairs with the Euro and the Japanese yen, for example, potentially affecting capital flows into developed markets. See chart: Trade-Weighted Currency Index Performance.

Exporters in developed markets can benefit, boosting trade given their currency weakness relative to the dollar. Emerging economies utilizing dollar reserves often struggle, though, as it costs more to obtain dollars, offsetting the benefits of exports/trade from their weakened currencies, which typically take time to materialize.

It should also be noted that dollar strength can place a burden on U.S.-based multinational corporations, too. For example, FactSet reports that the S&P 500® Index derives ~40.0% of its revenues from international operations, therefore pressuring profits as sales derived in weaker international currencies are translated back into the higher U.S. currency. This is why it is often difficult for dollar strength to be positively correlated with rising equity prices for an extended period.

Liquidity Surge Imminent

Which brings us to the current period and suggests the possibility for further equity market gains.

A review of the recent strength in the dollar initially caused us to expect persistent strength, though not to the levels reached in late 2022. Indeed, our thought process involved the likelihood of extended Fed policy, keeping market interest rates elevated, supporting capital flows into the U.S. and elevating the greenback further.

A few developments over the past few months have slightly altered this stance, especially given the mixed messages emanating from Treasury and Fed policy.

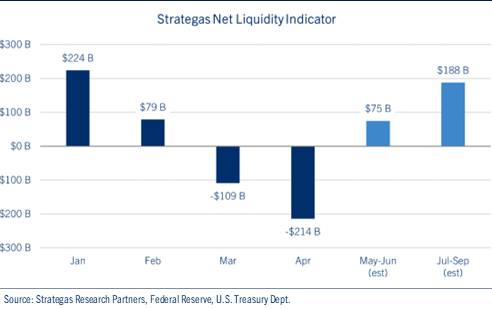

While monetary policymakers reiterate their concerns about the sustainability of inflationary pressures, indicating their preference for “higher for longer” rate policy, liquidity continues to expand. Indeed, the Federal Reserve recently announced a modification to its balance sheet reduction plan, known as quantitative tightening (QT). The amount of U.S. Treasuries dropping off its balance sheet will decline from $60 billion per month to $25 billion, therefore lessening upward pressure on market interest rates. See chart: Strategas Net Liquidity Indicator.

The more impactful move on liquidity growth is expected to come from the U.S. Treasury. A study by Strategas Research Partners notes that several forces combined to drain liquidity by more than $200 billion in April, led by tax payments into the Treasury’s General Account (TGA), the Fed’s QT program, as well as the end of emergency bank lending programs initiated after last year’s failure of Silicon Valley Bank. The result was upward pressure on market interest rates, increased demand for the U.S. dollar and selling pressure on longer-duration equities, including mega cap growth and technology stocks.

That tide is now shifting, and Strategas looks for a net liquidity addition of more than $250 billion by the end of September given a drawdown of the TGA through a series of actions including T-bill issuance and Reverse Repurchase Agreements (Repos), along with less balance sheet runoff (QT) by the Federal Reserve.

Conclusion

As a result, the added liquidity should serve to weaken the U.S. dollar, reduce upward pressure on bond yields and boost profits for U.S. multinationals. First quarter earnings announcements have come in ahead of expectations and we are currently reviewing our below consensus forecasts for corporate profits this year. Dollar weakness can be additive to EPS growth for large cap multinational corporations and the additional liquidity may boost equity prices higher. Of course, valuation and U.S. deficit spending remain significant longer-term concerns, yet the imminent liquidity surge will likely find its way into economic activity and risk assets in the months and quarters ahead.

Be well and stay safe!

Copyright © Comerica Wealth Management