by Adam Turnquist, CMT, Chief Technical Strategist, and Team, LPL Financial

Utilities hardly make it above the fold in the financial press as their relatively stable bond-proxy profiles are often overshadowed by trillion-dollar growth companies and stories of artificial intelligence (AI) taking over the world. However, the sector has recently found itself captivating Wall Street headlines, and perhaps surprisingly, it has not been due to its defensive nature during the market pullback last month.

The excitement surrounding AI has left many investors searching for the next big thing after meteoric rallies in names like NVIDIA (NVDA) and Super Micro Computer (SMCI). And while the growth trajectory of a utility company is not comparable to these poster children of AI, investors are starting to kick the tires on the sector as a potential derivative play to the AI boom.

To run the exponential growth of AI applications, data centers — the brain behind all the data processing and storage — require massive amounts of energy. According to the International Energy Agency (IEA), an average Google search consumes around 0.3 watt-hours of electricity, while a similar ChatGPT request requires 2.9 watt-hours. Now, if you multiply that by nearly nine billion Google searches a day, it equates to around 10 terawatt-hours (TWh) of additional electricity consumption needed for a calendar year if daily Google searches were replaced by generative AI searches. For context, the U.S. used around 11 TWh per day in 2022.

The IEA also forecasts total global electricity demand from data centers could reach anywhere from 650-1,000 TWh by 2026, potentially doubling their consumption of 460 TWh in 2022. If their estimates come in anywhere near the high end of the range, it would imply data centers alone could be consuming around the same amount of electricity as all of Japan.

Utility Companies are Taking Note

The U.S. is home to around one-third of the world’s data centers, according to the IEA, and domestic utilities are scrambling to meet their insatiable demand for power. Building out new power plants and transmission lines takes time and is expensive. Total capital expenditures among a collection of 34 power utilities in the country are forecasted to increase by 30% from 2022 to 2026.

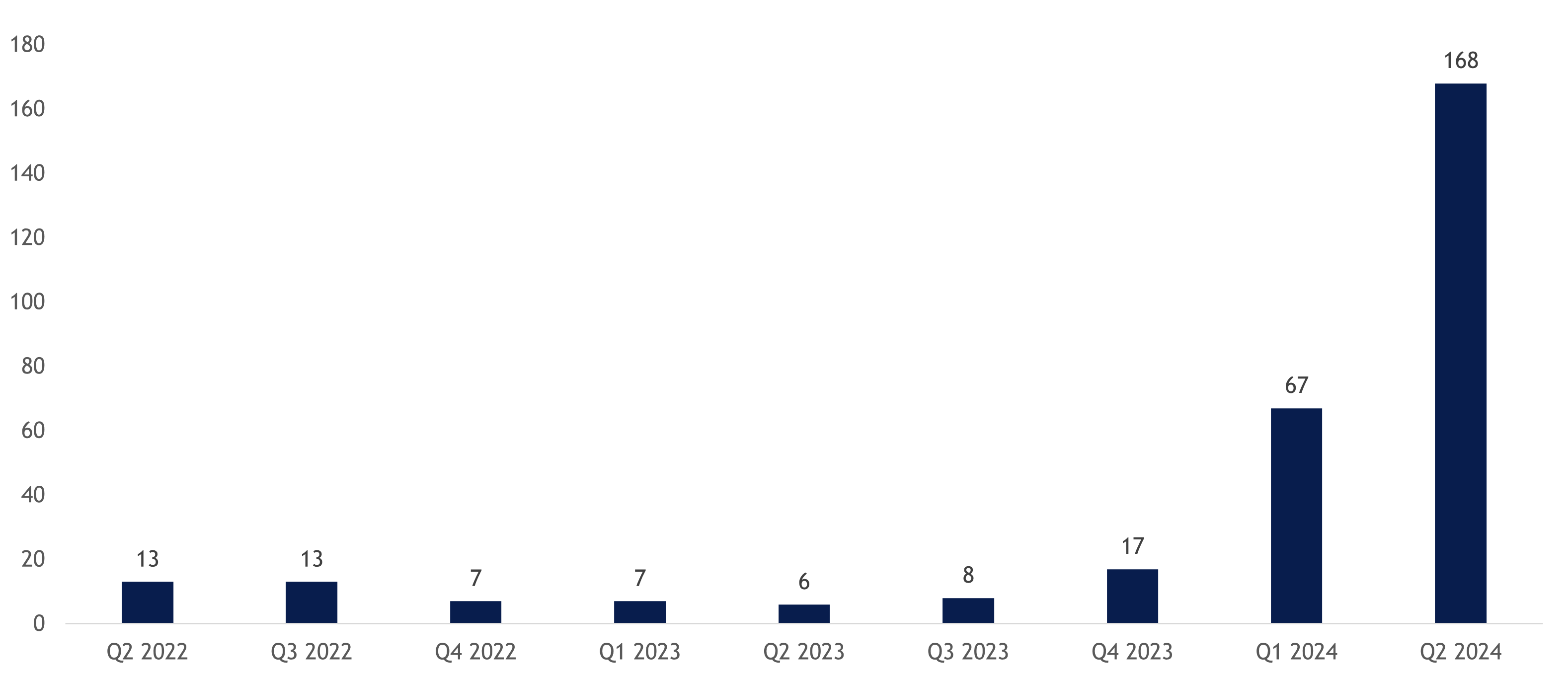

Data centers have also been a hot topic on utility company earnings calls more recently. The chart below highlights how many times the phrase “data center” was mentioned during quarterly earnings calls among companies within the S&P 500 Utilities Sector.

"Data Center" Mentions During Earnings Calls Within the S&P 500 Utilities Sector

Source: LPL Research, Bloomberg 05/08/24

Dominion Energy (D) had the most mentions this quarter and for good reason. The company provides power to Northern Virginia, the largest data center market in the world — it is estimated around 70% of all global internet traffic flows through a Virginia-based data center.

During their latest earnings call on May 2, the company highlighted how data center demand growth has “accelerated in orders of magnitude, driven by one, the number of data centers requesting to be connected to our system, two, the size of each facility, and three, the acceleration of each facility's ramp scheduled to reach full capacity.” The company further noted how data center demand loads are also changing from a typical demand request for 30 megawatts of capacity to new requests for larger data center campuses that can support demand up to 300 megawatts.

Turning to the Charts

Fundamental changes are often first observed in price action. As highlighted below, the utilities sector has made significant technical progress since reversing a key downtrend earlier this spring. Broad-sector participation has propelled the sector into an official uptrend, further confirmed by bullish momentum and moving average crossovers.

Relative strength is also improving. As highlighted in the bottom panel, the S&P 500 Utilities Sector vs. S&P 500 ratio chart — used to define relative strength and trend direction — recently reversed a downtrend and recaptured its 200-day moving average for the first time in over a year, suggesting utility sector outperformance could have more room to run.

Utilities are Breaking Out on an Absolute and Relative Basis

Source: LPL Research, Bloomberg 05/08/24

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly.

Summary

Utility stocks have found themselves in the spotlight recently after riding the coattails of AI excitement. Surging power demand among data centers could provide a major tailwind for the sector, although significant capital expenditures will be required to meet forecasted demand. While the sector is known for its bond proxy qualities and defensive nature, data center demand could also deliver higher growth rates and momentum to the sector. This could potentially open the door to new investors and justify a higher multiple. Finally, the technical backdrop for the sector continues to improve on both an absolute and a relative basis. Overall, LPL Research maintains a neutral viewpoint on the sector but acknowledges the recent positive fundamental and technical developments.

Copyright © LPL Financial