by Russ Koesterich, CFA, JD, Portfolio Manager, BlackRock

In this article, Russ Koesterich discusses why a higher rate environment may still allow stocks to end the year higher.

Key takeaways

- YTD, U.S. stocks are off to a strong start, while bonds have struggled. Historically rising rates have led to a pull-back in stocks.

- This year, stocks are proving more resistant to higher rates due to a few key factors. If this continues, stocks may gain from here.

Stocks are having another good year, bonds less so. During the first quarter, U.S. equity markets, as measured by the S&P 500, added another 10% to last year’s stellar gains, while most bond indices lost ground. Year-to-date the Barclays Aggregate Bond Index is down -1% and long-dated U.S. government bonds are off by roughly 3%. This leaves the question: Can stocks continue to advance in the face of higher rates? I believe they can.

I last discussed interest rates, bonds, and stocks last October. At the time, higher rates were leading stocks into a 10% correction. Both markets stabilized in late October and began climbing into year’s end.

This year, stocks are proving more resistant to higher interest rates. I’d attribute the resilience to four factors: a more muted backup in yields, lower bond market volatility, easier financial conditions, and a strong economy.

Last fall’s rate melt-up was of a different magnitude. 10-year Treasury yields rose from 3.75% to 5.00%, the highest level since 2007. This year’s backup has been more muted. While rates have risen abruptly in recent days, year-to-date 10-year U.S. treasury yields are up around 0.50%, with roughly 2/3rd of the increase driven by real or inflation-adjusted rates and the remainder by higher inflation expectations.

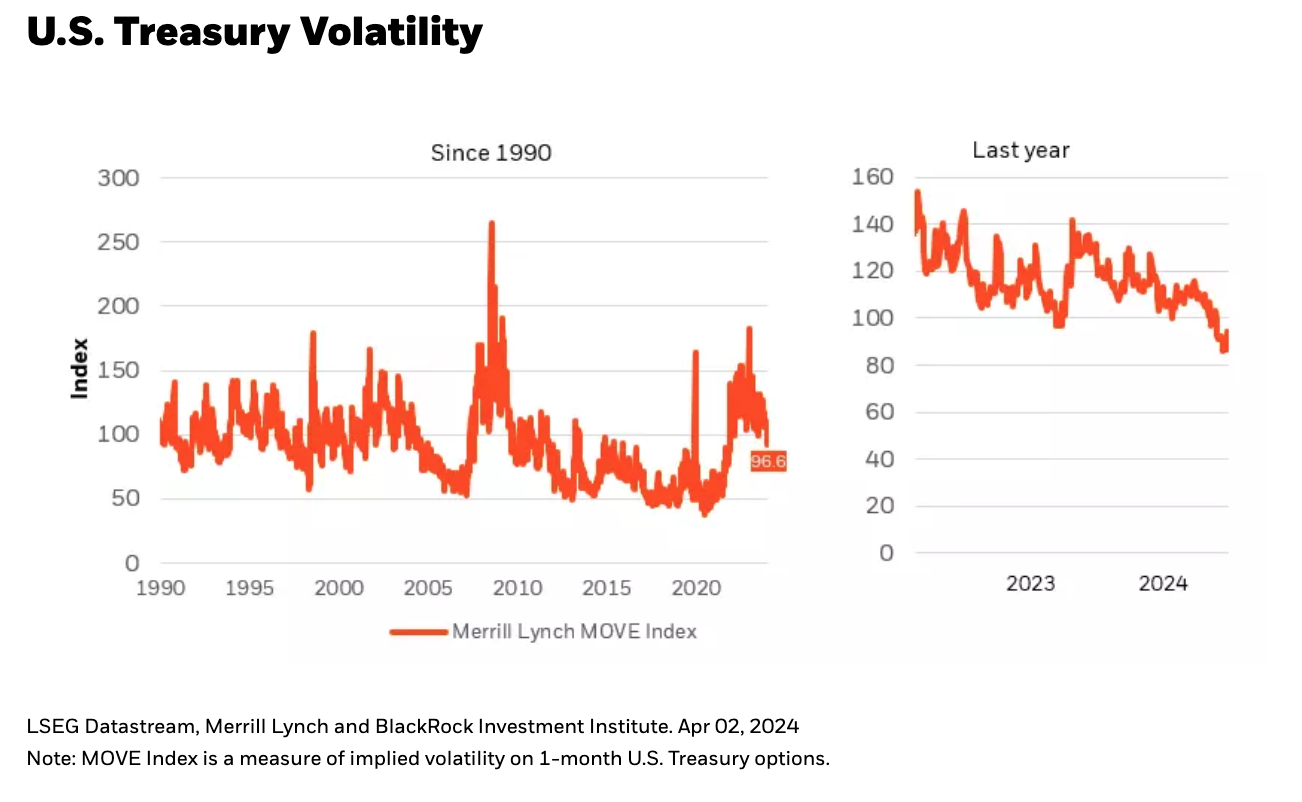

Not only have yields remained more range-bound, but rate volatility is substantially lower. Based on the MOVE Index, which measures U.S. bond market volatility, volatility is down 40% from the fall peak and back to levels last seen in 2022 (see Chart 1).

Cheaper Money

The concept of financial conditions is always a bit nebulous, but it can be roughly defined as both the cost and availability of money. Higher rates do represent a tightening of financial conditions. That said, most other measures, such as higher equity prices and tighter bond spreads, are signaling easier money. Based on the Goldman Sachs Financial Conditions Index, conditions are the easiest they have been in two years.

Easier financial conditions are not only supportive of risk taking, but also for the economy and corporate earnings growth. As financial conditions have eased, expectations for growth have risen. The Bloomberg consensus GDP forecast for 2024 real growth has risen from less than 1% in Q4 of last year to 2.20% today. Assuming inflation ends the year between 2 and 3%, this suggests nominal growth of 4.5 to 5.0%. Nominal growth in this range should easily support S&P 500 earnings estimates of approximately 10% growth.

Bottom-line

The recent backup in rates is probably not catastrophic for stocks. While they have struggled a bit following an uptick in bond volatility more recently, this should be viewed in the context of a 10% Q1 gain, an advance that occurred despite higher rates. To the extent rate gains are modest and occur against the backdrop of a strong economy, I think stocks can end the year higher. With this backdrop, I would advocate investors maintain an overweight to equities. To the extent it is practical, would also consider taking advantage of cheap volatility to add options structures to maintain equity exposure while balancing downside risk.

Copyright © BlackRock