by Quincy Krosby, PhD, Chief Global Strategist, Joshua Cline, Associate Analyst, LPL Research

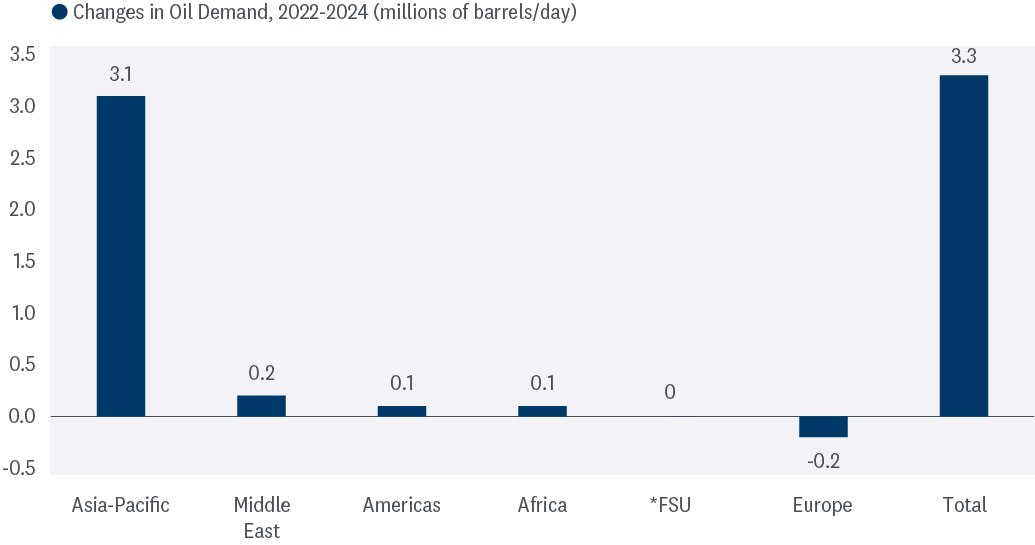

As the first quarter earnings season kicked off on April 12, expectations for the energy sector were decidedly negative. That low bar has tempted analysts to forecast a series of positive surprises as recent data releases for both the U.S. and China suggest a stronger economic underpinning, and the manufacturing sector appears to have bottomed in both countries. Oil demand — and prices — typically follow rising manufacturing and factory output, while rising consumer sentiment normally portends an increase in air travel, which also requires higher oil allocations.

Geopolitics Front and Center

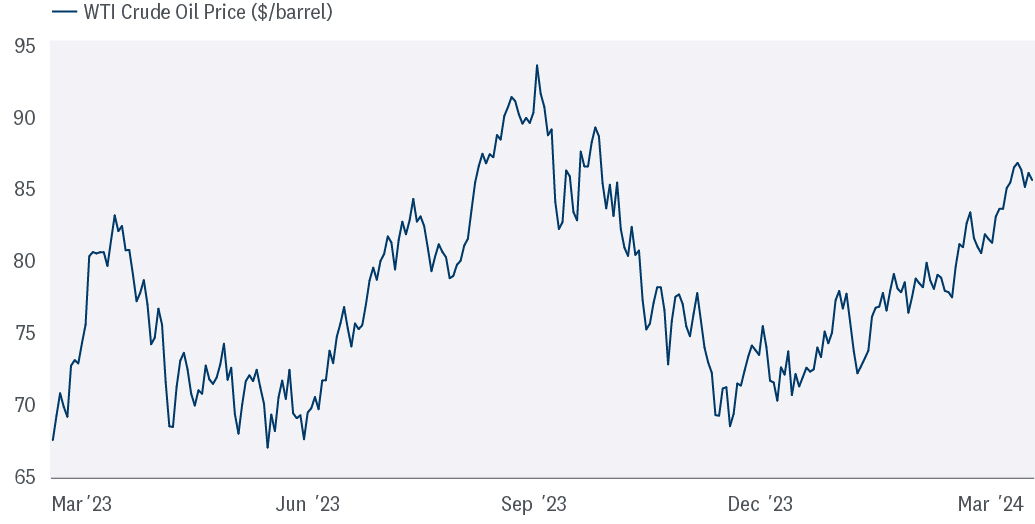

Certainly, geopolitical concerns have added to higher prices, with focus squarely on the Israel-Hamas conflict and worries hovering over markets regarding the potential for the war to broaden into the oil-producing region. The attacks on oil tankers in the Red Sea by the Yemen-based Houthis, considered a proxy for Iran, have also led to crude oil prices inching higher.

In terms of the Ukraine-Russia conflict, Ukraine’s continued drone attacks on Russian oil refineries have also pushed oil prices higher as supply disruptions, regardless of the cause, support prices.

Demand and Supply Forecasts

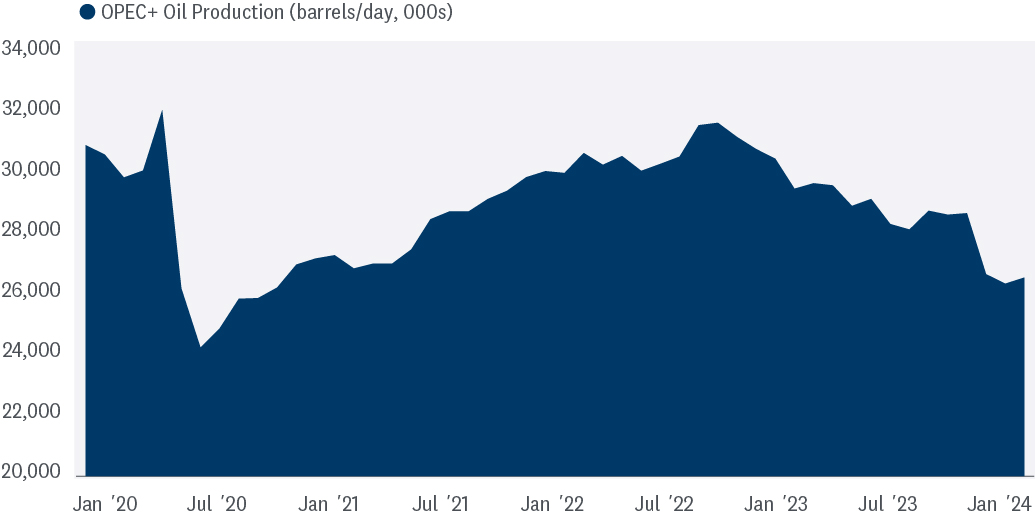

Within the discussion of the production/price equation, the OPEC+ decision advocated by Saudi Arabia and Russia to maintain voluntary production cuts until the end of June has helped maintain higher prices. The 53rd meeting of the Joint Ministerial Monitoring Committee, scheduled for June 1, will play a key role in the trajectory of crude oil prices, as will data releases from the world’s two largest economies, the U.S. and China, in helping to determine forecasts based on global demand.

OPEC+ Oil Production Remains Muted as Producers Stand By Cuts

Source: LPL Research, Energy Information Administration 04/11/24

Headlines associated with the International Energy Agency (IEA) forecasts typically move markets as the organization serves as an important global advisor to governments and the energy industry with timely data releases. In mid-March, the IEA altered its view on 2024 oil demand by forecasting global requirements would increase by 1.3 billion barrels per day as supply estimates were lowered, indicating a tighter market scenario.

The IEA’s predictions for oil demand peaking in 2030 continue to be refuted by oil company leaders who see robust demand for oil well beyond 2030. In 2019, when Warren Buffett’s Berkshire Hathaway (BRK/A or BRK/B) began its initial investment in Occidental Petroleum (OXY), Buffett commented that the investment was a bet on oil prices over the long term. Since then, CEOs of the energy majors have echoed that sentiment as they lead in merger and acquisition activity.

Economic growth forecasts issued by OPEC+ continue to estimate stronger global growth for 2024 and 2025, which would provide an important tailwind for oil demand. The cartel views the economies of China, the U.S., and India reinforcing its forecast. Although the goal of OPEC+ is to keep prices elevated, the consortium is also careful not to cut production dramatically, which could ignite a serious economic downturn denting oil prices.

New Oil Demand Driven Almost Entirely by Asia-Pacific Nations

Source: LPL Research, International Energy Agency 04/11/24

*FSU - the Former Soviet Union refers to the independent states that emerged following the dissolution of the Soviet Union.

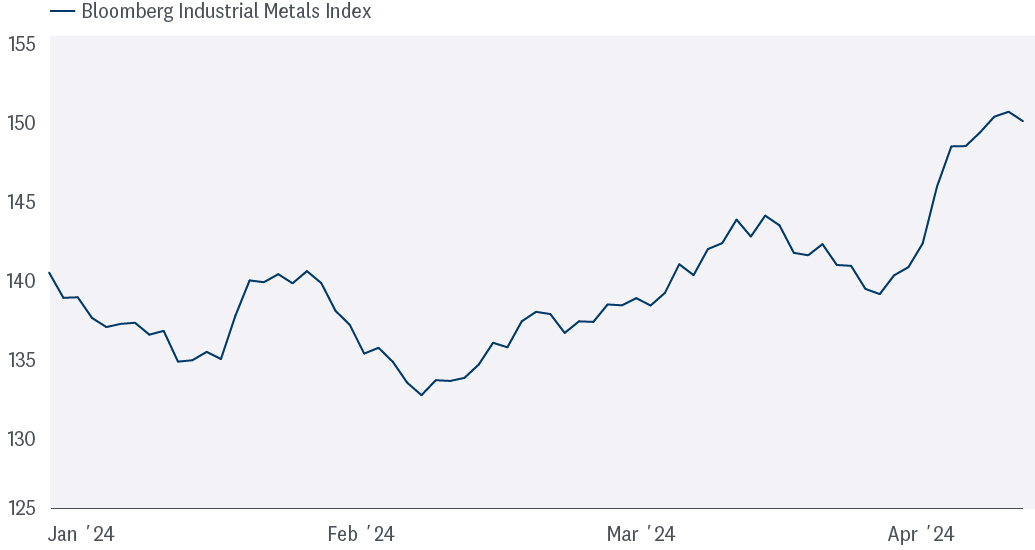

Transitioning Monetary Policy

Although Federal Reserve (Fed) speakers, including Chairman Jerome Powell, imply that the Fed remains data-dependent and requires a series of inflation-related reports confirming that inflation’s downward trajectory hasn’t stalled before they can consider initiating an easing cycle, the rally in precious metals, industrial commodities, and even oil, point to a resumption of inflation ticking higher. Moreover, financial conditions appear easier than Powell’s steadfast replies to the contrary.

Still, despite “sticky” inflation perhaps inhibiting the Fed’s first move to cut rates, the probability for a June 12 easing stands just below 20%. As the market moves closer to that date, the dollar should react to fresh incoming data. If the probability for a June 12 rate cut climbs definitively higher, the dollar should simultaneously soften.

Consequently, this would further ease financial conditions and be constructive for oil fundamentals. Following disappointment with the most recent Consumer Price Index (CPI) report, the dollar has edged higher, implying that the Fed may continue to hold rates higher for longer.

Industrial Metals Prices Have Moved Higher in 2024

Source: LPL Research, Bloomberg 04/11/24

Indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

The Reflation Trade

As global central banks appear poised to begin easing monetary policy sometime this year, the so-called “Reflation Trade” is gaining prominence. The momentum in commodities has embraced the future of lower rates, a weaker dollar, and a more solid global manufacturing and consumer landscape.

However, as in any major moves higher, especially the parabolic nature of the recent climb in crude oil prices, overbought conditions set in, most likely necessitating a pullback, or sideways trading to burn off the froth.

The overarching fundamentals of quality names within the energy sector, representing a reflationary cycle, include strong cash flows, with a focus on reducing debt levels, and solid positioning to return shareholder value with prominent share repurchasing programs and increasing dividends.

Additionally, valuations are exceptionally attractive given steady and reliable cash flow margins in most quarters.

Inflows into the sector remain muted as the price of crude oil continues to be the key driver for investors rather than strong corporate fundamentals. As a result, the sector remains under-owned, or in the market’s parlance, “unloved.”

Crude Oil Continues Its Run as Prices Approach $90

Source: LPL Research, Bloomberg 04/11/24

Past performance is no guarantee of future results.

Any futures referenced are being presented as a proxy, not as a recommendation.

Be Mindful of Weak Hands

Crude oil, like many other commodities, attracts speculators via a wide assortment of quantitative trading strategies that rely on the ability to uncover and quickly monitor information, data, and rumors to stay ahead of price action.

When prices edge closer to overbought conditions, as with oil prices at current levels, sell signals can lead to speculators racing out of positions. This accelerates prices moving lower at a rapid clip as they wait for the next catalyst to re-enter the market.

In this environment with geopolitical uneasiness dominating headlines, the temptation to exit the crude oil market may be negated by the potential for a significant military event that could meaningfully disrupt supply.

The Energy Sector is More Than Just Crude Oil Prices

The comprehensive components of the energy sector, ranging from the largest integrated oil majors, oil refiners, natural gas providers, oil services, drillers, and a wide assortment of production and exploration companies, provide investors with an opportunity to benefit from an industry transformation that is based on operating efficiencies, and returning wealth to shareholders.

Tactical Asset Allocation Insights

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its neutral equities stance tactically. The improved economic and earnings outlook this year has kept the risk-reward trade-off for stocks and bonds fairly well balanced, perhaps with a slight edge to bonds over stocks currently. Recent stubbornly high inflation readings may delay Fed rate cuts and limit the upside to stock prices over the balance of the year, although two or possibly three cuts may still come by year-end.

Within equities, on a tactical basis, the STAAC continues to favor a tilt toward domestic over international equities, with a preference for Japan among developed markets, and an underweight position in emerging markets (EM). The Committee recommends a very modest tilt toward the growth style after reducing its overweight position in mid-March, in favor of adding small caps to remove that underweight position. Energy remains a favored sector, along with communication services. Finally, the STAAC continues to recommend a modest overweight to fixed income, funded from cash.

Copyright © LPL Research