In his latest analysis, Alfonso Peccatiello, the Chief Strategist, at The Macro Compass explores the challenges that investors, and financial markets are facing. Peccatiello offers a unique perspective on investment approaches that differ from mainstream views. He highlights the significance that it’s not enough for investors to have an investment idea, in order to make money, but also one that tilts significantly from the consensus to gain maximum benefits in the market.

Peccatiello raises an issue in today’s investment environment; the struggle to find investors willing to take positions on either a surge in growth and inflation resembling the "roaring 20s”, or on a sharp slowdown that could lead to recessionary conditions. He observes there’s an interesting convergence occurring between investors and economists towards expectations, such as predicting a gentle economic slowdown with modest growth and inflation rates.

According to Peccatiello, recent changes in predictions indicate a shift towards expectations of overheating in the U.S. Economy, with anticipated nominal growth surpassing potential growth estimates. This situation is seen as offering a " landing coupled with some growth reacceleration " which is viewed favorably by market participants.

He also stresses the importance of being proactive, before the elections mentioning three expected insurance cuts by the Federal Reserve to stabilize the market and push stock prices up.

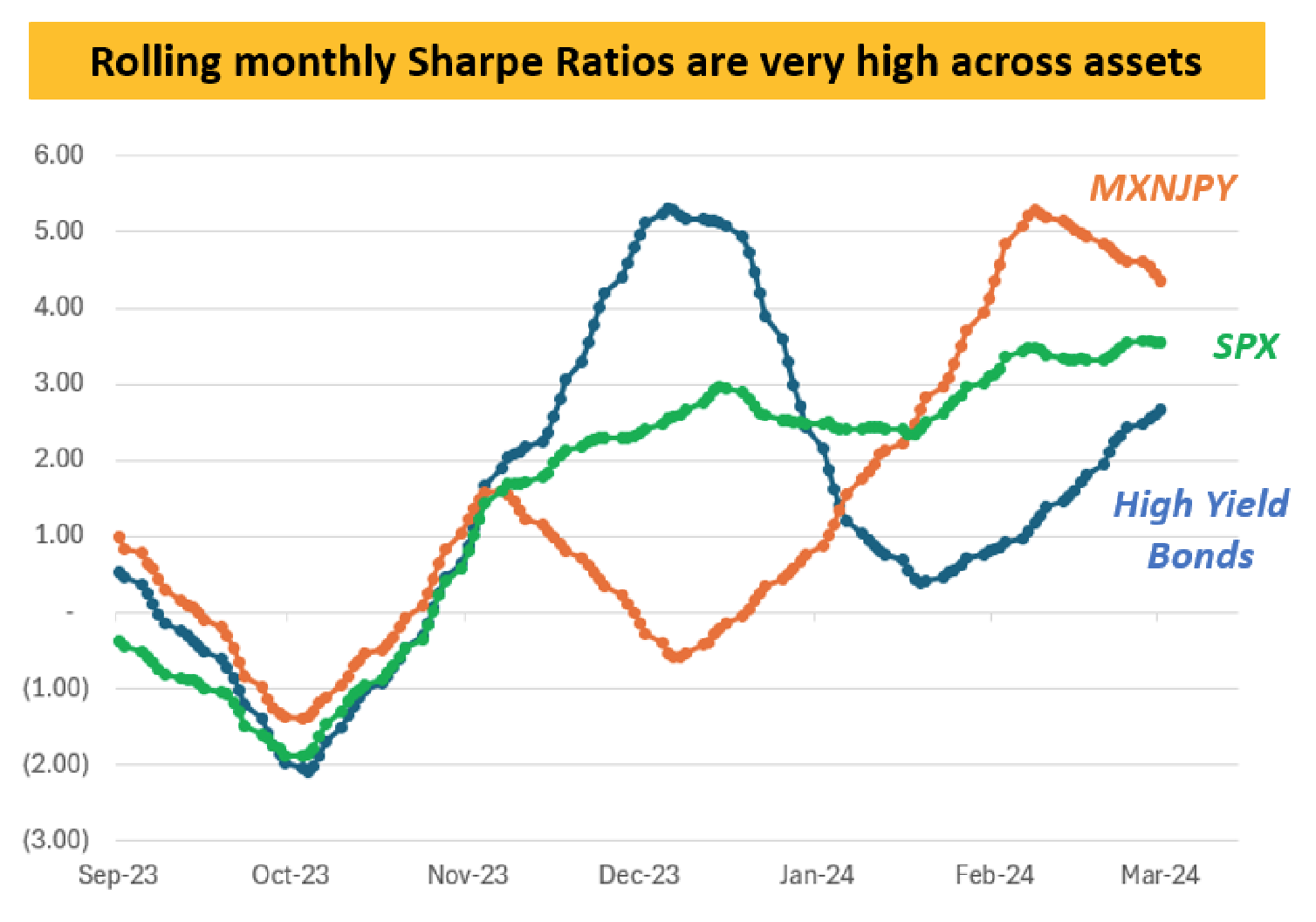

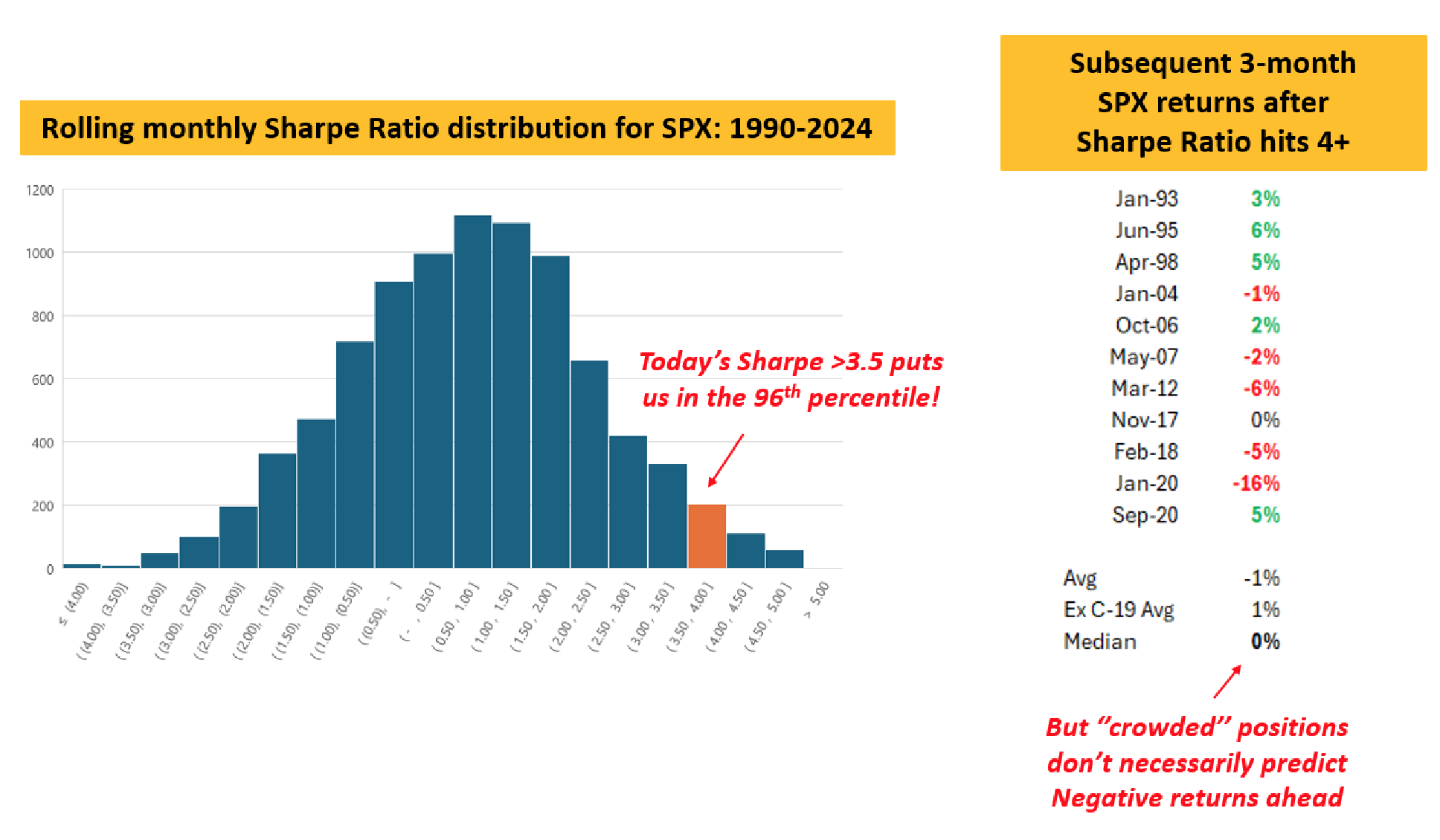

He illustrates how Sharpe Ratios can show how well investments perform relative to risk and how high Sharpe Ratios can lead to crowding in certain investment strategies. He points out clearly how crowded trades may not always result in returns, and warns that sudden market changes could impact these positions.

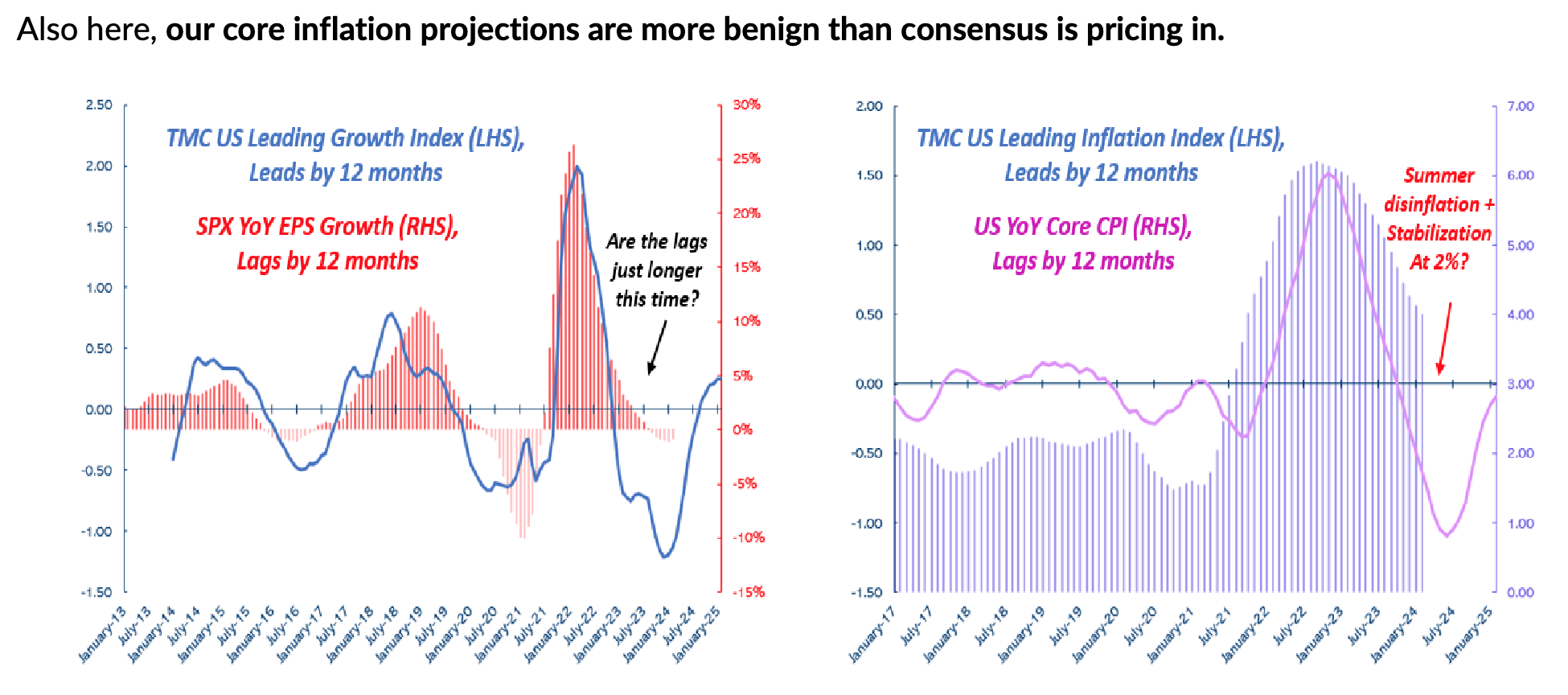

The Chief Strategist emphasizes the need for investors to carefully consider these factors when adjusting their portfolios. He suggests that deviating from crowded strategies and seeking value are crucial when making changes. Based on The Macro Compass (TMC) Macro Models he predicts U.S. Growth with expectations until summer.

The Chief Strategist emphasizes the need for investors to carefully consider these factors when adjusting their portfolios. He suggests that deviating from crowded strategies and seeking value are crucial when making changes. Based on The Macro Compass (TMC) Macro Models he predicts U.S. Growth with expectations until summer.

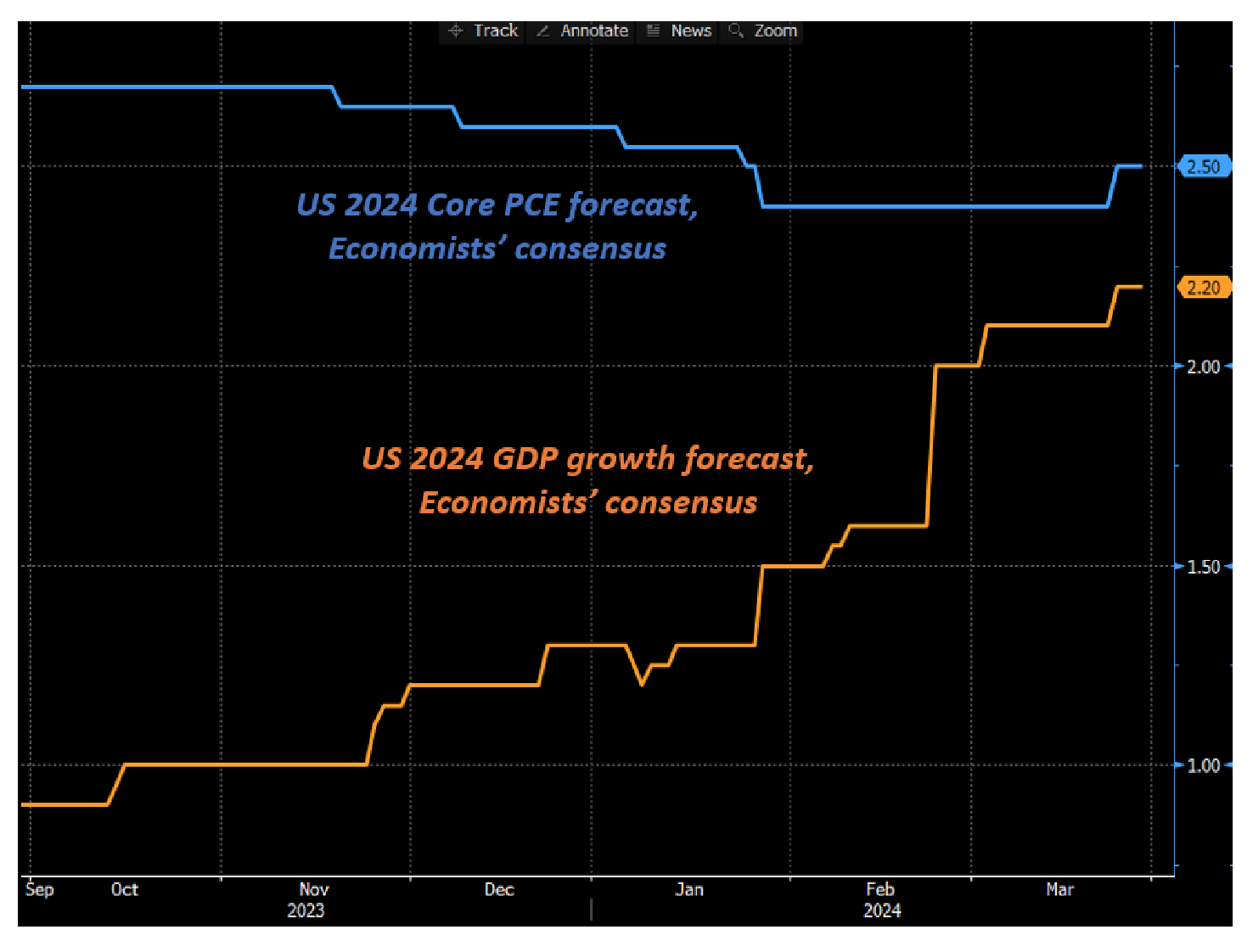

In examining the broader economic landscape, Peccatiello transitions from a forecast of quasi-stagflation to an anticipation of a soft landing, reflecting an adaptive perspective on economic conditions. "Economists had moved from a quasi-stagflation forecast in September 2023 (2.75% core PCE, 0.8% growth) to a soft landing forecast in January 2024 (2.35% core PCE, 1.5% GDP growth)" says Peccatiello. This shift indicates a nuanced understanding of the interplay between economic indicators and market performance.

Peccatiello’s strategy recommends focusing on U.S. Stocks and cash investments while reducing exposure, to emerging markets and industrial commodities.

At the core of The Macro Compass’s strategy is the distinction between overweight and underweight assets, a reflection of the nuanced approach to market dynamics. Peccatiello notes, "Assets highlighted in red have been now underweighted (EM equities and cyclical commodities) versus standard weights, and in green you can find the overweighted assets (US equities, cash)" explains Peccatiello. This selective weighting expresses a commitment to adaptability and precision in asset allocation.

Finally, addressing the current market sentiment, Peccatiello reflects on the phenomenon of the 'Everything Rally' and its implications for asset allocation. He observes, "Markets are sitting in the Orange NE Quadrant – The Everything Rally quadrant...This macro environment is particularly favorable for small cap, commodities, Bitcoin etc." (Peccatiello, 2024). This analysis not only captures the present state of the markets but also offers a strategic lens through which to view potential investment avenues.

Footnote:

1 (Alf), A.P. (2024) The Macro Compass: Alfonso Peccatiello (ALF). Available at: https://themacrocompass.org/ (Accessed: 28 March 2024).