by Tony DeSpirito, CIO of U.S. Fundamental Equities, Blackrock

Key takeaways

Actively bullish. What next for stocks after a strong start to 2024? While a near-term pullback wouldn’t be surprising, we see fuel for the positive momentum to continue throughout the year ― but with selection growing more important. As Q2 begins, we see:

- A relatively market-mild election season

- Stock-specific ways to maximize mega forces

- A growing opportunity set for GenAI investment

A positive January for U.S. stocks is typically a prelude to a positive year, with our analysis finding the correlation to hold 80% of the time since 1928. 2024 is also an election year, historically the second-best year in the four-year political cycle (behind year three). We believe the historical signal of a strong start, combined with what is likely to be peak interest rates and positive earnings guidance, bode well for equities.

Stocks look well positioned to outperform bonds and cash again this year, but high valuations mean investors need to be choosy. The equity risk premium, a measure of relative stock pricing versus bonds, looks more compelling for the equal-weighted S&P 500, sitting near the market’s long-term average. This implies the need to look beyond the mega-cap stocks that have been dominating the widely cited market-cap-weighted index to source attractively priced names with good long-term prospects.

“The opportunity set for stock picking is the most robust I’ve seen in 20 years. It’s an exciting time for active managers.”

Election year reflections

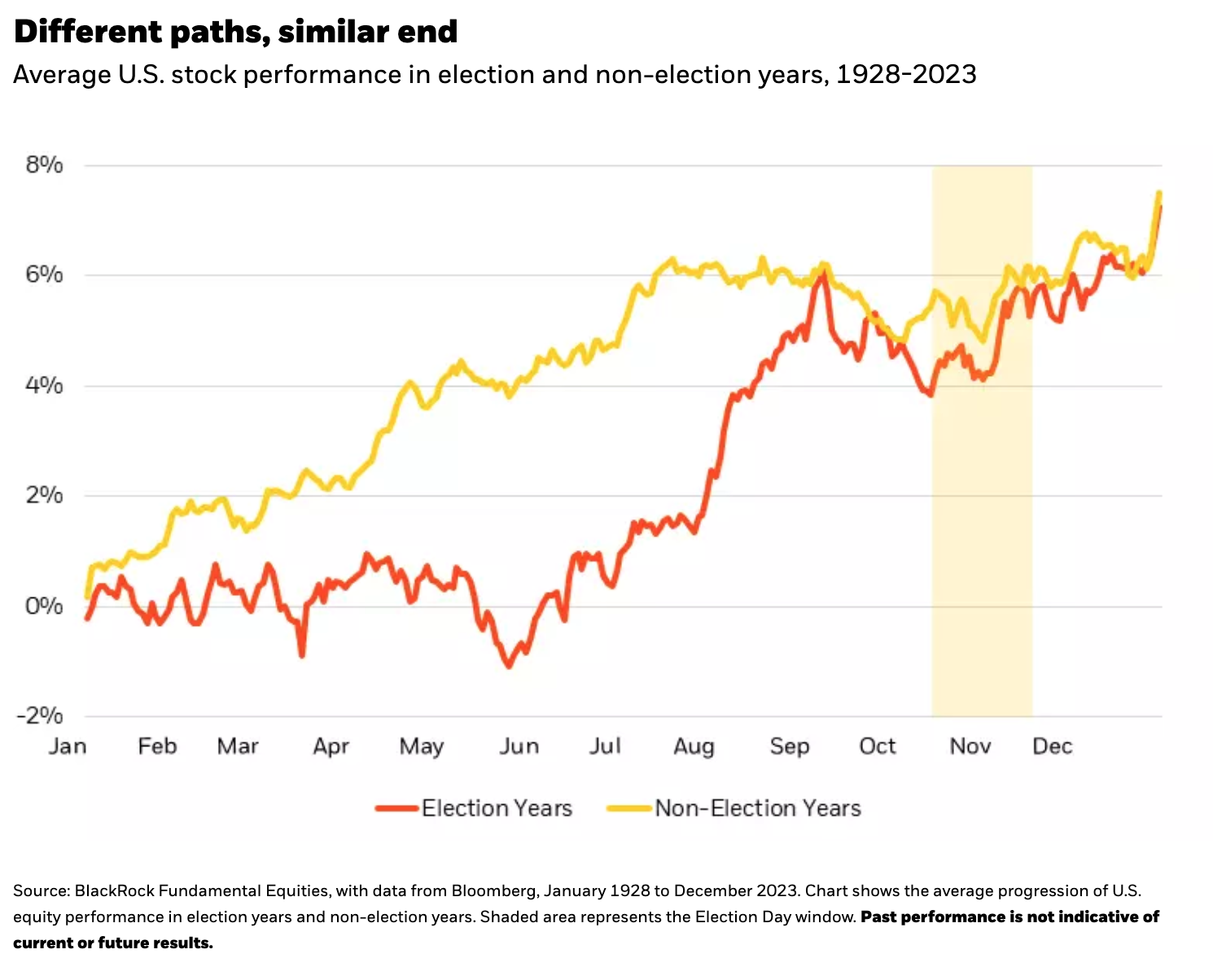

For equity markets, election years traditionally start slow (and volatile) and improve with greater certainty ― e.g., once candidates are nominated in the summer and after Election Day, as shown in the chart below. The outcome of the election historically has done little to change this pattern, suggesting that clarity is more important than parties or politics when it comes to the broad market.

One notable takeaway from our analysis of data back to 1928 is that average full-year price returns in election vs. non-election years are basically the same ― at 7.3% and 7.5%, respectively ― but the path to getting there is very different, as the chart shows. This year’s strong start (+7% through March 15 vs. the 0% election year average shown below) could mean an even better trajectory for stocks if past cycles are any indication.

Company chatter ― or lack thereof

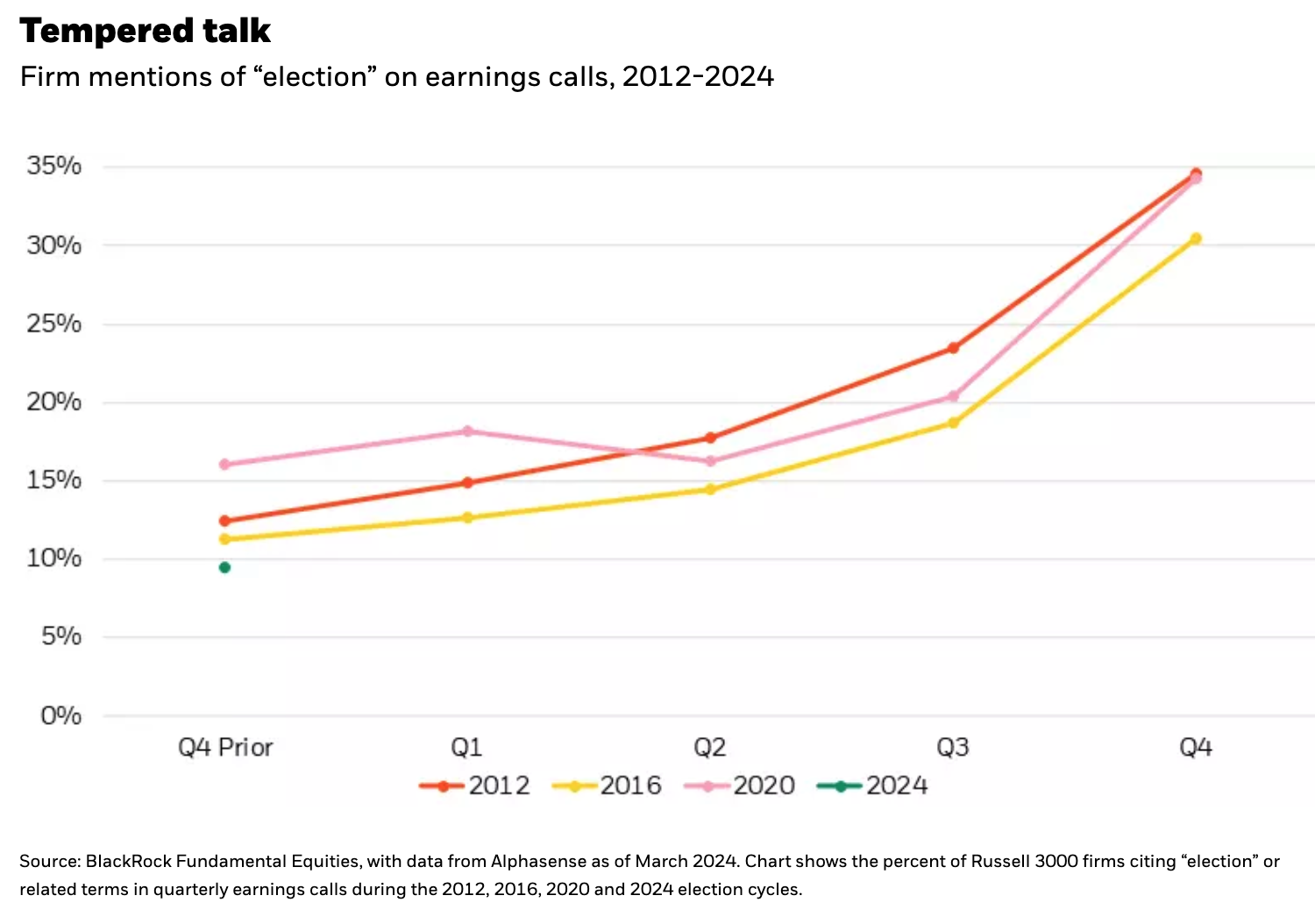

While many have dubbed this the most consequential election in decades, that sentiment is not necessarily showing up in company rhetoric. So far, we see the lowest percentage of firms discussing the election versus any of the past three cycles, with less than 10% of companies citing “election” in their Q4 earnings calls. Mentions typically pick up as the year goes on, but this is the lowest starting point in recent history. One reason may be that the likely candidates, the current president and a former president, are well known entities, blunting the uncertainty factor.

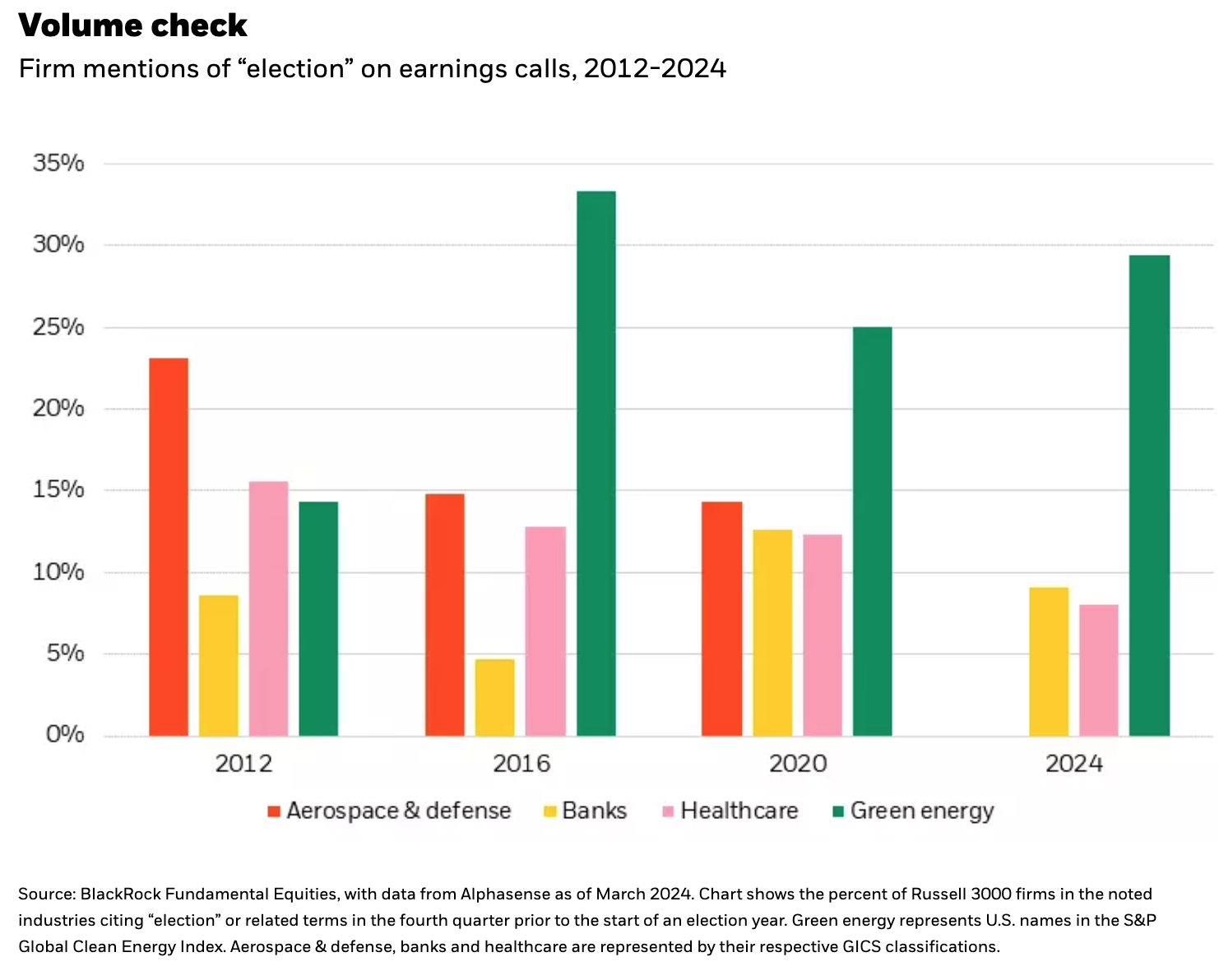

Looking across some typically “election-sensitive” segments of the market, green energy companies are giving greatest attention to the election with nearly 30% of firms making mention in Q4, as shown below. This is not surprising given the two parties’ differing views in this area.

Investment considerations

The election is just one variable in the market picture this year. Others, like interest rates and earnings trajectory, are arguably weightier considerations.

Where do we see potential implications for stocks? The clearest may be among companies tied to “green” initiatives if the election were to bring a party change in the Oval Office that could affect some of the regulation and incentives tied to the energy transition. The election mentions among companies engaged in these businesses may be an indication of that concern. Importantly, this would not change our long-term outlook for fundamentally strong businesses in this category, particularly those with global operations. It could even present a buying opportunity in some cases if prices were to adjust downward on election worries.

Healthcare companies, which are typically in the crosshairs of political machinations, have had little to say thus far. Potential candidates are not campaigning on drug pricing or “Medicare for All” as in prior cycles. This muting of political risks further supports our favorable outlook on this versatile sector ― one with defensive characteristics as well as attractive growth prospects amid increasingly brisk innovation, such as the GLP-1 “diabesity” drugs.

Mega forces matter more

Overall, we place measured emphasis on the short-term political landscape in shaping our portfolios for long-term performance. More important than politics are the secular trends that we see driving markets over a three- to five-year time horizon.

As fundamental-based investors, we take a company-by-company approach to exploit the underappreciated and mispriced opportunities in these trends, often applying time arbitrage to capitalize on short-term dislocations in what we see as good long-term investments. We offer three examples:

1. Digital disruption and AI

We acknowledge that generative artificial intelligence (GenAI), like every tech innovation before it, is on an excitement curve that can be followed by significant lulls in the momentum. But even in the moments of relative quiet there is progress happening below the surface ― and that means opportunity that may be less obvious to the broad market as well.

We are looking beyond the first layers of the AI technology stack ― data centers, chips and infrastructure ― to the next level of potential beneficiaries. GenAI is expected to become ubiquitous ― touching every individual and industry ― and it relies on massive amounts of data to perform and equivalent memory to store that data. Multiplied across the global economy, this creates substantial opportunity among companies that mine, own and sell data as well as those that organize, process and store it. We believe those involved with private data, which is deemed more valuable than the widely available public kind, hold an upper hand. Over time, we would expect new business models to arise.

2. Low-carbon transition

Mega forces are powerful, long-term trends, but they don’t necessarily move in straight lines. Slowdowns can and do happen. For example, while PC sales largely boomed from the 1980s to 2000s, there were individual years of temporary decline along the way. Similarly, the term “AI winter” was coined to describe several periods since the 1970s of transient ebbs in AI interest and investment. Importantly, slowing doesn’t mean a change in the long-run direction of travel, and that can create investment opportunity.

We’re seeing such a slowdown today in electric vehicle (EV) adoption. If you believe the sales decline is temporary and that the structural case for EVs remains intact, the recent pullback could present a compelling entry point or second buying opportunity in the EV supply chain. We see particular opportunity among makers of the technology components that go into both EVs and advanced driver-assisted systems for all vehicles regardless of powertrain.

Another underappreciated beneficiary of the energy transition may be public utility companies, which make their profits through spending on infrastructure. The transition from fossil fuels to renewable energy sources will require increased investment to build and rework physical structures, costs that the utilities will recover through the rates they charge to consumers as part of the agreed-upon rate of return they receive as a regulated provider. In short, increased capital spend on the grid will equate to greater profit growth for utilities.

3. Demographic divergence

Populations are aging worldwide. The number of Americans aged 65 and older will increase 30% from 2025 to 2050, according to projections from the U.S. Census Bureau. As people age, their healthcare spending rises. Data from the Centers for Medicare & Medicaid Services shows per-person healthcare spending among those 65 and older was over $22,000 in 2020, more than double the $9,000 annual spend of working-age Americans.

These structural trends are supportive of the healthcare sector broadly. Most recently, however, we’ve seen the profits of some health insurers dented by an unexpected rise in medical costs. We see the profit squeeze as temporary as insurers reprice premiums and adjust benefits accordingly. This temporary earnings setback masks what we see as a long-run growth tailwind, with insurers set to benefit across time from increased enrollments as populations age and demand for plans, especially Medicare Advantage plans, grows.

Our bottom line

A bottom-up lens can expose underappreciated opportunities or temporary dislocations in companies well positioned to benefit from the long-term structural trends taking shape.

We believe an actively managed, diversified portfolio of stocks can exploit the varied opportunities created across disparate mega forces in ways that thematic indexes cannot, while also allowing the flexibility to adjust exposures in an effort to capitalize as the individual investment theses and market dynamics evolve in what we see as a new era for equity investing.

Copyright © Blackrock