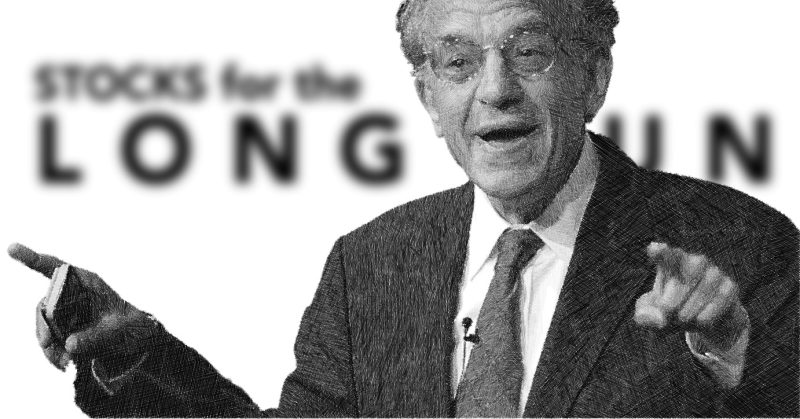

by Professor Jeremy J. Siegel, Senior Economist to WisdomTree and Emeritus Professor of Finance at The Wharton School of the University of Pennsylvania

One of the key market events is clearly the upcoming Federal Open Market Committee (FOMC) meeting this week.

The Consumer Price Index (CPI) and Producer Price Index (PPI) were slightly disappointing last week, which reinforces the hawks on the FOMC committee who are more resistant to lowering interest rates. However, I am not concerned about inflation, as the core year-over-year inflation remains biased by the very lagged shelter data—which drove 2/3rds of the increase in the core CPI year over year. When we substitute real time indicators like those from Apartment List National Rent Report, real inflation is more like 1-2% instead of almost 4%.

The sensitive commodity prices stopped going down and are beginning to show some firmness—particularly oil. The big downturn over the last two years in the Bloomberg Commodity Index has now flattened out and bottomed. We will have to watch this, but it is not overly concerning.

On the real economic data side, the February retail sales were somewhat disappointing, but the economy is still rolling along at a healthy level. Estimates for real gross domestic product (GDP) in the current quarter are tracking around 2% with the economy showing no apparent signs of weakness—which will further embolden Fed members who do not want to cut rates.

The most interesting aspect for the upcoming FOMC meeting will be the Dot Plot. I believe the Dot Plot will be considerably more hawkish than it was last December. The December forecast for the median federal funds rate might be revised down to two cuts from three cuts, and I wouldn't be surprised if the dots predicting less than two rate cuts are greater than those that exceed two rate cuts.

Headlines will say that this is more hawkish than what is priced into the Fed funds future market. I will remind our readers that the futures market prices are a biased predictor of what market participants expect to happen. Because Fed funds futures have a hedge feature (what finance theory refers to as a negative beta asset) the Fed funds futures rate is lower than what the market ‘expects’ will happen. I think there is an additional one cut priced in from this hedge feature—so a Dot Plot of two cuts is actually consistent with three cuts in the current market, which matches what we see now.

Market rotation last week coincided with the 10-year Treasury yield heading up to 4.3% with extra pressure on some of the Nasdaq stocks. Often when there are key reversals like Nvidia experienced recently, this rarely signals the end of the bull market—it is usually just a bump in the road to continued increases. I think momentum is likely to return to those stocks. Energy stocks also did better with rising oil prices last week.

It is good to see broadening out of the rally—one of our key investment themes for 2024—there’s more talk of a Magnificent 6 rather than 7—highlighting Tesla’s under performance over last nine months or so. This is a sign of market health; the Magnificent 7 are not being treated all as one group and we see separation between Tesla and the others based on different earnings projections.

Copyright © WisdomTree