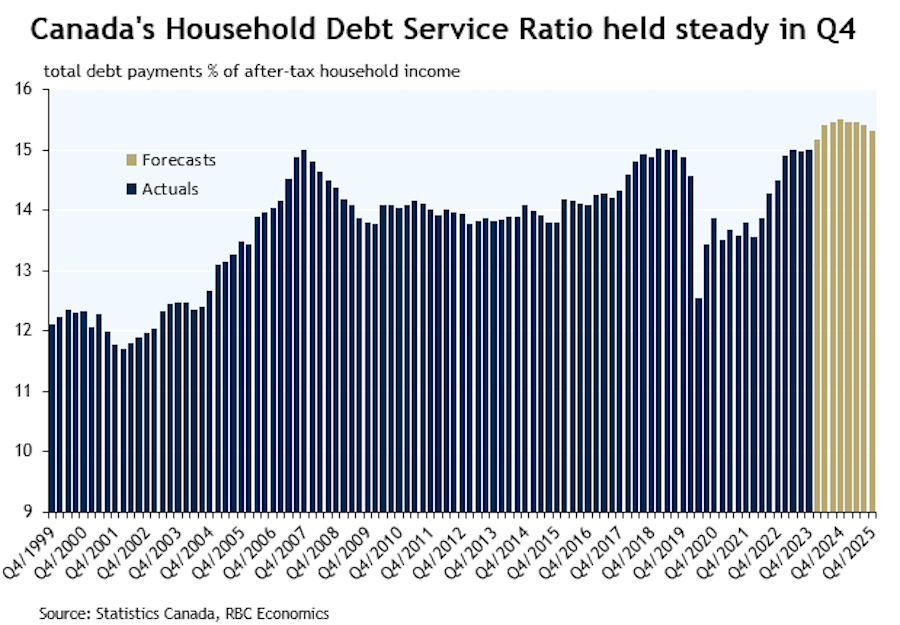

In a recent report by Carrie Freestone, Economist, at RBC Economics, she emphasizes the current stability of Canada's debt servicing ratio (DSR) despite an increase in consumer credit borrowing. Freestone points out that Canada's DSR saw change in the quarter of 2023 creeping up to 15.0% from 14.99% in the previous quarter. This analysis follows the Bank of Canada's series of interest rate hikes resulting in a 97.2% surge in mortgage interest payments and nudging the DSR from 13.6% to its level.

With an uptick in household credit market debt, which witnessed a $29.5 billion uptick in Q4 alone totalling $2.9 trillion (representing about a 3% year-over-year growth) the DSR has managed to hold steady. The rise in Q4 was mainly fueled by a $20 billion increase in mortgages; however consumer credit growth surpassed that of mortgages and non mortgage loans marking the net creation of consumer credit since 2009. "While mortgage borrowing has slowed down the rapid rise in consumer credit hasn't halted the decline of the debt to disposable income ratio, for three quarters in 2023 " elaborated Freestone.

The household debt-to-disposable income ratio decreased for the time in 2023 settling at around 179%. This drop was attributed to the rise in household income (% quarter over quarter) outpacing the growth in credit market debt (+1.0% quarter over quarter) amid subdued mortgage borrowing activity due to ongoing affordability challenges.

Freestone also highlights the uptick in household worth, which increased by 3.1% from the year to $16.4 trillion in Q4 primarily driven by a surge in equity and bond markets. However she noted that "The wealth growth was not evenly distributed, with the top 20% wealthiest Canadians holding over two thirds of household assets as of Q3."

The household savings rate in Canada remained steady at 6.2% up from 5.6% at the end of 2022 with both disposable income and consumption seeing growth rates. Notably Canadian households invested $11.8 billion in funds during Q4 2023 reversing a trend of outflows seen in the previous three quarters.

In her 'bottom line' conclusion Freestone stated that "Despite rising household debt levels, in Q4, the debt servicing ratio reflects the resilience of household income." She warns, "The speed at which incomes are increasing now probably won't last and we expect Canada's debt service ratio to go up from where its been. Many Canadian households are likely to feel pressure as the effects of past interest rate increases catch up with them."

Source: adapted from Carrie Freestone, RBC Economics - "Canada’s debt servicing ratio held steady despite massive accumulation in new consumer credit", https://thoughtleadership.rbc.com/economics/